Crypto Academy Season 3 Week 5 Homework Post for (@yousafharoonkhan) Death cross & Golden cross, How to use Binance P2P trade

This week, the professor explained the Death Cross and Golden Cross in detail. He showed them on the chart. He explained the P2P operation on the Binance exchange. He talked about the positive and negative aspects.

Question no 1:

Define Death Cross and Golden Cross in your own words. And what is the significance of DC and GC in trade? And what effect do these two have on the market?(in your own words.)

Death Cross and Golden Cross are an event that traders take very seriously. These events indicate the beginning of a bear or bull market.

Before explaining Death Cross and Golden Cross, I would like to explain what a moving average is. In the Death Cross and Golden Cross events, the terms of the 50-day and 200-day moving average are crossed. The average of an asset over 50 days is called the 50-day moving average. The average of an asset over 200 days is called the 200-day moving average.

In Death Cross and Golden Cross events, 50-day and 200-day moving averages are usually used.

What Death Cross

It is the event that occurs when the 50-day moving average crosses the 200-day moving average from top to bottom. By looking at this event, it is possible to understand that the trend change in the market has taken place.

If this event occurs, it means that the bull market is over and the bear market has begun. After this period, the direction of the price becomes downward. There is serious selling pressure.

During a bull market, the 50-day moving average is above the 200-day moving average.

The 50-day moving average crosses the 200-day moving average from above and the trend changes direction. The 50-day moving average falls below the 200-day moving average.

A bear market is considered to have started if the 50-day moving average stays below the 200-day moving average for a long time.

What Golden Cross

This event means the opposite of Death Cross. It is the intersection of the 50-day moving average with the 200-day moving average. The 50-day moving average crosses the 200-day moving average from the bottom up.

Thus, the direction of the trend begins to change. Bear season ends, bull season begins. After this period, the direction of the price becomes upwards and serious purchases begin.

In a bear market, the 50-day moving average is below the 200-day moving average.

The 50-day moving average crosses the 200-day moving average from the bottom up, the trend changes direction. The 50-day moving average rises above the 200-day moving average.

A bull market is considered to have started if the 50-day moving average stays above the 200-day moving average for a long time.

What is the significance of DC and GC in trade?

Death Cross and Golden Cross are very important in trading. Because if these events occur, changes in asset prices occur.

For example, you own some Bitcoin. When the Death Cross event occurs in Bitcoin, the Bitcoin price will decrease. A very serious sale will occur to someone else. In this case, you will have to sell the Bitcoin you have immediately. Because you may not see the current Bitcoin price for a long time. In this case, you will have the chance to sell your Bitcoins and buy Bitcoin again at the lowest price, at the lowest price.

Similarly, when the Golden Cross event occurs, it means that the bear period ends and the bull period begins. In this case, there will be a strong buying situation. If you buy assets as soon as you are sure that the Golden Cross is formed and you wait a while, you will get a decent amount of profit.

What effect do these two have on the market?

Golden Cross and Death Cross events seriously affect the market.

When the Golden Cross event occurs, it means that the flow of money to the market is provided, and therefore the asset price increases.

In the Death Cross event, it means that there is selling pressure in the market and investors withdraw their money from the market. It indicates a decrease in the asset price as the money flow to the market is not provided and the selling pressure is stronger.

In both cases, a high volume is observed in the market.

While the number of investors in the market increases in the Golden Cross event, the number of investors in the market decreases in the Death Cross events. So most people, investors like Golden Cross events more.

Question no 2:

Explain the points given below.

How many days moving average is taken to see Death cross and Golden cross in market for better result and why?

For the Golden Cross and Death Cross events to occur, the short-term moving average and the long-term moving average must intersect. A Golden Cross is formed when the short-term moving average crosses the long-term moving average from the bottom up. A Death Cross is formed when the short-term moving average crosses the long-term moving average downward.

Generally, the moving average is taken as 50 days for the short term and 200 days for the long term. Other times can also be taken. Most commonly, 50 days for the short-term moving average and 200 days for the long-term moving average are used.

Death cross and golden cross can occur in different time zones. Golden cross and death cross formations have been tested by traders for years. The 50-day and 200-day moving averages are considered to be optimal.

It has been observed that signals in the wider time frame are more effective than the signals in the shorter time frame when reading the charts.

How to see death cross and golden cross on the chart.

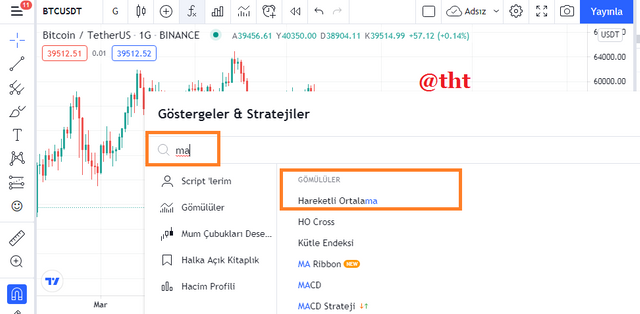

I use Tradingview for charting uses. I will open the BTC/USDT chart.

(tradingview BTC/USDT 1day chart)

I chose the BTC/USDT chart from the Tradingview site. I chose the time frame 1 day. In Death Cross and Golden Cross events, the strength of the signal increases as the time frame increases. Sometimes we can choose a 1-week time frame on the charts.

I have to click where it says 'fx' to set the 'moving averages'.

(tradingview BTC/USDT 1day chart)

I write "MA" for short in the search field. I double click on the first indicator that appears.

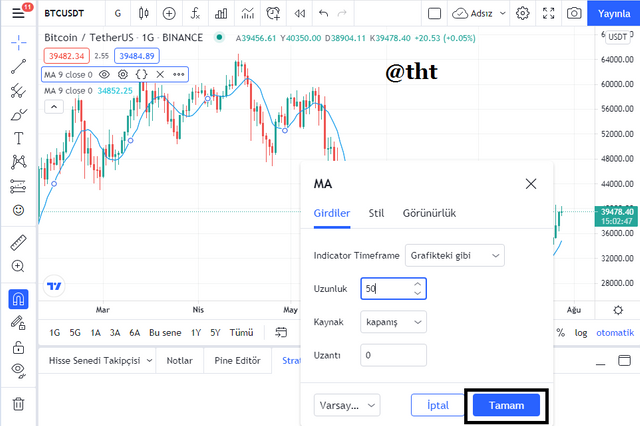

(tradingview BTC/USDT 1day chart)

I will make adjustments by clicking where I marked.

(tradingview BTC/USDT 1day chart)

I chose 50 days for the short-term moving average.

(tradingview BTC/USDT 1day chart)

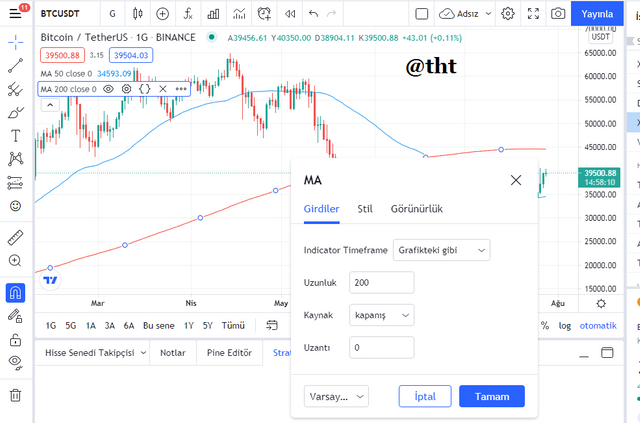

I chose 200 days for the long-term moving average. It will appear in red on the chart. The short-term moving average will appear in blue on the chart.

(tradingview BTC/USDT 1day chart)

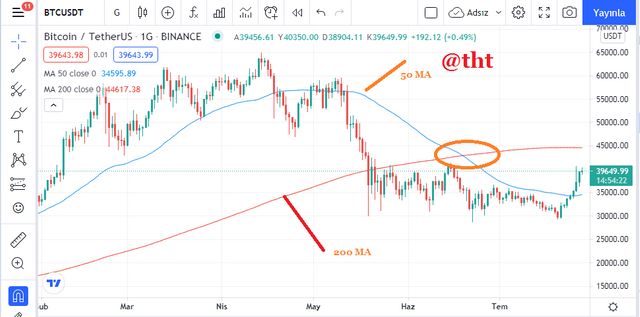

The chart shows the 50-day moving average and the 200-day moving average.

The Golden Cross is formed when the 50-day moving average crosses the 200-day moving average from bottom to top. The Death Cross is formed when the 50-day moving average crosses the 200-day moving average from above. I'll show them on the chart a little later.

Explain Death cross and Golden cross on the chart

Golden Cross

(tradingview BTC/USDT 1day chart)

In the Golden Cross event, the time frame we will choose on the chart is very important. We can see the golden cross event, which we cannot see in the 1-day time frame, on the 4-hour chart. However, as I said before, the strength of the signal increases as the time frame increases. The error rate is reduced.

On March 20, 2020, the 50-day moving average crosses the 200-day moving average from the bottom up. Thus, the "golden cross" event takes place.

The direction of the trend is starting to change. As you can see in the screenshot, the 50-day moving average stays in the upper region. The 200-day moving average remains in the lower zone.

The transition from the bear period to the bull period begins. Strong purchases begin. From this date, the 200-day moving average begins to act as support.

(tradingview BTC/USDT 1day chart)

On June 19, 2021, the 50-day moving average crosses the 200-day moving average down. Thus, the "Death Cross" event takes place. The direction of the trend is changing. The 13-month bull period is coming to an end. The bear period is entering.

After the Death Cross incident, hard sales begin. Bitcoin price is going down. Buyers are weak against sellers.

The 50-day average remains on the lower side. The 200-day moving average remains in the upper zone this time. The 200-day moving average is starting to act as resistance.

Sometimes erroneous signals can be received on the charts. Or, such events may take a very short time. For example, while the "Death Cross" occurred in March in 2020, the "Golden Cross" event occurred in May.

What is Binance P2P

On exchanges such as Binance and Huobi, users can transfer cryptocurrencies among themselves. The user buys cryptocurrency in return, using his local currency or other currency. On the other hand, the seller sells the cryptocurrency he owns to another user, in return he gets his own currency, or it can be another currency.

Cryptocurrencies are banned in some countries. The user may have difficulty in transferring money to the stock market through his bank account. On the contrary, it may be forbidden to withdraw money from the exchange to its own bank account. Some platforms offer various solutions to overcome this obstacle and further liberate cryptocurrencies. P2P is one of these solutions.

Users who will use the platform first choose their preferred price, then the payment method. Then, using direct contact with the other party, it agrees to be in an offline environment. The transaction is confirmed online. The buyer pays the seller. The seller also releases the cryptocurrency from escrow. The security system is active. In case of a dispute, the situation is reported to the authorities.

On the Binance P2P platform, buyers and sellers have the right to post ads to post their offers. Users who visit the platform examine the offers of buyers or sellers according to their preferences to evaluate them. When they like the cryptocurrency price, amount and payment method, they take the necessary steps.

The Binance platform agrees to guarantee the security of transactions. In case of a dispute between the buyer and the seller, it requests the necessary documents from the parties. It completes the review and gives confirmation about the user who is right.

In order for the transactions to take place in full, the buyer must pay the specified amount by the specified method. The seller must also release the cryptocurrency from the escrow system.

How to use Binance P2P ?

Let's visit https://www.binance.com/ first. Then let's complete the login process.

As you can see in the screenshot, my Binance account is verified. I have the opportunity to withdraw 100 BTC per day.

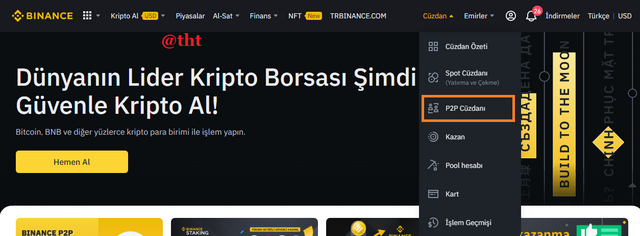

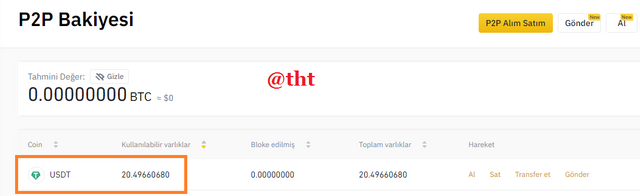

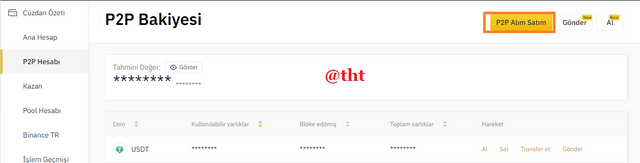

After logging into the Binance account, I click on the "Wallet" section at the top. Then I click on 'P2P Wallet'.

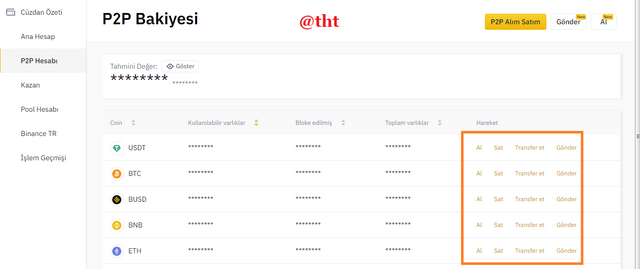

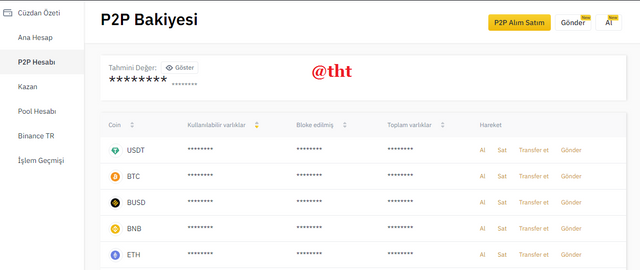

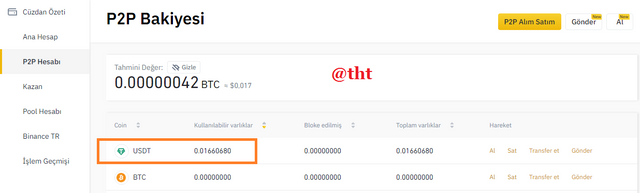

I entered the area with the P2P balance. Cryptocurrencies and various options are available here. There are buy, sell, transfer and send options.

How to transfer cryptocurrency to p2p wallet?

Here I first decide which cryptocurrency to transfer to the P2P platform.

I do not own any assets in the P2P balance. Therefore, I will transfer the USDT in my Spot wallet to my P2P wallet using the transfer method.

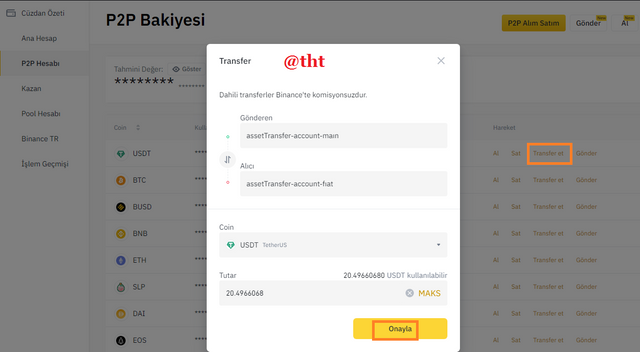

I clicked on transfer. I set the amount and clicked "confirm". I do this without commission on the Binance exchange.

I transferred about 20 USDT to my P2P wallet. Now it's time to use it on the P2P platform.

How to sell cryptocurrency in local currency via p2p (any country or coin)(screen shot neccessary to verify account)

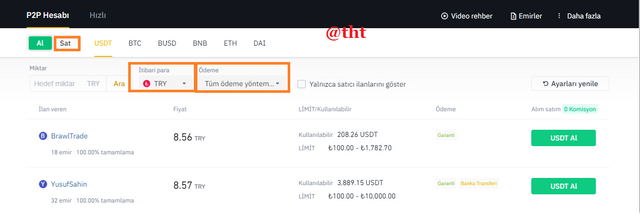

I'm in the area where the P2P wallet is. I click on "P2P Trading" at the top.

I clicked "Sell" as I will be selling on the P2P platform. Then I marked "TRY" as the currency. I preferred all payment methods as a payment method.

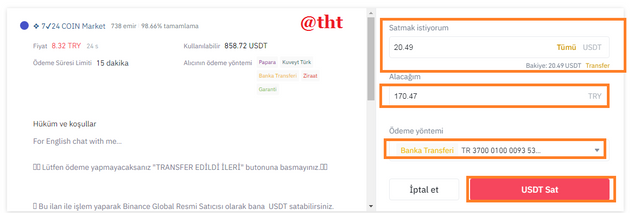

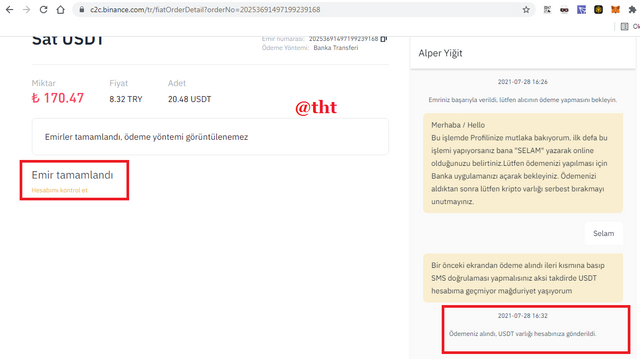

I checked all users. I will contact the user with a high completion rate, a large number of payment options, and a low limit. I clicked on the "USDT Sell" option.

The user wants to buy USDT at a very low rate. 1 USDT = 8.53 TRY in stock markets in Turkey, but the user wants to buy USDT from me for 8.33 TRY. It doesn't seem logical to make this trade. But I will show all the steps of the selling process in P2P trading.

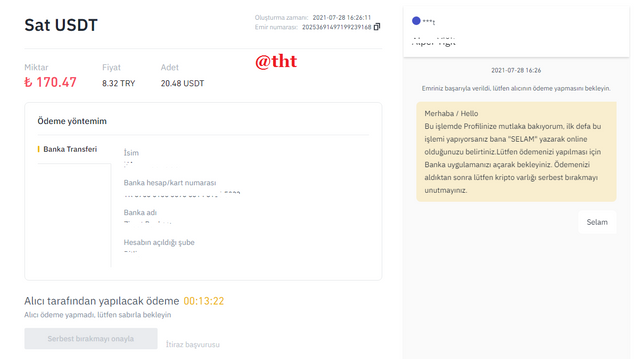

I have determined the amount to sell USDT. The Turkish Lira equivalent of 20.49 USDT is 170.47 TRY. I chose bank transfer as the payment method. After this process, I will click on the sell USDT option.

The person to whom I sold USDT has to pay me within 15 minutes, otherwise the transaction will be cancelled. On the right we have the possibility to chat with the buyer.

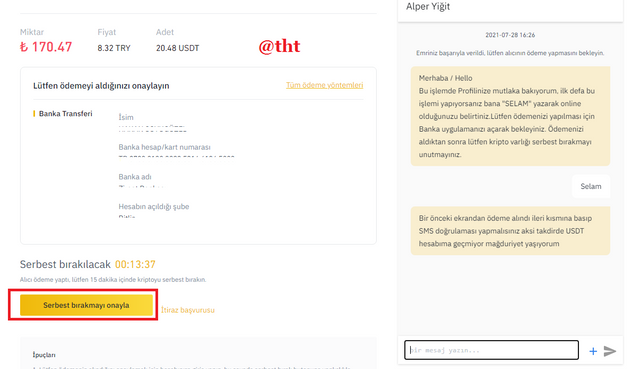

The buyer paid me. I checked from my bank account. I need to release the buyer's cryptocurrency within 15 minutes. I clicked on 'Confirm release'.

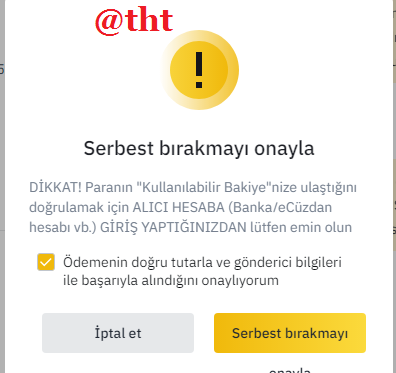

On the newly opened page, I clicked "confirm release" again.

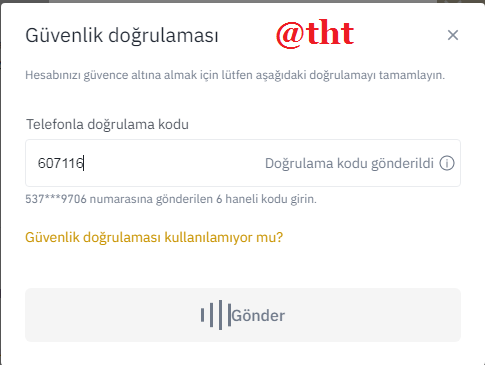

I made sms confirmation on the newly opened page.

After sms verification, the process is completed. The USDT in my account has been transferred to the buyer's account.

As you can see in the screenshot, USDT has been deducted from my P2P account.

What are the things to keep in mind during P2P trade and describe its four advantages and disadvantages.

There are some situations that we should pay attention to when trading P2P. I will explain these in order.

KYC Verified User: When trading P2P on centralized exchanges, we need to trade with approved users. This gives us an advantage in many ways.

Different Payment Method: Choosing different payment methods always gives us an advantage when transacting on the P2P platform. We need to add payment methods as much as possible while we are in the buyer position. When we are in the position of seller, we should prefer users with different payment options. This will increase the transaction realization rate on the platform.

Transaction Completion Rate: While some users have a very high transaction completion rate, some users have a low transaction completion rate. When trading on P2P platforms, we should prefer users with high transaction completion rate.

Rules Set by Buyers and Sellers: If we act according to the rules set by buyers and sellers, the realization rate of the transaction will increase. In addition, in case of any dispute, the process will work in our favor.

Limit: Buyers and sellers set a minimum and maximum limit on the P2P platform. Before making our transactions, we must act according to the limits set by the users.

Confirmation: Buyers should warn the seller after making the payment, while sellers should release the cryptocurrency. It should also complete the sms confirmation.

Chat: There is a window to chat with the buyer or seller. If we communicate with the buyer or seller, our transactions will be faster.

Document: There can be malicious people in every environment. If we want to be the right party in a dispute, we should keep the documents we deal with, even for a while.

P2P platforms are created for the benefit of users. These platforms have advantages as well as disadvantages.

Advantages

P2P platforms enable more intensive use of cryptocurrencies. It is possible to circumvent the restrictions in some countries with this method.

Affordable in terms of cost. I need to do a few transactions to withdraw my assets from Binance to my bank account. I need to transfer the assets in Binance to the stock markets in Turkey. Then I need to convert it to Turkish Lira in the stock market. When withdrawing Turkish Lira to the bank, I have to pay a transfer fee. In addition, I have to pay a transfer fee when transferring cryptocurrencies from the Binance exchange to the exchanges in Turkey. P2P platforms don't have any of these transaction fees.

More practical. As I just mentioned while explaining the cost-effectiveness, I have to do a lot of transactions when withdrawing money from Binance to my bank account in Turkey. In the P2P method, as soon as I contact the seller, my money is transferred to my account in Turkey.

Trustworthy. P2P platforms are highly reliable. You are not likely to be scammed due to the escrow system. In the event of a dispute, the appointed judge will immediately determine the right user.

Disadvantages:

Unpopular. P2P platforms are not popular enough. Some cryptocurrency investors don't even know about it yet. Since it is not popular, it becomes difficult to find enough buyers or sellers from each country.

Cryptocurrency prices are higher for buyers than exchanges, and lower for sellers. For example, while the USDT price was 8.55 TRY in the stock markets in Turkey, I had to sell USDT at 8.33 TRY.

P2P platforms have a limit issue. Low-budget users may have trouble with higher limits. Also, for high budget users, the limit may seem quite low.

Your transaction may not occur. If you are dealing with an inexperienced seller-buyer or if the seller-buyer is not someone who cares about their business, your transaction will not be executed.

Conclusion

In this week's lesson, we learned some very important topics.

Golden Cross and Death Cross events are very important events for traders. In these events, a change in the direction of the trend begins. In the case of the Golden Cross, while the bear period ends, the bull period begins. In the Death Cross event, the bull period ends and the bear period begins.

It is very important for us to observe or detect such events in graphics. We can buy cryptocurrencies at a lower price or we will have the opportunity to sell them at a higher price.

P2P platforms are platforms that allow cryptocurrencies to become more widespread. We know that cryptocurrencies are restricted in some countries and banks do not accept cryptocurrency payments. With the P2P method, users will have circumvented such restrictions.

Thank you professor for useful course.

Twitter sharing

https://twitter.com/Steemtht/status/1420401979969441799

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 5

thank you very much for taking interest in this class

Thank you.

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 17 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 6 SBD worth and should receive 30 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePig