Solana Blockchain - Crypto Academy / S4W4 - Homework post for pelon53

Hello guys...

It's been an amazing week learning about the Solana blockchain. I believe you got as much value as I did, because my knowledge about the Solana ecosystem has greatly improved. Below is my entry for the homework task, do have a pleasurable read.

Introduction

Accidental forks sometimes occur on blockchains . That is, a situation where two validators append a block to the existing chain at the same time; such that two blocks get added to the chain from a single validation round.

This accidental act, which does not help the efficiency of blockchains, splits the original chain of blocks into two - the original chain, and the accidentally forked new chain. Thereby, leaving room for an act of consensus to determine which of the two chains should be sustained.

These accidental forks reveal an operational inefficiency with respect to time and impacts negatively on the scalability of these blockchains.

The Solana blockchain came with an Improved efficiency structure for cryptocurrency blockchains by eliminating the possibility of accidental forks, and providing a framework for scalability. Let's learn more about the Solana blockchain as we walk through the homework questions.

Q1: Explain in detail the PoH of Solana

Image| Medium.com

Solana is a layer one Proof-of-Stake (PoS) blockchain that has achieved decentralization, scalability, and security, without the need for a layer two solution.

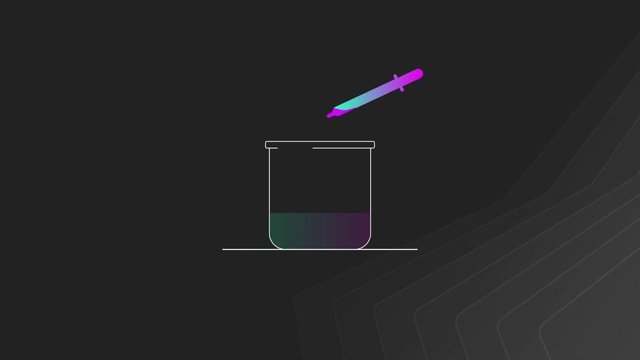

Unlike other PoS blockchains, the Solana PoS, through a tweak to the Secure Hash-Encryption Algorithm - SHA256, incorporates a Verifiable Delay Function (VDF) called Proof-of-History (PoH).

Image| Medium.com

With the PoH function, a sort of decentralized clock is created that allows for every transaction on the Solana network to be time-stamped without a network-wide consensus.

The PoH works in sharp contrast to other blockchains like Bitcoin and Ethereum, where the Network gets to vote on the validity of a block based on a first come approach before deciding on which one to verify next.

Using PoH, the Solana network reduces the delays arising from normal consensus processes. This is because validators do not have to recheck previous transactions before moving on to produce new blocks. All transactions are timestamped in a sequencial order based on the decentralized clock on the blockchain.

Q2: Explain at least 2 Use Cases of Solana

The Solana network is saturated with interesting projects. These projects boast of features that are very uniquely different from what has always been. Some of these projects are explained below:

1. Raydium ($RAY)

Image| cryptosorted.com

Raydium is a Decentralized exchange built on the Solana blockchain. Just like the Uniswap of Ethereum and Pancakeswap of the Binance Smart chain, Raydium is an Automated Market Maker (AMM) that enables Decentralized Finance (DeFi) functions like Staking, Liquidity mining, Swapping, Yield farming, etc.

A unique feature of the Raydium DEX is that any trade on the platform happens at a fair price gotten from price comparisons between the liquidity pools and the decentralized order book on Serum - another project on the Solana network.

From Raydium's integration with Serum, users can access a built-in Limit order on the exchange. This makes it possible for users to place limit orders - a form of pending order- and bet on their price expectations in the market. Of course, this is not the case with other DEXes as trades are executed at prices suggested by the Liquidity pool at the time.

Raydium brings the experience of the Centralized Finance world into DeFi by allowing for pending orders to be placed in its DEX, just like anyone could do on Binance, Coinbase, or any other centralized exchange.

2. Serum ($SRM)

Image| medium.com

Serum is another permissionless DEX on the Solana blockchain. Its proposal is to bring the speed and convenience obtainable in centralized exchanges to the decentralized world.

Apart from its decentralized order book and limit order functions, Serum has a high throughput of about 65,000 TPS, and some of the lowest transaction costs which are merely fractions of a cent.

Q3: Detail and Explain the SOLA token

Image| solatoken.net

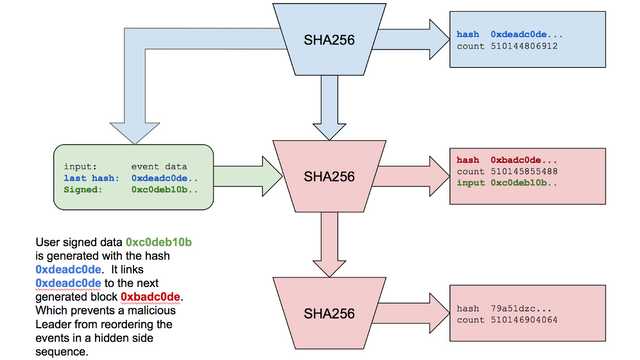

SolaToken is a DeFi protocol on the Solana blockchain that combines the function of a DEX and a CEX. It enables an automatic distribution of liquidity to optimize the efficiency of asset management.

As at the time of writing, coingecko.com reported the token information as follows:

| SOLA TOKEN INFORMATION | " " |

|---|---|

| Price | $0.04935875 |

| Market capitalization | $1,340,242 |

| Circulating supply | 27,153,077 |

| Exchange | Raydium (DEX) |

| Explorer | solscan |

| Website | SolaToken.net |

| " " | app.solatoken.net |

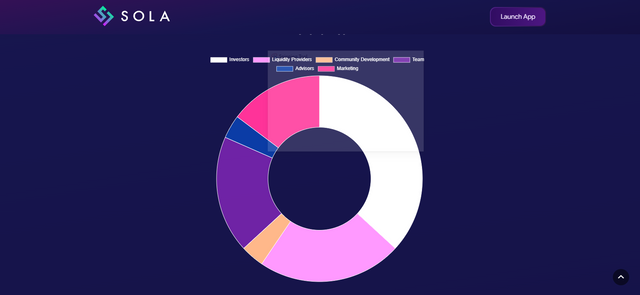

The SOLA governance token was released on the 9th of August 2021, with the token distribution schedule presented below.

Image| solatoken.net

From the token distribution information, the maximum supply quantity of the token is equal to its circulating supply. That is, all SOLA tokens are already in circulation. Hence, there is a perfectly inelastic supply - Fixed- supply schedule.

The SOLA token supply schedule is further subjected to a burning process where transaction fees and proceeds from the API are to be used to buy back $SOLA tokens for burning. With a goal to deflate the total supply in the market is 21 million. This makes the SOLA token deflationary in nature, with a fixed supply.

Q4: When did Solana Blockchain see its Operations interrupted? Why?

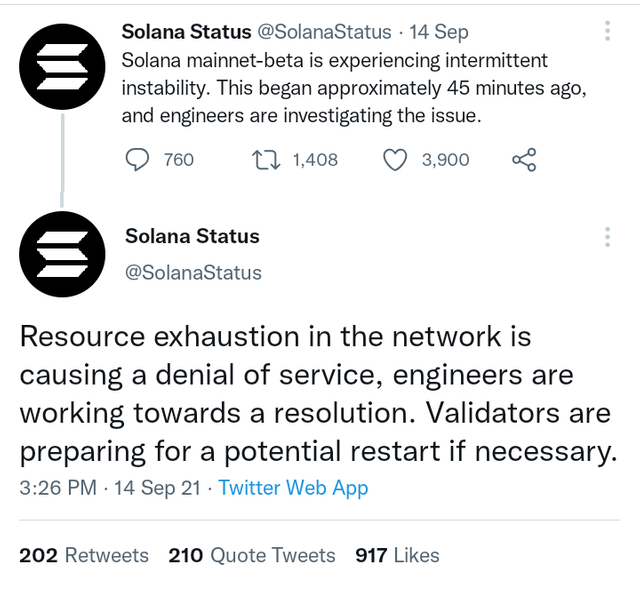

On the 14th of September, 2021. The Solana blockchain experienced what many have come to call "Resource exhaustion," following a sudden surge in the number of transactions made on the network per second.

A tweet from @solanastatus on the said date read...

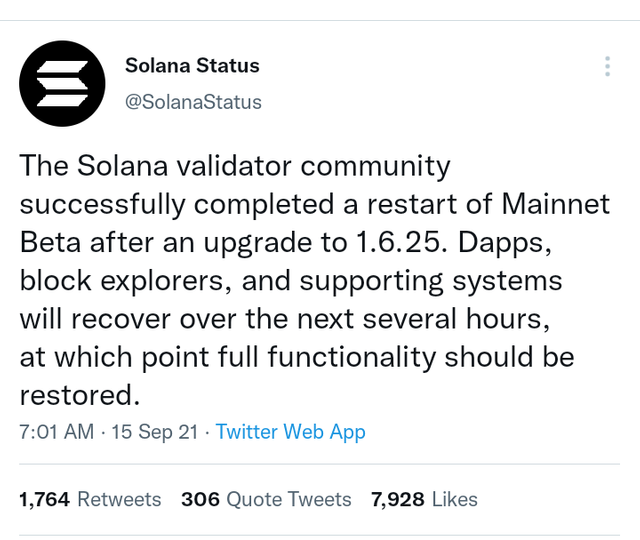

Subsequently, on the 15th of September, a tweet from the Twitter handle @SolanaStatus tweeted:

revealing that the downtime occurred as a result of a surge in the transaction count to an all-time high of 400,000 Transactions per second (TPS). Solana's throughput was set at 50,000 TPS, and the surge was a huge stress on the network.

The immediate result of this surge was a flooding of the processing queue, which led to a random forking of the network. These random forks exhausted the storage space of validating nodes, hence, forcing most of them to shut down.

The surge in TPS, which eventually led to the network's downtime was triggered by bots doing a high frequency trading on Raydium - a Decentralized exchange built on the Solana network- upon the launch of Grape Protocol’s IDO. These bots were trying to buy up the IDO token, such that they submitted far too many transactions than the network could carry.

Later on the 15th of September, another tweet surfaced with an information that the network has been successfully restarted.

Q5: Check the last block generated in Solana and make an approximate calculation of How many blocks per second have been generated in Solana

N/B: Take into account blocks generated from the initial block to the current one, and justify your answer with screenshots.

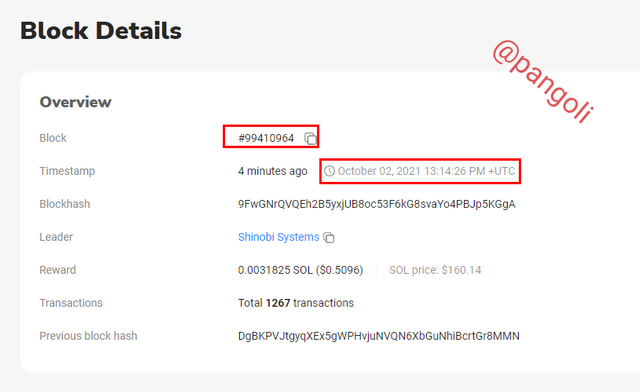

For this illustration, I first of all launched the solscan block explorer as shown on the screenshot below:

Image| solscan.io

From the screenshot, we can see that the present current block of the Solana blockchain at the time of writing is block 99410964 and the corresponding time stamp. The Solana Genesis block holds information to have been created on 16th March, 2020 at 08:30:51 Central Standard Time.

According to this article by the CEO of Solana, Anatoly Yankovenko, the Solana blockchain has a block time of 400 milliseconds. That is 0.4 seconds.

If,

0.4 second = 1block

1 second = 2.5 blocks'

1 minute = 60 seconds = (2.5 x 60) = 150 blocks per minute

1 hour = 60 minutes = (150 x 60) = 9000 blocks per hour

1 day = 24 hours = (9000 x 24 ) = 216000 blocks per day

1 year = 365 days = (216000 x 365) = 78,840,000 per year

Solana mined its first block on March 16 at 08:30:51 Central Standard Time. Today makes it exactly 565 days since the first block was mined on Solana. If we apply the same matric above, as of today, at 2.5 blocks per second, the total number of blocks mined will settle at:

565 x 216000 = 122040000 blocks.

Conclusion

The Solana network is unarguably one of the fastest Layer 1 blockchains out there. Interestingly, it is still in its infancy stage as more and more of its potentials are being uncovered as the days go by. With the speed, low transaction cost, and security that the Solana network has, it is no news that the value of its network will see a significant increase as more projects get to adopt it as their base layer.

Thank you for reading...

Hi there! If you read to this point, I am sure you enjoyed the article. Let's take this further, I'd like to connect with you on a more personal level. Feel free to hit me up on any of my social handles below: