Steemit Crypto Academy-Homework Task 6 @yohan20n

HOMEWORK WEEK-6 TASK

DAI

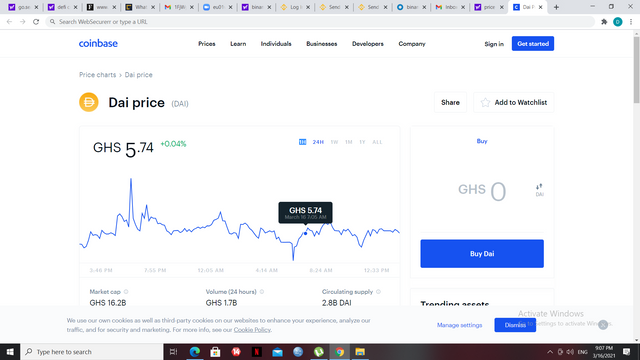

DAI is a stablecoin crypto currency which aims to keep it’s value close to one united state dollar (USD) as possible through an automated system of smart contracts on the Ethereum blockchain.

DAI is maintained and regulated by MakerDAO. Maker DAO was formed by a Danish in 2014.

DAI was also officially lunched on December 18, 2017. The price was kept close to one dollar during it’s first year.

In March 2020 as a result of result of extraordinary market volatility caused by COVID- 19 pandemic DAI experienced a deflationary deleveraging spiral that at it’s peak caused it to trade for up to $1.11 before returning to it’s intended $1.00 valuation.

DAI is created from an overcollateralized loan and repayment process facilitated by MakerDAO’s smart contracts in the form of a decentralized application. Users who deposit Ether or other crypto currencies accepted collateral are able to borrow against the value of their deposits and receive newly generated DAI.

DAI was able to be made a stablecoin due to it’s target rate feedback mechanism(TRFM). The TRFM is an automatic that the DAI stablecoin system employs in order to main stability.

A stablecoin is pegged to another table asset. Pegging is the practice of fixing the exchange rate of one currency to the value of another currency.

DAI stablecoin is pegged to the US dollar. Having a stablecoin opens up many new financial possibilities for burgeoning sectors that were not possible due to volatility.

DAI does not not only offer stabilization, but it also offers transparency and decentralization, since it is built on top of the Ethereum network. Since DAI is pegged to the US dollar, you will always only owe back what you initially borrowed in addition to interest.

The deposited assets inside a CDP can only be retrieved once the user has paid back the same amount of DAI they borrowed plus generated interest to retrieve their assets.

Active CDPs must always hold a higher collateral value that the value of debt the user has.

DAI was initially lunched with support for only one collateral, which was pooled Ether, also known as PETH to use as collateral for a CDP, they first had to deposit their ETH into a smart contract that pooled ETH, then gave them the equivalent amount in PETH. The purpose of using pooled ETH was so that if the market for ETH crashed, CDP will be able to retain a higher value of collateral than dept. IF ETH crashed the debt in a CDP then it would be worth more than the collateral held.

Maker would then have the ability to increase recapitalize the market by automatically decreasing the supply of PETH, which would increase demand and increase the price of DAI.

This then increases the value of the collateral in a CDP and decrease the overall value of debt.

A Global settlement is a last resort process to guarantee the target price to the holders of DAI.

When a Global settlement is triggered, it shuts down the system. This means that holders of DAI receive the net value of assets that they are entitled to, The process is fully decentralized and Maker voter govern the access to it in the case of an emergency.

Oracles and Global settlements are known as key external actors that help keep DAI’s price stable. They are external actors since they do not live within the protocol but rather live around it to help keep DAI safe. Another type of key external actors are keepers.

Keepers are Usually automated and independent actors who are Incentivized by profitable opportunities to contribute to decentralized systems.

Keepers can also make profit trading DAI; When the market price of DAI is higher than Target price sell to increase supply and decrease demand, which lowers the price of DAI back to it’s target price. Keepers also buy DAI when the price is below $1 USD to lower supply, which increase demand for the coin, in turn helping push DAI price DAI price back up to where it needs to be.

Thanks for reading my post.

Hi @marwone

Unfortunately, i found plagiarized content in your article and here are the links to it;

And yet, I have not seen any reference links in your article.

Plagiarism is not tolerated on steemit

Homework task

0

Please I did most of the work myself.

I didn't really know it will be a problem if I added a few lines from other sources.

I highly apologize for this act.

I will make sure to reference sources in the future.

Hi @marwone,

Plagiarism is a highly prohibited act on steemit and anywhere in the world.

I see you may not be fully aware of this which is why I urge you to complete the Achievement Tasks in the Newcomer's Community.

Precisely, achievement 3 will teach you more about content etiquette.

The added bonus with the completion of these tasks is that you get to learn about all the tools and the ABC's of steemit ecosystem.

Please come to me if you still have any issues on this matter as well as any challenges you may face in the near future.