Crypto Academy Season 3 Week 6 - Beginner's Course | Cryptocurrency Investment Tools.

Hello Steemians, I welcome everyone to the 6th week of Season 3 in the Steemit Crypto Academy. In this lesson, I will present my 3rd lesson for the beginner's course in the Academy. In the previous classes, we have focused on understanding the basics of technical analysis which includes the introduction of Japanese candlestick and Candlestick patterns.

Introduction

Just like I will always tell my colleagues, investing in cryptocurrency is simple but not easy. It is simple in the sense that you have the trigger button in your phone to place orders anywhere and anytime. But making the right decisions to know the crypto asset to invest in and also the right time to invest in is the difficult part of the process.

Though we have introduced ourselves to basic technical analysis, it is not enough to guide an investor to make the right decision in the market. There are other investment analysis and information a trader needs to make a good trading decision. The crypto market is very high and it is mostly influenced by fundamental factors and speculations of traders.

In this lesson, we will introduce some of the basic investment tools a trader needs to understand to make the right trading decisions and also have valuable information about the coin the user wishes to invest in.

Reviewing CoinGecko

CoinGecko is a cryptocurrency platform that provides users all the available information they need about the cryptocurrency market. The platform is a Singapore-based company developed to help cryptocurrency investors make good trading decisions. The idea about CoinGecko platform Is that users need to have valuable background information about the cryptocurrency asset they wish to invest in. This includes information on the team behind the project, keeping track of the Github of the cryptocurrency project, the community starts of the project, and the market statistics of the cryptocurrency project.

Exploring CoinGecko Platform

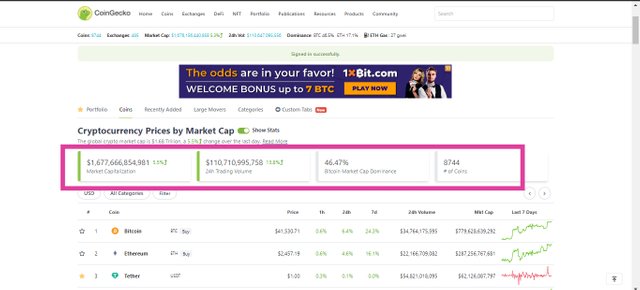

CoinGecko provides live feeds of cryptocurrencies in a well-organized manner. This can be ranked based on volume, 24hr changes, market capitalization, an all-time high and all-time low, etc. This can be seen in the picture below.

On the landing page of CoinGecko, we first see the list of cryptocurrencies ranked by MarketCap. From what we can see, Bitcoin is ranked 1st with the marketcap of $779.62 billion. Similarly, we can also see the total market cap of the entire crypto market and the 24hr trading volume of the crypto market. Furthermore, we can also see the number of cryptocurrencies listed on CoinGecko. Another valuable piece of information we can see is the Bitcoin dominance which helps us understand the performance of Bitcoin and Altcoins.

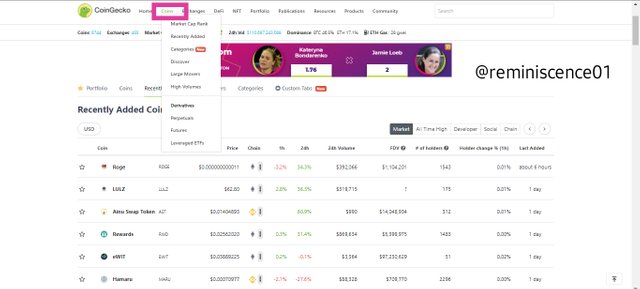

Coin Ranking

At the top right corner of CoinGecko landing page, we can see the different drop-down menu list. Clicking on Coins shows users the categories of cryptocurrencies in the market. This includes recently added coins, categories of cryptocurrencies by purpose, large movers, high volumes, etc.

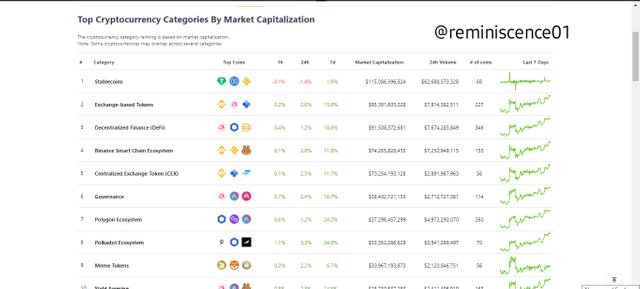

The cryptocurrency categories are ranked by Market Capitalization. This includes stablecoins, exchange-based tokens, DeFi, DEX, NFTs, Binance Smart Chain (BSC), Governance tokens, PolkDot ecosystem, Yield farming, Meme tokens, Privacy coins, etc.

From the image above, we can see that these categories also have additional information that will easily help a trader. The top coins in these categories are presented. Also, we have the 1hr, 24hrs, and 7days price changes of the categories. Furthermore, the 24hr trading volume of each category is provided with the number of coins in each category. From what we have in the image above, there are a total of 68 Stablecoins in the crypto market.

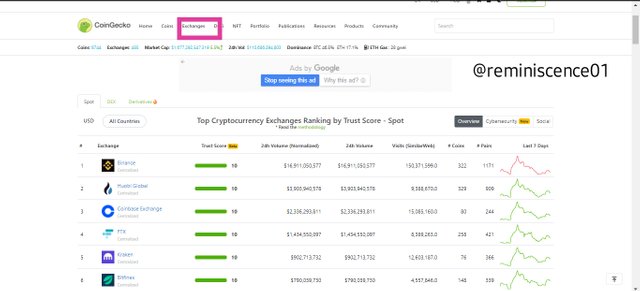

Crypto Exchange Ranking

Another amazing feature of the CoinGecko platform is the ranking of cryptocurrency exchanges. Here cryptocurrency exchanges are ranked by Trust Score to enable users to make the right decision on the crypto exchange to trade with. Furthermore, information on trading volume, number of visits on the exchanges, and also total trading pairs are provided to help investors make the right investment decision.

Aside from providing market stats of cryptocurrencies projects, there are other valuable features of the CoinGecko platforms that the users will also need to make good investment decisions and keep up-to-date information in the crypto market.

The market stats is not enough to provide investors the information they need to make good trading decisions. Some of these features include:

- Coingecko News

- Coingecko Podcast.

- CoinGecko Beam etc.

The students will be allowed to explore the rest of these features in the homework task. This will help them explore more about the CoinGecko platform.

TradingView Platform Review

The TradingView platform is one of the amazing trading platforms for traders in the financial market. TradingView is a social platform where active traders interact with each other and discuss market ideas.

TradingView platform also provides screeners and charting tools for traders. Similarly, there are drawing tool features that enable traders to carry out technical analysis and also customize their own charts.

Another amazing feature TradingView platform Is that, it provides built-in technical indicators, candlestick patterns, etc. Similarly, there is also a public library where users can have access publish their own indicator scripts for traders to access.

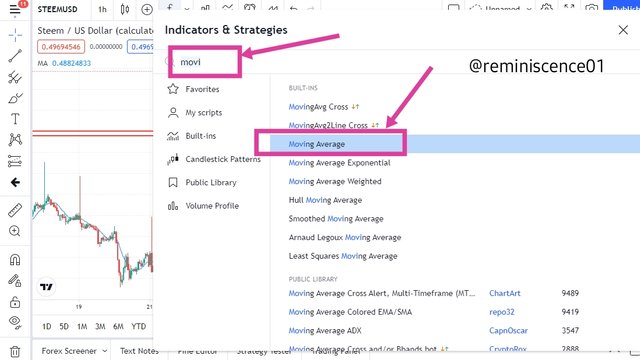

Adding an Indicator on TradingView Chart

To add a technical indicator, follow the steps below.

- On your browser, open TradingView. On the landing page, click on Chart.

- After that, you will be redirected to the charting interface. On the top corner of the page, click on the indicator icon. This can be illustrated in the chart below.

- After clicking the icon, a pop-up window appears which contains the indicators on Tradingview. There we can access built-in indicators, public Library which contains scripts written by other users.

- To access an indicator, you can type in the name of the indicators using the search box. After that, all the available scripts will be displayed. Click on your preferred indicator to be added to the chart.

From the chart above I have added a moving average indicator on the chart. Now I'm going to configure this indicator to suit my trading style.

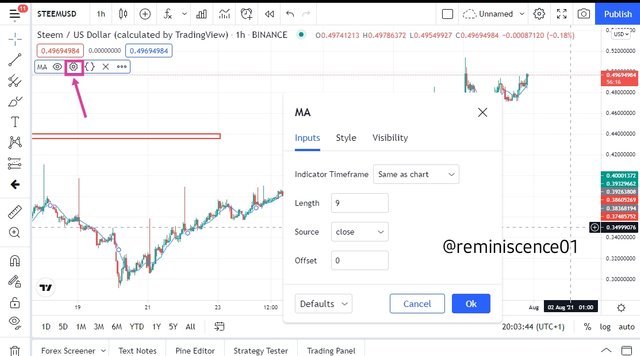

To configure an indicator added to the chart, follow the steps below.

- Click on the indicator bar at the top left as shown in the chart above. Here you can close the indicator or hide it on the chart.

- Click on the settings icon for a pop-up window showing the configuration of the indicator.

- Here you can change the indicator parameters, color, font size, etc.

From the chart above, i have configured the moving average indicator by changing the length to 50 and also the color to black.

The Tradingview platform is mostly used by traders because of its simplicity and configuration. The platform is designed to be very easy even for newbies to access. Similarly, the drawing tools enable traders to carry out markups for technical analysis.

Though most brokerage and exchanges haven't been integrated directly to Tradingview, traders make use of their brokerage trading platform to open positions or use the MetaTrader platform to place their trades after carrying out technical analysis on TradingView.

Cryptocurrency Portfolio

Managing your portfolio properly gives you high chances of minimizing losses and maximizing your profits in the crypto market. Portfolio includes a collection of assets like cryptocurrencies, stocks, commodities, ETFs, bonds, Arts, etc. These assets are carefully selected and monitored for in the portfolio by the investor for potential gains.

Managing your Cryptocurrency Portfolio

The goal of every investment is to yield profit in the future. Going all-in with your entire capital on a single coin exposes your capital to high risk. The reason is that cryptocurrency is a highly volatile asset that can dip or rise more than 40% in some minutes. For this reason, an investor needs to diversify his capital into different assets to minimize losses and also capitalize on crypto assets that will perform very well in a short period.

When you manage your portfolio properly, you tend to minimize the losses from the crypto assets that will perform poorly. For example, assuming you invested in 5 crypto assets and 2 out of the 5 perform poorly and the remaining 3 were profitable. The investor will cover the losses of 2 crypto assets that performed poorly from the profitable ones. From here you will notice the investor has encountered zero losses because he managed his portfolio properly by diversifying his capital into different assets.

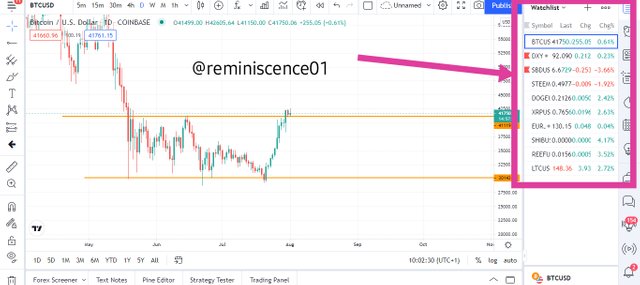

Watchlist

In the cryptocurrency market, there are more than 8000 cryptocurrencies in the crypto market. An investor can't keep a tab or monitor the performance of these cryptocurrencies to make investment decisions. Rather, an investor needs to carefully select cryptocurrencies that have the potential of yielding profits in the future. This can be backed up by carrying out technical analysis or fundamental analysis on the crypto asset. After which, the investor adds these crypto assets into his watchlist to monitor the progress and also the right time to add this asset into his portfolio.

The picture below shows my cryptocurrency watchlist on the TradingView platform. The crypto assets on my watchlist are being monitored and analyzed both technically and fundamentally daily for a potential investment opportunity. These crypto assets will be added to my portfolio when I get the best entry opportunity.

Conclusion

Cryptocurrency investment is a risky one due to the highly volatile nature of the market. A trader needs to acquire all the necessary information and tools needed to make the best trading decision. In this lesson, we have explored some of the cryptocurrency investment tools to assist a trader in making the right trading decision.

Also, in this lesson, the cryptocurrency portfolio and watchlist have been discussed in detail. Carrying out fundamental or technical analysis is essential to find the best entry opportunity in the market. However, managing your portfolio and diversifying your capital into different assets maximizes your chances of making quick returns and also protects you from losses.

Thank you for participating in this lesson. I hope you have learned something great to help you make the right investment decision in the market.

Homework Task

Please ensure you have understood the lesson before performing the homework task. Also, make your own research and don’t limit your knowledge to the lesson.

a) Explain CoinGecko and why it is a good cryptocurrency investment tool.

b) Explore CoinGecko and explain at least 5 unique features of the platform (Take a screenshot of the page).a) Give a brief explanation of Tradingview platform.

b) Explain the steps involved in adding indicators on Tradingview chart. You can add any indicator of your choice except moving average. (Screenshots required)

c) With relevant screenshots, illustrate how to modify the indicator you have added to your chart.a) In your own words, explain cryptocurrency Portfolio and Watchlist.

b) Explain the need for Portfolio management.

c) Select 5 cryptocurrency assets you wish to add to your Watchlist and explain your reason for selecting each of them. (Show screenshot of your Watchlist. It can be any platform).

Homework Guidelines

- Homework must be posted into the Steemit Crypto Academy community.

- Plagiarism is a great offense in Steemit Crypto Academy and it won’t be tolerated. Ensure you refrain from any form of plagiarism.

- Your post should not contain less than 300 words.

- All images, graphs, and screenshots from external sources should be fully referenced, and ensure to use watermark with your username on your own screenshots.

- Use the tag #reminiscence01-S3week6 #cryptoacademy and your country tag among the first five tags. Also include other relevant tags like #portfolio #trading.

- Homework task run from Sunday 00:00 August 1st to Saturday 11:59 pm August 7th UTC Time.

- Only users with a minimum of 125 SP and having a reputation above 50 are eligible to perform this homework task. Also, note that you must not be powering down.

The comment section is freely opened for suggestions and feedback on the lesson and homework task.

Cc:-

@steemitblog

Dear Professor: @reminiscence01 there is nothing four warning or multiple plagrism in my whole posts please verify and investigate my account to gave me permission to work in crypto Academy. Check my whole account and give me proof or gave me permission to work in crypto Academy. Thanks

This post is shared on Twitter

hi prof here is my entery port

https://steemit.com/hive-108451/@goodspeed22/steemit-crypto-academy-season-3-homework-task-for-reminiscence01-or-or-submitted-by-goodspeed22-or-or-07-08-2021

My task: https://steemit.com/hive-108451/@benie111/crypto-academy-season-3-week-6-for-prof-reminiscence01

I pray i do well this week

Can I use Coinmarketcap website to Explore my Watchlist?

Yes you can.

This is a great lesson. Let me go for it.

Esta tarea se puede publicar en cualquier idioma. Buenas noches

Respected Professor: please verify my post I shall be very thankful to you

https://steemit.com/hive-108451/@naveed15125/crypto-academy-season-3-beginners-course-homework-post-for-task-4-blockchain-consensus-mechanism

My entry

https://steemit.com/hive-108451/@beautybb/crypto-academy-season-3-week-6-beginner-s-course-or-cryptocurrency-investment-tools-from-reminiscence01-submitted-by-beautybb

Dear Professor: @reminiscence01 can i perform your task of the week because yesterday i posted a homework of a Professor and he replied me on my post:

There is no plagirsam or copy post in this task then why he comment me like this. Therefore, i want to ask to Do I elligible to performe task of you? I am elligible or not tell me Sir?

That was task on which i get comment:

https://steemit.com/hive-108451/@zeeshanakram/crypto-academy-season-3-week-6-or-homework-post-for-professor-awesononso-or-satoshi-nakamoto-wei-dai-and-cryptocurrency-units-of

It is quite unfortunate you won't be able to perform any crypto academy task until further notice. The reason is that, you have been blacklisted for multiple plagiarism.

Dear Professor: @reminiscence01 four times plagrism is allowed and only one time warning given to me by Professors. You can check it Professor only one warning given to me yet. Here is that one warning.

https://steemit.com/hive-108451/@awesononso/qvdwb4

Dear Professor: @reminiscence01 kindly given to me proof of multiple plagrism there are four warning allowed in academy. Given me proof of that warning and after that you can black list me.