Steemit Crypto Academy Week 7 Task: Introduction to Defi and Yield Farming | Uniswap Protocol || lecture by @gbenga

Introduction

Hello Steemians,

Welcome to another week in the Steemit crypto academy. I attended the lecture by the crypto professor @gbenga as the professor based his teachings on Introduction to Defi and Yield Farming | Uniswap Protocol. This blog is my homework task after the completion of the lesson. I will be discussing the topic of Decentralized Finance Ecosystem as well as a Project/Protocol in the Ecosystem.

First and foremost let's look at what Decentralized Finance is all about. Decentralized finance is the new finance sector that has come to displace the centralized protocol used by the local banks, brokerages, exchanges and many more. Decentralized finance is aimed at bringing notable innovation into the cryptosystem by eliminating the presence or involvement of third parties in transactions.

Unlike the case of centralized protocol, where the total control of the wallet is handled by the exchangers, decentralized finance eliminates that given users full control over their assets without the involvement of third parties or submission of orders. Not having your private keys means that you don't have your cryptocurrency assets - there are instances where this proved to be a very big problem for investors.

A Brief History about Defi

Many persons have speculated or should I say predicted that Defi came into existence in the year 2009 alongside Bitcoin. But from my little research, I have discovered that it all started when MakerDAO was launched in the year 2017. In 2007, Defi allowed users to do more things with their money other than sending and users had control over their resources.

The Ethereum blockchain has many protocols among which is the MakerDAO which allows cryptocurrency to be pegged to U.S dollars and also uses the digital asset as its collateral.

Benefit of Decentralized Finance

Below are a few benefits associated with Decentralized Finance

- No third party is involved in the transaction

- Non-Custodial I.e users have control over their asset.

- Openness I.e there is no restriction to as who can use it. It is open to everyone.

- It is also decentralised.

What is Uniswap

Uniswap is one of the Other platforms that are built in the Ethereum blockchain in the year 2018. It is important to mention here that Uniswap is a complete decentralised platform I.e it is not owned and operated by a single individual. Furthermore, it is also important to mention here that it uses an automated liquidity protocol as it's trading model.

Note here that Uniswap is an open-source platform, I.e any anyone is eligible to copy and also create their decentralized applications. As I have earlier mention, unlike the centralized platforms Uniswap is decentralised platform meaning users have absolute control of their asset. Research has shown that Uniswap is currently number four in the list of the largest decentralised finance.

UNI Token

UNI is the native token of the Uniswap protocol, it was introduced in the year 2020. UNI was distributed to users that have in one way or the other interacted with the Uniswap protocol either by exchanging ERC-20 tokens on the platform or has once acted as a liquidity provider. We’ve discussed earlier how the protocol has already been acting as a sort of public good. The UNI token solidifies this idea.

How to use Uniswap

As earlier discussed, Uniswap is an open-source protocol, meaning that anyone could create their frontend application for it. However, the most commonly used address to access it are https://app.uniswap.org OR

https://uniswap.exchange.

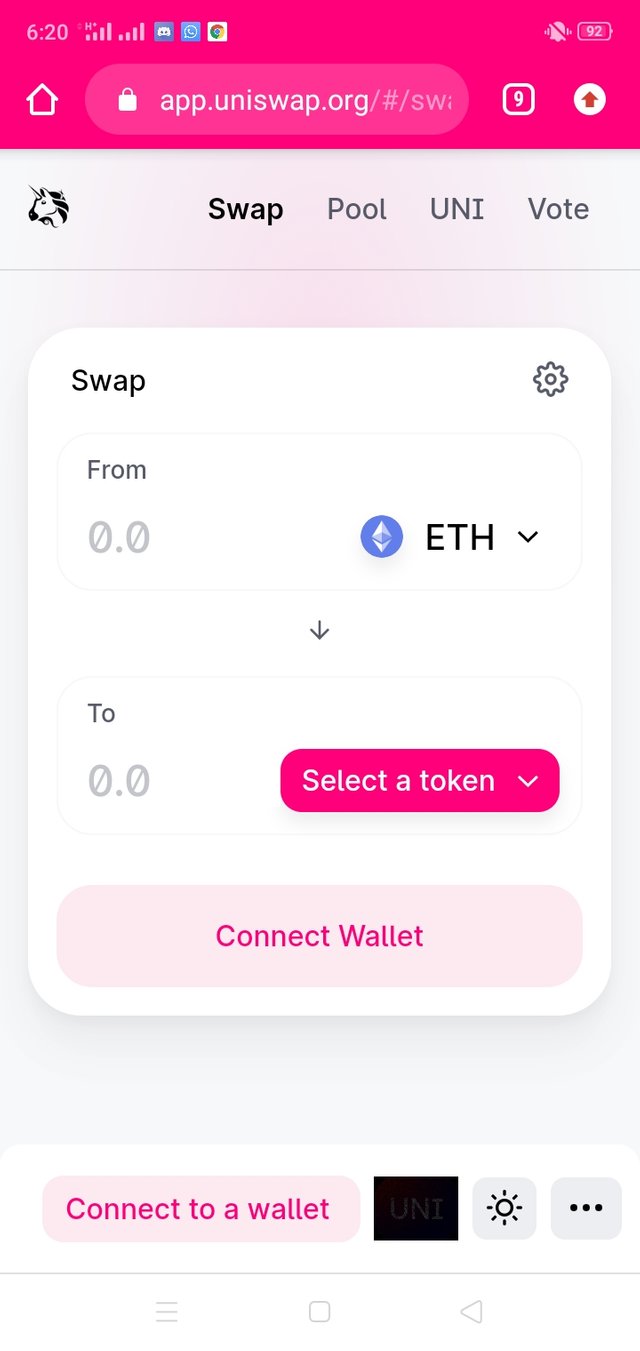

- Go to the Uniswap interface.

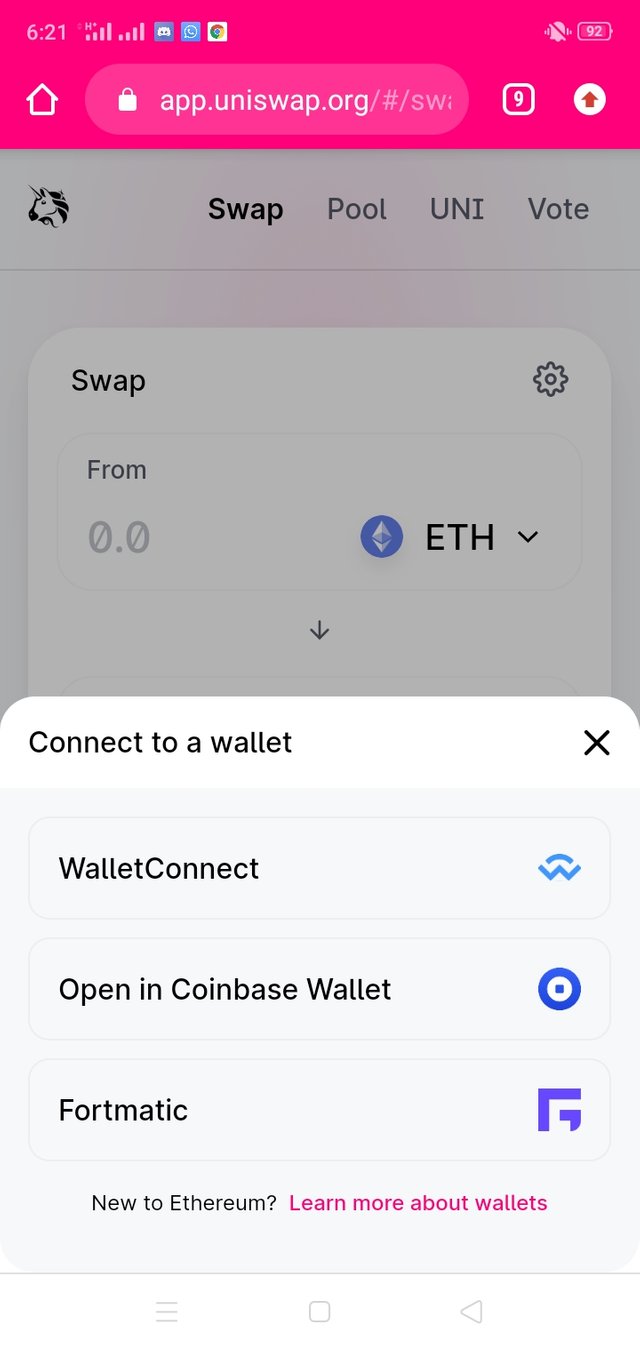

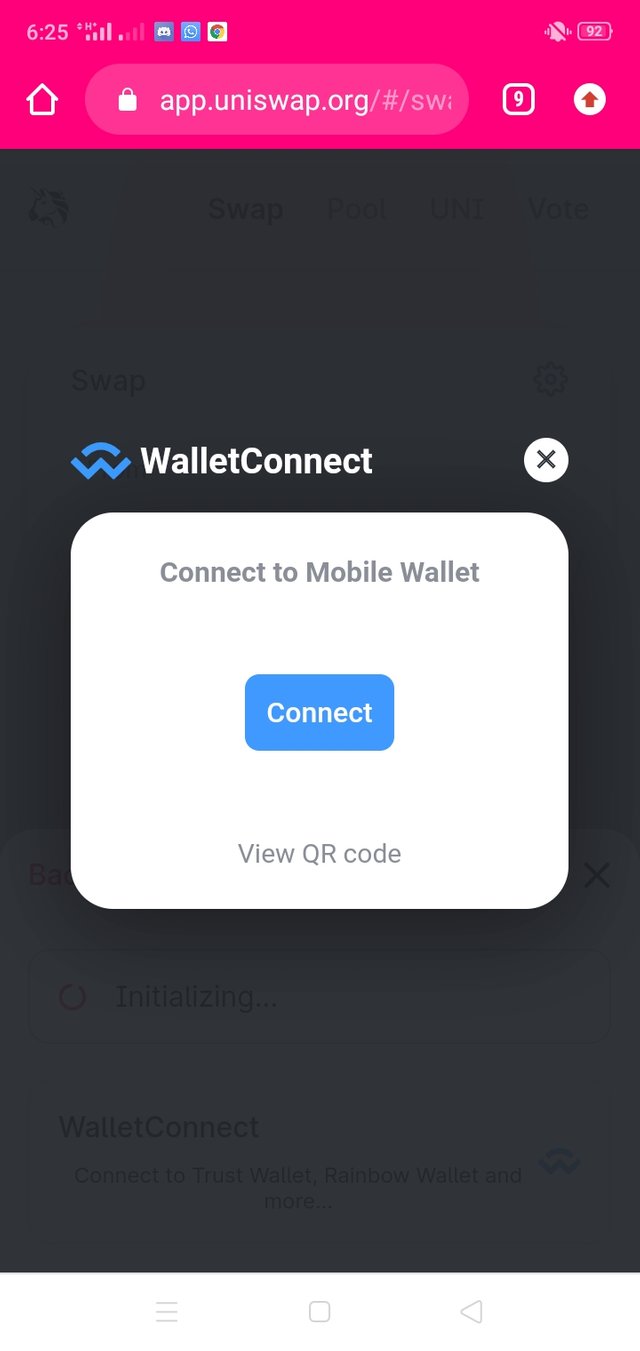

- click on connect to a wallet. Select among wallet connect, open in coin base wallet or fortmatic

- when you click on connect to a wallet you will see these

You can use MetaMask, Trust Wallet, or any other supported Ethereum wallet.

Select the token you’d like to exchange from.

Select the token you’d like to exchange.

Click on Swap.

Preview the transaction in the pop-up window.

Confirm the transaction request in your wallet.

Wait for the transaction to be confirmed on the Ethereum blockchain. You can monitor its status on https://etherscan.io/.

Conclusion

In conclusion, other notable protocols under DeFi's DEX ecosystem are UniSwap, Oasis, IDEX, Bancor, AirSwap, and a lot more. Finally, we can then conclude that Decentralized Finance (Defi) is the new world in the finance and crypto ecosystem which has brought a lot of benefits to the ecosystem by eliminating third parties from transactions and Uniswap is a notable protocol built on the Ethereum blockchain that offer the provision of liquidity of ERC-20 tokens using the Automated market maker to quote a price to users utilizing the tokens deposited by Liquidity providers, thereby eliminating the creation of order book for buy and sell characterized with exchanges that operate on the centralized protocol.

I want to appreciate in a more special way professor @gbenga for this wonderful lecture, it's a great one and I look forward to learning more from the professor and other Steemit professors.

Special regards;

Cc: @steemcurator01

Cc: @steemcurator02

Cc: @steemitblog

Cc: @gbenga

Cc: @trafalgar

.jpeg)

.jpeg)

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Question

A lot of people say Uniswap is a scam while others hold their stand that it is Legit and completely Decentralized. What is your take on this?

Rating 8

My take on Uniswap is that it is not a scam and from the little research I have made I believe it's very legit. Thank you prof.