Steemit Crypto Academy Season 4 Week 8 - Beginner's Course | DeFi Products

Hello Steemians, I welcome you all to the 8th week of season 4 in Steemit Crypto Academy. We will be rounding the season on an interesting topic known as DeFi Products.

The crypto market is greatly advancing and filling up the loopholes in our traditional day finance. DeFi is one of the cryptocurrency ecosystem that is evolving rapidly in the crypto market. Through DeFi, financial services can be accessed easily by crypto users, and also users can get to earn annualized interest on the crypto assets they are holding.

In this lesson, we will discuss some DeFi products and how they work. Let's get down to it.

Introducing DeFi

Decentralized finance (DeFi) is a cryptocurrency system that uses decentralized network and protocols to provide financial services to crypto users. DeFi aims to eliminate third-party involvement in accessing financial products. DeFi also provides seamless and permissionless financial services to crypto users making it available for anyone to access financial products like lending, staking, liquidity mining, borrowing easily. DeFi also guarantees the security of assets through the peer-to-peer network and smart contracts registered on the blockchain.

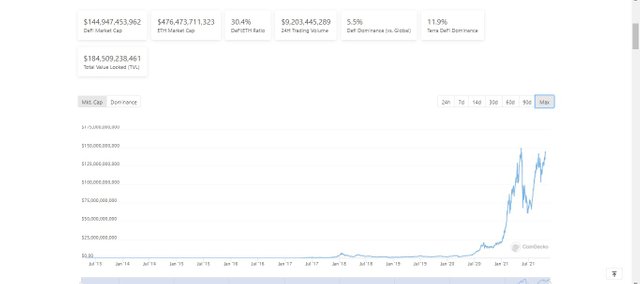

The DeFi market is increasingly growing with a market cap of $145 billion and a 24hour trading volume of $9.1 billion across all platforms. Crypto users can take advantage of the opportunity offered in DeFi ecosystem to have a better financial service. This will in turn increase the dominance of cryptocurrency in the financial market and also fasten its adoption.

DeFi Products

DeFi products are financial services tools developed to bring about decentralization in the financial industry by eliminating third-party involvement in assessing financial services. The DeFi products gives crypto users room for much flexibility in accessing financial services while providing a high level of security to protect users funds.

Below are some of the benefits offered by DeFi products to users.

Benefits of DeFi Products to Crypto Users

- Transparency:Unlike the traditional financial system where transactions and system operation are not made public, DeFi products offers a transparent system as transactions are made public to users and are also recorded on the blockchain.

- Permissionless: DeFi products are made for everyone in the system to access. There's no limit or barriers to any user in the crypto market. This is different from the traditional system where users need to carry out some form of verification before accessing financial services.

- Decentralisation: In the traditional financial system, the banks, brokers, and financial institutions serve as intermediaries in transactions. This reduces the speed of the transaction as this transaction needs approval and verification before it can be executed. Similarly, users' funds are secured as they have access to their private keys which gives them enough freedom to take control of their funds.

- Low Cost: Just like we have discussed, the elimination of intermediaries helps to increase the speed of transactions and at a reduced cost. All thanks to the blockchain technology and smart contracts utilized by DeFi products to automate transactions.

Exploring DeFi Products

In this section, we will be exploring some DeFi products and also how they work. Let's get down to it.

Decentralised Exchange (DEX)

Decentralization eliminates intermediaries and third-party involvement in the transaction process. This alone does not only increases the transaction speed but also lowers the cost of the transaction. DEXs is a peer-to-peer platform that allows crypto users to exchange their cryptocurrencies while having full control of their funds. Through DEXs, crypto users can have the confidence to exchange and have access to a wide range of cryptocurrencies transactions in a secured manner. Transactions on DEX are recorded on the blockchain and initiated through smart contracts ensuring that users' funds are properly secured and transactions are made transparent to everyone in the system.

How DEX works

Unlike the centralized exchanges that provide order books for its users to match orders, most DEX utilizes the AMM (Automatic Market Maker) to provide liquidity for users to get matching orders. The AMM model uses a mathematical model to help users exchange crypto assets.

When a user initiates a buy order on DEX, this buy order is matched with another user who wants to sell the same crypto asset. This is what we call peer-to-peer transactions where there's the elimination of intermediaries. Assets prices on DEX are determined through the help of the AMM model which also helps to maintain liquidity and allows users to swap their crypto assets at ease.

PanCake Swap

PanCake swap is a decentralized exchange platform that is built on the Binance Smart chain. Pancake swap do not only allow users to swap their crypto assets (BEP-20 tokens) at ease, they also enable them to be liquidity providers to generate passive income from transaction fees. Let's look at how to swap crypto assets on Pancake swap.

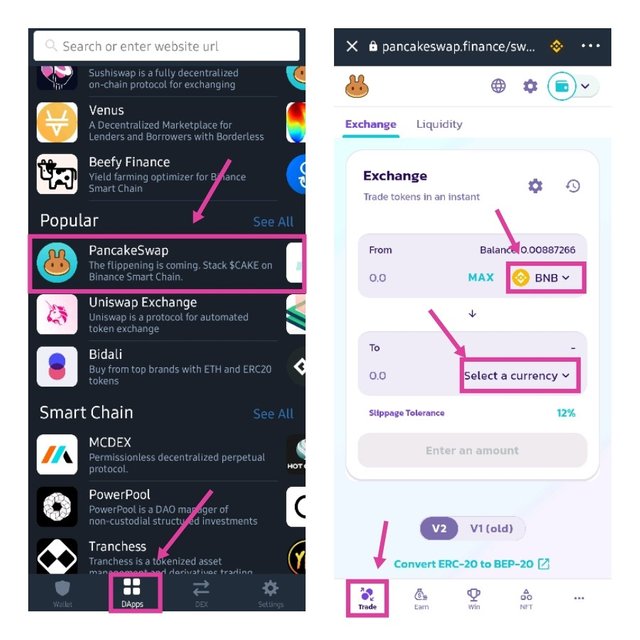

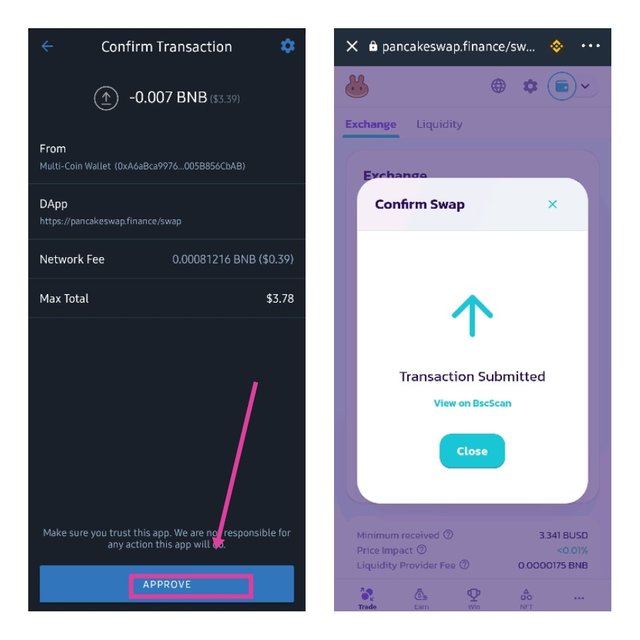

In this section, I will be accessing Pancake swap from Trust Wallet. Trust wallet has a DApp function that enables users to have access to most DApps and a user can easily connect their wallet to the platform. The steps are as follows:

Steps:

- Open your trust wallet and click on DApps at the bottom page. Pancake swap is a popular DEX platform on trust wallet. Click Pancake swap icon to be redirected to the platform.

- On Pancake swap homepage, switch to Trade at the bottom page.

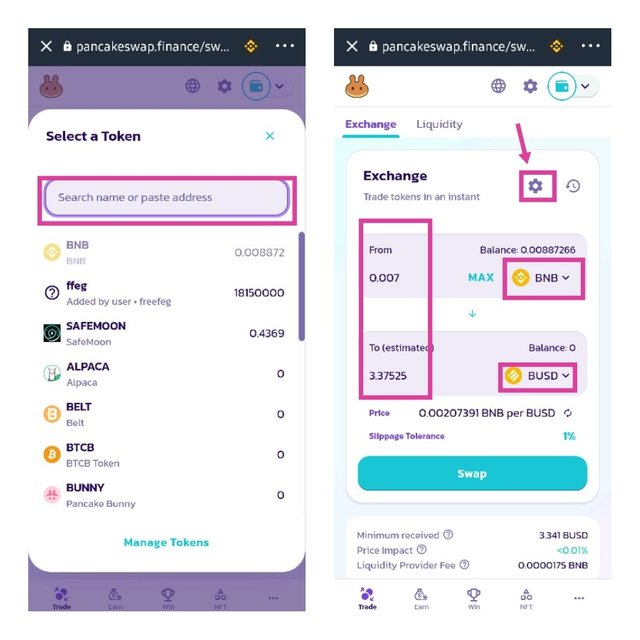

- After that, select the crypto assets you wish to swap by clicking on the drop-down arrow. You will see a list of crypto tokens (BEP-20) available. In the case, your preferred crypto token is not on the list, type in the smart contract address of the token in the search bar to add the token on the list.

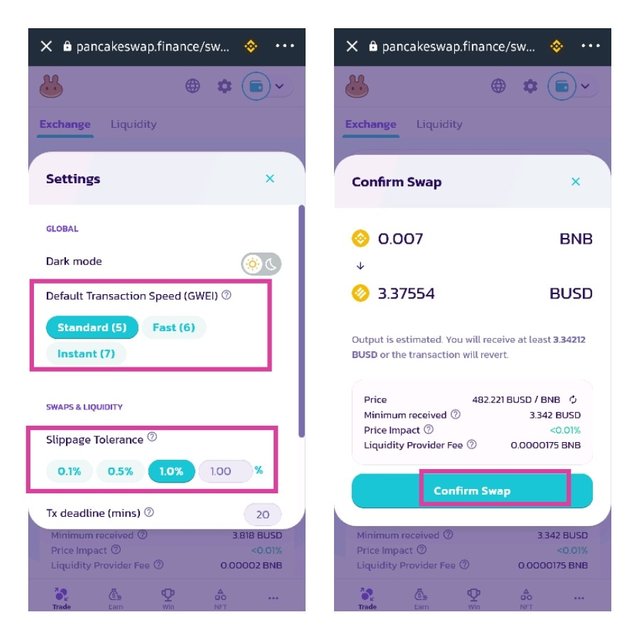

- After that, input the amount of token to be swapped. You can click on the settings icon to configure the transaction process. Note that this configuration comes with a condition applied to have a smooth transaction. Increased gas fees will lead to an increase in transaction speed and also an increase in transaction fees.

- After that, click on Swap. A smart contract call will be initiated on your wallet to approve the transaction. Click on Approve for the transaction to be submitted.

Transaction details can be viewed on BSC scan.

Note: BNB (Binance coin) is used for transaction fees across Binance smart chain. This is because BNB is the native cryptocurrency of the Binance Smart chain. Ensure you have enough amount of BNB to cover up transaction fees.

Liquidity Mining

In order for decentralized exchanges to provide liquidity for their users, liquidity pools are provided for users to lock/deposit their crypto assets and earn rewards from transaction fees. This is another amazing way crypto users can earn passive income by becoming LP providers. This also improves the development and activities of the ecosystem. We will be looking at how to provide liquidity on JustSwap.

JustSwap is a decentralized platform built on the Tron network. JustSwap enables crypto users to exchange TRC-20 tokens and also allows users to earn passive income as liquidity providers. Users who participate in JustSwap liquidity mining earn annualized interest (APY/APR). We will explain how to acquire and add LP tokens on JustSwap to earn interest.

Steps in JustSwap Liquidity mining

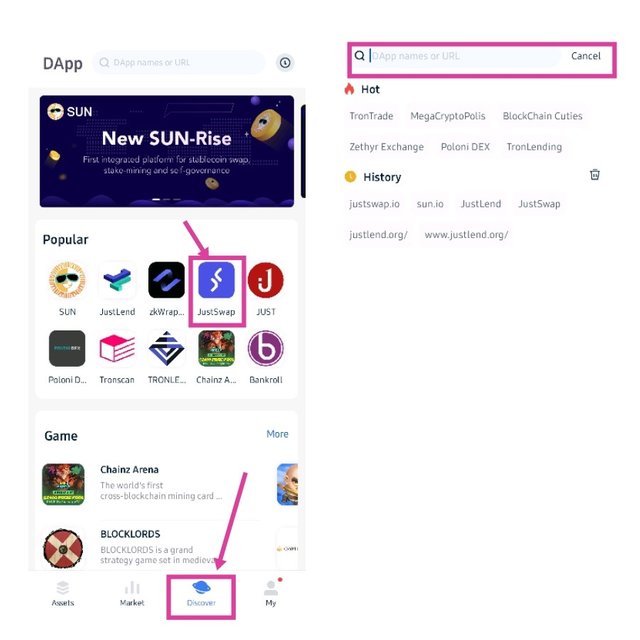

In this section, I will be explaining how to add liquidity on JustSwap using the Tronlink Pro wallet. Tronlink wallet is a mobile wallet for TRC tokens. We will be accessing JustSwap from Tronlink discover page which enables users to interact with DApps on Tron network. The steps include:

Open Tronlink wallet and click on Discover at the bottom page to access DApps features. The Discover section is a feature of Tronlink that enables you to interact with DApps directly from your wallet.

On the Discover page, JustSwap appears on the landing page as a popular DApp on Tronlink wallet. You can click the icon to be directed to [JustSwap.io](JustSwap.io} page. You can also use the search bar to visit JustSwap by typing JustSwap.io and hitting the enter key. This can be shown in the screenshot below.

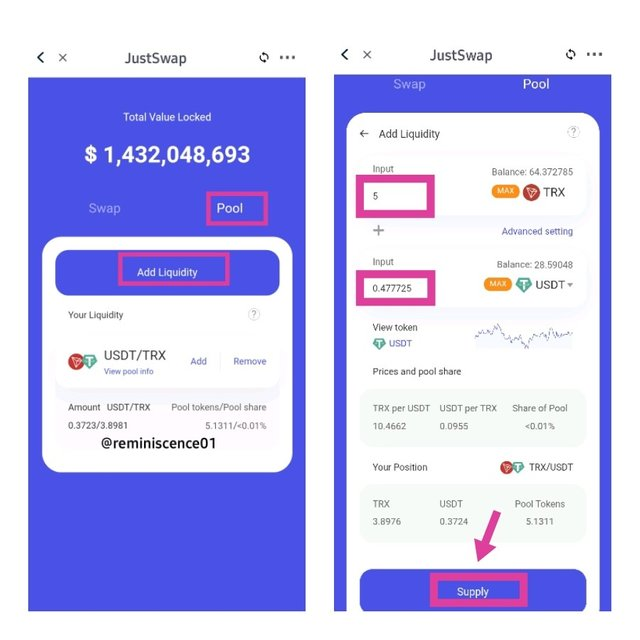

- On the JustSwap landing page, I switch to pool and clicked on add liquidity.

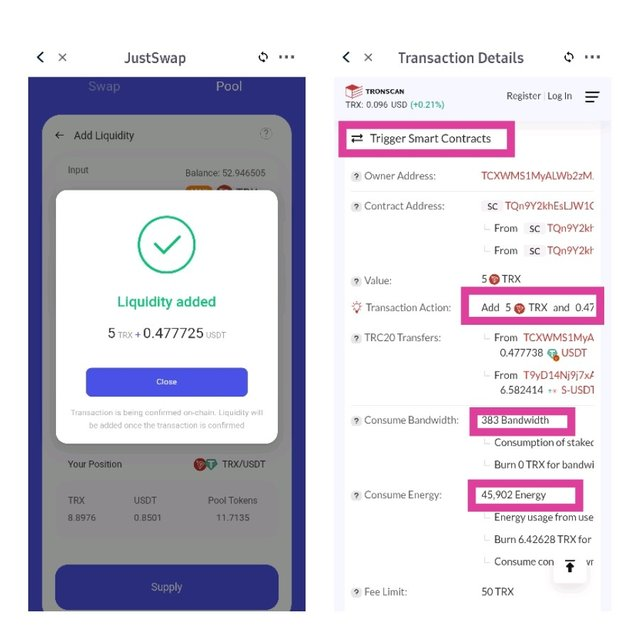

- After that, I selected the USDT-TRX liquidity pool to supply to the pool and added the amount to be supplied to the pool. In this case, I inputted 5TRX which amounted to 0.47 USDT and I clicked on Supply. This can be seen in the screenshots below.

- After clicking supply, a dialogue box appeared for me to confirm supply with the details of the transaction. Then I clicked on confirm supply.

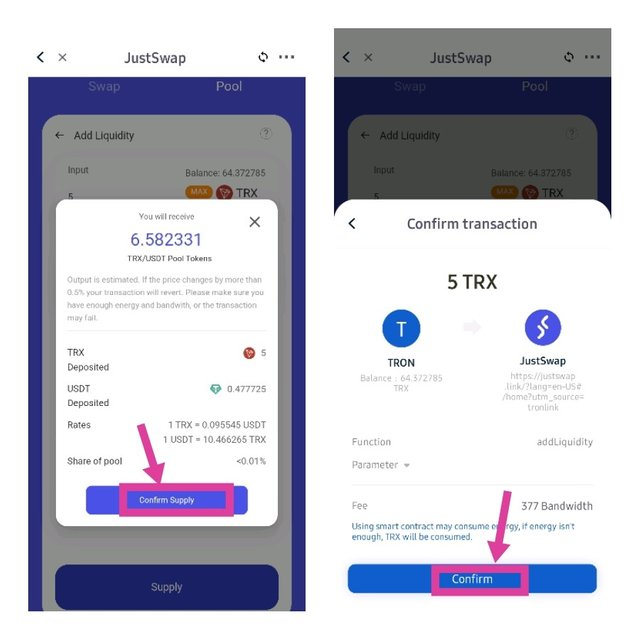

- A smart contract call was lifted on my Tron wallet to confirm the supply of TRX and USDT on the JustSwap liquidity pool. After that, I clicked on confirm to confirm the transaction from JustSwap. This can be seen in the screenshot below.

-After confirming the supply, the transaction was successful which can be seen in the screenshot below. The details of the transaction can be viewed on Tronscan. From the screenshot below, adding liquidity on JustSwap is a smart contract triggered transaction which consumed both bandwidth and energy. 383 bandwidth was consumed and 6.4 TRX was burned to accommodate 45,902 energy needed to carry out the transaction.

Note: Transactions on Tron Network consumes both energy and bandwidth. A user can acquire these two resources by freezing TRX. In the situation of insufficient resources, TRX will be burned to cover up for the resources used.

Conclusion

The DeFi ecosystem is shaping present-day finance by providing a seamless and borderless ecosystem for crypto users. It is no doubt that DeFi will dominate the financial market in the future and bring decentralization and control to the users.

Furthermore, the DeFi ecosystem provides unlimited streams of income for users. This can be through providing liquidity and staking their assets in LP pools. Users should also understand that there are risks associated with DeFi and also investing in cryptocurrency. It is required that proper research should be made on DeFi platforms before depositing your assets.

Thank you for being part of this lesson.

Homework Task

Some part of this homework task will require you to carry out a real transaction. You can perform a transaction as low as $1 to complete your illustration. Also, make your own research and don’t limit your knowledge only to the lesson.

- a) In your own words, explain DeFi products and how it is shaping the present-day finance.

b) Explain the benefits of DeFi products to crypto users. - Discuss any DEX project built on the following network.

- Binance Smart Chain

- Tron Blockchain

- In the DEX projects mentioned in question 2, give a detailed illustration of how to swap cryptocurrencies by swapping any crypto asset of your choice. Show proof of transaction from block explorer. (Screenshots needed)

Homework Guidelines

- Homework must be posted in Steemit Crypto Academy community. Your homework title format should be " [Your Title] - Crypto Academy / S4W8- Homework Post for @reminiscence01".

- Plagiarism is a great offense in Steemit Crypto Academy and it won’t be tolerated. Ensure you refrain from any form of plagiarism.

- Your post should not contain less than 400 words.

- All images, graphs, and screenshots from external sources should be fully referenced, and ensure to use watermark with your username on your own screenshots.

- Use the tag #reminiscence01-s4week8 #cryptoacademy and your country tag among the first five tags. Also include other relevant tags like #defi, #dex #cryptocurrency.

- I believe you are aware of #club5050 program going on in Steemit ecosystem. There's a reward for joining the program in Crypto Academy. Do not use the tag #club5050 if you wont participate in the program.

- Homework task run from Sunday 00:00 October 24th to Saturday 11:59 pm October 30th UTC Time.

- Only users with a minimum of 200 Steem Power and having minimum reputation of 55 are eligible to perform this homework. Also, note that you must not be powering down.

- Users who have used upvote tools to gain SP or build their reputation are not eligible for this homework.

Note: You can only drop your homework link in the comment section if not reviewed after 48 hours.

The comment section is freely opened for suggestions and feedback on the lesson and homework.

Cc: @steemitblog

Sir

Very informative it was

Wanted to participate but my SP & SR are not upto eligibility level as I am new and trying hard to earn a respectable reputation here

Surely I'll participate after coming to required eligibility

Learned new things here like how DeFi and DEx works

Thank you professor for your awareness contest with so descriptive and meaningful illustration 😊🙏

#club5050 😀

Hola profesor, gracias por esta clase magistral, aquí le dejo mi tarea de la semana, ya pasaron las 48 horas

https://steemit.com/hive-108451/@danay/curso-para-principiantes-or-productos-defi-crypto-academy-s4w8-publicacion-de-tarea-para-reminiscence01

https://steemit.com/hive-108451/@andersonhm/proof-of-keys-steemit-crypto-academy-s4w7-homework-post-for-awesononso

Buenas profesor @reminiscence01 @wahyunahrul mi tarea de la semana no fue corregida por favor ayuda.

Thank you Prof for the awesome lecture sir

Thank you. I'm looking forward to your submission.

Saludos profesor excelente tema !

This is a nice topic to exploit. Thank you very much Professor

Thank you. I'm looking forward to your homework task.

Ok

I'm back and I will do my best performance I hope. Thank you sir for this topic.

Thank you. I'm looking forward to your homework task.

In task no 1, a), should we choose one DeFi product to describe or explain the whole DeFi product. And in task 2, is it enough to discuss one project from binance Smart Chain and one from TRON.

Explain DeFi products in general. In question 2, you are required to choose one project from each blockchain.

Understod proff.

Good day professor @reminiscence01, pls concerning that question 3, let's assume I want to discuss on Justswap, should I talk about the liquidity mining aspect of it or i should talk about the swapping aspect of it since the question emphasized on 'swapping any cryptocurrency of our choice' pls am kind of confused

buen dia... tengo la misma duda. hay que hacer intercambio solamente en los 2 proyectos mensionados? o hay que hacer intercambio en un proyecto y mineria en el otro proyecto?

Liquidity mining is different from swapping. The question said you should swap any crypto asset of your choice.

muchas gracias profesor...