Steemit Crypto Academy [Beginners' Level] | Season 4 Week 1 | The Bid-Ask Spread

INTRODUCTION

It's a great pleasure to participate in this home work task and great appreciation go to the professor for coming up with such a brilliant task to study and analyze according to my own understanding of the lecture

QUESTION 1

Properly explain the Bid-Ask Spread.

Bid ask spread

Bid price means that a buyer pays for the commodity according to their wish at a very high price

Ask price means that a seller sells the commodity according to there wish at the lowest price

The formula of Bid ask spread is Ask price -Bid price

BID ASK SPREAD

The difference between the bid price of the commodity and the ask price of the commodity in the trade market is known as the bid ask spread

QUESTION 2

Why is the Bid-Ask Spread important in a market?

• The bid ask spread is very important in the market because it guides marketiers on the right time to buy or sell a commodity

• The bid ask spread helps in making good decisions

• The bid ask spread helps to indicate when the commodities are available at the market

• The bid ask spread helps marketiers to initiate limit orders and also helps to determine the price they want to sell or buy an asset

note

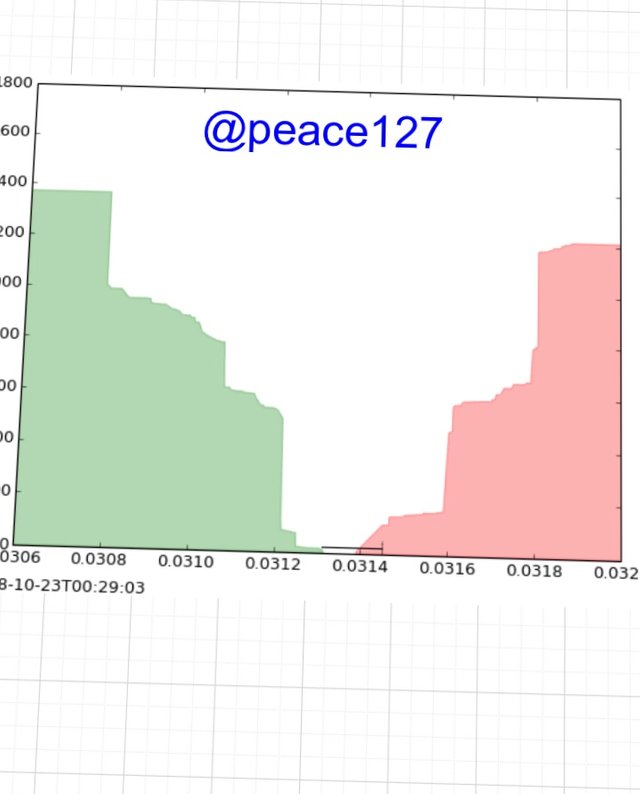

The gap between the Bif price which has a green wave and the Ask price which has a red wave is known as the bid ask spread

In BTC there are limit orders from the sellers and buyers leading the bid price and ask price to be many hence leading to liquidity in the market

Liquidity is changing the assets into cash that's to say when the gap between the ask price and the bid price is wide, it shows a limit order due to the conduction of buyers and sellers hence dare is no liquidity

QUESTION 3

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

Bid price = $5

Ask price= $5.20

Spread = Ask price - bid price

= $5.20-$5

= $0.20

Spread. =$0.20

b.) Calculate the Bid-Ask spread in percentage.

Spread in percentage = (spread/ask price)x 100

Bid price = $5.20

= (0.20/5.20)x 100

= 0.03846x100

= 3.846%

%spread = 3.85%

QUESTION 4

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

Bid price = $8.40

Ask price = $8.80

Spread = $8.80 -$8.40

Spread = $0.40

b.) Calculate the Bid-Ask spread in percentage.

% spread = ( spread/ask price)x100

Ask price = $8.80

Spread = $0.40

% spread = (0.40/8.80)x100

= 0.04545455x100

% spread = 4.55%

QUESTION 5

In one statement, which of the assets above has the higher liquidity and why?

• The liquidity of crypto X is higher than crypto Y because crypto Y has a wide bid ask spread while crypto X has a small bid ask spread

QUESTION 6

Explain Slippage.

- Slippage this when orders are filled at a price different from what the trade intended to pay

Normally the slippage occurs when an order is executed at a price totally different from the price a trader intended to pay. It also occurs in a wide bid ask spread in the crypto market.

In slippage, the crypto markets have a low liquidity which may cause the orders not to match as expected by the market traders.

In slippage, a market trader may wish to buy an asset at the price available but before the trade is executed, the price may change due to high volatility of the prices in the market .

QUESTION 7

Explain Positive Slippage and Negative slippage with price illustrations for each.

POSITIVE SLIPPAGE

Positive slippage is when orders are filled at favourable prices. That's to say the prices favours the buyers and sellers. The buyer may fill in an order at a high price but due to positive slippage the buyers order will be filled in at a lower price than he expected.

Examples of positive slippage

a) If a buyer places an order to buy crypto Y at $10 and the order is executed at $8 then there is a positive slippage of $2

($10-$8=$2)

b) if a seller places a sell order for crypto Y at $20 and the order is executed at $21.8 then there is a positive slippage of $1.8

If an order of an asset to be bought at $180 and it's executed at $178 there is a positive slippage of $2 because the buyer filled the order at favourable prices

NEGATIVE SLIPPAGE

Negative slippage is when orders are filled at less prices that are favourable

This occurs when a buyer makes an order and it's filled in at a higher price than intended hence leading to negative slippage and for the sell order, the orders are filled at lower prices than expected by the market traders hence leading to negative Slippage

EXAMPLES

a) if a buyer places a trade to buy crypto X at $200 and the trade is executed at$202, this means there is a negative slippage of $2

($202-$200=$2)

b) if a seller places a trade to sell crypto Xa at $400 and the trade is executed at $398 this means there is a negative slippage of $2

($400-$398=$2)

c) if an order is sold at $80 and instead the trade is executed at $79.9 this indicates that there is a negative slippage of $0.1

CONCLUSION

The difference between the bid price of the commodity and the ask price of the commodity in the trade market is known as the bid ask spread .

There are two types of slippage which includes positive slippage and negative slippage

POSITIVE SLIPPAGE**

negative slippage is when orders are filled at favourable prices. That's to say the prices favours the buyers and sellers. The buyer may fill in an order at a high price but due to positive slippage the buyers order will be filled in at a lower price than he expected.

Hello @peace127,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should be clearer in your explanations.

Some explanations are either incorrect or incomplete. Try to understand the topic better.

Thanks again as we anticipate your participation in the next class.

I will improve next time