Metric Indicators - Crypto Academy / S5W2 - Homework post for pelon53.

Greetings steemians it's another amazing amazing week and we are in the season 5 of the crypto academy, the lecture on metric indicators was excellently delivered and I will be delivering the assignment based on my understanding of the lecture. Below is my work.

Question 1 - Indicate the current value of the Puell Multiple Indicator of Bitcoin. Perform a technical analysis of the LTC using the Puell Multiple, show screenshots and indicate possible market entries and exits.

The puell multiple indicator is used to track the miners profitability and give a better understanding of the market by determining the income of the miners per block, the mining of BTC is really complicated and not an easy task as it requires great equipments to compute and produce a block. at first the initial reward for mining a block was 50BTC but now after series of halving which we will discuss in the subsequent question the reward for mining a block is now 6.25BTC.

The puell multiple indicator helps us to know when the cost of mining an asset is high and when the cost of mining and asset is reduced and low and when miners will be selling off assets due too profit made and when it is a good time to buy an asset.

Below is the formular used by the puell multiple indicator

mining issuance / 365 moving average of mining issuance.

Indicate the current value of the Puell Multiple Indicator of Bitcoin

from the image the current value of puell multiple indicator of bitcoin is 1.198364

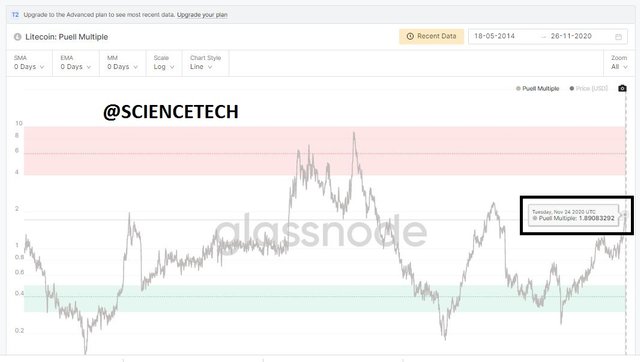

Perform a technical analysis of the LTC using the Puell Multiple, show screenshots and indicate possible market entries and exits.

this section would require us to navigate to the website link

value of LTC for puell multiple indicator is 1.89083292

AN ENTRY

For an entry it is quite simple and understandable that when the puell multiple indicator is on a green mark as we can see a green and a red mark from the image below. it is a great indication for a buy entry as the cost of mining is currently low and the production of new blocks are done with ease

from the chart above we can see that in the month march 2020 there was a great fall in the cost of mining the LTC asset making it a great indication for a buy.

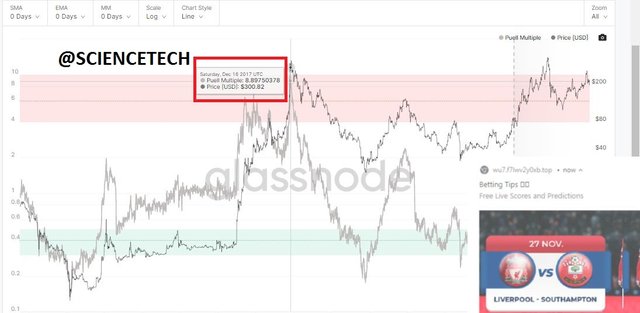

AN EXIT

For an exit it is quite simple and understandable that when the puell multiple indicator is on a red mark as we can see a a red mark from the image below. it is a great indication for a sell exit as the cost of mining is currently high and the production of new blocks are now expensive

from the chart above we can see that in the month December 2017 there was a great rise in the cost of mining the LTC asset making it a great indication for a sell since the miners is assumed to have made money.

2.- Explain in your own words what Halving is, how important Halving is and what are the next reward values that miners will have. When would the last Halving be. Regarding Bitcoin

Basically, I will define halving to be an occurrence, where the block reward for mining a particular crypto currency, is divided into two /reduced by 50% so as to regulate the number of the asset in circulation and in this way, make demand for the asset very strong which would keep the asset in good value.

How important is halving :

Halving is very cogent and important to the network since it brings the number of circulating assets down and creates heavy demand for it which would lead to an increased value. We can see Bitcoin's cases that have left it very volatile in bullish trends, most of its halving have left a lot of demand for it and the effect on its price is appreciating

New benefits miners would have :

Miners of Bitcoin had block rewards of 50BTC at 210,000 blocks as of 2009 and after the next halving in 2012,the block reward reduced to 25BTC at 420,000 blocks and in 2016,it became 12.5 BTC at 630,000 blocks and the last recorded one in 2020,saw block rewards at 6.25BTC at 840,000 blocks (This is the record as of May 11,2020) and the final halving expected to be in 2140 with 6.930,000 blocks at 0BTC

The next bitcoin halving time :

Bitcoins are halved once each 210,000 blocks have been mined and in periodic calculation, it's about 4 years via the Bitcoin's anonymous Satoshi Nakamoto theory and just like I slated on the previous paragraph, the next halving is bent to take place some time in 2024 with a block reward of about 3.125 BTC

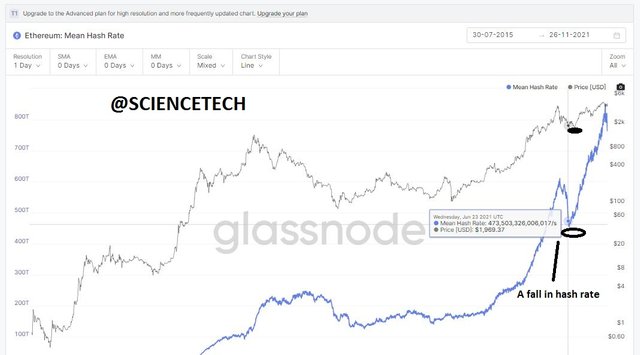

3.- Analyze the Hash Rate indicator, using Ethereum. Indicate the current value of the Hash Rate. Show screenshots.

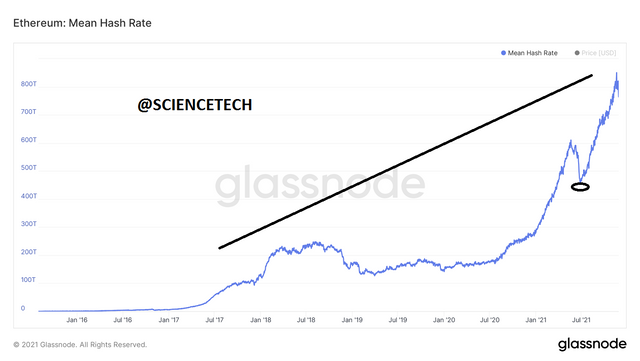

The hash rate has to do with the total computational power that miners uses to mine and process transactions with speed. so therefore to carry out this analysis, I will be navigating to the website link to get the hash rate of etheruem.

from the image above, we can see that the current hash rate is 789,231,880,522,000/s

.png)

looking at the chart above on the average, we will notice a constant progressive rise in the hashrate of ethereum except for some little retracement which I will be showing in the graph below how it affected the price of etheruem during those times.

from the image above, we can see that a fall in the hash rate in june 2021 caused a fall in the price of ethereum which was also a great buy indication for investors who are willin to stake on a long term. regarding the fact that etheruem is back from the china effect on cryptocurrency there are speculations that the hash rate will constantly be on the rise hopefully hitting its all time high. which is a great opening for investors who are willing to hodl for a long term.

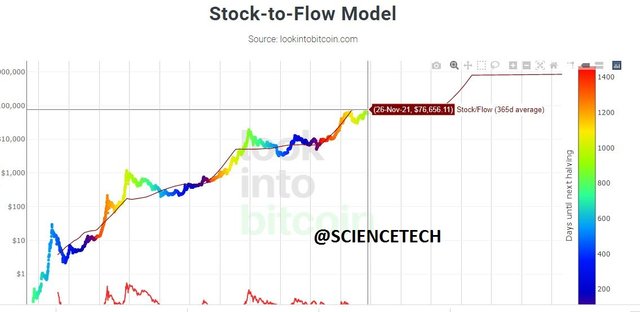

4. Calculate the current Stock to flow model. Explain what should happen in the next Halving with the Stock to Flow. Calculate the Stock to flow model for that date, taking into account that the miners' reward is reduced by half. Show screenshots. Regarding Bitcoin.

If you have ever attempted to purchase an asset or commodity and you discover that it is only in a limited quantity, most times you are willing to pay anything just to get the asset making the price of the commodity higher.

In this scenario, the stock to flow model is used to check the current stock against the production of new ones determining whether the asset will be scarce or not.

I will be calculating the current stock to flow model for bitcoin.

In other to get the current circulation, we will check the coin market website link

So we have 18,884,625

SF = stock / flow

so every 4 years there is a halving of the asset supply and there is a creation of new blocks every 10mins. working with this statistics, we will be have 52,560 blocks every year

in order to calculate the flow it is given by the reward per block x the block production per year

flow = 6.25BTC x 52,560 = 328,500

SF = stock / flow

SF = 18,884,625/328500

SF= 57.487

current stock to flow = 0.4 x SF ^ 3

0.4 x 57.487 ^ 3 = 75,992.18

Explain what should happen in the next Halving with the Stock to Flow. Calculate the Stock to flow model for that date, taking into account that the miners' reward is reduced by half. Show screenshots. Regarding Bitcoin.

In the next halving which will take place in 2024 hopefully the early hours of 2024. the reward for mining a new block will be halved from 6.25BTC to 3.125BTC. we will also have new 656,250BTC issued.

Taking into account that the reward will be reduced by half, I will be calculating with 3.125BTC instead of 6.25BTC. with 18,884,625 currently in supply let's dive into the calculation.

flow = 3.125BTC x 52,560 = 164,250

SF = stock / flow

SF = (18,884,625 + 656,250)/164250

SF= 118.970

current stock to flow = 0.4 x SF ^ 3

0.4 x 118.970^ 3 = 673,553.933 BTC

CONCLUSION

The homework post was an amazing one and the simplicity to which it was delivered is something to commend. I learnt about the puell multiple indicator showing how the profitability of miners could be to an advantage either for a buy or a sell depending on the current status.

we also learn about the hash rate and the time in which a block is usually produced. what an increase in hash rate indicates and what a decrease does, we didnt stop there we drifted into the concept of halving and when the next halving will occur.

learnt about the stock to flow indicator, how to both calculate and read it on the chart. It was a great experience for me and I say a big thank you for the knowledge.

lovely regards

@pelon53

Según las observaciones del equipo de SCA, se ha detectado que su cuenta comete irregularidades. Estás bajo vigilancia.

Calificación: 0.0