Mastering Trading Psychology: Emotional Discipline in Cryptocurrency Markets" .

Hello guys, greetings to you all and equally I'm so happy to have you all on this week's engagement challenge. Lots of seasons have passed by and we have nourish ourselves with lots of information on trading.

One of the key aspect as a trader is managing emotions. Being disciplined enough when taking decisions and not working on impulse. These are a key factors that distinguish successful traders from the rest of the traders out there. To begin with, we will work with some guidelines which are going to help us tackle the topic in a more analytical approach.

Question 1: Identifying Emotional Triggers in Trading

| Talk on common emotional triggers ( fear, greed, overconfidence) that affect a lot of traders. |

|---|

Trading is an easy but yet complicated and analytical task which traders find it's so difficult figure it out at once due to some reasons or the other. A key factors contribute to traders failure due to emotions which can lead to sustainable loss in the crypto Market if not handled with patience and tranquility. Below is an outline of these points on cases in which they happens .

1. Fear

It is human nature to fear in circumstances when things don't go the way they expected or they are being triggered by something going against their thinking. We often get fright in the crypto Market as well when certain things are rises such as the worry of losing money when it trade goes against our plan. It's often results in panic selling.

At some point the market might just be experiencing some turbulence due to certain conditions which might actually resolve itself when the period is over. But for the fact that we don't have proper knowledge of what is happening, we often get caught up in the middle and sell too early or too late.

Another factor is hesitation to enter the market when prices are imbalance. At this point traders will wait and wait until the market starts shooting to certain height before they can have college to put in a trade. This might just be a temporary correction in the market and it might result to a sell off or a buy off pretty after the correction period it's over.

For some reasons, trade us with improper knowledge of what is happening in the market will equally either lose money is it to hesitation to enter the market or Miss money due to un informed decisions so enter the market which may only be noticed later on when the market has skyrocket.

Example:

Scenario: A sudden market u-turn due to unexpected bad news or occurrence.

Manifestation: Traders sell their positions to "cut losses," even if the price hasn't reached their stop-loss.

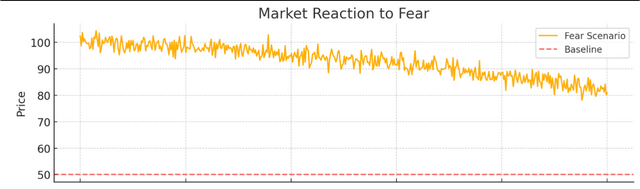

Chart Illustration:

A steep decline in price with heavy volume as fear takes over.

2. Greed

What is greed; it is the dissatisfaction of something after having a portion and still hoping for more. Greed and trading are two parallel lines. Traders are often caught up in the middle who are full of greed.

Often times we see ourselves make money in the market and due to that fact , we tend to overtrade hoping to make more profit and in the end sometimes losing some of the profit made or all of it in the process.

Of a trading is a risky act on each trader is advised to have a standard number of trades for a given Market in a day. Irrespective of the market direction once this number of trades have been made, it is wise enough to quit the market and then take out the profit we have for the day or for the time duration.

Another manifestation of greed is when traders tend to hold too long on positions after making numerous amount of profit. This is no good way to go about it as holding too long to particular positions, the market might results a reversal, and eventually putting you in losses.

Therefore it is wise enough to set stop loss and take profits on every trade and once this objectives have been attained we can our gains and quit the market.

Example:

Scenario: A case where a particular stock rallies significantly at some point, and traders buy at higher prices, fearing they'll "miss out."

Manifestation: Drastically Overbought conditions results to sharp reversals.

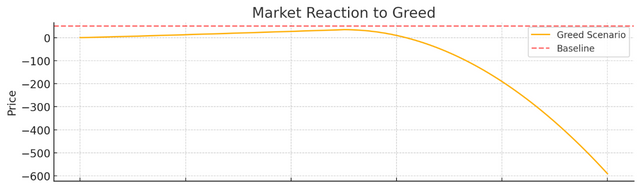

Chart Illustration:

A parabolic price increase followed by a sudden crash.

3. Overconfidence

Overconfidence if something most traders face in real time while carrying on their trading activities. I myself I have been a victim of our confidence and the end result is catastrophic. After winning a series of trade, we often get some level of confidence that put us in a position that we think we can lose anymore.

This is just where the Trap lies. At this point, most traders will go about putting on multiple entries neglecting trading factors such as risk management, large lots sizes.. with hope of gaining more profit in return. In the end just a slightest move in the market will drop them in losses. I am speaking this from experience on a trade I made some time ago.

After getting $300 in one day, I thought my strategy was top notch. In the next trade, I met multiple entries with because sizes, the first few minutes the market was going in my direction. Few moments letter A sharp decline a car and all my stop losses were touched. This result in me losing all the profit I made in that day. Since then I have learned my lessons never to do it again in training.

Example:

Scenario: A trader ignores risk management and goes in for large positions after a winning multiple trades.

Manifestation: Huge losses when the market moves an inch against them.

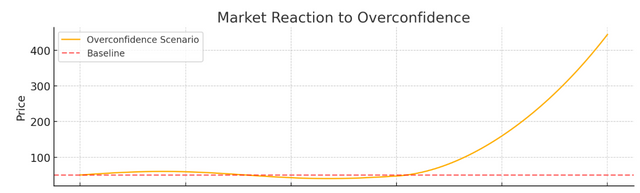

Chart Illustration:

A trend reversal that catches overconfident traders off guard.

4. Hope

Hope is the last thing we hold on to in critical situations. So it is in trading as well. Sometimes we find ourselves caught up in losses at some point that closing will results in bigger losses, at this point we have nothing to do as we know nothing about the market or can do anything to change the situation.

The only thing we can do is but sleep tight and Hope that the market might return and goes in our favor. To be rest assured, I want to say it doesn't work that way. We should learn to cut our losses at some point and leave the market when found in such critical conditions. But before doing we should have an informed knowledge about what is happening exactly in the market.

Proper analysis can inform us if the market is going to return and should even higher or continue in the same trend. Trading is a risky game and it should be done with caution. Seek knowledge which is well applicable before taking action in trading.

Example:

Scenario: A trader holds a particular stock that’s falling, thinking it will return.

Manifestation: Increased substantial losses as they refuse to exit.

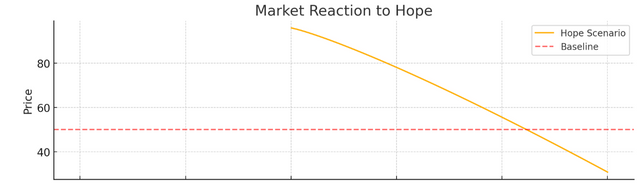

Chart Illustration:

A continuous downtrend with minimal pullbacks.

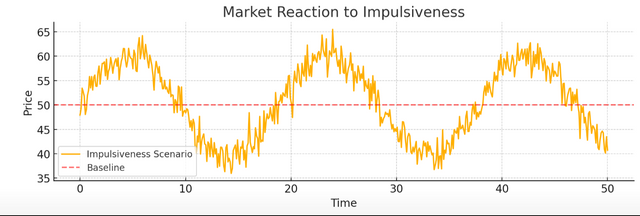

5. Impulsiveness

Impulsive trading are common among new traders just getting into the crypto market. This type of trading is done by following the trend. When the markets move down, traders sell equally and when the market moves up traders buy as well.

Impulsive trading can work at some degree but not in every scenario. In cases of Market fluctuation where a price is facing difficulties to break out, carrying out impulsive trading is the worst thing a trader can do at that point.

It is for certain the market is not going to obey any of the directions it takes at every instant. As we are faced with series of up and down movements in such a way that you don't know exactly what next is going to happen in the market. At this point it is but advisable to wait until a breakout is observed.

Impulsive traders will follow the trend in every up and down movements an eventually results in substantial losses. A good trade should be planned, analyzed and observed before execution.

Example:

Scenario: A trader enters a position during a sudden breakout without verifying the trend of the market.

Manifestation: Entering at the top or bottom and suffering losses.

Chart Illustration:

Spikes in price followed by consolidation or reversals.

Question 2: Overcoming Psychological Barriers

Share techniques to overcome psychological barriers like fear of missing out (FOMO), loss aversion, or overconfidence

The 3 above measures are substantial for carrying out informed Market decisions. Fear of missing out, loss aversion and overconfidence works abruptly with high level of discipline and understanding of the trade before us.

1. Overcoming Fear of Missing Out (FOMO)

FOMO is a condition where traders enter the market at certain points with the fear that they are missing out. They don't want to leave out profits in the market and consequentially enters position which are at the risky zones. For instance entering a trade at the peak.

At this point, the market might be at some point of exhaustion and might eventually retrace backwards. Consequently, a trader who enters trade at this point will result in substantial loss. Therefore it is advisable enough to seek valid information and carried out proper analysis before entering the market.

Obviously, it should be noted that we must not be present in every trade. Some trades may pass Us by and we should know that the market is full of opportunities. If you miss an entry today you probably wait for the next one rather than hesitate and jump in the market trend which might end up losing your money.

Techniques To avoid Fomo:

Set Entry Criteria: Make predefined entry points based on technical indicators like support, resistance, or moving averages.

Example:

For instance the price of STEEM is currently trading at $0.20 and rallies to $0.25, in this scenario, avoid chasing or trying to catch up with the price but rather, wait for a retracement to the 50% Fibonacci level before making your entry.

Stick to a Plan: every trade is supposed to be planned analysed, back tested before execution. There afterwards once executed, stick to your trading plan with clear risk/reward ratios.

For instance, if your plan states a 3:1 reward-to-risk ratio, avoid trades that don’t meet this criterion, even if the price is moving quickly. Be wise enough not to get caught up in the market temptation.

2. Overcoming Loss Aversion

Before we go on to Loss aversion, let's know what it is all about. This is the case where traders I'll consistently afraid to cut their losses even in non-profitable trades hoping that the market might return their favor.

It hurts quite all right to miss money in the market, but some level of discipline should be put in trading in such a way that decision making should not be too judgmental. But rather following a strict organized planned strategy.

In cases where the losses exceed The profit made, talk less of a losing trade, it is advisable to analyze the market critically and know exactly what position we stand in the market in order to be able to carry out informed decisions which I'm going to save us to trade another day.

Techniques to deal with losses:

Use Stop-Loss Orders: just as previously mentioned every trade has to be analyzed tested and confirmed before execution. This is done by taking precautionary measures such as risk management, with what ratio and applying them equally. Stop losses I have for to cut our losses automatically when the market reach our predetermined levels.

This does not require you to manually cut the trade off but this is done using trading tools or applications. In such cases the trade goes against you based on your risk reward ratio. This make sure that we doesn't lose too much in the market if the market goes against us.

Example:

If you buy STEEM at $0.20, set a stop-loss at $0.18 to limit your loss.

Reframe Losses as Lessons: we should take note that losses are inevitable in trading. It is but no matter inquire losses but then how we treat this losses is substantial.

Carrying out predetermined analysis on why a particular trait didn't work out is important to avoid such mistakes in the future. You should be able to ask yourself person like: did I do something wrong, did I misinterpret the trade, did I miss a break out. After carefully examining these options we should be able to move on to the next street with confidence and more informed about Market in search scenarios.

From the example of both one should be able to Analyze why STEEM fell after you bought it at $0.22. Did you misinterpret a breakout?

Position Sizing: taking proper lots sizes is important in trading to minimize losses. If a trade goes against you at some point, you should know exactly what you are risking to lose. (e.g., 1-2%) of your account per trade.

Take for instance If your account size is $1,000, only risk $10–$20 on a STEEM/USDT trade.

3. Overcoming Overconfidence.

I believe we have already mentioned something on over trading in the first point. There are no such things like: "Know it all" in trading. Trading is a continuous and gradual learning process and even the best of traders stay inquire losses on Some days.

So it is advisable to stay composed after winning trades and not post your moral and go in trading rampantly thinking you can't inquire losses anymore. Just a blink of an eye and you are gone with the market retraces against you.

Even in winning situations, we should be able to stay true to ourselves and obey the rules governing the trading scenario such as risk management, proper lots size. I'm stating our risk reward ratio accordingly so make sure we are always one step ahead in case the market don't go as planned.

Techniques to tackle overconfidence:

Review Past Mistakes: Regularly review your losing trades in the past to remain grounded of what then go right so as to stay informed of this decisions you made back then in order to keep yourself updated of what is happening in the market and avoid making the same mistakes over and over again.

Example:

After profiting from STEEM’s uptrend, review a trade where overconfidence led to excessive leverage and losses.

Stick to Risk Management: stay true so yeah position sizes regardless of recent wins.

For instance, If you normally trade 1,000 STEEM tokens, resist the urge to increase this after a winning streak.

Use a Trading Journal: document all your tradings including emotion and rational trades this will keep you updated and inform of what didn't go right or what did go right.

For instance you can reveal a trade you made in the past and write down why you entered a STEEM trade at $0.24 and whether the trade aligned with your strategy.

Question 3: Developing a Trading Routine

Propose a daily or weekly trading routine that includes psychological preparation, such as journaling trades, setting realistic goals, and practicing mindfulness.

Unlike they say practice makes perfect, it is important to keep something a continuous process in order to achieve greater results. A routine is something we do in cycles. It could be a sport, eating habit or trading habit as well. Our base focus being trading.

It's raining habit is setting and following strictly a strategize plan which best work for you and sticking on to it daily weekly as long as there is continuous progress and tangible result.

Daily Trading Routine

A daily routine is substantial for day traders hoping to opt their game in trading. To be successful as a day trader, there are things you need to put in place and follow them strictly to make sure everything works according to your plan. That is routine.

Morning Preparation

1. Mindfulness Practice (10–15 minutes)

Always start your day with meditation, breathing exercise and stretches to maintain your composure and reduce stress before getting into trading. It is little but mighty.

2. Market Analysis (30 minutes)

Take a quick review on market news and economic report to stay informed of what is happening around us which may affect Market decisions. This gives us the site to see the market based on current happenings.

After unanimous review of the market, one should be able to identify key support and resistance level, trend directions and therefore be able to make the necessary setups based on the current trend of the market for that day.

3. Set Realistic Goals (10 minutes)

Setting realistic goals is very important in trading. Before any execution, a church should be well planned analyze backtested and confirm before an entry is made. Every day should have a daily goal, be it profit or losses.

What I mean to explain is this if your target is to make $200 a day, you should stick to your plan and strategy making sure everything's works to what your target. Equally one should be able to set realistic goals on losses as well. You should be able to point out the amount of money you are willing to lose to get to your target. For instance for a profit of $200, one can set your space on the percentage loss let's say $20.

Finally you should focus on executing the trade and watching carefully to see if your plan is working accordingly. Take notes of Market fluctuation and what is not working in your plan for a given day and put it in your journal for review.

Most important point, avoid looking at the money but rather focus on your goals and maintain discipline to reach your target.

4. Trade Execution

After carefully analyzing the market and making sure everything is according to your strategy, it is time to execute your trades. But before making an entry make sure the setup meet your entry criteria .

Monitor your trades carefully and make sure everything is going according to plan. One thing is for sure not every trade for work in your favor, so be able to relax while your trade execute. Also practice taking some time off your screen to avoid impulsive actions.

5. Emotional Check-Ins

While your trade is in execution, it is important to check your emotion level at intervals. You should be able to point out situations like being of a stressed, feeling too confident, fearful. In such cases you should be able to take off a few minutes to relax and calm down before you could resume review of your trade.

6. Mindful Breaks

It is important to take scheduled breaks between time intervals of 60 to 90 minutes to retest your focused and make sure you are in the trade 100%. You should be able to do activities like stretches, maybe take a glass of water and practice breathing exercises to maintain your composure.

7. Journaling Trades (15–30 minutes)

You should be able to record each trade being executed while taking notes on points like entry and exit positions, position sizes and also equally measuring your strategy to review how good are effective it was in a given trade of series of trades.

You should be able to take the market conditions as well while taking into account your state of composure and mindfulness during a particular trade.

Finally State the outcome and make mention of the lessons you have learned from a particular trade which could be applied in future

8. Review and Reflect (10 minutes)

Take some time off to evaluate yourself, and check if you were able to follow your strategy from the beginning till the end. Make mention of areas needing improvement and be kind enough to celebrate small wins as this might eventually lead to bigger achievements in the future so long as your strategy is improving

*Evening Routine

9. Skill Development (30–60 minutes)

Ending of your day, you should be able to take a quick review on trading strategies and equally trading books to keep yourself informed of market conditions and take review of passed trades to apply it in future using technical analysis

10. Visualization and Gratitude (10 minutes)

Take a quick review of your trades in that particular day and reflect on what went well or what went wrong why expressing gratitude for learning opportunities it has presented to you

Weekly Trading Routine

Weekend Review

1. Performance Review

To begin with, we start by analyzing all trades that were made within the week and then taking into account their risk/reward ratio, wins/ losses I'm checking as well how compose and maintain our state was during these sessions. Check into account if some level of tranquility and discipline was maintained.

2. Plan Adjustments

After performance review, we should be able to check in to see areas which needs adjustment in our plan. Equally we should be able to refine our strategies so suit the current market conditions. By so doing, we will at least stay informed of precise Market States.

3. Goal Setting

Checking to see if a particular strategy works well, we should equally be able to set realistic goals for the upcoming week making sure everything is put in place to make it happen.

- Mindset Reset

Practice gratitude and mindfulness on little wins before getting into the next week's trade. This will help clear our doubts and maintain our state of composure while walking into a new week.

By consistently following your routine, you can greatly enhance both your technical skills and psychological resilience.

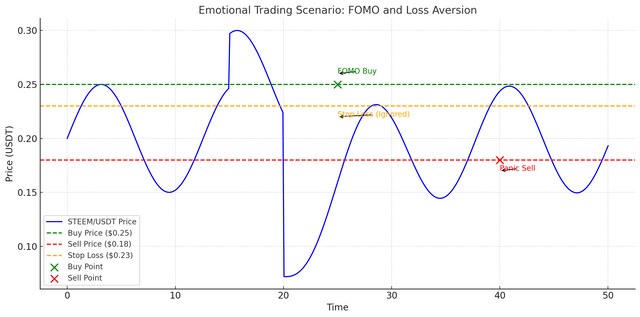

Question 4: Case study on emotional trading

Analyze a hypothetical or real-life scenario where emotions led to a significant trading error. Explain how emotional discipline could have prevented the loss

The Impact of Emotions on Trading

Trader’s Situation:

A certain trader enters the STEEM/USDT market after seeing a sudden 15% rally in a particular day, bearing in mind the price will continue to move forward they decided to invest with huge amount of capital without implementing stop losses driven by the fear of missing out.

Outcome:

1• after the market has surge to a a price of $0.25 the trailer made the market at this point, driven by Fomo , trader buys STEEM at $0.25 after the rally. The price continue to move up for a little bit before things turns south

2• As many traders who entered early begin to take their profits, it affected today of what movement and the market notice a sharp reversal. At the instance the price of steam dropped to $0.20 within hours.

3• The trader seeing himself in losses decide to hold on to the trade Hoping for a rebound. Therefore their service trader refuses to sell his positions and hold on to his position as the price dropped to $0.18

4• finally did trader sees there is no turning back in the trade and decide to sell his position at $0.18 . By taking this action, he loses 28% of his capital.

Analysis of Emotional Triggers

1• FOMO: the biggest mistake did trader made was entering late in the market, while chasing the price. They could have still be an option if he had waited for a pullback to a particular fibonacci level of let's say 50%

Before putting his entry.

2• Hope: after noticing he has made a terrible mistake by entering late in the market, the trailer decide to hold on to his position hoping by God's grace the market world turn back and puts him in profit.

3• Overconfidence: Base on the particular surge in price, the trailer was so confident the market will continue to move in the same sense for some reasonable amount of time or days before retracement. With of a confidence, he invested heavily ignoring risk management and Market discipline.

How Emotional Discipline Could Have Prevented the Loss

1. Predefined Strategy:

Had it been the trailer had a predefined rule our strategy, he would have avoided entering trades with steep Rallies but rather wait for a confirmation on a retracement before making his entry.

Example: he could have possibly put a buy limit order at $0.22, near a support level, thereby limiting his chances of buying added top price.

2. Risk Management:

Due to the current sweetness of the market price, the trader forgot to implement risk management criteria which he finally paid the price dearly.

Example: lets say if trader implemented a stop-loss at $0.23, he would have walked away only with 8% loss rather than 28%.

3. Position Sizing:

Rather than investing heavily in seemingly favorable Market conditions, it is advisable to invest only 2% of your capital to minimize unforeseen scenario

Example: in position of an account of $1,000, it is advisable to risk only $20 house a lot size in any given trade.

4. Avoiding Emotional Decisions:

By having it strategize plan, the trader could have possibly avoid and entering a trade based on impulses but rather follow their plan, or enter at a better price to reduce losses.

Example: His case could have been better off if he had waited for a confirmation by use of Moving average, RSI to spot conditions of overbought or oversold As an additional means of confirmation..

5. Trading Journal:

By tracking his trading I'm learning from past mistakes. He would have possibly learn not to react impulsively in given market conditions but rather learn from the mistakes they have made in the past.

Example: Take for instance him taking some time off to review his fomo. Will trigger him not to make the same mistake he made before.

Points to note

Trading emotionally often leads to what decision making result into tangible losses

By staying strick I pre-defined strategy, proper entry and exit points, emotional impulses could be greatly reduced.

Had it been the trader have practice emotional discipline, he would have been able to save his trade from substantial losses and saving him to trade another day.

Question 5: Building resilience in volatile markets

Discusses how to build mental resilience to handle high-stress trading environments, including techniques for maintaining focus during high volatility conditions.

Building mental resilience is critical for navigating high-stress trading environments, especially during volatile market conditions. Here's a breakdown how to manage such conditions.

1. Develop a Pre-Trade Routine

Coming up with a well structure routine Can help you establish a cool and calm mindset before getting into any trade

Technique: Start your day with breathing exercises to reduce anxiety.

Example: take at least 5 minutes strictly on deep breaths before analyzing the STEEM/USDT chart.

2. Focus on the Process, Not the Outcome

Switch your mindset from winning a trade rather to executing your strategy and sticking to your plan as well to make sure everything is working according to plan.

Technique: reevaluate your trades based on your trading plan rather than focusing on win/ loss

Example: If your STEEM/USDT setup requires a specific risk/reward ratio, stay true to executing it without hesitation or switch.

3. Use Stress-Reduction Techniques

Meditation: practice mindfulness to stay in the moment and avoid cases of overthinking

Exercise: regular exercises carried out an intervals can reduce tension and improve your focus.

Breaks: take breaks at interval, taking off some time from your screen especially in cases of volatile markets.

Example: go for a 10 minute walk after executing a trade to reset your mindset and regain your focus.

4. Stick to a Trading Plan

Having a well-defined structure plan reduces emotional impulses and keep you updated in fluctuating market conditions.

Technique: be rest assured to include Include entry/exit points, stop-losses, and position sizing in your plan which are a basic necessity for every trade.

Example: In a STEEM/USDT trade, if you set your stop-loss at $0.20, exit without hesitation when the price hits the point.

5. Leverage Technology for Automation

We should implement automatic tools based in trading apps so limit our manual interaction with a given Market

Technique: automate your limit orders that is stop-losses, and trailing stops. To avoid closing manually when did price move in that direction.

*Example: Automating a take-profit order at $0.30 for a STEEM/USDT position, while making sure you stick to your plan till the price reach this point.

6. Practice Visualization and Simulation

Simulate high stress scenario trades by using demo or other tools to better prepare yourself when you finally get to trade in real life.

Technique: make Use demo accounts or rewind to historical volatile markets occurrence.

Example: return STEEM/USDT’s high-volatility periods and practice making trades in the background.

7. Cultivate a Long-Term Mindset

Avoid focusing on short-term gains, such as days weeks

But rather think in probabilities such as monthly or yearly.

Technique: Keep a journal to track progress and point out areas of improvements over time.

Example: revisit your STEEM/USDT trades every week to identify patterns and refine your application.

8. Stay Educated and Prepared

Knowledge reduce and certainty doubt and boost confidence of various Market scenarios thereby living to informed the market decision.

Technique: stay updated about market conditions and make sure you have a good knowledge of the pair you trade.

*Example:" Research STEEM’s fundamentals and news to anticipate what next could happen to the price movement.

9. Build Emotional Awareness

Examine yourself, take into account what triggers your emotion and take preliminary measures to avoid such scenarios or to reduce them at least.

Technique: Use self-assessment questions, bike ask yourself for real., “Am I trading out of fear or greed?”

Example: Before trading during a STEEM/USDT rally, hold on for a minute I'm review your terms to make sure your decision aligns with your strategy.

10. Seek Support and Community

Drawing communities of four rooms if possible to share your knowledge on a particular token. Interacting with different traders you put always stay updated and informed about what is happening to a particular token or the general market overall.

Example:you can join a steeemit discussion forum to assess your your STEEM/USDT trades an gain constructive feedback.

Overall, emotional disciplined is something every trader should possess Which can help them make informed Market decisions without hesitation or share of missing out.

Rounding up with this amazing topic, I invite the following 3 persons to join me participate

Best regards: @rafk.