[In-depth Study of Market Maker Concept]-Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

.jpg)

Hello friends. I believe you are all fit as I am? This article is my submission to Professor @reddileep's class on the In-depth Study of the Market Maker Concept. The assignment was given as below:

1- Define the concept of Market Making in your own words.

2- Explain the psychology behind Market Maker. (Screenshot Required)

3- Explain the benefits of Market Maker Concept?

4- Explain the disadvantages of Market Maker Concept?

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

Define the concept of Market Making in your own words.

Cryptocurrency markets are known to be volatile because the prices of these digital financial assets swing up and down at a rapid pace. Such price directions are by no means automated by the developers of the cryptocurrency, but it is rather a repercussion of the actions of traders on the market. By selling and buying cryptocurrency elements on respective markets, traders momentarily determine the price of these elements.

When the coins or tokens are purchased at a high market ask price consistently, the respective cryptocurrency asset gains a bullish momentum. On the other hand, when the ask price of a cryptocurrency asset is low, and traders further buy the assets at lower and much lower prices continuously, this event further drives the price of the cryptocurrency asset down.

The bid and ask prices on the market of a cryptocurrency asset contribute immensely to the liquidity of the asset, and the individuals or firms that are responsible for the custom ask or bid prices are alluded to as Market Makers. The name reflects their act of “making” the kind of market or price they want, whether it is a sell order or a bid order.

Market makers particularly capitalize on conditions such as market spreads to make a profit by purchasing assets at a low price and then later sell the digital asset at a higher price. This process, as stated earlier, adds to the liquidity of the asset’s market and also helps reduce the bid-ask spread market condition in some cases.

A buy limit is predominantly utilized by traders to place an order, in which they seek a lower price point for the asset, whereas a sell limit order is employed by traders to sell their assets at a price point that is higher than the current market price. Such orders are placed on hold when executed till the needs of the order are filled. The traders then acquire profits.

Market Making is, therefore, the process in which a cryptocurrency trader improves the liquidity of a cryptocurrency’s market by purchasing and selling the digital financial entity at advantageous price points so that they can capitalize off the market spread to acquire profits.

Explain the psychology behind Market Maker.

Cryptocurrency traders, in general, execute orders with the mindset of making profits by capitalizing on the market condition of an asset, and market makers are no different. As discussed earlier, Market makers are the individuals who are responsible for the market-making process. Market makers acquire cryptocurrency assets at low price points and sell them at a high price point by means of a buy limit order and a sell limit order respectively.

Since the orders are usually not concurrent with the current market price of the digital assets, the executed orders are put in a pending state until the conditions of the market meet the demands of the order so it can be filled. These numbers are not arbitrarily set by traders. Instead, the market makers analyze the performance of the digital asset with respect to a particular timeframe and make predictions about a viable imminent low or high price point.

Since the market is psychologically and emotionally directed by fear and greed, there are market markets that intentionally manipulate the price direction of a digital asset for financial gains. Such individuals or firms are able to do so because they possess a significant amount of the respective cryptocurrency asset to redirect the market with observable consequences. Such cryptocurrency whales control the market by reducing the price of an asset by purchasing a large amount at the digital entity at a low price point with the aid of a buy limit order.

Their orders are placed on hold after execution, but they attain a filled status when the assets are sold to them by other traders at the price the whales asked for. At this point, this filled order can significantly push the price of the respective cryptocurrency low. These manipulative whales then hold onto their acquisitions till the price point of the asset is considerably higher again and then sell off to secure massive profits at the expense of small or budget-sized traders.

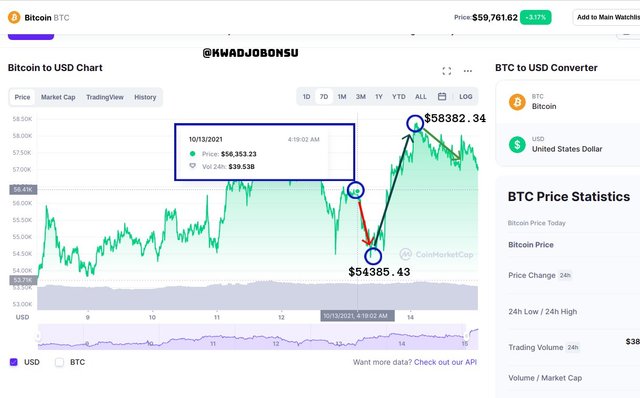

An illustration of the above trading psychology is as follows:

Considering the scenario where the current price of Bitcoin is $56.353.23, as highlighted in the rectangle. A manipulative whale will then place a bid price of $54385.43 for the acquisition of a large number of Bitcoin.

A buy limit order will be executed with the respective parameters, and the executed order will be placed on hold for the respective amount of time it will the order to be filled.

Once the order is filled, the market maker will acquire the cryptocurrency asset. The whale in question will then sell the assets at a specific but higher price point, for instance, $58382.32 by means of a sell limit order.

Depending on the liquidity and the performance of the digital asset on the market, it would take quite some time before its price soars and meet the demands of the whale. The order will be filled and the whale will acquire great profits at the expense of mostly small traders.

Explain the benefits of Market Maker Concept?

ia. The implementation of the market maker concept, as stated earlier, makes an immense contribution to the liquidity of an asset on the market. The presence of high liquidity translates to an active market, where orders of traders are filled quickly.

ib. This form of speed tends to attract more traders who invest in the asset to capitalize off the market conditions. Hence, the actions of market makers by means of the bid and ask orders add up to the value of the respective digital asset.

ii. The market maker concept when applied helps traders to make profits on the market of an asset. Since the traders purchase the digital elements at low prices and later sell them at higher prices, they are able to secure significant profits with little risk. The low-risk factor of such actions also adds up to the essence of this ideology.

iii. During the market making, traders after the acquisition of the digital financial asset sell them at a high price. This action contributes tremendously to how volatile the cryptocurrency entity is and further pushes its price high across markets. This characteristic, in turn, aids investors to acquire paper profits that can be realized once they sell their holdings.

iv. The action of the market maker notion helps in closing the bid-ask spread that is prevalent across the markets of a cryptocurrency asset. This event helps in unifying the price points of the digital assets, and it confers a standard and robust price to the asset across the board.

Explain the disadvantages of Market Maker Concept?

i. Most cryptocurrency exchanges are decentralized; hence, they are not under the regulation of any central authority. The absence of a central authority element means that traders on cryptocurrency exchanges can execute mischievous orders that are meant to manipulate the market in their favor. Traders with small capitals usually end up losing their assets to the tricks of whales.

ii. The manipulated price direction of the asset also reflect on charts. Traders who rely on the price action without good risk management can also fall prey to such deceit. False signals will be generated on the charts and by other indicators, and traders who execute orders accordingly can attract severe losses on the market. This will cause financial loss.

iii. Also, the liquidity provides by the market markets does not last long. Often, traders exit markets of certain assets once they secure their profits and move on to a distinct market of a different cryptocurrency to provide liquidity. Therefore, the liquidity of cryptocurrency assets is ephemeral and erratic.

iv. The manipulation of prices sometimes results in an abysmal performance of a digital financial asset. Novice traders or investors who do not have great emotional control can further drive prices of cryptocurrency assets low when they observe the huge drop in the price of an asset, which in this case is a product of the manipulative actions of a whale, and then sell their assets at a loss to secure "what is left". Sometimes, it can take a considerable amount of time for the price of the cryptocurrency element to recover.

Explain any two indicators that are used in the Market Maker Concept and explore them through charts.

Market makers utilize data from several mechanics before making a decision concerning when and what asset to purchase or sell. More often, market makers observe the bid and sell elements of the exchange’s order book to obtain a decent trend of the price direction of an asset. Additionally, technical indicators are employed to assess the trends of an asset’s price. Technical indicators, more importantly, can communicate the volume of trades at respective sectors, and this information can be used to identify possible market manipulation strategies at work.

For this section, the two indicators I added to the chart are the Exponential Moving Average Indicator and the Volume Indicator

i. Exponential Moving Average Indicator

The Exponential Moving Average is commonly used by Market Makers to observe the trend of an asset on the market with respect to a particular timeframe. Two EMAs are regularly used, and they are both of distinct periods. One EMA is assigned a shorter period, whereas the other is assigned a longer period. A crossover between these two lines communicates an imminent bullish or bearish price direction.

When the shorter length EMA crosses below the longer EMA, it denotes a bearish direction of the asset’s price which is an indication that sellers are currently dominating the market. However, when the shorter one crosses over the longer EMA, it signals a bullish price trend. A bullish trend is a message that buyers are in control of the market at that point in time. The ability of a Market Market to discern these signals aids them in purchasing and selling assets to make profits.

ii. Volume Indicator

The Volume Indicator mainly signals the rate of distribution and accumulation occurring during a period of time. Accumulation is an allusion to the rate at which traders are buying the asset, thereby pushing its price point higher, whereas distribution refers to the act of traders selling their assets on the market. The Volume indicator shows the volumes of trades and the dominant event that took place during that period.

Combing these two indicators can help Market Makers to identify manipulative market conditions, where whales are seeking to profit off smaller traders. In the instance below, the BTCUSDT pair within 15 minutes time frame was selected on the Tradingview platform. The Volume and two EMA indicators have been added to the chart. The blue line represents the 21-period EMA, and the red line stands for the 55-period EMA. The green volume grids represent distribution, while the green ones denote accumulation.

In the image above, a crossover between the two EMA happened at crossover 1, and the shorter EMA move below the longer EMA. This signaled a bearish price direction. The price of the asset during that period, indeed, moved in a downward manner. Also, it can be seen that while the price point of the asset was low, an accumulation took place with a volume of 1381 at the price of $57208. This means that a huge volume of the asset within the respective timeframe was purchased at a low price.

After some time, the two EMAs crossover once again at crossover 2. This time, the shorter EMA moved over the longer EMA signaling a bullish market direction. Truly, the market took off violently in an upward fashion as shown in the screenshot above. Once it reached its peak, a considerable number of sell-offs took place. At the period where the price of the asset was $59169, a distribution with the volume of 1407, which is quite similar to the previously identified accumulation volume took place.

So on hypothetical grounds, if this event was the action of a Bitcoin whale then that individual or group would have made huge profits off other traders on the market. Hence, the implementation of indicators, as well as the order books of exchanges, can help traders spot manipulative intents on the market.

Conclusion

Market making is a common act on cryptocurrency markets where traders called Market makers to acquire assets at low prices through the utilization of buy limit orders and make a profit after selling those assets at a higher price point on the market, by means of a sell limit order. These events in totality contribute to the liquidity of the market, although the provided liquidity does not last for long.

The actions of manipulative whales can have detrimental effects on the capital of unwary and inexperienced traders. Therefore, it is important that precautionary measures such as analysis of order books and implementations of multiple indicators are done to identify potential deceptive market trends.

I thank Professor @reddileep for such an educative class.