Crypto Academy Season 3 Beginners' course - Task 3: Bitcoin, Cryptocurrencies, Public chains || By @jaspichman125

Hello professor @stream4u, I am glad to submit my CryproAcademy Homework Post For Task - 3: Bitcoin, Cryptocurrencies, Public chains.

- What is cryptocurrency?

- How would you like to see cryptocurrencies in the future?

The word crypto is derived from an ancient Greek word “kryptos" meaning hidden. While currency is anything that can be used as a medium of exchange for goods and services. It is generally accepted by the people as a means of transfer of value.

Traditionally, currencies are issued by the government in form of paper or coins. Cryptocurrency is therefore, a hidden money or currency. That’s a shallow definition though.

Cryptocurrency in a broader way, is an electronic or virtual currency that can be used to pay for goods and services just like the conventional currencies. Unlike conventional currency, Cryptocurrency is digital/virtual, encrypted by cryptography and decentralized.

Cryptocurrency runs on an open-source decentralized digital distributed ledger system called blockchain. Cryptocurrencies are governed by a peer-to-peer network of computers on the Blockchain. Bitcoin is the first ever known cryptocurrency.

All transactions made in cryptos are recorded and assigned a unique cryptographic alphanumeric identification number called Hash on the blockchain. Each block on the blockchain represents a separate transaction. A copy of the transaction data is then distributed (sent) to other people on the network.

All these things happens without the intervention of a third party or a middlemen – this is called decentralisation. Decentralisation is a unique feature of Blockchain and it’s associated cryptocurrencies.

There are several features that makes cryptocurrencies to be unique.

Security: the blockchai network is secured by cryptographic codes which provides a military-grade security on the blockchain. Blockchains have not been hacked so far except cases of password breach or compromise.

Decentralisation: “decentralized” means there’s no central authority, regulatory bodies or agencies, third parties or intermediaries that may influence decision making in processing transactions. Thus, users have 100% autonomy to decide when, how, what amount and with whom the transaction is made.

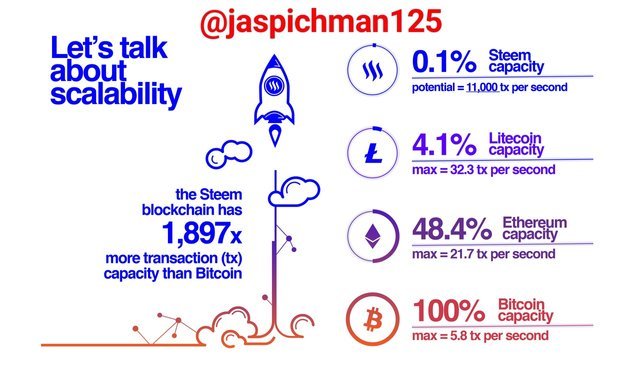

Scalability: this refers to the numbers of transactions processed per second on the blockchain network. Unlike the traditional payments systems or gateways such as Visa, PayPal, or Mastercard, blockchains are highly scalable – processing thousands of transactions per seconds. STEEM Blockchain is ranked first above Bitcoin and Etherium in terms of scalability.

In terms of scalability, Steem blockchain is better than both BitcoinandEtherium networks as shown on the infographic above.

In terms of scalability, Steem blockchain is better than both BitcoinandEtherium networks as shown on the infographic above.

Problem solving: the premise upon which blockchain came into existence was to solve the problem of greedy middlemen that stands between buyers and sellers or any two parties engaging in transactions. Blockchain solved this problem with its decentralisation feature. Transactions can be carried out seamlessly without the intervention of Middlemen or third parties.

Usability: cryptocurrencies are easy to use and access. No hassles. You can buy, sell and do so many things with cryptocurrencies.

Demand: just like any other commodity, cryptocurrencies are influenced by market forces such as demand and supply. The more people value it, the more they demand for it and the higher the price.

Scarcity (limited supply): Bitcoin has a fixed supply of 21 million coins. Over 18 million coins are currently in circulation or supply. New coins are created through a process called mining. The last Bitcoin is estimated to be mined in the year 2140.

Though altcoins have somewhat unlimited supply of coins, the limited amount of Bitcoin to be mined is what gives it power above the altcoins because of it’s inherent algorithm that controls inflation by producing just a fixed amount of coins.

Immutabiliy: transaction records cannot be altered, tampered with, or erased. Once, transactions are executed or processed on the blockchain, nobody can changed the data again. It will remain irreversible forever.

Transferability: cryptocurrencies more like fiat currencies, can be transferred between two or more people.

Privacy/Anonymity: the identity of users are not required before transactions are processed, confirmed or validated. Both the sender and receiver of crypto are kept anonymous. Once the system validates the transaction, the deal is done.

Portability: you can carry your cryptocurrencies in your e-wallets, phones, tablets or laptops. You might have 100 BTC in your online wallet and nobody knows. 😉

Transparency: transactions are validated by all the parties or users on the network so, there’s no room for any fraudulent activities on the blockchain.

There are over 10, 000 different cryptocurrencies in circulation today, each created for different purpose, running on different blockchains. Bitcoin is the first cryptocurrency ever. Below are types of cryptos

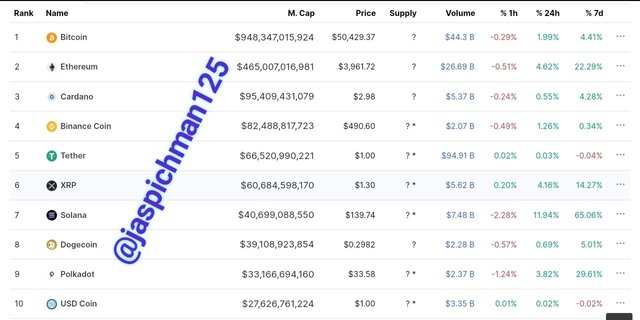

Bitcoin: as mentioned earlier, is the first cryptocurrency ever. The name of the coin is same with the name of the Blockchain.

Altcoins: alternative coins “altcoins” for short, refers to all other coins apart from Bitcoin. They are alternatives to Bitcoin. There are over 10,000 altcoins available today. Etherium is also an altcoin.

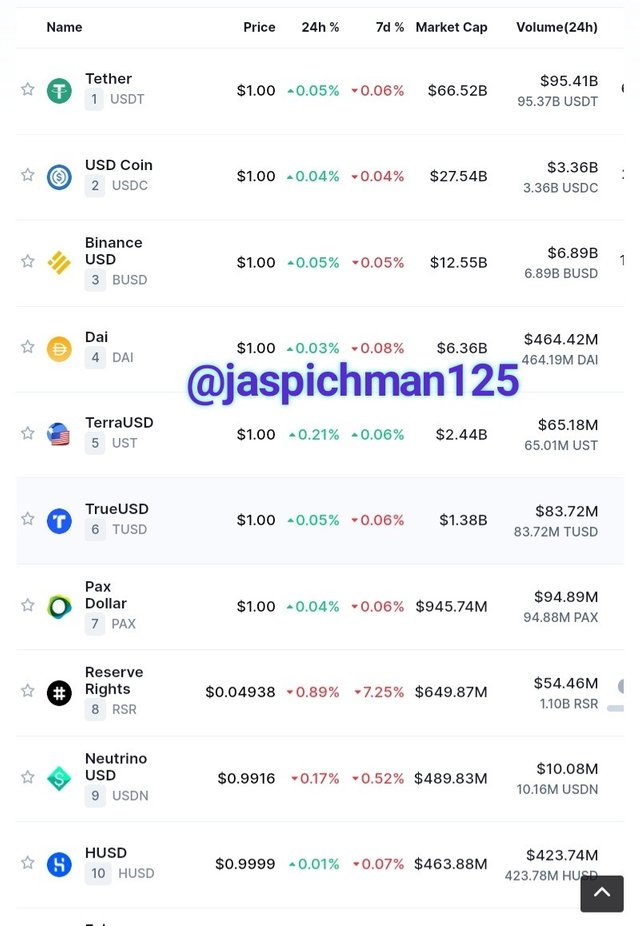

Stablecoins: this category refers to all the coins that are designed to minimise volatility and also to maximise utility of cryptocurrencies. They’re pegged with fiat currency like the US Dollars (USD). Examples of stablecoins are US Dollars Token (USDT), and Binance US Dollars (BUSD), Steem Dollars (SBD). As the name implies, the value of stablecoins does not change due to market volatility. Their values are constant with respect to the value of US Dollars.

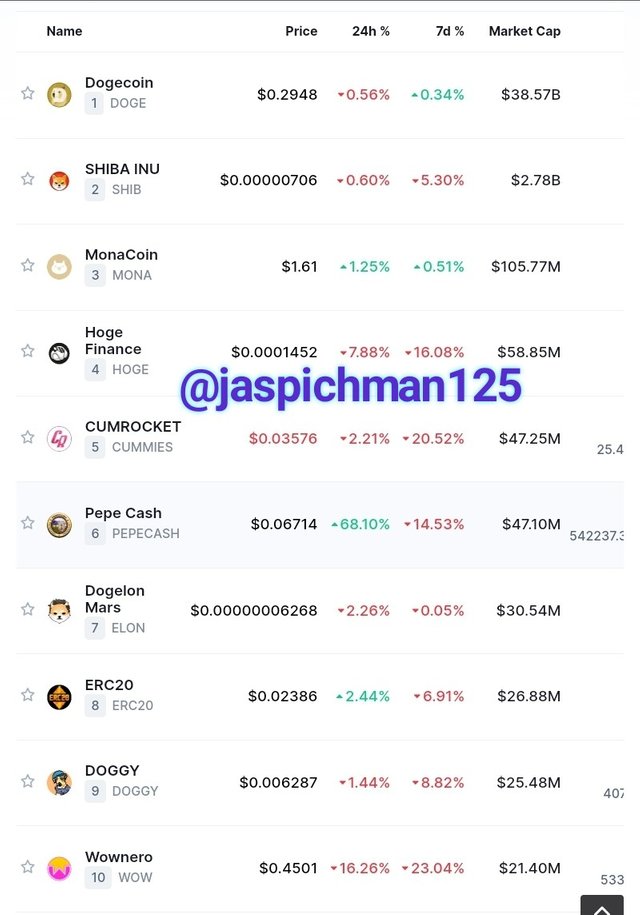

Meme coins: this comprises of Dogecoin (DOGE), Shiba Inu (SHIB), Monacoin (MONA), etc.

Source

Shitcoins: Shitcoins is a derogatory remarks for all coins that do not have any intrinsic value or significance. The creators of such coins doesn’t have solid problem which they aim to solve with the creation of those coins, hence, the name shitcoins – meaning worthless, meaningless and valueless coins.

Source

People can easily buy or sell cryptos via exchange platforms as well as digital wallets.

Exchange platforms: these are decentralized platforms that facilitates buying and selling (trading) of cryptocurrencies and other crypto related activities like gaming and smart contracts.

Wallet: this is a digital wallet where people can store, retrieve make their assets accessible to them. Cryptocurrency wallet could be a physical device (hardware wallet), a computer program which stores not only your assets, but also passwords, seedphrases, private and public keys. Examples of crypto wallets are Binance (arguably the best wallet with over 150 coins listed on the platform), Coinbase, Gemini, Coinsmart, Ledger Nano, Trust wallet, etc.

There are 3 ways in which security is achieved on blockchains. They’re

Hash, proof-of-work, and distributed ledger.

Hash: is a unique cryptographic alphanumeric identification number assigned to each block on the blockchain. Hash provide additional security to blockchain because every single block is being assigned a unique code, a kind of fingerprint. Blocks are interconnected with each other via the Hash in order to from a chain.

Proof-of-work: with respect to security on the blockchain, PoW is an inbuilt protocol that slows down the rate at which new cryptocurrencies are mined. On the Bitcoin blockchain for instance, it takes an average of 10 minutes to calculate the accurate proof-of-work and add new block to the blockchain. This protocol makes it difficult to change any information because you’ll have to recalculate the Proof-of-work of all the blocks on the blockchain.

Distributed ledger or consensus: When a transaction is complete, a copy of the block information including the Hash of the block is distributed to all the nodes or parties on the entire blockchain network. For instance, if a hacker wants to tamper with the information on block A, he/she will have to change the records on other people’s copy of the block data. When the system detects any attempt to make changes to a certain block, it triggers the other users on the blockchain to verify whether the change is legitimate. This way, security becomes tighter on the blockchain.

I see cryptocurrency as the future of finance. It is the currency of the future. As we already know, cryptocurrency is the first alternative to fiat currency or money. Over 40 million people are using cryptos currently therefore , I would like to see increased adoption by the populace in the future.

Even people who are into cryptocurrency business not many use cryptos in daily transactions such as buying of groceries, online shopping, paying for services, etc. I would like to see cryptocurrencies shift from an investment phase to utility phase where people can use cryptos in normal day to day transactions.

I would also like to see cryptocurrency Debit Card in the future. Cryptocurrency ATM is already functioning in other parts of the world but I would like to see a widespread use of cryptocurrency ATMs in the future.

High energy consumption has been one of the points that constantly comes up from critics of cryptocurrency. Bitcoin particularly has been criticised by environmentalists due to it’s high energy demands. As an ambassador of the UN’s sustainable development goals (SDGs), I would like to see a major development in the cryptocurrency world that would cut down the amount of energy it consumes so as to have a healthy environment.

I would like STEEM to be among the top 10 cryptocurrencies in terms of market cap. STEEM is currently capped at #188.

Governments have been highly critical of cryptocurrency. Some governments have even went a further mile to ban the use of cryptocurrencies. I would like to see a turnaround in this regard whereby governments will lift the ban on cryptocurrency and make it a legal tender just like the country of El Salvador.

Pros:

- Potential for high profit

- Cheaper transaction fees

- Protection from fraudulent activities of middlemen

- Instant transactions (high Scalability), worldwide transaction

- Absolute anonymity

- Inherently secure

Cons:

- High tendency for large losses

- Highly volatile – market fluctuations

- Risk of cyber attack/hacking

- High energy demands

- Account keys recovery is not feasible

- Potential for tax evasion

Cryptocurrency is the future currency. It is the future of finance. It gives people hedge against inflation. It gives equal opportunities to people regardless of race, age or geographical location.

Immense gratitude goes to my professors;

@stream4u

@reminiscence01

@yousafharoonkhan

@wahyunahrul

Thanks for reading through my post.

Best regards; @jaspichman125

Hello @jaspichman125,

Thank you for taking interest in the 3rd Task of the Beginners’ class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.

Thank you prof @awesononso for accessing my homework.

Your kind words makes me more humble. I'm glad I made it. I'll continue to put in my best.