"Mastering Trading Psychology: Emotional Discipline in Cryptocurrency Markets".

Discuss common emotional triggers

Trading particularly is an inherently stressful business which many a times seems to put traders right through the grinder while exposing them to all sorts of emotions within the financial markets. To unlock the trading strategy, it is necessary to realize those emotions and understand how they can potentially emerge during the transient in the market.

In this article, we will explore the most common emotional triggers that affect traders: Of fear, greed, and overconfidence. To help you to understand the ten emotions being able to affect trading choices and how they may reveal themselves when market movement occurs, examples of each are highlighted below

Fear |

|---|

Trading is also full of fear, and arguably, fear is the main underlying feeling in trading. When markets are volatile or trending, prospects of losing big can elicit a feeling of fear and panic and traders are forced to transverse from their plan and make hasty choices.

An example of fear taking hold in the markets might be identifying the moment when a trader loses a lot of money in the portfolio. The immediate inclination might be to try and cut the loss by immediately getting out of positions, which essentially mean selling off to reduce the losses that could otherwise be regained if the positions held. As a result, the trader lets their fear get the best of them and may walk away from the market which has prospective for generating more income in the future.

It also has a way of leading to reluctance to assume new positions or miss out on good opportunities to invest. This means even the traders may decide to leave their money in their pocket instead of risking it into the economies.

Greed |

|---|

The first is the desire to amass as much money or property as would be enough; the second is the act of pursuing to obtain more money or assets than are necessary, which is greed. This leads for example to holding losers for much longer waiting for a recovery or entering positions with much bigger sizes than are comfortable.

Suppose that a trader entered a trade where the market is in their favor but the trader decides to wait longer to take big profits. Even, when the market signs start signaling that the trend could be going the other way The trader is blinded by greed and does not get out of a position and loses of his capital.

Another element for greed is in a trader’s quest to make more money, trading in a number of unrelated markets in an attempt to make bigger profits at the same time. This strategy can prove disastrous because the risk exposure to the trader is far higher and can lead to significant losses

Overconfidence |

|---|

Hubris translates to a state of mind where we possess a more than sufficient amount of self assurance in our knowledge or skills, compared to what is present on the ground. This is an emotional trigger which can make traders use large amounts of money to trade or use high risk-reward trades, prompted by an impression that they are in a position to manage the operational mechanisms of a market than it actually is.

For example, a trader may have had a sequence of wins in the market and might overemphasize on their capability of a good predictor of the directions that the market might take. They begin trading more, based off of hunches to speculate on stock exchange rather than following tested stock exchange strategies. This combined with the fact that they overestimate their abilities, means that they end up losing large sums of money where they do not trust their intuition.

Another type of overconfidence that you see many employees displaying in the workplace is complacency. These traders are therefore prone to stay on the wrong side of market analysis, do not analyze the market shifts well or simply get overconfident and make wrong decisions continuously which would have been prevented had the trader stuck to analysis and proper consideration of the market forces.

The paper attempts to argue over fear, greed and overconfidence factors which test crucial to success in the emotional commercial market segments from which traders operate. Fear leads to wrong decision at wrong place and at wrong time, greed leads to wrong risk taking and over confidence is equal to ignoring signals.

In order to successfully manage trades there is need to look at ways of overcoming them as outlined by Bartlett et al (2008). Often, this may include learning to be fully present in the present, to think and contemplate on a consistent basis and, yes, practicing rational risk assessment. These are feelings any trader needs to recognize and if he/she takes steps towards managing these emotions, then one would indeed learn to trade happily. As you know, trading is full of up and down movements, however, by controlling your emotions you can become a real monster on the stock exchanges.

Question 2: Overcoming Psychological Barriers |

|---|

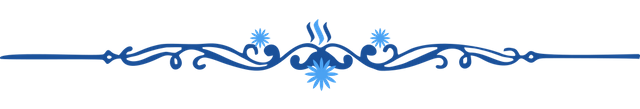

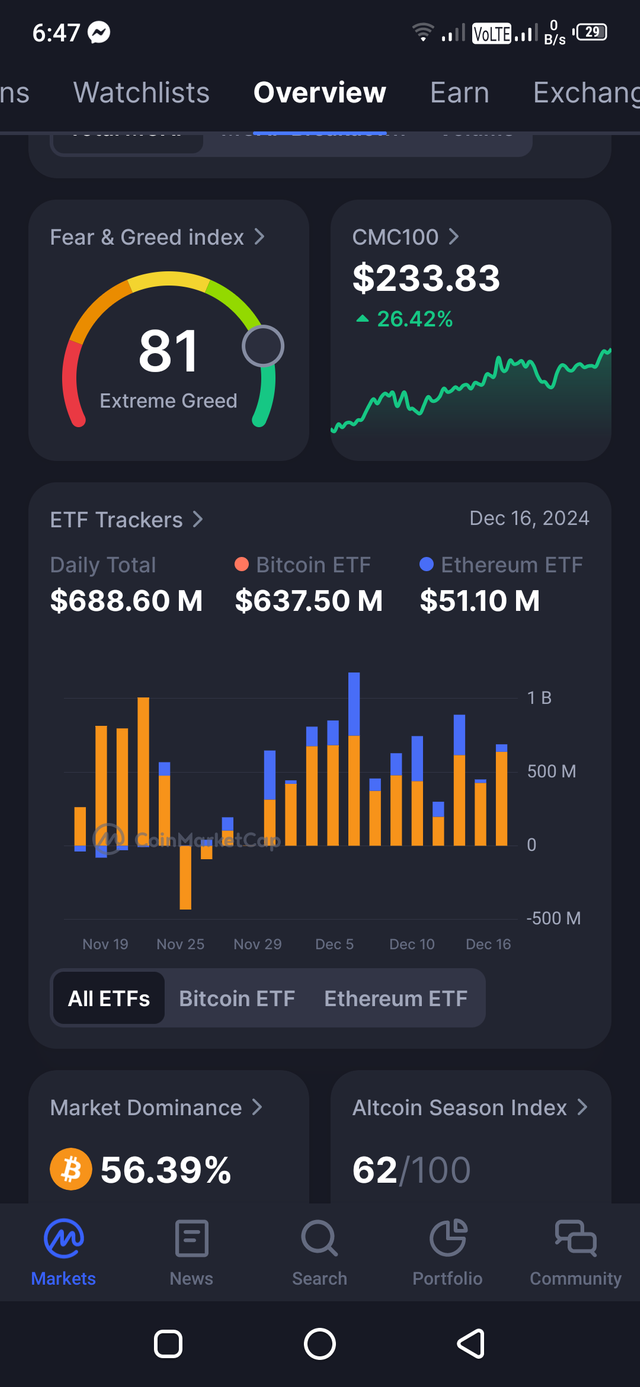

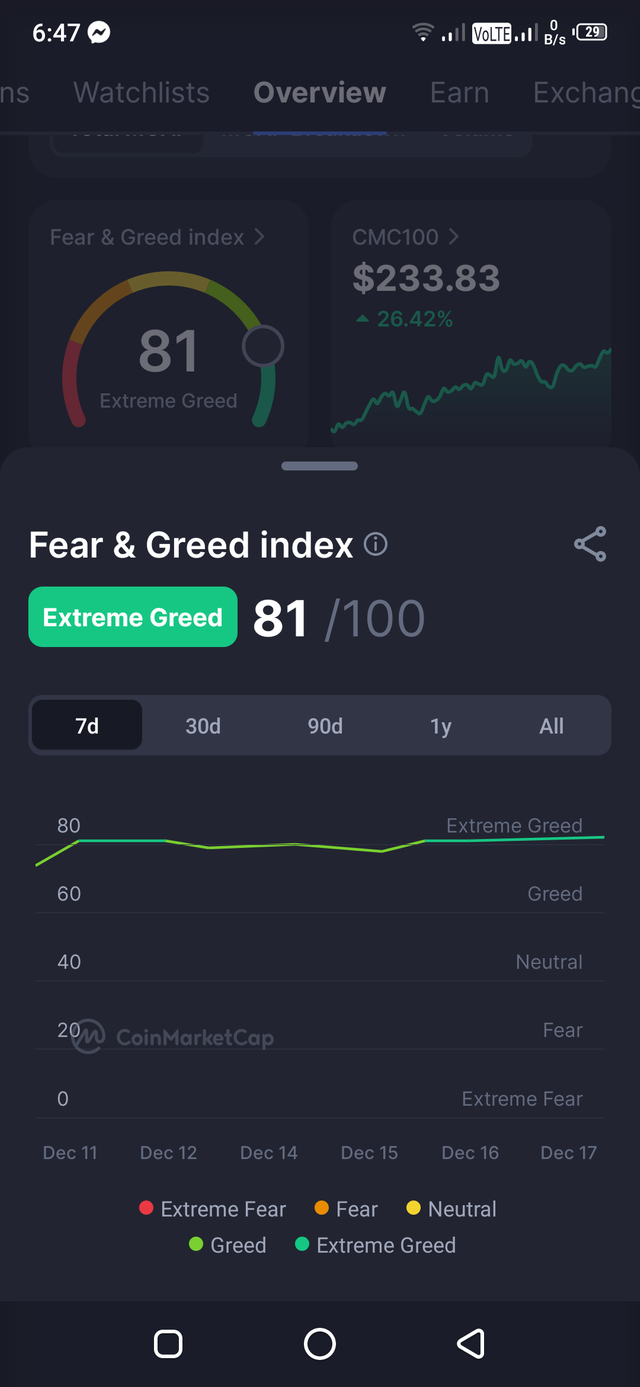

The experience trading the Steem/USDT pairing shows that there are multiple psychological levels or divides that affect the traders in the process. It indicates that due to such barriers, the judgment is often influenced and defective decision can be made. In this writing we shall discuss three common psychological barriers:

Discusses easily five biases namely

- Fear of Missing Out

- Loss Aversion

- Overconfidence

- provide you with tips to combat them

Fear of Missing Out |

|---|

The Fear of Missing Out is a real and encyclopedic universal that can hold forex traders in many different ways. Whenever a trader is frightened that he or she is likely to lose out on some profit, which may make him take silly risks, follow the herd, or become excessively bullish.

When it comes to trading in Steem/USDT, FOMO can be severely detrimental because the crypto market is very volatile, and news, opinions, and movements are often passed around within minutes by social media or forums.

Technique 1: Stay Disciplined and still get traffic using a strategy |

|---|

Another way of managing FOMO when trading is to have some form of a plan in place, or a trading strategy in other words. Because you have development strategies that indicate when to open a trade and when to close it, what stop orders to use, and when to take profits, you’re less likely to make reckless decisions based on your emotions.

Technique 2: Do Not Make Periodic Decisions In Hollywood |

|---|

The main cause of FOMO is emotions and thus the best way to overcome this is to set a trading schedule and adhere to it. This implies one having to be systematic in getting and reviewing market data, keep records of trading that is referred to as a trading diary and always looking at the broader perspective of events and not timelines.

Technique 3: Before you begin trading, you will need to evaluate your motivation to trade as follows: |

|---|

Sometimes, FOMO is caused by a desire to make fast money, or from attempting to show others how skilled you are at trading. When this happens, the best way to approach it is to put a few of them aside and contemplate why you carry out certain trades in the first place. Some of the questions, might be like; “is this a reasonable decision given my trading plan?” or “Am I ready for this trade; or will I still be comfortable if the trends reverse?” can sometimes help reduce the ill effects of FOMO

Loss Aversion is a behavioral theory that describes the inability and ineffectiveness of an individual to vield to gains equivalent to the amount of money he or she could lose. This concept was developed by Kahneman and Tversky of psychology who had later been awarded in economic Nobel Prize.

In the context of Steem/USDT trading, loss aversion can manifest in several ways:

Being in pursuit of losses by trying to amplify loss-making trades in the thinking that a trader can be able to recover such a loss.

The inability to take small profits within target price levels, the act of waiting for further extra gains with individual trades

As with all such principles, the formula can be twisted either for noble purposes or degenerated in praxis; its degeneration would be manifested in rigid adherence to the losing trades, out of the aversion to turning the losses into concrete figures.

Technique 1: Adopt a Long-term Perspective |

|---|

Another suggestion which traders should employ in order to address the problem of loss aversion is to look at the long-term. We have also come to understand that no particular trade defines a portfolio’s value, and that the ideal trading strategy invariably involves a combination of trades that yield considerably more profits than losses.

Technique 2: Develop a Stop-Loss Strategy |

|---|

If you have a clear plan on what to do if you are losing a trade, which you should, then you can minimze your problem of loss aversion. It also helps avoid the common pit of trying to get back our losses and this makes you have a criterial when to exit a trade hence eliminating the emotions.

Technique 3: Facing loss aversion? |

|---|

Here are the steps to follow, all of which can be driven by psychology tools:

In order to eliminate the impacts of loss aversion, there are several psychology instruments that are possible to apply, such as, visualization and mental accounting. Visualization entails practicing how you will be going about trade and how financially successful you will be. On the other hand, mental account separates the gain and losses in your mind and since people care much about their losses than gains thanks to loss aversion this makes it easier.

3. Overconfidence |

|---|

The term overconfidence was defined as a state where a person tends to be too confident in his skills or information acquired. In trading this can result to a trader feeling that they know best, engage in high risk deals or simply embrace inapplicable techniques.

Technique 1: |

|---|

The Third Organizational Element of Trading Performance: Frequent Reviews

To analyze your trading performance, it’s also important to look at those signs of overconfidence that can develop over time. You will be able to identify the strength and weakness when holding your win rate, draw down and profitability figures.

Technique 2: Stay Grounded and Never stop Growing |

|---|

It will train organizational employees in being humble and not so confident on how good the organization is. Such approach helps traders implement the understanding about the market as a non-stationary process, and there is always something new to discover, which makes overconfidence a harmless factor.

Technique 3: Seeking More Trading Strategies |

|---|

Another way to work against overconfidence as a trader is to expand your trading strategies. As one example, if you have multiple trading strategies or markets or investments of different kinds, having more than one way to hedge your bets lessens the likelihood you will get too cocky and stick to one, which would increase the number of errors you make when predicting the market.

This kind of thinking is effective to work on psychological barriers that aregeneral for fast and volatile market of Steem/USDT. This is why understanding FOMO, loss aversion, and overconfidence plays a key role as it makes the trader avoid making decision based on emotions that harm them and instead makes them get the right decision by being consistent and making the right mathematical choices thus can lead to long term profits as well as an enjoyable trading experience. This is important to remember: a trading career is not a sprint – it is a marathon which is won by incremental progress and ongoing improvements.

Question 3: Developing a Trading Routine |

|---|

The trading world is a very competitive and asking environment- both physically and mentally. This one is self-explanatory – handling emotions, setting proper goals and consistently keeping in mind the drawing big picture, can make an enormous difference for trading results. For creating efficient daily or weekly trading schedule it is critical to emphasize the psychological preparations to the technical ones as well as the expertise of the market. In this article, you will find out how to apply psychological preparation for trading: how to use trading journal, how to set goals properly, and how to practice mindfulness in trading.

Preparation of the Mind for Daily And Weekly Foreign Exchange Trading

1. Journaling Trades

What is trade journaling:

Trade journal can be defined as the record of the trader’s activity in the particular market along with entry and exit points, reasons of such decision making and evaluation of those particular trades. Recording ones’ perceptions and subsequent experience is a very useful system in exposing certain patterns or traits in ones’ trading, which could be therapeutic and beneficial in personal growth.

Why is it important? |

|---|

- Learn from mistakes: It also helps to keep a record of trades so after making mistakes you can easily figure out where you went wrong.

- Increase self-awareness: Writing a journal assists you to gain insight of feeling and mentality kept while trading.

- Improve decision-making: The best way to combat oneself while making trade decisions is to justify why certain trades are taken or exited, which will be advantageous for countering bias.

How to start trade journaling? |

|---|

- Create a template: Develop a clean, clear format consisting of date, time, market, entry, exit, and reasons as well as performance info box.

- Be consistent: It is advisable to update the journal in  — daily or weekly.

- Review regularly: Review the entries in your journal now and then in order to perform an analysis of what you have gone through and make necessary changes.

2. Setting Realistic Goals |

|---|

What does a reasonable trade goal look like?

Reasonable trading targets are specific, attainable, relevant to the trader’s personality, and capability to take prudent calculated risks and one’s financial position. An example could be something like positive ROI, positive profit percentage, or somehow achieve a certain profit per a specified time horizon.

Why is it important?

- Stay focused: Cream of the crop A realistic goal will keep you on course and motivated because your goals are achievable.

- Avoid emotional burnout: If you set more realistic targets you have less of a chance of burning out and will learn to enjoy trading as an activity.

- Measure progress: Realistic goals allow you to set standards with against which progress and the overall strategy can be tweaked for improvement.

How to achieve realistic trading objectives? |

|---|

- Define your trading style: It helps you identify the limits and opportunities in trading according to your trading personality, continuous risk, and trading capital.

- Break down long-term objectives: Other objectives should be drawn more specific and short-term and to a significant extent should be related to achieving the ultimate vision.

- Be specific and measurable: Make sure that goals are set in a concise manner, this precludes the element of insecurity in their achievement.

3. Practicing Mindfulness

What is mindful trading?

Being mindfully means remaining in the present moment, and not passing any judgment on what is happening around. One can have better decisions making especially in trading through mindfulness because it helps one be fully aware of the activity being done while also avoid other unnecessary activities that will not only interfere.

Why is it important?

- Manage emotions: Mindfulness makes you aware of feelings and assists in moderating its influence in decision making, thereby managing fear, greed among other related prejudicial effects.

- Improve focus: Avoiding distractions means that there is less chance that you will be side tracked from the plan you have set, therefore not making hasty decisions.

- **Enhance discipline:Mindfulness helps cultivate discipline in another way; train yourself to release short term changes to your commodities trade and looking at the long term gains.

How to practice mindfulness in trading?

- Mindful breathing: You should begin by taking time to meditate on your breath for probably five minutes before you engage in trading session. Sit for a few moments, eyes closed and slowly breathe in and out, feeling the breath come in and go out.

- **Mindful observation:Approach the markets keeping an almost passive watchful attitude. Do not label them and instead, observe your thoughts, feelings and behaviour in the process.

- Mindful breaks: Use your trading session in practice, and therefore always have a possibility to take a break and fresh your mind in case you experience some emotional stress.

Thus, the specification of psychological preparation within a daily or weekly trading schedule can define the general trading performance. Writing down the trades you make, having achievable targets, and being attentive facilitate the building of a fine emotion, decision, and attention management process. Adopting these practices will not only assist you in obtaining improved outcomes in the markets, but also assist you in an individual development process and advancement toward enhanced ability to handle the challenges. Always bear in mind that trading is a long-haul game, not a race, and very often, managing your mental health is at least as important as managing your money.

Emotions in Trading: One of the main sources of many mistakes |

|---|

Buying and selling in financial markets is generally referred to in terms of the fight between the spirit and the flesh. This is because , fear, greed, anger and hope can greatly prolong the outcome of such decisions. While emotions of human beings are natural first responses, they can quickly Costs many people a lot of money in trading. We started with an assumption of a trade scenario in which emotion had been prioritized and led to loss, and emotional self control could have saved such loss. The pros of the analysis will be depicted as follows: understanding emotions and managing effects of entrapment through improvement of decision making to avoid mistakes, so that traders can avoid common pitfalls.

Hypothetical Scenario: The Impulsive Trade |

|---|

Here is Alex a young trader with lots of dreams just joining one of the biggest trading firm’s in the world. He wants to be financially successful and provide his family with a good life in the sphere of generation and maintaining money. As a result, Alex realizes that he often uses feelings to make decisions, and therefore makes a lot of money in the process. For all of it, he has absolutely burning desire to learn from these experiences and grow emotional discipline so that he doesn’t have to go through these experiences in the future.

Therefore, suppose one day Alex is analysing stock market, he would find that there exists a small-cap Biotech firm that has early stage clinical trial outcomes for a promising therapy. Much attention has been paid to the stock, while its price continues to go up. Fueled by the hope of a huge return on investment, Alex makes the mistake of investing large percentage of his fund in this stock without considering rules of money management. Here, the firm’s balance sheet and current market circumstances are all largely ignored in favor of his feelings over the possible gains to this decision making.

Ironically, the stock price of the company takes a new dip due to some reasons, and he loses lot of amount, financially. The motive behind such decline of the price is independent of the clinical trials’ outcome yet influenced by the market trends and the firm’s inability to seek capital for the further advancement of the study.

**Emotional Discipline: It protects against impulsiveness A shield against impulsiveness

In the above perennial scenario, the same phenomenon of emotion is exhibited in the matter of trading decision and more of the dire consequences for the extent that one follows suit. The position of Alex on taking the biotech company stock is a clear way of showing how emotions play out a role in trading so as to lead to a lot of loss. Had Alex had emotional discipline, he would probably have avoided making such hasty and costly investment decision.

In trading Emotional self regulation is the ability to curb feelings that may lead to unwise decisions and instead make decision based on reality factors such as the market analysis, firm basis as well as risk management. Emotional discipline, therefore, is defined as the awareness of emotions, of the consequences drawn out from those emotions and of being able to control the emotions themselves.

Some of the strategies for creating emotional discipline include making a trading plan, then following it to the letter. Traders who are engaged in the market most often make systematic, wild, and consistent decisions based on some planned structure. For instance, Alex could have established trading plan that included; the kind of firms that he wanted to invest in,the parameters he used to screen the stocks and the measures he was willing to take when faced with risks in that particular investment. Thus, if the author had remained consistent with the plan that was envisioned for him, the enchanting pull of the potential gains would have held him back from making a lousy investment in biotech company stock.

The fact that education has to involve the acceptance of discipline in the process of education makes education also another way to build emotionally discipline. Analyzing the psychological features of trading and emotions during trading can provide knowledge to traders for further work on the proper behavior of emotions. Had Alex Cukier and his team understand different emotional biases together with how individuals could be able to recognize them they could have prevented themselves from making a decision influenced by the prospect of gains hence leading to the considerable loss as indicated in this case.

In addition, compliance of the traders to the principles of mindfulness and stress management means that the trader can be able to manage or control on how stress interferes with decisions that he or she makes. Traders could also indulge in meditation, deep breathing and progressive muscle relaxation to help calm themselves down and think, take rational decisions. Had Alex been able to control his emotions, he’d have been able to anticipate that without some cleverness, he’d be making an impulsive decision to invest into the idea because he was excited about it.

.jpg)

source

Finally, Alex’s hypothetical trade shows us how emotions dictate trades and leads to an impulsive trade. A study has shown that emotions have a potential to influence trading greatly and in the process bring about costly errors. One is able to regulate his/her emotions, hence is able to take appropriate decisions after weighing various factors like analytical and statistical analysis, strength of the company and managing risks. Forming a trading plan, refining the knowledge, avoiding emotional eating and being prepared to work with stress – these steps will contribute to having an emotional discipline and not to make mistakes because of the emotions. Finally, we need to note that the main engine in trading is a person and his mental abilities to be able to make the right decisions and execute them.

Dealing in the financial markets is quite an exciting and invigorating activity that at the same time can be very a very complex one. Merchants are usually under lots of pressure due to fluctuations in prices as well as, constant changes in the market. Entering such waters require not only skills in trading strategies and eventual risks but also the psychological endurance to withstand fluctuations of moods and directional focus during turbulent times in financial markets. The following essay examines different strategies and strategies on how traders might enhance their mental strength in their trade to survive the ruthless world of trading.

1. While it is crucial to address the mental side of trading, it will not be possible to explain it in detail here; putting into consideration that this article will act as an introduction to the comprehensive eBook.

It is good to understand some of the mental processes involved in trading before moving into the methods involved. Every now and then new information indicated by the trading application requires someone’s attention and decision so the trading atmosphere can be mentally intense. Examples of the emotional problems are fear, greed, frustrations and hope all of which cause a lot of nasty things to happen especially in relation to stock buying. The trader’s attitude also contributes greatly to this aspect because a trader’s cognitive style greatly determines his/her level of resilience. The companies that attempt to approach the markets with the kind of focused and disciplined attitude normally have a better run when there is turmoil.

2. Building Coping Mechanisms on Emotions

Hence there is need to take appropriate measures towards successfully controlling emotions when trading in the market. This includes:

1)Mindfulness and Meditation

There are ways and strategies on how a trader can achieve mindfulness and relaxation to reduce emotional reactions. These techniques promote a state of mental clarity and emotional refinement, which helps the traders address changes in the market better. It has been said that using consistent practices, the trader is in a position to manage stress and stay calm when encountering the uncertainty in the market.

Breathing Techniques |

|---|

Good breathing strategies, for instance, use of diaphragmatic breathing may be an effective strategy in the management of stress and emotions. With increased breath control, a trader can actually put his body in the right condition for handling pressure work in terms of concentration.

Cognitive Restructuring

In cognitive restructuring, traders learn to change a thought to another thought by replacing negative thoughts with positive ones. This is because this approach helps the traders to confront their fear and opponents by analyzing the viability of such thoughts and allowing the traders to come up with better ways of thinking and thus enhancing their psychological sanctity.

3. Improving Executive Functions

Trading also requires the ability to analyze information flows and to make decisions based on them as quickly as possible. Enhancing cognitive functioning can be achieved through:

Regular Exercise

Several research studies have revealed that physical activity improves cognitive performance because it helps to stimulate the release of BDNF, a protein that is essential to neuron survival. They also help lowering stress, enhancing mood and general mental health.

Adequate Sleep

People need adequate sleep to have a healthy brain functions, to enhance memory and also to help control emotions. Socially responsible sleeping may reduce or could enhance traders’ abilities to make sound decisions and emotions while that of employees during working hours.

Nutritional Intake

Diet directly affects the body and its capabilities where the brain operates, moods and how much energy is used. Eating healthy foods that contains all essential nutrients will help traders have a clear mind during the trading time.

4. Building a Support System

A trader also usually has a network of friends or advisors who went through the same experience and can assist. This network could support this effort, question beliefs, and enable traders to build more sound mind-sets.

Peer Groups and Communities

Getting advice from other members of peer groups or other companies or business involved in the same trade offer a lot of benefits. Through discussion, traders can also gain the knowledge from fellow traders and also easily to seek solace when stressed.

Mentorship

Asking for a mentor for the new trader makes a lot of sense as they can turn to the knowledge of experienced traders. A mentor can pass on knowledge and experience, offer advice in moments of despair, and guide a trader through floods of emotions better.

5. Learning and creation

Of course, traders should constantly incorporate fresh knowledge and change because the financial markets are always developing. Through the establishment of a growth mind-set when going for trades, traders can improve on ways of solving problems that challenges in trading need from them.

Staying Informed

When traders are aware of these facts about the markets, the trends and even the economic factors in the markets they can easily be prepared and make future adjustments. It also makes it possible for traders to transform into more adaptable people capable of adapting to changing market conditions.

Reflective Practice

Reflective practice is a continuous process where a lot of emphasis is placed on the need to assess one’s performance, make conclusions and evaluate for any areas of improvement. It promotes experience gaining and enhances traders’ mental toughness over an extended period, showing that the practice is essential in traders’ relationship management with the marketplace.

Strengthening Mental Toughness involves the management of emotions, cognition and social resources. As a result, traders are able to achieve cognitive agility that is much needed for performance in high-pressure trading situations if they engage in self-reflection, mindfulness, improvement in cognitive functions, seeking help, and learning. Lastly, it can be clearly ascertained that the attainment of mental toughness is a progressive power of transformation, self control and flexibility of mind for traders so that they can remain on track and manage the uncertainties of the stock exchange market effectively and efficiently.