Steemit Crypto Academy | Summary On Homework Task Week4-Season4

As Week 4 of Season 4 of Homework concludes on October 2, 2021, I would like to thank the 77 students who tried and worked this week by submitting their essays to answer the assignment.

This week we have presented the most important and best Williams % R Indicator trading methods in a detailed explanation for you to use and incorporate into your trading strategy.

The "Williams Percent Range" or more commonly known as "% R" is a very important indicator, considered one of the best known and most efficient oscillators of the technical indicator family.

The creator of the "Williams Percent Range" or "% R" indicator is Larry Williams, who created the "Williams Percent Range" or "% R" indicator based on the stochastic indicator, but without the "component" smoothing "and also the inverted scale. The "Williams Percent Range" or "% R" indicator is reputed to be one of the few technical indicators that can signal a reversal at least 1 or 2 periods before the reality.

Many traders also use the indicator to determine when the market is oversold or overbought and obviously also for trend reversals, thanks to the innate qualities of the “Williams Percent Range” or “% R” indicator.

We always state that the main goal of our Steemit Crypto Academy community is to ensure knowledge and promote opportunities for quality learning that are equitable and inclusive in the cryptocurrency field for all.

Next, I asked the students a few questions to assess how well they understood the topic and to assess the cognitive gains they made from reading the lesson.

The questions to be answered are:

1. Explain the Williams %R indicator by introducing how it is calculated, how it works? And what is the best setting? With justification for your choice.

2. How do you interpret overbought and oversold signals with The Williams %R when trading cryptocurrencies? (screenshot required)

3. What are "failure swings" and how do you define it using The Williams %R? (screenshot required)

4. How to use bearish and bullish divergence with the Williams %R indicator? What are its main conclusions? (screenshot required)

5. How do you spot a trend using Williams %R? How are false signals filtered? (screenshot required)

6. Use the chart of any pair (eg STEEM/USDT) to present the various signals from the Williams %R indicator. (Screen capture required)

7. Conclusion:

How is Williams% R used?

This indicator makes it possible to capture the exhaustion phases of a trend.

The way it is calculated explains in fact that if in a strong market the closing prices do not manage to stay close to the highs (or the lows in the event of a downtrend), then it is a clear signal that the the trend is weakening. , and therefore there may be a reversal.

However, if used this way, in its purest form, Williams% R would have the limit of generating many false signals.

To be able to use it you have to go to "Insert", "Indicators", "Oscillators" and you will see the Williams' Percent Range.

By default, the indicator period is 14. You can change this setting if necessary.

- How do you interpret overbought and oversold signals with The Williams% R when trading cryptocurrencies? (screenshot required)

The Williams Percent Range Indicator is an oscillator type, so it fluctuates. It oscillates between the values 0 and -100. When the oscillator is between 80 and 100%, it means that you are in an oversold market situation. If the value is between 0 and 20%, it means that you are in an overbought situation.

As can be seen, the WPR indicator consists of two horizontal lines along the 20% and 80% thresholds. These thresholds are precisely that of oversold (20%) and overbought (80%). If the oscillator goes below 20% you are in an oversold situation, while if the oscillator goes above 80% you are in an overbought situation.

These thresholds are important because from the moment the oscillator crosses them, as Larry William theorizes, there is a strong potential for a reversal, or the possibility that the price will change direction.

What are "failure swings" and how do you define it using The Williams% R? (screenshot required)

To detect Failure Swings or oscillatory failure, it is necessary to verify that the indicator does not manage to exceed its reference lines.

For example, when prices are falling rapidly, it becomes difficult for the indicator to break above the -80 line.

Conversely, when prices rise sharply, it becomes difficult for the indicator to cross the -20 line.

A sell signal is identified when an oscillatory failure or swing failure materializes, unlike the appearance of a buy signal which is indicated by a swing failure.

How to use bearish and bullish divergence with the Williams% R indicator? What are its main conclusions? (screenshot required)

Rather, the strength of the Williams Percent Range lies in its reliability in exploiting bullish and bearish divergences.

These are the situations in which, while the trend "improves" (that is, it registers new highs if bullish, or new lows if bearish), the Williams% R instead moves into the 'other direction, showing decreasing highs (bearish divergence) or increasing lows (bullish divergence).

In these cases, our W% R tells us that the trend has lost momentum and that we are approaching a reversal. The market is therefore potentially ready for a change.

When our bearish divergence occurs, we can open a short position below the candle which confirmed the divergence by placing a stop loss above the high of the candle.

These are situations that don't happen very often, but when our Williams Percent Range does occur it gives us a good chance of a successful trade.

How do you spot a trend using Williams% R? How are false signals filtered? (screenshot required)

When using the WPR indicator, be sure to look for confirmations in the market. In fact, using this tool, one could see an extended lunge below 20% or above 80% before the reversal occurs. For this reason, the reversal must be confirmed with a market that is in the trading range in order to get a valid signal.

And it is precisely for this reason that the Williams Percent Range indicator has great potential to forecast (anticipate) turning points only in a secondary market.

To optimize their investments and ensure winning technical analysis, one of the most common tactics among traders is the combo between W% R and EMA. In this second case, we are referring to a very simple tool to apply to the graph. It is recommended to set it to 14 periods, so that it can correct any false signals.

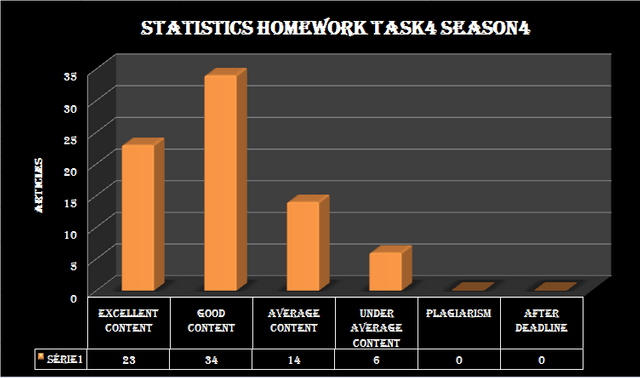

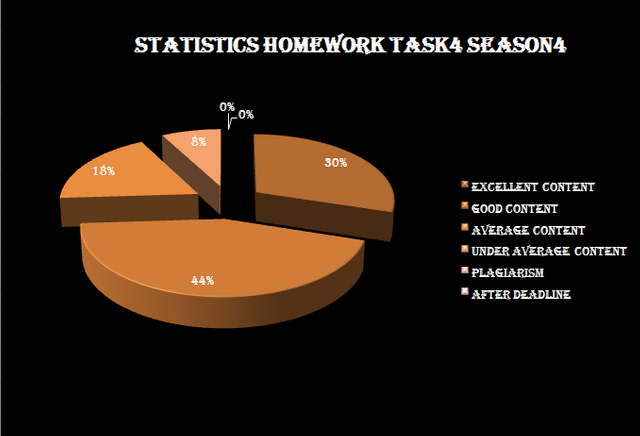

During this week, results saw an increase in excellent work to represent 30% of the total writing, with an increase also in articles with good content to reach 44%, compared to a not high percentage for articles with medium content to reach 18%, bringing the total homework Successful ones rewarded 92% versus only 8% who couldn't get above average grades, and if that's anything to be said, it's the seriousness with which students get what they are asked and how eager they are to learn and do their best to get on top ratings.

We also note the absence of the percentage of articles affected by plagiarism to be 0%, and it remains our great hope that students will continue to do so. Writing articles without these practices that remain the number one enemy and fighting them is the most important towards improving their level and advancing their knowledge.

We also mention that there are conditions to participate in answering the homework you submitted and the required reputation is 65 and 600 SP, so I invite all participants to respect these conditions so as not to waste the preparation effort without getting an evaluation and reward.

We would like to first thank all the participants for their challenges and inspiring achievements, and we hope that the spirit of this competition will continue for as long as possible, and we hope that the culture of challenge and facing obstacles will spread in all communities.

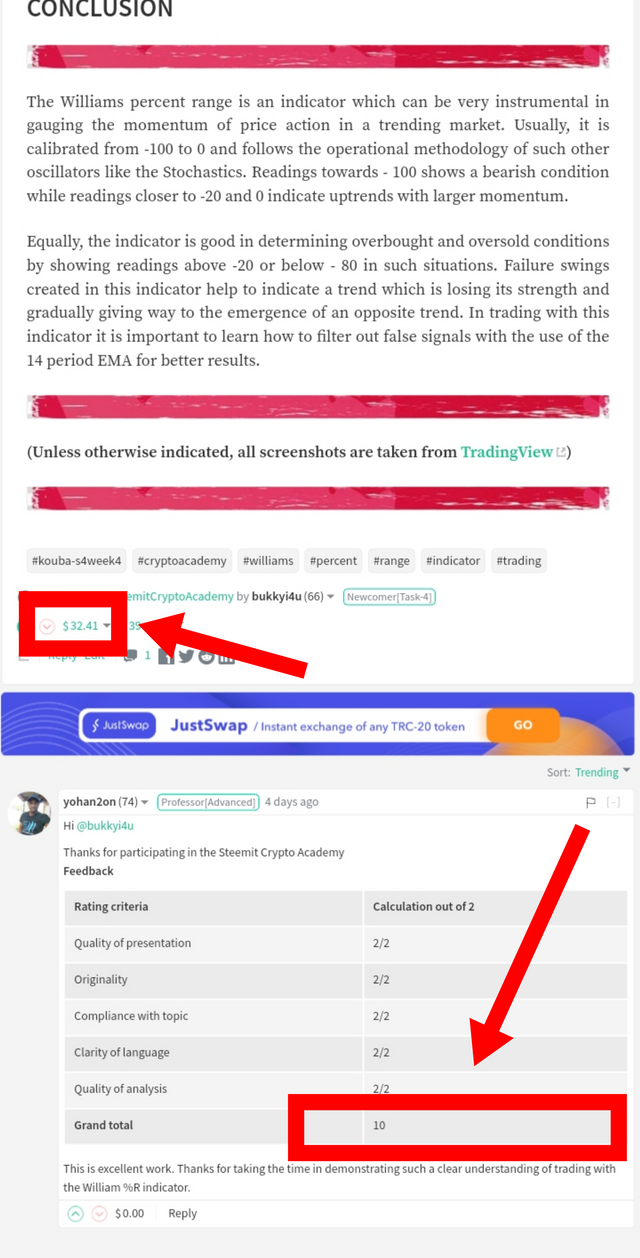

We are pleased to announce the names of the three winners of the 4th week of the 4th season competition :

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Thank you professor, I came to learn a lot from this lecture.

Thank you for selecting my post, hope you liked it.

Congratulations to others who participated and who get selected.

Thank you!!

Thank you professor for the opportunity to receive such high-quality education. Congratulations to every participant.

Hello professor @kouba01 I got 10/10 marks prior to the nominees here. I haven't been nominated a single time in this season. May I please know the reason of my exclusion from the nomination?

Here is the link to my post

Having the highest rate before other participants does not mean that you should be named at the end of the week. There are some details in distinguishing between you, as I have more than 10 students, so the selection criteria were accurate.

Alright professor I respect your decision but you know, this has happened with me before as well. And at that time I was told the selection criteria depends upon the number of time the student has been nominated before as well as his Steem Power. So I was confused, as I fulfilled the required criteria this time. Anyway, I'll be working on your next task given.

Good day to you

Good job !!

Hello, professor @kouba01, I wasn't satisfied with my reward last week. I got a 10/10 rating and only got a minimal vote from @steemcurator01.

As teachers we are not responsible for the rewards, you have already identified the admin @steemcurator01, so he will review the upvote.

Respected Professor,

To be honest, I wasn't satisfied from your remarks and marks this week on my Homework Task. I asked you in comments on my post as well. But still, I didn't got any satisfaction from your answer. Even I didn't get any reply to my second comment.

Here is the link of my homework Task

https://steemit.com/hive-108451/@salmanwains/crypto-trading-with-williams-r-indicator-steemit-crypto-academy-s4w4-homework-post-for-kouba01

This week, You graded my Homework task and gave me 4.5 Marks. I just wanted to know the reason.

Because, I researched well, did exactly what was asked. I got help from Your lecture, from assignments of other students who got 10/10 as well as I did my own research.

You pointed out some mistakes in my assignment, OK. But Still, Do you think my homework task deserved 4.5 Marks Only? I just wanted you to look at my post again consider it for Re-Checking. Because we are humans and humans can do mistakes at any stage.

And please don't take it personal. Because I'm on my way to do your next assignment and I just want fair grading. That's it!

Thank You!

Thank you