The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

Hello Steemians,

It’s really pleasure to go with another homework task by Prof. @awesononso. After the last week homework task related with Bid & Ask spread, I am writing this with the gained experience by it and the feedbacks give by the Professor.

-%20Steemit%20Crypto%20Academy-%20S4W3-%20Homework%20Post%20for%20@awesononso.jpg)

Image edited from www.canva.com

I will arrange the content of this article as per the questions order.

01. Define the Order Book and explain its components with Screenshots from Binance.

For an easy understanding, let’s take a physical market.

In order to complete a trade, there shall be at least a buyer and a seller. In a simple market, there are sellers who sell tomatoes at different prices. They display their prices at their stocks. On the other side, there are several buyers who is willing to buy the tomatoes at their desired prices. If we list out all the selling prices of different sellers with their quantities and simultaneously list out the buyers’ desired prices with their desired quantities, simply that document is the Order Book.

Same criteria is applicable in the crypto market also.

▸There are sellers in the market who has their different selling prices and with the stocks to be sold.

▸And there are buyers who is willing to buy crypto at their different prices and different stocks.

▸If a trader ( Seller or Buyer) open a trade with their quantities and the trading price, then it will be listed separately in selling list or in buying list and it will be arranged by the price.

▸The open trade will be appeared in the list until it gets traded. The so called list is order book.

Red colored list is the selling list (Sell orders).

Green colored list is the buying list (Buy Orders).

There are 3 columns called price, Steem & amount.

▸Price means the buying or selling price of STEEM in BTC.

▸Steem means the number of STEEM coins to be sold or bought.

▸Amount means the total value of buying or selling Steem in BTC.

2. Who are Market Makers and Market Takers?

As a trader (Buyer or seller), he has the full authority to open a trade at any price and that will be listed in order book.

Normally people will try to gain profit as much as possible. Therefore they would try to trade at lower price than bid price in buying and higher price than ask price at selling. Their order will be listed in order book until it gets fulfilled. The traders who are willing to trade at said prices in two different criteria are called Market Makers.

Some type of traders are there who is willing to trade at the current market price. They don’t go for any negotiations. Therefore their orders would get fulfilled at instant. These type of traders are called Market Takers.

3.What is a Market Order and a Limit order?

As I mentioned earlier, some trades which are traded by market makers, are beyond the current price, in order to gain more profit. These type of orders are called Limit Orders. These orders are displayed in order book for a long period.

As I mentioned earlier, some order are placed at current price which are usually traded instantly. These type of orders are called Market Orders. These types of order are displayed in order book for a long period

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

As I explained earlier, Market makers are trying to drag the market up and down based on their negotiated prices. Since these negotiated prices, they have to wait until a trader comes and accept their offer. Until such time, there is no movement in the market. ( If we consider only this transaction in this particular market). That means the markert is having LOW LIQUIDITY.

When Market Takers comes into the trading, they trade at the current price which the order isn’t opened for a second even. That means the market is moving very well. So the market is having HIGH LIQUIDITY

.

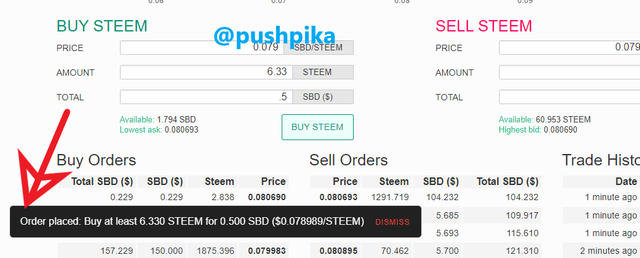

5. Place an order of at leaset 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.(Make sure you are logged in to your wallet).

a)

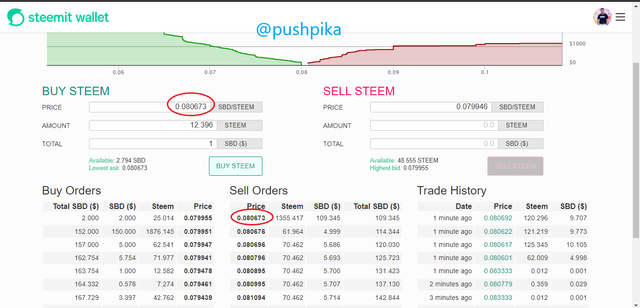

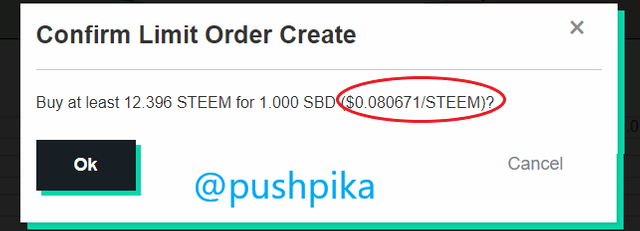

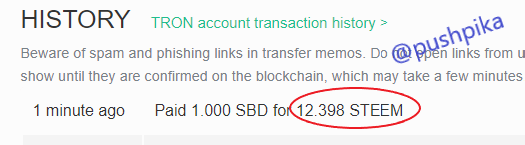

Order Place at Lowest Ask; Screenshot from steemit wallet

Yes. It was so instant. I set my order to 0.080671 SBD which was the lowest ask at that particular moment. That was not even listed in the open order list. Since there is a seller who is willing to sell the STEEM to my price (Lowest ask) , trade was completed.

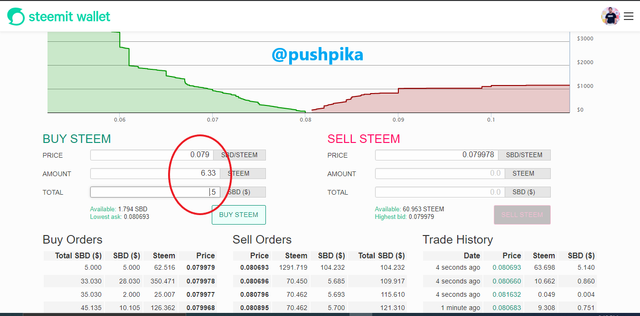

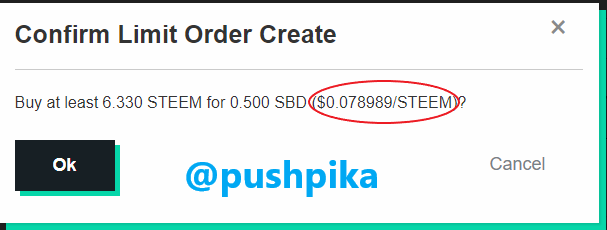

b) Then I changed the lowest ask to 0.079000 which was not listed in the buying list. The order was gone into “open order” list and still it is there till the price get down.

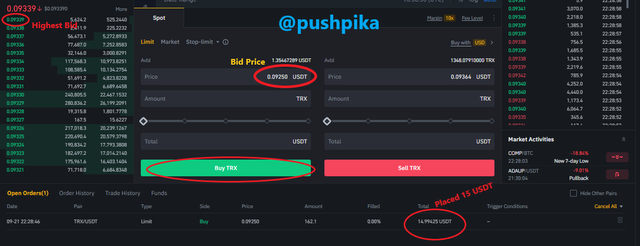

6. Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

I placed an order to buy TRX at the rate of 0.09250 USDT.

At the moment, lowest ask was 0.09348USDTand highest bid was 0.09339 USDT.

I have to keep my order open until a seller agrees on price quoted price. That means the lowest ask shall be lower than 0.09250 USDT to complete the order.

At the time, candle was a bearish candle and there was a continuation of down trend. So I expect that the order will be completed in near future.

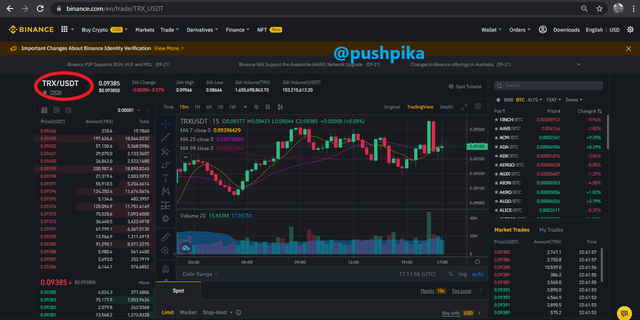

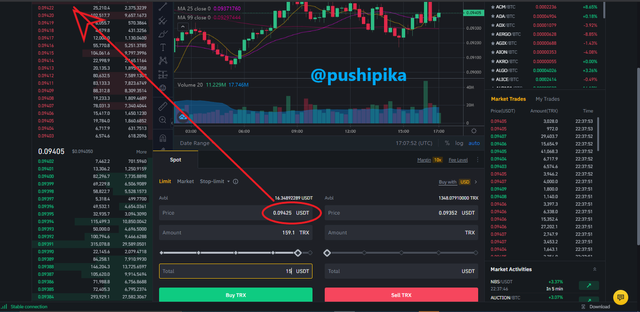

7.Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Step 1

Go to Binance Exchange and select TRX/USDT chart.

Step 2

Since we want to have a market order, we shall place a buy order at a price which was listed in selling order book.

Step 3

Enter the amount in USDT. ( 15$)

Step 4

Click on Buy TRX tab which is colored in green.

Step 5

Go to open orders and find out that the order was completed.

8. Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

Highest Bid = 2.082 USDT

Lowest Ask = 2.083 USDT

a.) Bid-Ask Spread = Ask price – Bid Price

= 2.083-2.082

= 0.001 USDT

b.) Mid Market Price = ( Ask Price + Bid Price)/2

= (2.083+2.082)/2

=2.0825 USDT.

I would like to thank to professor @awesononso for your awesome guidelines and make us encourage to learn about the basis of crypto and marketing.