"Smart Investing in Cryptocurrency: Tips for Purchasing and Managing Digital Assets"

Predicting which cryptocurrencies will rise by 2024 involves significant speculation, but several factors can help identify promising projects. Here are some criteria to consider and a few cryptocurrencies that are often mentioned as having potential:

Factors to Consider

Technology and Innovation: Cryptocurrencies with innovative technology or unique solutions tend to have greater growth potential. For instance, Ethereum is known for its smart contract platform, and many projects are developing new blockchain technologies.

Adoption and Partnerships: Coins with broad adoption, whether by individual users or major corporate partnerships, generally have better growth prospects. Bitcoin and Ethereum, for example, have extensive adoption.

Development Team and Community: Projects with strong development teams and active communities are often more likely to succeed. Credible, dedicated teams and supportive communities can aid in development and adoption.

Regulation and Compliance: Projects that adhere to existing regulations and plan to comply with future regulations may be better positioned to handle legal challenges and have better long-term prospects.

Utility and Use Cases: Coins offering real-world utility or solving specific problems in the blockchain ecosystem tend to have long-term value. Examples include DeFi (Decentralized Finance) platforms and NFT (Non-Fungible Token) projects.

Promising Cryptocurrencies

Ethereum (ETH): With its transition to Ethereum 2.0 and improvements in scalability, Ethereum remains a top contender for long-term growth.

Polkadot (DOT): Designed to enable interoperability between different blockchains, Polkadot has significant growth potential.

Chainlink (LINK): Providing oracle services for smart contracts, Chainlink could continue to be a critical component in the DeFi ecosystem.

Cardano (ADA): Known for its cautious approach to development and commitment to research, Cardano may offer long-term potential.

Solana (SOL): With its high speed and scalability, Solana could continue to attract attention in the crypto space.

Remember, investing in cryptocurrencies carries risks, and it’s essential to conduct thorough research and consider financial advice before making investment decisions.

Certainly! Here are some tips for buying cryptocurrency with a focus on the year 2024:

Tips for Buying Cryptocurrency for 2024

Conduct Thorough Research

- Understand the Project: Dive deep into the cryptocurrency's technology, purpose, and team. Read the whitepaper and assess the project's roadmap.

- Evaluate Use Cases: Look for cryptocurrencies with clear, real-world applications and potential for widespread adoption.

Diversify Your Portfolio

- Spread Your Investment: Don’t invest all your funds in one cryptocurrency. Diversify across different assets to mitigate risk.

- Mix Established and Emerging Coins: Combine well-established cryptocurrencies like Bitcoin and Ethereum with promising newer projects.

Assess Risk and Volatility

- Prepare for Fluctuations: Cryptocurrencies are known for their volatility. Be ready for significant price swings and invest only what you can afford to lose.

- Set Stop-Loss Orders: Implement stop-loss orders to protect your investment from severe losses.

Choose Secure Platforms and Wallets

- Select Reputable Exchanges: Use well-known and trustworthy cryptocurrency exchanges with strong security measures.

- Use Secure Wallets: Store your assets in secure wallets, such as hardware wallets or non-custodial wallets, for long-term safety.

Stay Informed

- Monitor Market Trends: Keep up with the latest news and trends in the cryptocurrency space. Follow regulatory changes, technological advancements, and market sentiment.

- Join Crypto Communities: Engage with online communities and forums to gather insights and opinions from other investors and experts.

Understand Regulatory Impacts

- Know the Regulations: Be aware of the legal and regulatory environment for cryptocurrencies in your country. Regulations can impact your investment strategy and tax obligations.

Have a Clear Investment Plan

- Set Goals and Strategies: Define your investment goals, including entry and exit points. Develop a strategy based on your financial objectives and risk tolerance.

- Stick to Your Plan: Avoid making impulsive decisions based on short-term market movements. Stick to your investment plan and adjust only when necessary.

Evaluate Project Fundamentals

- Check the Team: Assess the credibility and experience of the development team behind the cryptocurrency. A strong, reliable team can be a positive indicator of a project’s potential.

- Review Community Support: A vibrant and active community can be a sign of strong project support and potential for growth.

Invest Gradually

- Dollar-Cost Averaging: Consider investing in small, regular amounts rather than making a large single investment. This strategy can help mitigate the impact of market volatility.

Focus on Long-Term Potential

- Think Long-Term: Look for cryptocurrencies with strong long-term potential rather than seeking quick gains. Invest in projects that are likely to grow and adapt over time.

By following these tips, you can make informed decisions and position yourself for potential success in the evolving cryptocurrency landscape leading up to 2024.

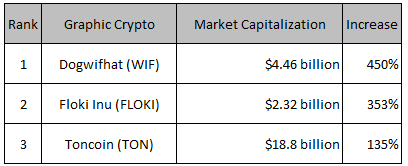

When it comes to graphic crypto, there are several top-performing cryptocurrencies that have caught the attention of experts and investors alike. In 2024, some of the best graphic cryptos include WIF, FLOKI, and TON, whichhave seen significant increases in their market capitalization.

Here is a graphical representation of the top 3 graphic cryptos in 2024:

Note: The market capitalization and increase values are subject to change and may not reflect the current market situation.