Crypto Assets Diversification - Crypto Academy / S4W4 - Homework Post for @fredquantum.

Hello friends and welcome to my assignment task by professor @fredquantum, in this assignment I will explain the concept and importance of Crypto Assets Diversification, I hope you enjoy and learn from my assignment.

Question one

Explain Crypto Assets Diversification?

According to CoinMarketCap, there are now 12,000 cryptocurrencies in existence as it is; new tokens pop out almost daily with different uses and backstories. The top currencies such as Bitcoin, Ethereum, and the likes are to a great considered tradable as they constitute the bulk of the market. Furthermore, to invest in the cryptocurrency market one of the wise actions to take is to diversify your assets. It is just like not putting all your eggs in one basket. Thus, the success or failure of your investment adventure totally depends on this principle so it is important to understand how to diversify your assets properly.

Crypto asset diversification is principally the practice of apportioning your funds into different cryptocurrency assets to mitigate risk should one or two of the assets perform poorly or less than expected. The crypto asset crash in 2018 proves this to be true. However, a small-scale investor can invest in one or two assets but for a big-time investor, you will have to create a sizeable portfolio of crypto assets.

To illustrate this, let us assume I want to invest $500, and I purchase $500 worth of Bitcoin and the market dips at %50, In the best case scenario, I may be left with $250 worth of Bitcoin which is a loss.

But if I had invested $100 each in other assets such as BTC, ETH, ADA, STEEM, TRX, the 50% dip that affected Bitcoin would affect the $100 allocated to it making me lose $50 instead of $250 and as a result, I would still have $450 instead of $250 if I had invested in only one currency.

The idea is to observe and select some of the best-performing cryptocurrencies and invest in them. Furthermore, you will have to consider a few things such as the asset’s past trends, their price, and future potential as well. You can also choose to invest in one or two different projects such as the Asian, European, American blockchain.

Strategies to use for Crypto Assets Diversification

There are a few strategies that can help you diversify your assets, therefore, mitigating your risk of loss significantly:

- Time Diversification

This is one of the oldest channels of distributing one’s assets in the crypto world. In this strategy, you will have to time the market and invest at intervals. Instead of investing all at once, you buy at stipulated periods, you can choose to buy 20% of your assets each month and it may take you up to 5 months to get a full portfolio using this method. Time diversification does well by helping you avoid certain things such as poor decision timing however, it is not all rosy as timing the crypto market is quite difficult especially for newbies in the market.

- Coin Usage

Coins differ as such, it is not wise to compare them, Bitcoin is principally used to store value and make payments, coins such as Ethereum help to power DeFi Protocols and it is also used as a key in smart contract tech.

Base on this information you can choose which coins to invest in, a properly balanced portfolio should cover different use cases. If you opt to implement this strategy, you can rest assured that you would have reduced your risk to the minimum level.

- Fundamental and technical analysis

Through technical analysis, you can make an evaluation of the assets by observing their price trends and charts. It principally involves studying the past trading behavior of assets to predict their future price movements. Meanwhile, fundamental analysis looks at current happenings in several industries that can affect assets. These two analyses can help you make choices pertaining to which asset to invest in or not.

Determining Factors That Can Affect Investments

- Timing

It's critical to have an understanding the fundamentals of tokens and coin trading as decides your cryptocurrency trading portfolio. By so doing, you will be well-positioned to know what to do when the market turns bearish and activity is heading downhill if you comprehend the time issue.

The general rule is to purchase when the bears are in charge (when the market is down) and sell when the bulls are in charge (when the market is up). The major problem here is not the forecasting of market prices, but rather knowing what action to take in the face of current circumstances.

- The 1-4 Rule

Summarily, the rule states that you should invest in at least four assets in your portfolio. So if you want to invest $5000, your portfolio should contain at least 4 assets i.e. you can divide your capital into 5 places summing up to $1000 per asset.

This is one of the safest strategies out there that can significantly cut your losses.

- Competence

It is advisable to focus on your core abilities and strengths. This is another important aspect for your cryptocurrency investing portfolio. Questions such as:

What types of coins and tokens do I study a lot?

Which industry do I have the most experience in?

Do I have a good understanding of utility tokens or do I prefer security tokens?

Through consistency, you can familiarize yourself with cycles that work and you will master them. Nobody understands everything, so it's preferable to focus on one area where you have a competitive advantage which will in the long run reduce your mitigate your losses.

Question two

What are the benefits/effects of diversifying one’s assets?

Risk Mitigation

I opine that this is one of the top advantages of diversifying crypto assets in portfolios; overall you reduce the risk and volatility of your assets. If you have one crypto in your portfolio as your investment whenever that crypto isn’t doing great your portfolio shadows that reality. However, if you diversified your asset investments and one of the coins isn’t doing well, the other coins in the portfolio will cover for its downsize. This helps your portfolio to remain stable and less prone to downsizing. It is very unlikely that all your crypto assets will fall at once.Investment opportunities

Let us assume you invest in Bitcoin, Ethereum, ADA, Litecoin, Tron, and so on, you stand a better chance to recover your investments as profits in contrast to when you invest in one only one asset. You have a bigger chance of hitting it big when you invest in several assets at once than when you invest in one. Let’s assume your portfolio contains the following coins each worth $1000Bitcoin

Ethereum

Ada

Steem

Solana

Then Bitcoin experiences a bull run at %5, ETH 7%, Ada 8%, steem, 10%, Solana 13% respectively,

Bitcoin $1000 * 5% divided by 100% = $50

Your other assets at +7% + 8% + 10% + 13% = 43%

Ada+Steem+Ethereum+Solana $4000 * 38% divided by 100% = $1,520

So if you had invested your $5,000 capital into Bitcoin alone, with its 5% bull run, your Bitcoin asset would have become $5,250 which would have been your total portfolio’s worth.

But by diversifying your assets and investing $1000 into different assets, the total worth of the portfolio becomes $6,570.

Question Three

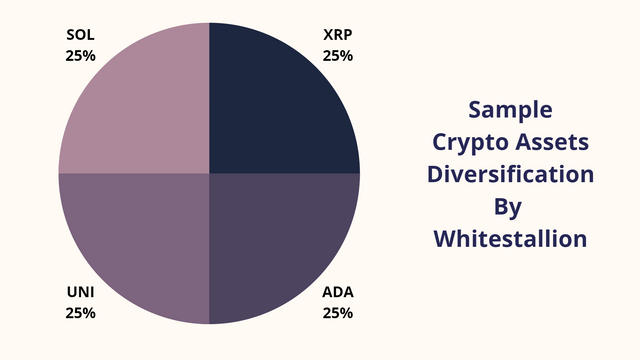

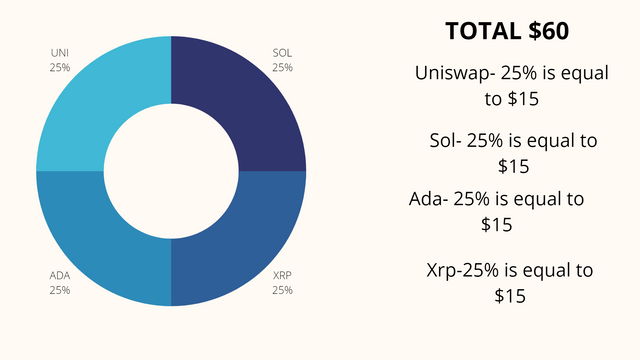

Construct Crypto Asset Diversification According to the 1-4 Rule?

To answer this question I will need to define what Crypto Diversification is, and what the 1-4 rule is before I proceed.

Crypto Diversification

This is the act of putting your money into different crypto assets to mitigate loss1-4 rule

This rule is one that operates by dividing your capital into four different crypto assets to as well, mitigate loss. It is more like outing your eggs in different baskets.

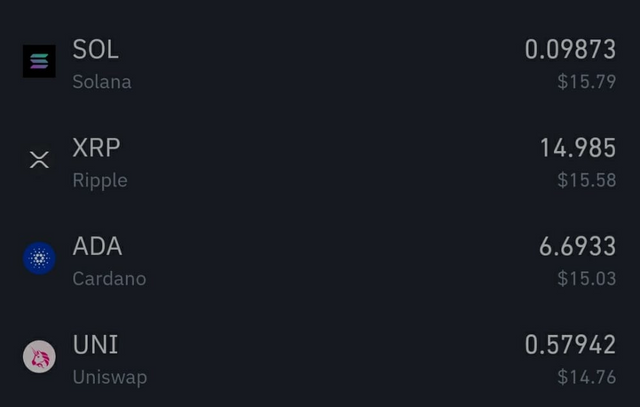

To proceed, I will be investing $60 as the Professor instructed into 4 different assets, $15 each:

- ADA-Cardano

- XRP-Ripple

- SOL-Solana

- UNI-Uniswap

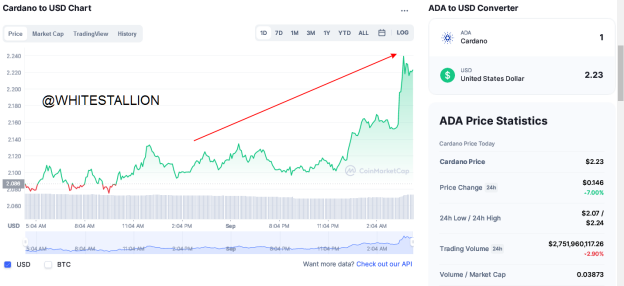

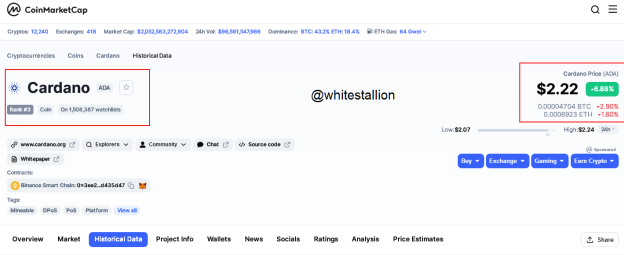

- Cardano ADA

This network works with the Proof of Work system that allows innovators to bring about good change globally. Cardano was founded in the year 2017 and it was named after Polymath Gerolamo Cardona. The token allows its users to participate in the network’s operation so they can have a say in case there is a proposed change to the software.

Furthermore, DApps and smart contracts can be developed on the technology. Summarily, ADA was founded by Charles Hoskinson. He was also a participating founder of the ETH network. Interestingly, all proposed developments can be challenged before they are implemented.

Reason why I chose ADA

From my research, I understood that Chainlink is about sealing a partnership with ADA which will, as expected, bring a bull run to the cryptocurrency. Furthermore, ADA has been on a bull run for a while now.

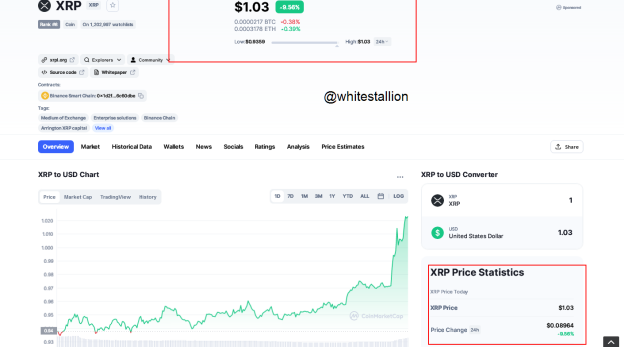

2.Ripple XRP

Ripple ranks #6 on the CoinMarketCap, as when writing this assignment it had a selling price $1.03. XRP was fashioned to have speed and cost less in addition to its scalability in contrast to other digital assets and platforms. The network performs on transactions on average, 3-5 seconds. One interesting fact about this token is that anyone can be a ripple validator with the current list being made up of both educational and financial institutions.

Why I chose Ripple XRP among my assets

Throughout this week, XRP has been on a bull run, it has risen by about 2% in the last 7 days and by 9% in the last 24 hours thus, the current price is now $1.03 and the market is still bullish

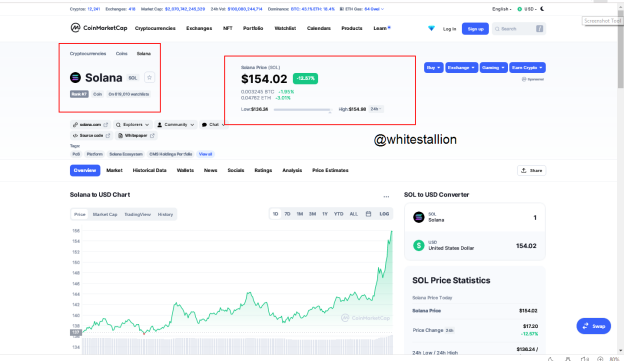

3.Solana

The SOL token has a market capitalization of $45,780,262,058.45. During my research, I consulted CoinMarketCAP which according to them, the SOL coin had a price of $153.54 when I was writing this assignment. It is a blockchain technology that works in such a way that it provides DeFi solutions to projects. It was launched in March 2020 and its operational headquarters is in Geneva, Switzerland. The SOL cryptocurrency reached $154.98 on 30th September 2021. The SOLA token is ranked #7 in the market capitalization rank. At this rank it has $2,632,042,720.47. as its the trading volume in the last 24 hours during the writing of this assignment.

Why I chose Solana

During writing this assignment, DEX which is a project powered by Solana sealed a deal of $18 million. This single deal is expected to set ripple in a bull run, although the crypto has already been in a bull run for 7 days now.

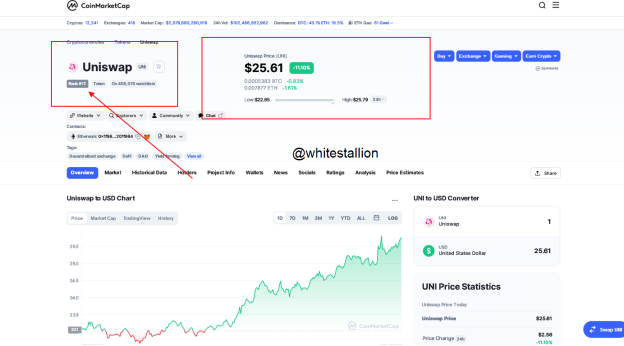

4.Uniswap UNI

Uniswap is ranked 12th according to CoinMarketCap. Today 1st October 2021 the live trade price is $25.61. Its 24 hours trading volume also is $663,473,528. As of the last 24hours before writing this assignment Uniswap was up 11.29%. The coin’s circulating supply is 611,643,724 coins and the max supply of about 1,000,000,000 coins. It is available on platforms such as Huobi, Binance, etc.

Hayden Adams founded this coin in November 2018 which was birthed when he tried to introduce AMM on the Ethereum network. It is a popular decentralized trading protocol that aids the trading of DeFi tokens.

Why I chose Uniswap

Principally, China’s interruption on exchange platforms tokens such as Huobi has gone down the drain, bearish style while Uniswap has been experiencing a bull run.

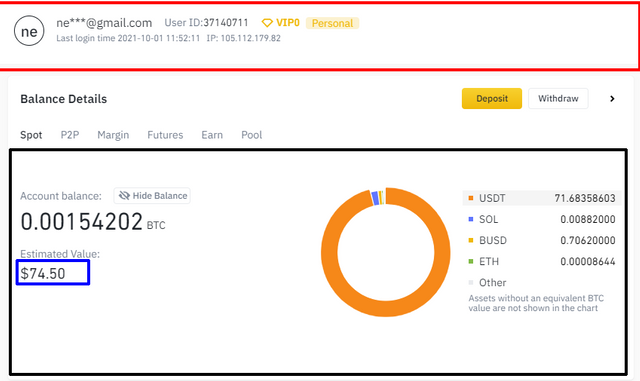

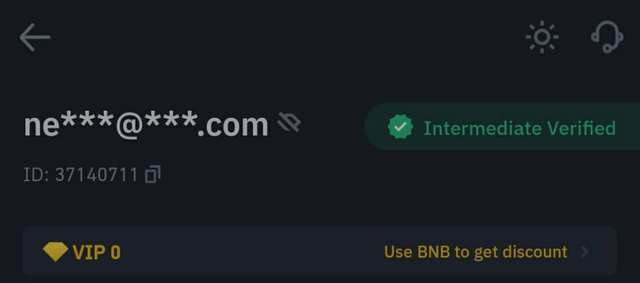

- Verification Status on Binance - Intermediate Verfied✅

- Reservoir - As clearly indicated on the image above using a Blue marker $74

After performing a detailed fundamental and technical analysis on all of the selected assets I wish to purchase it's now time to make a real-time purchase of the following coins below.

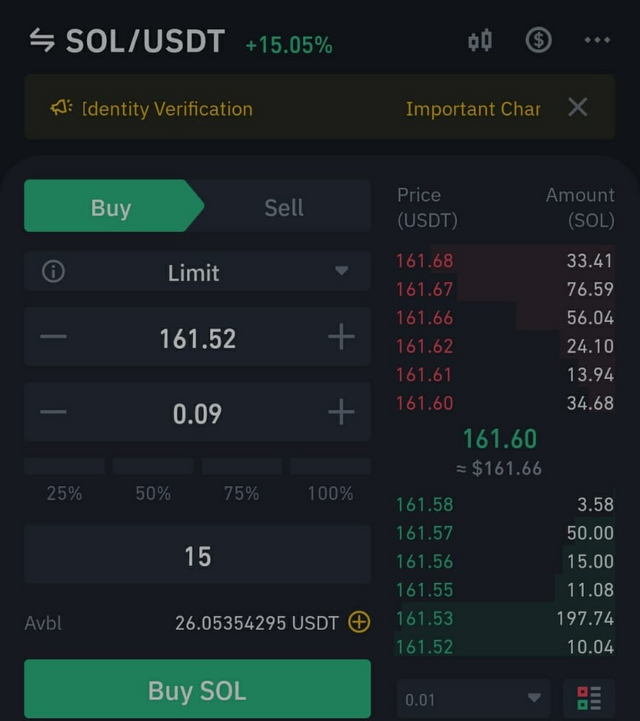

SOL

In order to purchase at least a 15$ equivalent of SOL, i made sure my account had more than $15

Place my limit price, Usdt amount and clicked on the Buy Tab.

After clicking on Buy, the order immediately queued and was executed immediately.

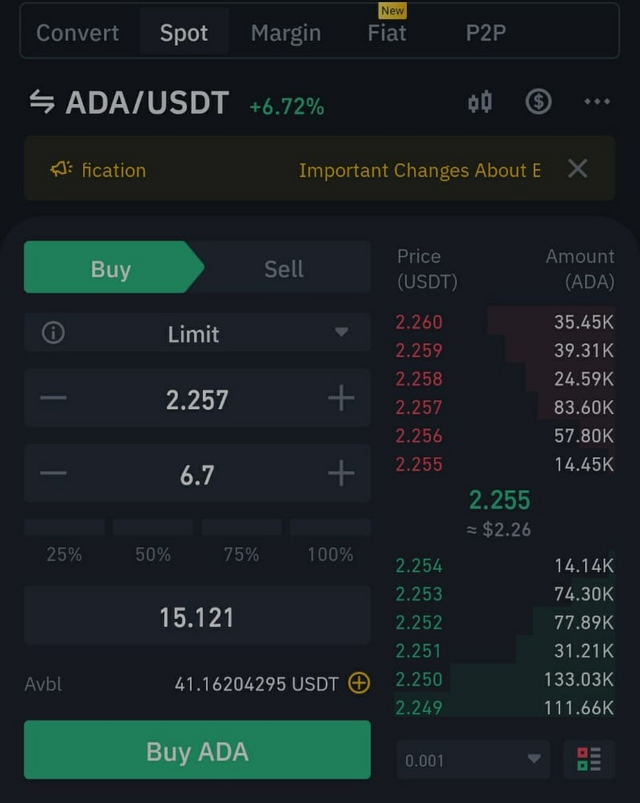

ADA

In order to purchase at least a 15$ equivalent of ADA, i made sure my account had more than $15

Place my limit price, Usdt amount and clicked on the Buy Tab.

After clicking on Buy, the order immediately queued and was executed immediately.

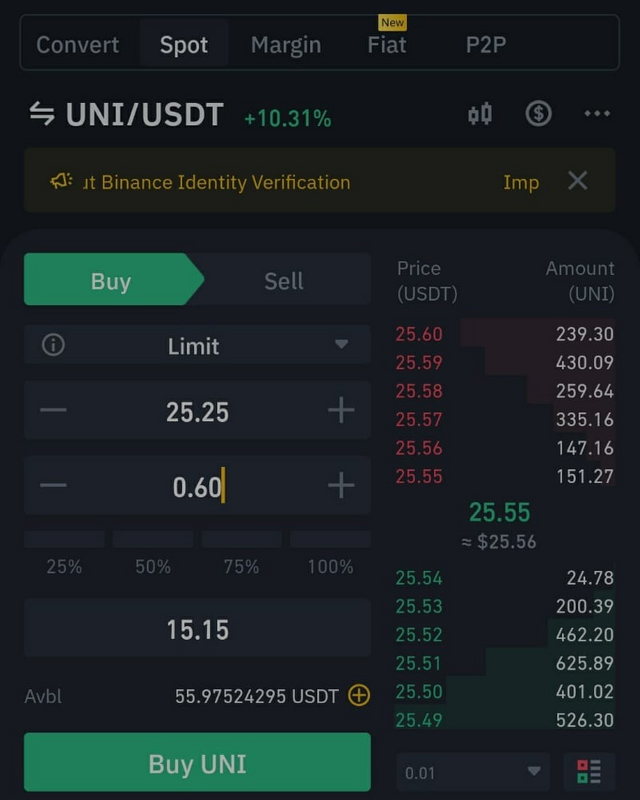

UNI

In order to purchase at least a 15$ equivalent of UNI, i made sure my account had more than $15

Place my limit price, Usdt amount and clicked on the Buy Tab.

After clicking on Buy, the order immediately queued and was executed immediately.

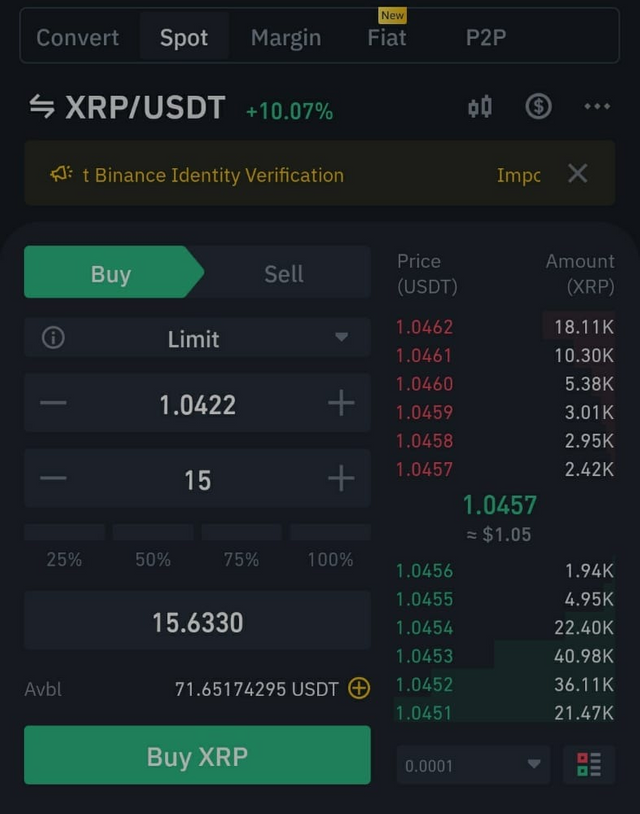

XRP

In order to purchase at least a 15$ equivalent of XRP, i made sure my account had more than $15

Place my limit price, Usdt amount and clicked on the Buy Tab.

After clicking on Buy, the order immediately queued and was executed immediately.

At the end of this session i was able to purchase the following coins above, $15 each , summing a grand total of $60.

Question Four

Explain Arbitrage Trading in Cryptocurrency and its benefits?

Arbitrage strategy is one that allows traders to secure gains by simultaneously and selling identical cryptocurrencies or stocks across two separate and different platforms. This strategy allows traders to make a profit from the disparities in pricing for similar assets between the two regions represented on either side of the trade.

Furthermore, arbitrage can be described as the act of purchasing a crypto asset in one market and after a bull run, selling it for a higher price in another market. So if I want to make safe profits, I can choose to buy a cryptocurrency from a platform like Binance and sell it on Kucoin provided one of the markets sells it higher than the other.

Spatial Arbitrage

This is simply the process of buying a crypto asset from one exchange and selling it immediately on another exchange for profit. This method is straightforward and involves leveraging on the minor differences in price between exchanges to make profits.

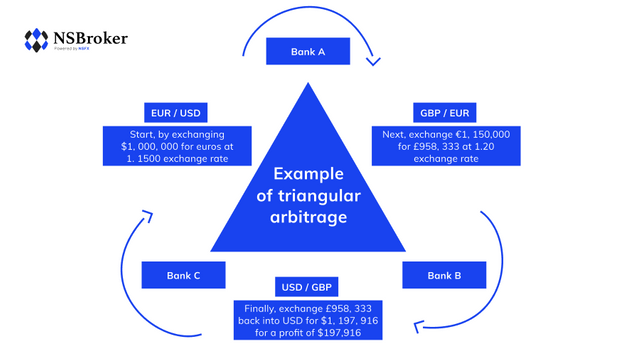

Triangular Arbitrage

This strategy involves buying one cryptocurrency and then trading it for another cryptocurrency on the same exchange that is undervalued in comparison to the first. Because of the differences in prices, profit is made

Question Five

Discuss with illustration how to take advantage of Exchange Arbitrage?

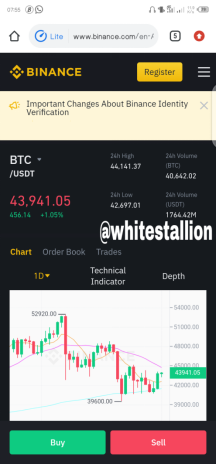

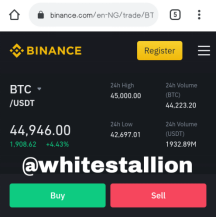

To illustrate Arbitrage, at the time of writing this assignment 1st October 2021 BTC/USDT was sold for $43,941.05 on Binance

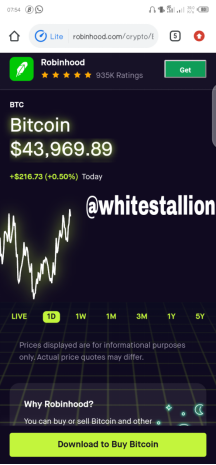

Meanwhile, the same BTC/USDT pair was sold for $43,969.89 on Robinhood.

Arbitrage simply means I'll buy Bitcoin for a lower price on Binance and sell it for a higher price in Robinhood. The price differences in the exchange platforms will make me get profit.

Question Six

Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved

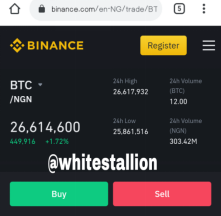

From the fundamental analysis on the deprecating Nigeria Naira (NGN), in respect to United States Dollars (USDT)

I will be using the assets to illustrate an arbitrage.

As of when writing this assignment on 1st October 2021, BTC/NGN was #26,614,600

Furthermore, the price of BTC/USDT during writing this assignment was $44,946.00

As earlier stated, the deprecating nature of the Nigeria Naira in comparison to the United States makes it a perfect example to illustrate Arbitrage.

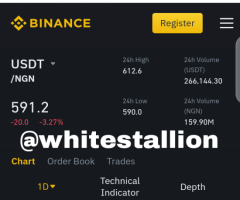

When I was writing this assignment, 1 USDT sold at NGN591.2

The explanation is that if I have $44,946.00, I will buy the BTC/USDT pair after which I'll proceed to sell the BTC on USDT/NGN pair which as shown above is #26,614,600.

After I successfully carry out this trade, I will then change it to USDT which as shown above is

=NGN591 to 1USDT

Thus #26,614,600 ÷ #591=$45,033.16

The profit calculation is thus:

Final USDT $45,033.16 - Initial USDT $44,946.00 = $87

By using the arbitrage strategy, I would have made $87 profit.

It’s not all rosy, some of the limitations that are involved in this strategy are the transaction fees which can be quite high sometimes either as transfer, network, or withdrawal fees. Also, since we working with one or more of the currencies being undervalued, a dip might occur just before you sell or buy one of the coins which turn out to be losses in most cases.

In the case of cryptocurrencies such as Bitcoin, Ethereum, and XRP I can identify an opportunity by observing that one or more of these currencies is undervalued in the exchange platforms. Thus, I can make a profit from triangular arbitrage by selling Bitcoin for Ethereum and using Ethereum to purchase XRP

Conclusion

There is nothing more to say, crypto-asset diversification is a fail-proof strategy to minimize or mitigate loss in trading. By putting your capital into different assets you can rest assured of a profit. Arbitrage also is a worthwhile strategy that can help a trader make easy and quick profit by buying a coin at a lesser price from an exchange platform and selling it for a higher price on another platform. If these strategies are mastered, they can make one’s trading experience to be smooth and lovely

Special thanks to Professor @fredquantum