Steem Blockchain: STU, Reputation, Author/Curator Ratio, etc.- Steemit Crypto Academy- S4W7- Homework Post for @sapwood

.jpg)

Hello everyone. I hope you are as fit as I am? This article is my homework submission to Professor @sapwood's assignment on Steem Blockchain: STU, Reputation, Author/Curator Ratio, etc. The assignment was given as below:

(1) What is STU? What is the break-up of STU? Take a real example to indicate the STU and calculate the different rewards that Author and Curators generated from your last Post Payout? (Screenshot required)

(2) Indicate the Raw reputation score of your Steem Account and calculate your Reputation? Cross-check it with the Reputation score displayed in Steemworld.org?

(3) What percentage(of the Post Payout) was generated as liquid rewards(SBD) from your last Post in terms of USD equivalent? Explain how the rise of SBD has shifted the supply dynamics? As per your last post payout calculate the ratio of Author: Curator Reward in terms of USD equivalent?

(4) Explain how & why an initiative like #club5050 can shift the demand/supply dynamics in favor of STEEM?

(5) Consider a user having a reputation lower than you, upvotes your Post-- Does it affect the Payout and increase the Rep? If the same user goes for a downvote, does that affect your Payout and Reputation both? Explain Why & How; with Examples?

What is STU? What is the break-up of STU? Take a real example to indicate the STU and calculate the different rewards that Author and Curators generated from your last Post Payout?

The Steem Token Unit (STU) are keywords that define the payout framework in the Steem ecosystem. It was formulated by some developers on the network and is not regarded as a technical keyword in the Steem blockchain layers. The primary goal of Steem has always been to reward its community members with cryptocurrency for their genuine and valuable contribution to the platform.

The rewards, which are characterized as a whole as the Steem Token Unit, comprises three main assets: the Steem Power (SP), Steem, Steem Backed Dollar (SBD). Each has its own dynamics but is closely related to a large extent.

Steem is the basic cryptocurrency unit of the Steem network, and all other forms of cryptocurrency on this blockchain obtain their values from the Steem element. It serves as a liquidated financial entity and can be sold or purchased on a number of cryptocurrency exchanges. The Steem unit can also be committed to a long-term investment through the process of Staking.

Once staked, the Steem now becomes Steem Power. It takes four weeks to revert the process. The quantity of an account’s SP determines its influence in the Steem reward pool. The amount of reward that can be generated is commensurate with an account's Steem Power holdings.

The Steem Backed Dollar is another cryptocurrency element in the Steem blockchain and was initially developed to behave like a Dollar. It is a convertible unit that can be exchanged for Steem and vice versa. Due to the external market conditions of the SBD, the initiative to peg it to a Dollar failed and now possesses a volatile price direction outside the Steem blockchain.

All these financial elements are integrated into the reward system of the Steem network for its Proof of Brain mechanism. Users are rewarded through the creation of content as well as curation of articles or posts on the blockchain. The rewards are only claimable when the payout is due seven days after it was posted.

The reward framework has three options:

i. 50% Steem Backed Dollar / 50% Steem Power: This option divides the earnings in half and assigns each part to SBD and SP respectively. Other times, Steem alongside SBD and SP are all distributed as the payout. This occurrence of this event, however, depends on the Debt ratio.

ii. 100% Power Up: This payout option converts all the receivable rewards into Steem Power. Hence, at the end of a payout, the claimed reward becomes staked Steem tokens that add up to one's SP holdings and according affects one’s influence on the Blockchain reward pool.

iii. Decline Payout: When users go for this alternative, they decline any form of reward for that particular post. Hence, no SP, SBD, or Steem will be generated from the post once its payout period is due.

The reward for a payout is not fully distributed to the author. Curators of the post also receive a fair share of the reward pool. For any post on the Steem network with an active payout configuration, 50% of the reward is allocated to the author, whereas the other half is disbursed among the curators.

The form of the distributed curators’ reward is Steem Power, while the remuneration for the author is 25% SBD and 25% Steem Power. Thus, considering the scenario where the SBD print rate is 100% and the first payout option (50% SBD / 50% SP) is selected. In the case where the 100% Power up alternative is selected, the 50% of the post payout will all be converted to Steem Power, as mentioned earlier.

Now let us consider a real case to apply the abstract information above:

The screenshot above is that of a Crypto Academy homework that was paid out on 12th October 2021 at 6:37 am. The payout was $56.71, and the SBD print rate was still 100%. The 50% SBD/ 50% Sp payout option was selected.The reward for the Curators and the Author will be calculated as follows:

Author Reward:

As indicated by the image, 50% of the $57.71 payout, which is $28.42, was allocated to the author.

i. 25% of the STU or 50% of the Author’s payout was received as SBD:

25% SBD = $28.42 / 2

25% SBD = 14.21 SBD

On October 12, 2021, at the sixth hour, the price of SBD was $7.2655

Hence 25% SBD = $103.242755

ii. 25% of the STU or 50% of the Author’s payout was received as SP:

25% SP = $28.42 / 2

25% SP = 14.21 SP

On October 12, 2021, at the sixth hour, the price of Steem was $0.5981

Hence 25% SP = $8.499

Therefore the gross STU of the Author = $8.499 + $103.2427

50% STU = $111.7417

Curators Reward:

50% of the STU as indicated above is $28.29

SP receivable= $28.29 / $0.5981

Curators SP = 47.5171

Taking all the information above into consideration, the actual worth of the STU of the post’s payout = $111.7417 + $28.29

100% STU = $140.0327

Indicate the Raw reputation score of your Steem Account and calculate your Reputation? Cross-check it with the Reputation score displayed in Steemworld.org?

The Reputation of an account on the Steem network is calculated using the formula below:

Reputation= Log 10( Raw Reputation Score ) - 9 ) * 9 ) + 25

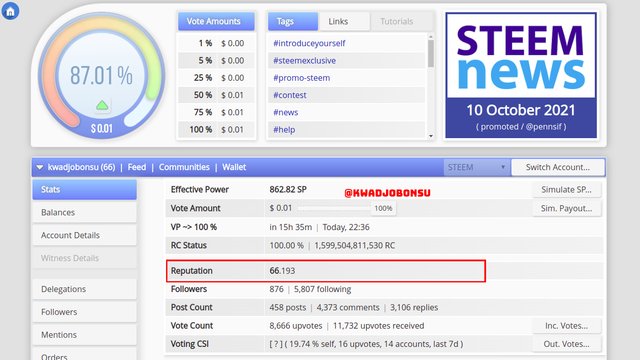

The Raw Reputation score of my account, according to the steemdb website at the time of visit, is 37765702987358

The computation of the Reputation score is a follows:

Reputation= ( Log10( 37765702987358 ) - 9 ) * 9 ) + 25

Reputation = (13.5771 - 9 ) * 9 ) + 25

Reputation = [ ( 4.5771 ) * 9 ] + 25

Reputation = 41.1939 + 25

Reputation = 66.1939

As highlighted in the image above, the Reputation of my account is indeed 66.193 according to the calculation of the Steemworld website.

What percentage(of the Post Payout) was generated as liquid rewards(SBD) from your last Post in terms of USD equivalent? Explain how the rise of SBD has shifted the supply dynamics? As per your last post payout calculate the ratio of Author: Curator Reward in terms of USD equivalent

Percentage of SBD in terms of USD

The percentage formula is as below:

[ ( USD worth of SBD or 25 % STU ) / ( USD worth of 100% STU ) ] * 100

The respective parameters according to question 1 are :

USD value of 25% STU / SBD = $103.242755

USD value of 100% STU = $140.0327

Therefore, Percentage = [ ( $103.242755 ) / ( $140.0327 ) ] * 100

Percentage = 0.737276 * 100

Percentage = 73.726%

Ratio of Author to Curator Reward in terms of USD

The formula for Ratio is as below:

( the value of element 1 / sum of element n) : ( the value of element 2 / sum of element n)

The respective parameters derived in Question 1 are as follows:

USD value of Author’s STU = $111.7417

USD value of Curators’ STU = $28.29

USD value of 100% STU = $140.0327

Hence Ratio of Author to Curator USD value of the payout =

Ratio = ( $111.7417 / $140.0327) : ( $28.29 / $140.0327)

Ratio = 0.797968617 : 0.202024241

Ratio ( Rounded Figure ) = 0.8 : 0.2

The ratio of Authors to Curators USD Values = 4: 1 or 8 : 2 or 80 : 20

How the rise of SBD has shifted the supply dynamics?

Earlier, one of the mentioned forms of the payout was the 50% SBD/ 50% Steem option. Other times, liquid Steem is incorporated into the payout framework, but it depends on the debt ratio. Nevertheless, this system of payout is intended to distribute half of the Steem Token Unit payout to curators, and the other half to the author.

This framework takes into consideration the hypothetical $1 dollar-pegged nature of the Steem Backed Dollar (SBD). This translates to 25% STU being generated as liquid Steem, whereas the 75% STU is staked as Steem Power. This event, consequently, limits the supply of liquid SBD or Steem on the market and plays a pivotal role in the price point growth of these cryptocurrency tokens.

Conversely, the percentage of the distribution changes tremendously when the SBD token experiences a price change that surges beyond $1. When the Steem Backed Dollar token is being sold on the markets at a price point higher than the $1 Dollar peg, the author earns considerably more than the curators.

The Proof of Brain mechanism accounts for 65% of the supply pool in the Steem ecosystem. Hence, when authors earn more, the amount of liquid SBD or Steem abounds, limiting the receivable SP from payouts on the network. This inflation can have adverse repercussions on the growth of the platform and its cryptocurrency price points on the market.

Considering the past payout instance in Question 1, SBD was selling at $7.2 instead of the planned $1 peg. Hence, the resulting actual ratio of the Authors to the Curator's STU USD worth was 80 to 20, even though the 50% SBD / 50% SP payout configuration was selected. This means that the author earned 80 percent of the payout pool, while curators earned 20 percent of the reward.

Explain how & why an initiative like #club5050 can shift the demand/supply dynamics in favor of STEEM?

The leaders of the Steem ecosystem, after careful consideration of the ecosystem’s state, recently rolled out an innovation initiative. It is called the Club 5050. The premise of this initiative is that users of respective accounts must convert half of the liquid SBD claimed from the payout of posts into Steem Power.

This move is designed to combat the surge of the SBD’s demand in the ecosystem. The implementation of this initiative, therefore translates to 50% curators reward, 50 % Authors reward ( whereby 25% STU will be SP, 12.5 % of STU (thus 50% of the liquid SBD payout) will be powered up, and 12.5% STU will remain as liquid SBD).

The implementation of this notion at large will eventually and effectively limit the number of liquid SBD in the system. This event will certainly result in a notable scarcity of SBD on the market, and the price point of this virtual currency will rise, as there will be more market demand for it.

Furthermore, since the curators’ rewards are in Steem Power, the percentage of staked Steem for each post that applies this concept – thus, if the 50% SBD / 50% SP option is at work – will result in 87.5% of the STU being committed as Steem Power.

Once such an immense number of Steem is staked on regular basis, the number of liquid Steem on the market will reduce significantly as time progress. This situation will translate into a low market supply of Steem, which will, in turn, cause a surge in the demand for Steem on the market.

Once the demand surges, the price point of Steem will rise exponentially. The increased Steem price will also translate into a bigger return on votes from accounts with a good number of staked Steem as SP. Account owners will be able to reward others with an appreciable worth of votes and also earn significantly from curation.

Consider a user having a reputation lower than you, upvotes your Post-- Does it affect the Payout and increase the Rep? If the same user goes for a downvote, does that affect your Payout and Reputation both? Explain Why & How; with Examples?

In the Steem blockchain, a metric called Reputation is a key indicator of an account's state of quality with respect to its activities on the network. The base reputation for new accounts is 25, but this number can increase or decrease depending on the gross number of downvotes and upvotes as well as the individual weight of each vote received from other accounts on the blockchain. An upvote of significant weight increases the reputation of an account on the Steem network, whereas a downvote diminishes one’s reputation on the network.

The weights of the votes, however, are commensurate with the amount of Steem Power holding of the account. Hence, upvotes from accounts with large SP have much positive influence on the recipient's reputation on the blockchain.

Likewise, a downvote diminishes the reputation figure of the recipient account. Upvotes also add up to the reward pool of a post’s payout, while downvotes take away the proportionate amount from the pending payout’s reward pool.

With the Steem voting mechanics, when a user with a lower reputation casts an upvote on the publication of a different account whose reputation is higher, rewards that are proportional to the weight of the upvote, as well as the available Steem Power, will be generated for the other user.

The account that performed the upvoting will also reap its share of the curation reward once the payout is due. Also, the reputation of the recipient account will increase proportionally to the weight of the upvote with a heavy emphasis on the available Steem Power of the voting account.

For instance, when my Steem account with a reputation of 66 receives a 10% weight upvote from a different account of 61 Reputation with 10000 SP, $0.03 will be generated and added to the reward pool of the post. The reputation of the recipient account will experience a positive impact and increase accordingly.

However, a downvote from an account of lower reputation considering that it has a good amount of SP will negatively affect the payout of the recipient account proportionally to the weight of the vote and the available Steem Power of the voting account, but not the reputation.

Hence, the reward pool will reduce by the respective amount produce by the downvote, and the reputation of the recipient account will stay the same. I

An example will be the same account of 61 reputation and 10000SP downvoting my post. $0.03 will be subtracted from the pending reward pool of the post, but the downvote will not have an impact on the reputation score of my account.

Conclusion

STU stands for Steem Token Unit. It represents the various tokens distributed through payout mechanics on the Steem blockchain. The native tokens on the Steem blockchain are Steem and Steem Backed Dollar. The Steem is a liquid financial asset that can be traded and also invested through the process of Powering Up. Through Powering Up, a liquid Steem becomes Steem Power, which is an element that grants account the commensurate influence on the supply pool of the Steem network.

Reputation is a core element of the Steem blockchain. When increased organically, it improves the overall quality and outlook of the Steem network. It can be increased or decreased in various ways as discussed in the article. How high or low the reputation changes is directly proportional to the weight and the nature of the vote received.

The growth of the SBD’s value beyond the intended developer’s pegged price has led to the recalibration of the reward mechanics of the Steem ecosystem. As a result, an initiative called the Club 5050 has been introduced to help correct the excess supply of the liquid pool in the Steem ecosystem. This program sets to empower more Powering Up activities among users to help the ecosystem regain control over certain factors.

I thank Professor @Sapwood for this great lecture.

Do not use the #club5050 tag unless you have made power-ups in the last 7 days that are equal or greater than any amount you have cashed out.