Steemit Crypto Academy Season 2: Week2| TOKENS, PARTE 1: to @pelon53

Hello dear colleagues from the SteemitCriptoAcademy community. Grateful for this second season of study, I present my entry to the Tokens task taught by professor @pelon53

[freepik](https: //www.freepik.es/)

Security token

After having studied various concepts of the security token, I understand that it is a type of cryptographic token that is issued during a token sale or an initial coin offering. It can also be considered as a digital asset issued on the blockchain to represent the financial security of investors.

In 2017, the blockchain launched the first offering of tokens with the aim of raising donations through a round of financing. Since then, several companies have adopted security tokens.

Companies use the security token to represent an investor share in their capital. They also act as investment contracts whereby people invest in anticipation that their value will increase over time, providing an opportunity to take advantage of dividends and proceeds from the sale. They can also be backed by tangible assets such as real estate, company stocks, arts, among others.

One of the most relevant characteristics that we find in security tokens is compliance with regulations and audits against regulatory entities, for this reason the market cannot be manipulated after issuing them. This makes the security tokens legal and therefore safer for any investor participating in the distribution.

When an investor participates in the distribution of the shares of a company, they have control over the tokens delivered and can participate in voting and decisions within the company. Since tokenized securities are social capital that gives the owner the right to own a property.

Unlike other tokens, security tokens cannot be exchanged, but can be sold to other investors as long as it is stipulated in the legal basis of the company.

As I explained previously, this type of tokens are legislated, for this reason the regulatory entities must qualify if it is a security tokens for this they must pass the Howey test to identify whether control of the National Securities Market Commission (CNMV) is required or not.

El Test de Howey es una forma para determinar si en al prestación de un servicio se está dando lugar o no a un contrato de inversión, esta metodología surgió de una sentencia del Tribunal Supremo de Estados Unidos. Esta sentencia resultó de interpretar la Securites Act de 1933 y la Securities Exchange Act de 1934, en el caso SEC v. Howey.

www.leyesyjurisprudencia.com

Basically the ¨Howey Test¨ is based on two fundamental factors, the first is that the tokens that are issued must act as investment contracts in which investors expect prices to rise. Second, there must be an established company or group of investors with a legal project that investors can trust.

Example of a security token issuance platform

Harbor:

Harbor issues security tokens to help business startups introduce these tokens in a way that complies with all necessary regulatory frameworks. The company behind the platform is also helping companies transact their traditional asset classes on the blockchain to boost their tokenization.

Harbor is based on the regulated token system R-Token, which is the ethereum blockchain authorization token that allows transfers.

Entonces, the main focus of Harbor is to be a platform that provides the possibility of an alternative investment by issuing security tokens, allowing new methods to obtain private capital, that are simply inaccessible in traditional finance.

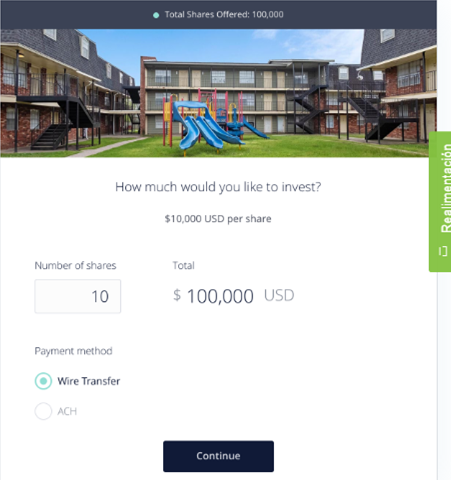

Let's imagine that a real estate developer needs to raise private capital for a resort that is valued at $ 600 million. For the development of the project, $ 200 million should be raised as soon as possible. Harbor would allow tokenize $ 200 million and thus be able to dilute the initial investment value. Suppose that for this project two thousand security tokens are issued with a maximum of two thousand shareholders. Each token will be worth $ 100,000. which makes collection more feasible and faster, since it is easier to find investors with $ 100,000 than an investor with $ 200 million.

In the Harbor interface we can find lists of projects in which we can invest, of course following a series of verification requirements as an investor.

screenshot harbor.com

Tokens de Utilidad

A utility token is a type of digital asset issued to finance the development of a project within the blockchain. They are usually bought to exchange them or have access to a product or service offered by a platform or company that issues it.

It is important to understand that this is not an investment, but rather a currency that is used more as a coupon for product development, since utility tokens are not designed to provide investment opportunities, they are simply the way developers of projects raise the necessary funds to finance the project they are developing.

We can determine if it is a utility token when we participate in an ICO, where we observe that a number of tokens are issued with scheduled dates for distribution, that we buy with a type of membership or a loyalty program, which gives access to certain services that the ICO provider makes available.

It should be noted that if we decide to participate in an ICO, we must review the project very well before. Unlike security tokens, the utility token is little or no regulation at all, that is, the investor's rights are practically unprotected and depend on the goodwill of the provider.

Example of a utility token issuance platform.

OmiseGo (OMG) Network

As an example of a utility token, I chose OMG, which was issued to fund the OMG Network project, a platform that offers the alternative of a decentralized exchange that resides on the Ethereum blockchain. The OMG network allows everyone to use their assets freely without relying on banks, providing an open approach to financial services.

screenshot omg.network

If you want to know more about the benefits it offers visit its white paper

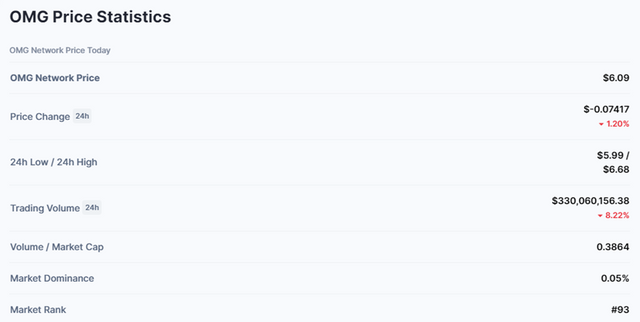

Users and developers can use OMG to pay for network services. This utility token is consistently rated as one of the largest ERC-20 tokens in the world by market capitalization. The developers set the total supply limited to just 140.245 million OMG coins.

screenshotcoinmarketcap.com

OMG Network is up 6.20% in the last 24 hours. CoinMarketCap's current ranking is # 93, with a market cap of $ 918,525,406. It has a circulating supply of 140,245,398 OMG coins and a maximum supply of 140,245,399 OMG coins. coinmarketcap.com

Equity tokens

Equity tokens play a role in financing startups. They are comparable with security tokens, however, despite complying with some regulations, it is more feasible to launch small projects with few investors because they do not have to comply with regulations and strict audits.

ETOs represent the acquisition of funds for companies based on the issuance of equity tokens. The project financing process consists of several stages. First, you must have the company's documentation in order, create a web platform, and then start a financing campaign that targets potential investors. Here you will be informed of the intention to release the company.

The terms of negotiation or commercial requirements are limited to the definition of the terms of the offer. At this stage, companies must declare their value as well as the total amount of planned investment, must establish a minimum investment amount and investor voting rights. The Trade Regulations also contain requirements for the marketability and transferability of trademarks.

Once the commercial terms have been determined, a contract is concluded between the issuer and the investor.

Other important features of the Equity Token

- Encrypted: Unlike physical share contracts that are recorded in book form, Equity tokens record your contractual information on a blockchain.

- Transferability: Tokens can be transferred to other users on exchanges.

- Property Rights: As an investor, you own the shares.

- Collateral: ETOs are intended to ensure that investors actually participate in future earnings. The holder of an equity token can legally enforce their rights.

Example of Equity token issuance platform.

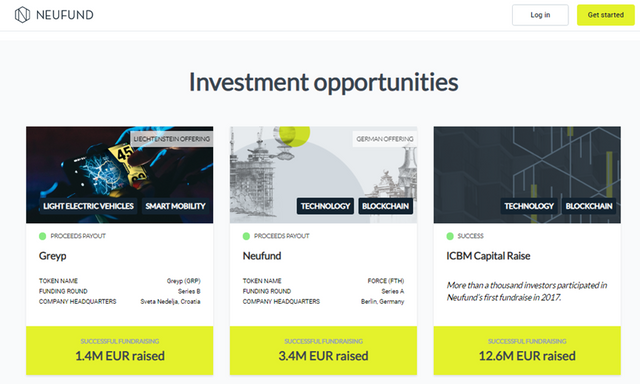

Neufund

In a platform in charge of raising funds, in addition to giving small and large projects the opportunity to raise capital, it also gives investors the opportunity to choose innovative projects where to invest safely.

Neufund aims to provide Equity Token Offerings (ETO) with a simple and transparent interface, easy to understand for both investors and companies that want to request fundraising.

screenshot https://neufund.org/

Some sources of information:

en.wikipedia.org/wiki/Security_token

https://docs.oracle.com

https://irishtechnews.ie