Crypto Academy / Season 4 / Week 1 - Homework Post for [@awesononso]: The Bid-Ask Spread

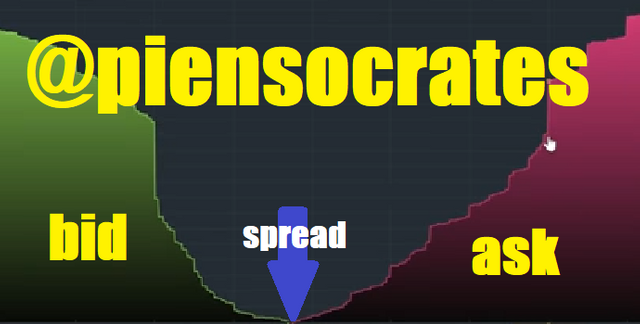

Image created by myself

1. Properly explain the Bid-Ask Spread.

To understand what the Bid-Ask Spread is, first of all we must understand what the Bid Price and Ask Ask Price is. Every asset that is quoted in the market has a price that is established based on what buyers are willing to pay for it (this is the Bid price) and, on the same way, based on what sellers are willing to receive as payment. for the same (this is the Ask Price).

Knowing this, it is already very easy to understand that the Bid-Ask Spread is the gap, the difference, that occurs between the Ask Price and the Bid Price. From this differential the liquidity or lack of liquidity of the asset market is born and from that liquidity or lack of liquidity the current market price is produced.

In terms of mathematical logic it can be expressed like this:

The bid-ask spread is the same that: bid price - bid price

Based on this, we must also apply another formula to precisely determine what the spread percentage is:

Spread Percentage = ((Spread/Ask Price)*100)

2. Why is the Bid-Ask Spread important in a market?

Below we can see what a bid-ask spread looks like in case of a higher or lower percentage, depending on the percentage of it.

Wide spread percentage

Low spread percentage

The bid-ask spread is important in the markets due to the fact that it is the element that drives price fluctuations in the asset markets.

Asset markets (be they cryptocurrencies or whatever they are), work based on a constant interaction between what the buyers and sellers want and what their put into their orders in the market.

In the market there are limit orders and market orders. The former are executed at prices above the current price (in the case of limit orders to sell) and at prices below the current price (in the case of limit orders to buy); and the second (I mean, the market orders) are executed at the current market price at the time they are placed or executed.

Both market orders and limit orders are then the marketmakers, the determinants of the market price.

So, the greatest importance of the bid-ask spread lies in the fact that thanks to their knowledge and understanding, traders can better understand what is happening in the market, what is determining prices and what is most likely to happen. in an immediate plane with the market price of the respective asset.

3. If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

Bid-Ask Spread= 5.20$ - 5$ = 0.20$

Then:

Bid-ask spread = 0.20

b.) Calculate the Bid-Ask spread in percentage.

% bid-ask spread ?

%bid-ask spread= ((0.20$/5.20$)*100)

% bid-ask spread= 3.85%

4. If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

Bid-Ask Spread= 8.80$ - 8.40$ = 0.40$

Then:

Bid-ask spread = 0.40

b.) Calculate the Bid-Ask spread in percentage.

% bid-ask spread ?

%bid-ask spread= ((0.40$/8.80$)*100)

% bid-ask spread= 4.55%

5. In one statement, which of the assets above has the higher liquidity and why?

In this case, asset X has greater market liquidity, and this is due to the fact that it has a greater volume of trade, which we can visualize through a lower spread percentage than the other asset, comparatively speaking.

The wider the bid-ask spread percentage, less the liquidity present in the market. Why? I will explain it like this; We know that the price occurs because there are buyers willing to buy, and establishing purchase orders, in conjunction with sellers willing to sell and establishing sell orders; When there are a large number of buy and sell orders, it means that there is great market movement between buyers and sellers agreeing to buy and sell at prices that are not so far from each other; then it is said that there is liquidity, there is volatility.

But when the opposite happens, that there is no volatility or liquidity, it is precisely because buyers order orders at prices that are very dissociated from those to which sellers want to sell, because they do not really care to buy on that moment. On the other hand, it is then the case that sellers place purchase orders very dissociated from those that buyers are willing to buy from, because they do not really care to sell on that moment. It is in these joint scenarios in which the markets get into ranges or lateralities; And it is precisely when analyst traders determine in their forecasts that the market's highest probability is range or fall.

6. Explain Slippage.

As we all know, the higher the spread percentage, the lower the volatility or liquidity of the market, which means that there will be a greater difference reflected through the buy and sell orders, between the prices at which buyers want buy and the prices at which sellers want to sell.

This situation of disassociation will also affect the market price of the asset, and will make it have a price that is susceptible to slippage.

Which means that when someone places a buy order at market price, it will be executed at a different price than what is actually defined as the current price.

Example: Suppose I want to buy a cryptocurrency called "ZZZZZ" and that currency has no liquidity. Technically, when I look at the price chart I see that the market price of said cryptocurrency is $ 20, but it does not fluctuate almost neither up nor down, in fact, it sometimes passes whole minutes and hours in which the price does not change, not even a penny.

Suppose, hypothetically speaking also, that I arrive and place a purchase order, at market price, for said cryptocurrency at that specific moment when it is at $ 20. In a cryptocurrency with sufficient liquidity, with a low bid-ask spread, the order would be executed immediately at $ 20, but since it is a cryptocurrency with low liquidity, the purchase ends up being executed at $ 19.63. What happened here? There was simply a price slippage due to lack of liquidity.

In the same way, if instead of a market order I place a limit order on an asset whose market has low liquidity, it will happen that the order will not be executed in the short term, and it may take a long time for ocurr (in the event that this scenario effectively occurs).

Therefore, if I am in a hurry to buy or sell the asset, it would not serve me to place an order in this way, which would force me to sell or buy at market price, with the consequent level of slippage.

7. Explain Positive Slippage and Negative slippage with price illustrations for each.

To understand positive and negative slippage, you simply have to understand that slippage positive is when we buy or sell at a price that is more favorable to us than the one we expected to buy at.

In the same way, it must be understood that negative slippage is that which occurs when we buy or sell an asset at a price that is more unfavorable to us than the one at which we expected to buy.

I will illustrate it through examples:

Suppose I want to buy the ICX cryptocurrency at a time of high volatility in the market, and the cryptocurrency is worth $ 1.73. Suppose I place a market order to buy 10 units of said cryptocurrency. If it were executed at the price of $ 1.73, the total purchase price would $ 17.3, but since there is big liquidity, it ended up executing at $ 16.86. There was a positive slippage, I bought a more favorable price.

If, on the other hand, the cryptocurrency ICX, worth $ 1.73, was at a time of low volatility, the scenario would be the opposite, that is, the slippage that would occur would be negative in nature. For example, I would buy 10 units that instead of costing me $ 17.3, they would end up costing me $ 17.75 (to mention some amount). In this case there would be a negative slippage, I would buy at a more unfavorable price for me.

Now let's talk about both cases of slippage in sales cases:

Suppose I want to sell the IOTA cryptocurrency at a time of high volatility in the market, and the cryptocurrency is worth $ 1.47. Suppose I place a market order to sell 10 units of said cryptocurrency. If it were executed at the price of $ 1.47, the total sale price would be $ 14.7, but since there is great liquidity, it ends up executing at $ 15.24. There was a positive slippage, I sold a more favorable price.

If, on the contrary, that cryptocurrency in the same price scenario, were in a moment of low volatility, the situation would be the opposite, that is, the slippage that would occur would be negative. For example, I would sell 10 units that instead of giving me $ 14.7 as gross profit, it would give me $ 13.81 (to mention some amount). In this case there would be a negative slippage, I sold at a more unfavorable price for me.

This is all we need to understand about it!

Well, this is my participation in the Crypto Academy, in this first week of the fourth season, and doing this task for @awesononso (Nigeria) Until next time!