[Bitcoin's Trajectory] - Crypto Academy S4/W5 - Homework Post for professor @imagen

.jpg)

Hello everyone. I hope you are all well? This post is my submission to Professor @imagen's lecture on Bitcoin Trajectory. The assignment was given as below:

1.) How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved.

2.) What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

3.) Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

4.) What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

5.) Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, Tron , or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders/developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots.

6.) Conclusions

How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved.

The phenomenon of Bitcoin halving is the process whereby the miners’ rewards are reduced by half of its previous returns every time 210000 blocks are fully mined. This process usually occurs in four years span. This reduction is necessary to combat inflation which could significantly affect the market value of Bitcoin. As the number of Bitcoin available on the market reduces, there will be a strong demand for them, which inevitably will drive up its price.

In as much as the event of Halving keeps inflation in check, it also diminishes the returns of miners. Bitcoin utilizes the Proof-of-Work consensus mechanism, and this requires high-performance technology equipment for the computation of intricate algorithms to solve certain conundrums. These types of machinery demand high electrical power and are expensive to purchase in the first place. Hence, the rewards from mining are partially used by miners to cover such expenses.

Now, the incidence of Halving means that after 210000 blocks are mined, the expected returns will be fifty percent of the previous one. This translates to lesser returns in the event that the price of Bitcoin swings to a low threshold. However, should the demand for Bitcoin soar, the fifty percent lesser remuneration may be enough to motivate these miners to continue rendering their services. Also, it is commonplace for the price of Bitcoin to skyrocket months later after Halving occurs.

Before the 1st halving occurred in 2012, the reward for miners was 50 Bitcoins for a single block, and the price of Bitcoin was hovering around $11. When Halving took place, the returns were cut by 50%, and miners received 25 Bitcoins for each block mined. The price of Bitcoins on the market also shot up to around $1100 some months later.

The 2nd halving took place four years after 2012, thus 2016. By 2016, another set of 210000 blocks of Bitcoin had been fully mined. The former reward of 25 Bitcoins was according reduced to 12.5. The price also skyrocketed from the $1100 margin to the $19000 range some months after the occurrence of the halving. The price fluctuated back to the $8000 range and continued volatility.

The latest Bitcoin halving event happened in the month of May 2020 – thus four years or 210000 blocks after 2016. The expected reward for miners dropped to half the previous and is now 6.25 Bitcoins for every block successfully mined. After the halving, the price rose to the $20000 mark after multiples and currently trading for $54000.

.jpg)

The next Bitcoin halving is expected in 2024 when the total mined blocks stand at 840,000 – thus an additional 210,000 to the previous gross blocks mined. The reward will be according reduced to 3.125 Bitcoins for every block successfully mined. The image above from CoinMarketCap presents a real-time countdown to the next halving occasion. At the time of the screenshot, there were 135,997 Blocks left to be mined before the next halving takes place in approximately 1017 days and 16 hours.

Other instances of cryptocurrencies that undergo Halving include Litecoin and Bitcoin Satoshi's Vision (BSV).

1. Litecoin

With a supply limit of 84 million, Litecoin experiences halving to curb its inflation rate. Though the reduction will affect the return of miners, it is expected the controlled inflation rate will drive the price point of these cryptocurrency assets high so that the few coins can be worth more. This characteristic will then provide an incentive for miners to continue with their responsibilities on the blockchain. Litecoin’s halving happened once every four years, thus when 840000 blocks have been completely mined.

The first Litecoin halving happened in August 2015, and the reward of 50 Litecoin dropped to 25 Litecoins. In August 2019, the second halving event, which happened after 840,000 were fully mined, the returns of the miners dropped respectively to 25 Litecoins. Each halving event experienced a tremendous rise in the price of Litecoins some months after the event took place. The next Halving is expected to happen on August 2023, which is approximately 666 days, and 2 hours from the time of writing, and the expected halved reward will be 12.5 LTC.

2. BSV

Bitcoin SV is a fork of the main Bitcoin network that was created in the latter quarter of 2018. At that period, the reward for the mother Bitcoin network was 12.5 BTC so the corresponding BSV reward for miners was 12.5. The BSV is also capped at 21 million, a number similar to the limit of the BTC supply. As a financial entity, BSV is also prone to inflation. As a result, it undergoes halving to contain the level of inflation. Rewards of miners are accordingly diminished, but the rise in the price of the coin due to higher demand makes it worthwhile.

BSV halving happens every four years, thus after 210000 blocks have been successfully mined on the network. The first BSV halving took an event in April 2020, and the rewards of miners were cut down to 6.25 per mined block. The next BSV halving is expected to happen in January 2023, thus one year and 88 days at the time of writing, according to the image above. The reward will be respectively reduced to 3.125 BSV when this happens.

What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

Cryptocurrencies operate on blockchains, and in the previous section, the reward of miners for successfully mined blocks was considered. Now before a block is added, it has to undergo series of verification processes, and a consensus mechanism is primarily the framework a project employs for such a task.

It has specific demands that must be successfully fulfilled before the respective elements such as the validators and the nodes can make the new block added to the network. This procedure strengthens the decentralized and public nature of blockchains while ensuring high security for the network against malicious actions.

With a consensus mechanism, multiple independent nodes are utilized for the verification processes. So in the event that one fails, the network will still be operational as the other nodes will be functional and will be able to come to an agreement. Therefore, businesses, as well as individuals who rely on the network for their operations, do not experience outages or downtime as recently experienced on Facebook, which employs a centralized network for its operations.

There are various forms of consensus mechanisms, and each has a unique functional system. Some projects use one form of consensus mechanism, while few others are able to combine multiple mechanisms to improve the efficiency of the project. In this section, the Proof-of-work consensus mechanism and the Proof-of-Stake consensus mechanisms will be considered.

1. Proof of Work Consensus Mechanism

This type of consensus mechanism was first implemented by Bitcoin. It relies on the operation of technological machines to perform complex computations in order to solve a mathematical problem on the respective network. The miner who is first to successfully do so for a block of the transaction is then rewarded with the designated amount of cryptocurrency assets per the regulation of the project. The function of the Proof-of-work mechanism is quite similar to the traditional mining activity, where heavy-duty equipment is used in extracting minerals from land.

The devices used in this type of consensus mechanism are power-hungry and expensive to purchase as well as maintain. Consequently, projects that employ POWs have experienced unfavorable or harsh reprimand from various governing bodies around the world. The carbon footprint of these projects is also not environmentally friendly. Most projects that solely depend on POW have problems with scalability as there are not enough miners available to speed up the process of confirmations.

On the bright side, the nature of POW confers much higher security to projects that use them since it is difficult to hijack such networks. Also since it is expensive to set up rigs for POW, it considerably deters fraudulent individuals and firms from launching malicious mining operations on the network. To these ends, the decentralized nature of the blockchain as well as its security is preserved.

2. Proof of Stake Consensus Mechanism

The Proof of Stake consensus mechanism is more energy efficient compared to POW, as its framework eliminates the need for miners and their energy-consuming equipment for the process of block validation. Instead, it implements a staking policy whereby participants are required to commit a number of their cryptocurrency assets to earn commensurate rewards from their investments. The percentage of the staked coins accordingly determines the rewards the participant will receive. Hence, a higher staked number of the respective cryptocurrency results in higher results, and vice versa.

This characteristic renders projects that employ POS mechanisms highly scalable for various undertakings. Furthermore, the POS leaves a small carbon footprint on the environment, and since its energy consumption is considerably low, there are not many governmental restrictions on such projects. Blocks of the transaction on these networks are verified by individuals alluded to as validators. These validators also stake a number of their holdings. The blockchain chooses a validator to verify a block of transactions, and when done successfully, it rewards the validator based on the proportion of the committed asset on the network.

The POS, however, has its fair share of some demerits. A validator stands the chance of losing a portion or all of their committed resources should they validate incorrectly or be unavailable when selected to validate a block. Additionally, the security on POS is not as robust as it is on POW. Furthermore, participants with considerably higher stakes are more likely to be selected as validators over individuals with smaller committed cryptocurrencies on the network. This in a way could introduce favoritism or a form of centralization.

| Proof-of-Stake | Proof-of-Work |

|---|---|

| POS is energy efficient | POW requires high electrical power |

| POS is environmentally friendly as its carbon footprint is low | POW is not environmentally friendly. It produces a high carbon footprint |

| POS has faster transaction speed | POW is a slower transaction speed |

| POS utilizes validators for confirmation | POW requires miners and their rigs for confirmation |

| Considerable POS projects burn tokens to control inflation | Some POW projects perform Halving to control inflation |

| POW has a good scalability stance due to its rapid transaction rate | Low transaction speed affects the scalability scope of the POW project |

Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction.

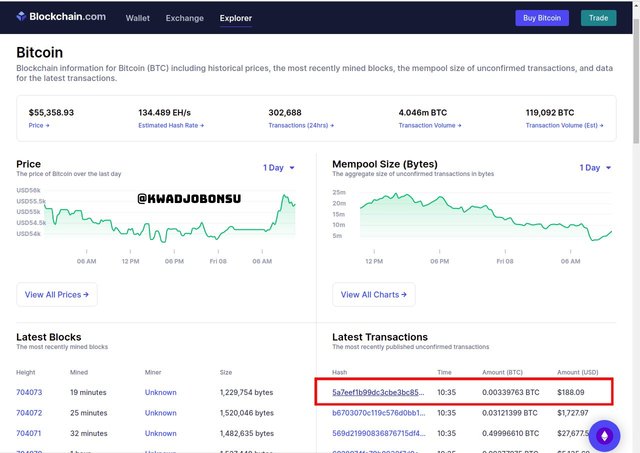

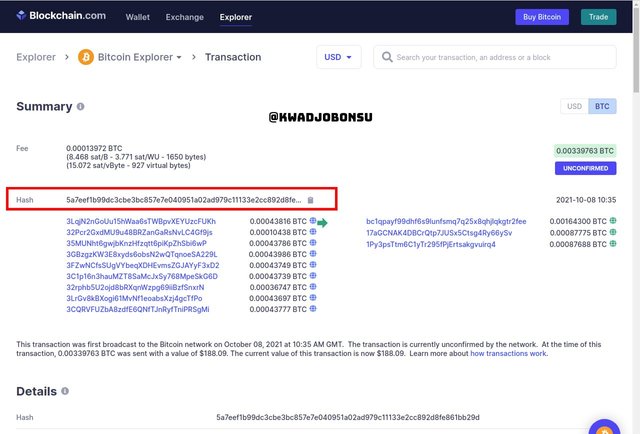

For this section, I used the Blockchain Bitcoin Explorer.

- At the time of visit, the latest Bitcoin transaction, which involved an equivalent of $188.09, is highlighted above

- The corresponding hash of the transaction is

5a7eef1b99dc3cbe3bc857e7e040951a02ad979c11133e2cc892d8fe861bb29d

- The details of the transaction are as above in the image.

What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

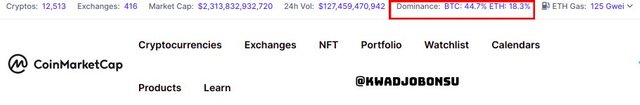

An altcoin is a term that is used to describe any other cryptocurrency coin aside from Bitcoin, the mother coin. There are over 12,000 cryptocurrencies available, and each of these has similar or distinct uses cases as well as a blockchain of operation. They have individual prices and market capitalization; however, the cryptocurrency coins Bitcoin and Ethereum control a larger percentage of the gross market capitalization.

Bitcoin and Ethereum account for about sixty percent of the market cap on a regular basis. Also, most Altcoins are directed affected by the trajectory of Bitcoin; hence, significant growth in Bitcoin is realized across multiple Altcoins, whereas dips in BTC prices also affect those of the other coins.

Regardless, there are some Altcoins called Stable coins that have their values pegged to a specified number. Therefore, the volatility of the cryptocurrency market does not have a considerable impact on Stable coins. Since Altcoins are also financial entities of investments, the price of an Altcoin can soar very high momentarily before declining back to a lower value.

Even more surprising, there is a particular period where the surge in the price of Altcoin is experienced across board without the corresponding rally of Bitcoin’s worth. Such a mooning period of the prices of Altcoins is what we refer to as Alt Season. During this season, Altcoins outperform and outweigh Bitcoin and its market capitalization respectively.

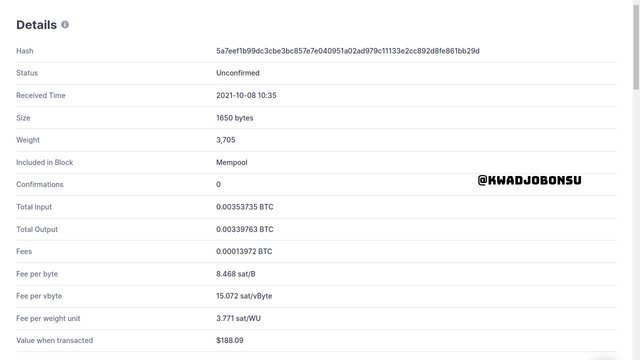

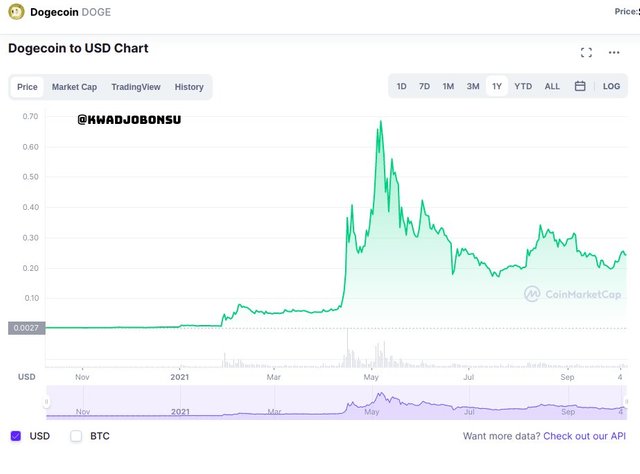

A general thumb of rule when assessing the eligibility of an Altseason is that three-fourth of the top fifty cryptocurrency coins, excluding Bitcoin, must out perform Bitcoin. This period is usually speculated to last for averagely 90 days. As shown the image above, the last AltSeason commenced in late March 2021 till the third week of June,2021. During that period, seventy-five percent of Alt coins performed considerably better than Bitcoin on the market over multiple weeks.

Instances of Altcoins that experienced price mooning include the Solana and Dogecoin cryptocurrencies.

The value of Dogecoin multiplied by over nine times during the onset of the Altseason. Its bullish rally continued despite few fluctuations here and there over a period of days. The price of Dogecoin prior to the bullish run was about $0.05. During the Altseason, it soared to about $0.60, and even it the $0.68 mark per Dogecoin. It later declined through massive selling activities on the massive, but still maintained a price point that was considerably higher than its original prior to the Altseason.

The reason behind the bullish rally of Dogecoin was partially attributed to the support from the multi-Billionaire Elon Musk, who regularly demonstrated his staunch backing for the cryptocurrency. It is believed that his influence played a big role in this bullish run. This reason seem plausible considering a similar effect of Elon Musk on the valuation of Bitcoin through his comments on the cryptocurrency asset on the Twitter social media platform.

The price of Solana also increased about four times. Before the Altseason bega, Solana was worth about $14.However, its bullish rally saw price points like $46. There were severe price swings, yet the price points were considerably still higher than the initial price at the start of the Altseason. The price growth sustain during the period of Altseason, and took off from there.

The increase in the value of Solana is attributed to the rampant incidence of adoption among developers. The Solana blockchain offers a better alternative to dominant blockchains like Ethereum. The high transaction fees on the Ethereum blockchain was a big disadvantage to projects that operate on it. Hence, a cheaper and better alternative was longed for among developers. The Solana blockchain delivered the exact qualities that the projects developers sought for. Hence, adoption of the network led to an increase in the demand for its native token, thereby causing the price to rise.

As at the time of writing, the dominant coins on the Market are Bitcoin and Ethereum, as they both account for about 60% of the market capitalization. This can be confirmed from various cryptocurrencies platforms as highlighted above in the screenshot from the CoinMarketCap website .

Also, the blockchaincenter website indicates that it is not AltSeason at the moment as the index fall at 51. Hence, due to the dominance of Bitcoin on the market, it is rather Bitcoin season as it continues to control the market.

Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, Tron , or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders/developers? Indicate the currency's ATH and its current price.

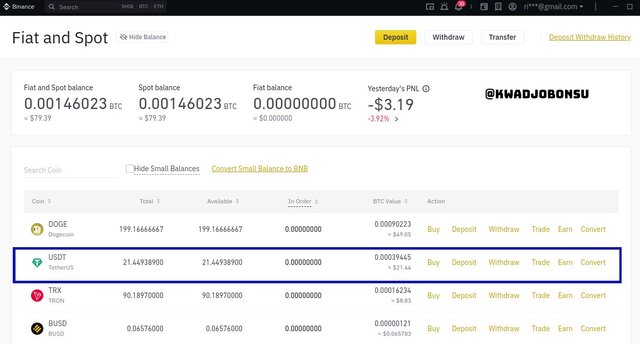

For this section, I used the Binance Desktop Application on my device to make the purchase. I exchanged $15 worth of USDT for XTZ (Tezos) coin.

- The holding of USDT in my Binance Spot Wallet is highlighted above.

- I selected the USDT/XTZ. I placed a buy limit order of 15.5673UST for 2.1 XTZ at the price of $7.413. I then clicked buy to execute the order.

- The order was instantly filed. However, there was a slight positive market slippage as the order filled at a price of $7.407. The transaction fee was 0.0021 XTZ.

.jpg)

- 2.0979 XTZ reflected in my Binance Spot Wallet account as highlighted above.

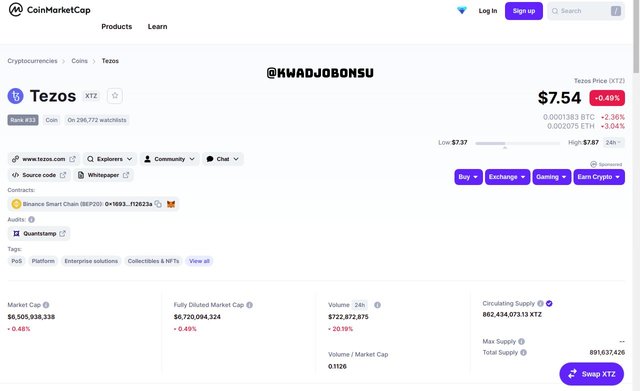

Tezos

Tezos is a decentralized blockchain that employs Smart Contracts in its operation. It functions primarily like the Ethereum blockchain. Hence, project developers can launch use the Tezos ledge as its underlying framework of operation. Since it is decentralized, it inherently has higher security and integrity as data on the network are publicly verifiable and cannot be altered. Unlike other smart contract-based networks where the developers and management decided the directions and form of upgrades on the network, Tezos has a distinct form of governance.

Participants on the Tezos blockchain vote and reach a consensus on the form of rules and upgrades to be conducted on the network. Also, participants are a reward for their approval of proposed upgrades presented to the community by the developers. These characteristics, as a whole, helps sustain the decentralized and democratic framework of the system. Its native token is called XTZ. It can be staked by participants to earn more since the network utilizes the POS consensus mechanism.

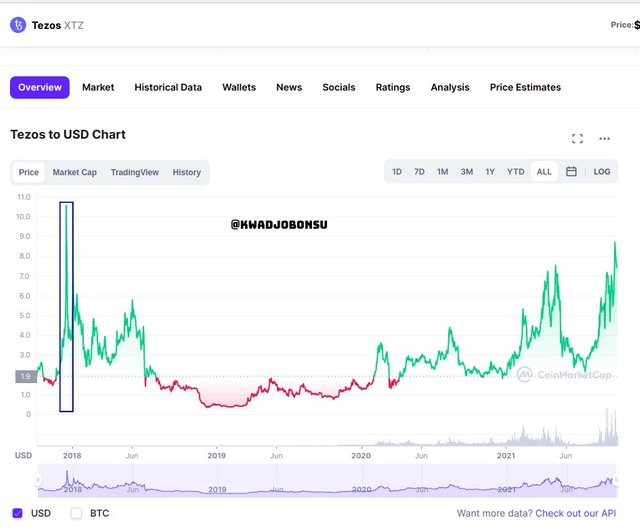

As of the time of writing, the XTZ coin was ranked 33 and was selling at $7.54. Its Market Capitalization was around $6.5 Billion Dollars, while its fully diluted Market Capitalization was an estimated $6.72 Billion. The 24-hour volume of Tezos (XTZ) was 722 Million Dollars, and the circulation pool of the coin was about 862 Million.

Its All-Time High price happened in late 2017 as it was sold at a price of $10.35 USD. It can be purchased on various trading platforms.

I chose Tezos because it has scales better than a lot of popular blockchains. This makes it attractive to developers since transaction fees will be low and speeds will be high. Mass adoption of the network will cause the blockchain to evolve. This will inevitably evoke a high demand for its native tokens since they are required for democratic governance on the ledger. The high demand will eventually make the price of the XTZ coin rise significantly.

Conclusion

Cryptocurrency assets have financial values, and any marketable entity is susceptible to inflation. Therefore, necessary measures such as Halving is implemented to control the inflation of cryptocurrency coins. Bitcoin, BSV, and Litecoin are all examples of cryptocurrency assets that have undergone the process of Halving to curb the incidence of inflation. All these coins also have an underlying framework of mechanism that is applied to reach an agreement. Some projects use the POW consensus mechanism, while others use the POS mechanism. There are other types of consensus mechanisms, as well as projects that make use of multiple mechanisms. Each has its pros and cons, thereby making them more suitable for certain undertakings than others.

I thank Professor @imagen for this wonderful lecture.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.