Investment through Private and Public Sales - Crypto Academy / S4W6 - Homework Post for @fredquantum.

Hi @fredquantum, thanks for lecturing us on Investment through Private and Public Sales. I really enjoyed reading this topic and it was well understood. I will be submitting my assignment below.

What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

First of all i will like to take the question above into parts, that is i first want to explain some key terms in the question asked. I will like to explain what investment in general is before trying to link it to crypto. So Investment in a lay mans language is simply the process of acquiring an assets or item with the sole aim of generating income or profits from it. No one will ever invest with the aim of losing, its always about the profits we can get from the assets acquired. Just like how we have long and short term goals for everything we do, the same applies to investment. We also have long term investments which are normally acquiring assets which its profits will be obtained over a long period, but with the short term investment, one just acquires assets and makes profits instantly or just over a short period of time.

Now thats enough of investment, lets now try to link it to the crypto. A Crypto Investment is not very different from any order investment in the sense that, for every investment you engage in, you first of all must have knowledge of it. So Crypto investment is an investments which a person does a form of analyzing which is either Technical Analysis, Fundamental Analysis, Sentimental Analysis before he engages in a trade. The individual who makes this investment is either engaging in a long term or short term. This is solely done for profits. In the crypto world we have terms we associate with long term, we say HODL which simply means Hold On For Dear Life just as the name implies Hold on which means holding for a long time, with this the individual obtains an assets and holds it for a long period and sells it in years time thats if he has gotten the required profits he was estimating, but with the short term the individual just obtains assets and sells it over a short period of time.

Crypto Investment Tools

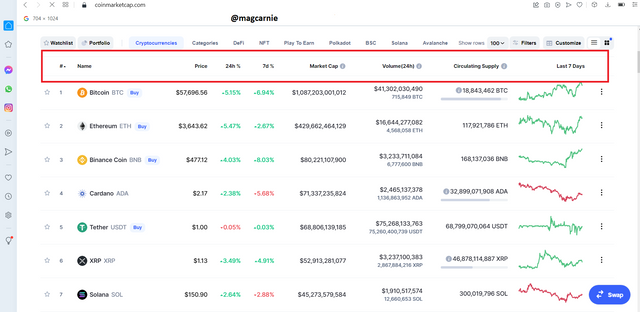

These are tools that makes investment through crypto very easy for users be able to do their investment. These tools serve as an avenue for individuals to make their research and analysis before they try any form of investments. Some useful tools that are popular that people normally use for their research and analysis include, Coimmarketcap, Coingecko, Coinbase which provides detailed information market cap, Volume(24h), Circulating supply and many more thats helps in the analyzing process. It also has a portfolio section where individuals get the opportunity to list their targeted assets and help them track its development. It also shows the assets that are performing and those that are under-performing. Below is a screenshot i took from https://coinmarketcap.com.

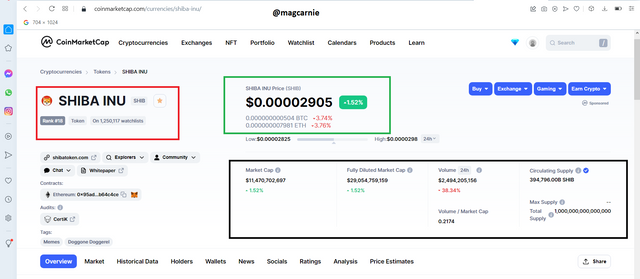

Lets take an asset like Shiba Inu and try using coinmarket cap as a tool for my analysis before i try investing into it. I will be putting a few of its details in a table form.

| Token | SHIBA INU SHIB |

|---|---|

| Price | $0.00002906 |

| Market Cap | $11,470,702,696.74 |

| Fully Diluted Market Cap | $29,054,759,158.50 |

| Volume 24h | $2,494,205,156.46 |

| Circulating Supply | 394,796.00B SHIB |

| Volume / Market Cap | 0.2174 |

| Max Supply | 1,000,000,000,000,000 |

| Market Rank | #18 |

With the above information given to me by the site i have if not enough but much information just for me to start my investment in the asset. The price above shows that its still in the state which i could buy more and with its circulating supply and market cap and also its ranked gives you a bit of good confidence for you to start your investment.

- Talk extensively about the following. Also, highlight the benefits and risks associated with each.

i. Private Sale in Cryptocurrency.

ii. Presale in Cryptocurrency.

iii. Public Sale in Cryptocurrency.

** Private Sale in Cryptocurrency**

As the name suggests already, It is a type of sale that is done very private meaning it is hidden from the general public.

This is a type of sale where selected individuals are invited by the company incharge of the token to discuss about it, review the project, the possible problems associated with it and its solutions. Companies now use this opportunity to get investors to invest greatly into the project. The investors dont just agree to their submission but also try to analyse and review the coin in their own knowledge and if they see they it is something that can make them hug sums of profits then they determine as to the amount they can invest and their possible returns. So now if the coin is bought then it becomes the first sale of the coin which is termed as the Initial sale of the coin.

Pros

Some of the advantages of private sales is that it provides an avenue to individuals who wish to invest into the project to buy the tokens at a relatively cheaper price. This helps them to maximize profits at the end of the sale. Another advantage is that investors are given a form of discount which makes them to be able to purchase more of the tokens. This also yields more profits for the investor at the long run.

Cons

As there are advantages to it so does it has its disadvantages as well. Lets discuss a few. It is known to be a high risk investment. This is because no one knows the future prediction of the token which can lead to a big loss to the investor at any given time. There is also a very low chance of you getting a refund of your money incase where the token fails. This will lead to loss for the investor.

Presale in Cryptocurrency

Presale in cryptocurrency as the name implies is a sale that is done before the actual coin becomes public. This is usually done so companies can raise enough funds to fuel the launching of the project when its due. Presales are usually done just when the project is about to end. Just like the private sale, here the coin is also sold to investors at a lower price or at a discount. It is also the second phase of coin offering.

Advantages

Now lets discuss some advantages of presales. One of the advantages is that most investors get the opportunity to purchase or invest more into the project before it becomes public to the people. Also prices are reduced so investors can buy more or investors are given a discount per token so they can buy more. This will help them maximize profits.

Disadvantages

Just as it has advantages so does it has a few disadvantages. Presales are also know to be of high risk for investors. Just like the private sale, the token also has an unpredictable future which can run into a loss in the future.

Also in presales, just a few investors are allowed to purchase the token, this in a long run affects project.

Public Sales in Cryptocurrency

This is termed as the last phase where the project is given to or shown to the general public. This is also the stage where the project is listed on various exchanges for public investors to show interest in it. In as much as the private and presales are more or less done secretly just amongst a few investors, public sales mostly go with big advertisement like social media hypes, commercials and many more. I always say that the public sale is the unbiased form of sale which is open for all whether you are a big investor or a small one. In fact everyone can invest as much as he or she wants to.

Advantages

Lets try and check some advantages, the public sale is known to be a low risk investment to investors because investors have the opportunity to know the movement of the project. Liquidity in public sales is always increased due to the increased number of investors on board.

Disadvantages

Some few disadvantages associated with public sales are , it is always sold at a higher price as compared to the private and presale, the discounts also offered are very low.

What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

Not just with cryptocurrencies but for any project to stand, project owners must set out mediums in which they can use to propagate their projects to the general public. The most popular one we all can testify is through social media which is no doubt one of the best platforms that aids in propagation of messages to general public. Also a few ways that can be use include the developers website, meetings, exchange platforms and many more. I will be explaining them one by one below.

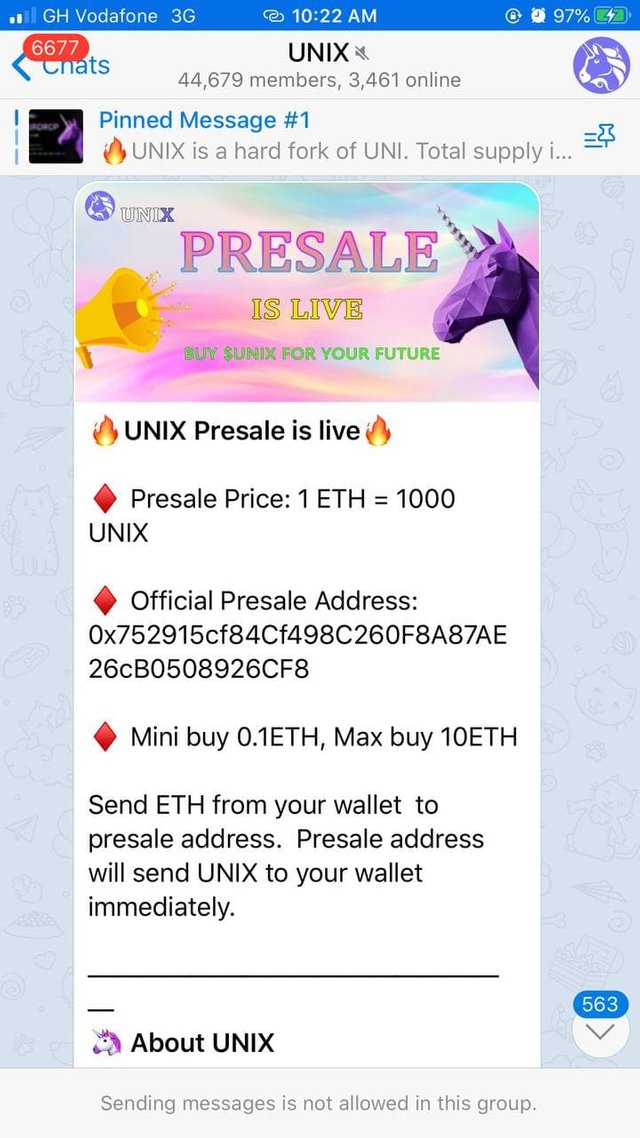

Social Media

The use of social media platforms such as telegram has really helped in the sales of their coin. Platforms such as telegram as has systems like bot that can be used to check the activity of the coin and interaction between the interested clients. Discord too is no exception which is also a great tool that project owners use advertise or showcase their tokens to the public Below is a screenshot of the telegram page of UNIX token which will be launched soon. It has about 44,679 members on it.

The Projects Website

For people to believe that a project is really genuine or has a good reputation, what they mostly look out for its the projects website. A website is just a platform that contains all information about the project and it can also serve a platform where investors can buy the project or invest in it. Interested investors who wish to ask questions that are bothering their mind can chat project owners directly through the the chat sessions. Below is a screenshot of the Uniswap token.

Through Meetings

This is also a medium that works fine especially with private sales which project owners sit with investors to discuss about the project and after a successful one they invest into the project if they are convinced.

Through Exchanges

This is also another medium project owners use. It is basically the last phase that is done in the 3 stages, mostly associated with public sales. This is where project owners enlist the project onto a platform, this is known to be a less risked way of investment.

Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages, and specify the initial supply available, and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

The Med Token

The Med token which has MD as its token symbol was created to be run on the binance smart chain. The Md token was created by Med who comes from Ghana in the Western part of African. It is a token that comes with insurance for its customers and also has the intention of maximizing profits for investors. The MD token is also one that has adopted the proof of history mechanism which helps for easy transactions to take place. Proof of history is something that is well known by all investors to be one of the best mechanism so therefore a good thing that our team added to it.

The Med token will soon be listed on various exchanges such as Binance, Houbi, coinbase and many more. It will also be made available in a way that it can be paired with popular cryptocurrencies like BTC,ETH and stable coins such as USDT and USDC. With a total max of 10,000,000 MD tokens out of which just 8,000,000 MD has been sold out to both private and public investors. The team has been able to raise $1,350,000 through sales from the funds which will help fund the final stages of the token and also pay some workers in the team. The official date which is proposed for the MD token to be listed on the above exchanges is 10th December, 2021 and let me also add that it will also be added on coinmarketcap soon.

The MD token will also have its official website launched on the proposed dated, It now has its team on almost all social media platforms. Currently it has about 40,000 subscribers on telegram and discord where most or frequently asked questions are been answered by The Med Team.

Now below are the 3 stages in which the Private Sale of the MD token took place which different dates, prices and different funds allocated to it.

1st Private Sales

Date of ICO - 10th December 2021

Med token price = $0.5

Med Token Supply = 2,000,000 MD

Fund raised = $50,000

2nd Private Sales

Date of ICO - 17th November 2021

Med token price = $0.6

Med Token Supply = 2,000,000 MD

Fund raised = $100,000

3rd Private Sales

Date of ICO - 20th November 2021

Med token price = $0.7

Med Token Supply = 2,000,000 MD

Fund raised = $200,000

Now that we have completed our sales with 3 different investors, The Med token had a total of $350,000 from the sales of

6,000,000 MD tokens. We have decided to pause any presales for now since most of the token has been sold, the next to do now is to move to public sales.

Public sales

The public sales of the Med token took a total of 5 days since this involved the public. Below is a summary of how the public sales took place.

Date of ICO - 25th - 30th November 2021

Med token value: $0.85

Med Token Supply = 2,000,000 MD

Fund raised = $1,000,000

In summary for all the sales we have 1,000,000 from the public sale which when added to the 350,000 of the private sales gives us a total of $1,350,000 fund raised. This will help pay up the team and also help push the project to greater heights

Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

AMASA (AMAS TOKEN)

Amas is an ERC20 standard token that serves as a governing token for the Amasa project. The token ICO occurred from 23rd September to 30th September which is a duration of 1 week.

The ico had a goal t auction 3,750,000 tokens and at the end the total tokens that was sold was around 200,000,000. During the ICO a price of 1 AMAS was 0.08. it was a very successful ICO.

you can visit amas through this webiste

Now let me explain what the AMASA project is.

The project has some people listed as key advisers their names are listed below;

· Tim Bass (block 8)

· Niki Ariyasinghe (Chainlink labs)

· Sameep singhania (Quickswap)

· George Samman (geora.io)

· Reza Naeeni (Swash App)

The project has very clear mission which are;

·Making income streaming easy and safe. They wish to offer users a common account to accommodate and manage your funds made from income streams. Some of these income streams that are allowed are earning from playing games, NFT ownership, social media interactions, referrals and also allowing IoT to access device data.

·Provide stability. We are all aware of how volatile cryptocurrencies are. AMASA wish to provide shield to the assets of its users using a technique called automated swap. The systems will automatically swaps your earned funds to a stablecoin in order to protect it against price fluctuations. The stablecoin is stored in the staking pool which earns interest.

· Amplification. You can connect your wallet to an expert community that has a variety of portfolios. Your portfolios are manages by experts and protocols as well.

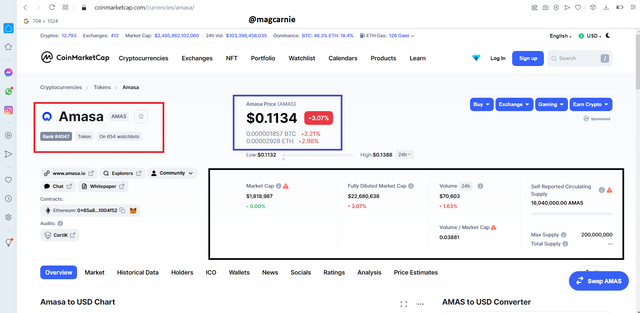

From coinmarketcap the Amas token has the following

| Token | Amasa AMAS |

|---|---|

| Price | $0.1158 |

| Market Cap | $1,848,082.48 |

| Fully Diluted Market Cap | $23,043,422.46 |

| Volume 24h | $70,393.45 |

| Circulating Supply | 16,040,000.00 AMAS |

| Volume / Market Cap | 0.03809 |

| Max Supply | 200,000,000 |

| Market Rank | #4150 |

What are the criteria required for listing a token on CoinMarketCap. Is there a criterion for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

In my quest to learn more about upcoming coins, i have come across many coins which i had finished it project but then when i checked on coinmarketcap to help me do my analysis on the coin i realized that it wasn't listed there so i asked why ? So i decided to go and do some research on the criteria required before a coin will be listed on coinmarketcap. So lets to know what i found.

So Before any token will be listed on coinmarketcap, it must first of all pass through a series of test or evaluation to confirm its validity.

- The first way to go by it is through an online form

This online form is free for everyone who wishes to fill it up. From the online form one must provide - Accurate details

- It must have functional website and must have Block Explorer.

- The asset must be openly and actively traded on one of the Coinmarketcap-listed exchanges.

- You also need to provide a way through which coinmarketcap.com can communicate with you.

- It should have an active social media account.

After all this is provided the next stage is the tracked listing which also entails the following

- Leverage cryptography, consensus algorithms or distributed ledgers, peer-to-peer technology and/or smart contracts to function as a store of value, medium of exchange, unit of account, or decentralized application.

- Must have a functional website and block explorer.

- Must be traded publicly, and actively traded on at least one (1) exchange (with material volume) that has tracked listing status on CoinMarketCap.

- Provide a representative from the project with whom we can establish open lines of communication for any clarifications.

Next is the Evaluation process, which also has the following criteria

- Trading Volume

- Community Interest & Engagement

- Traction/Progress

- Team

- Product/Market Fit

- Impact & Practicality

- Uniqueness & Innovation

- Project Longevity & Activity

Next is the House Rules, which also has under it a set of rules that one must abide by. You can read that through this link

The last one is the Delisting Policy which just talks about right preservations. A few of the rights preservations include

- Low liquidity or suspicious trading activity.

- The project’s cessation of development and/or business activity.

- The project’s listing on CMC was the result of misleading, incomplete, or false information.

- The project (and/or its associates) is under investigation, on regulator watchlists, or is found guilty of a breach of law(s), statute(s), and regulation(s).

- Extraordinarily poor implementation or reception by the project’s community.

The above information was taken from coinmarketcap

Now if all these are met then the coin will be listed on coinmarketcap.

Listing tokens on Centralized Exchange

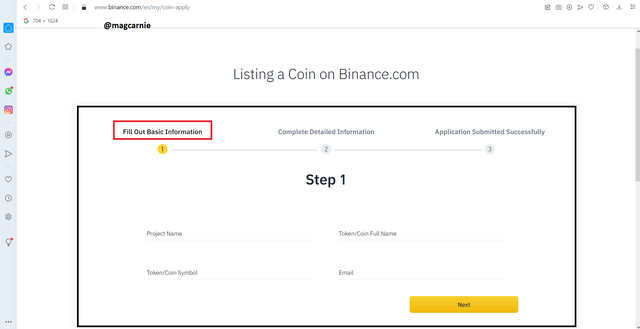

Now talking about how to list a token on a centralized exchange, i will like to use the binance exchange to explain this particular question.

To list a token on binance exchange, the token must pass through some series of stages. These stages are

- Application phase

- Complete Detailed Information

- Application Submission

Lets take them one by one and explain, taking the Application phase

In this phase, the user must provide details of the token. Some of the details that are asked are the project name, token full name, token symbol and email. Click on Next after your done filling it all

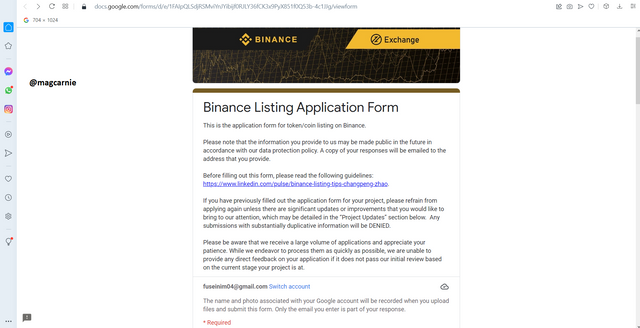

The next phase is the Complete Detailed Information

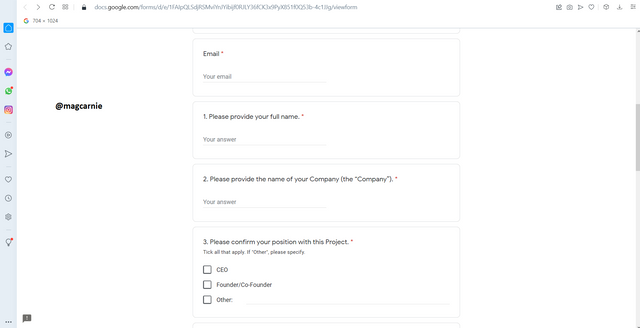

In this phase the user is provided with a google form which request for his full details. The google doc has about 10 pages which the user must fill out before he can proceed.

The google doc can be gotten here googledoc

Now the last phase is the Application Submission. This is the phase where your application will be submitted to the binance team for evaluation. If the team is satisfied with the application, they will contact the individual for any him to complete the next process they will outline to him.

Conclusion

Crypto investment is an investments which a person does a form of analyzing which is either Technical Analysis, Fundamental Analysis, Sentimental Analysis before he engages in a trade. The individual who makes this investment is either engaging in a long term or short term. This is solely done for profits. In the crypto world we have terms we associate with long term, we say HODL which simply means Hold On For Dear Life just as the name implies Hold on which means holding for a long time, with this the individual obtains an assets and holds it for a long period and sells it in years time thats if he has gotten the required profits he was estimating, but with the short term the individual just obtains assets and sells it over a short period of time.

Thanks so much to prof. @fredquantum for lecturing us on this wonderful topic.

amazing post with many information Amazing job !!

Thank you