Sun.io: Sunswap, Integrated stablecoin swap, Staking, Mining, veSUN, etc.- Steemit Crypto Academy- S5W1- Homework Post for @sapwood

Hello friends, it's nice joining the brand new SteemitCryptoAcacademy Season 5 week 1 lesson. Hope we all had a productive 2 weeks break from the community? So, I will be participating in this week's lesson as presented by professor @sapwood on Sun.io: Sunswap, Integrated stablecoin swap, Staking, Mining, veSUN, etc.

(Designed in Canva)

(1) Discuss the various features of Sun.io, a comprehensive Defi facility of the Tron family?

The Tron Ecosystem has continued to receive boosts and expansion as it is observed to come up with more friends and user experience capacity that can match other ecosystems. The domain name Justswap has been acquired by Sun.io all in the Tron Ecosystem with relatively few changes made which can be observed in its recent version1.5.

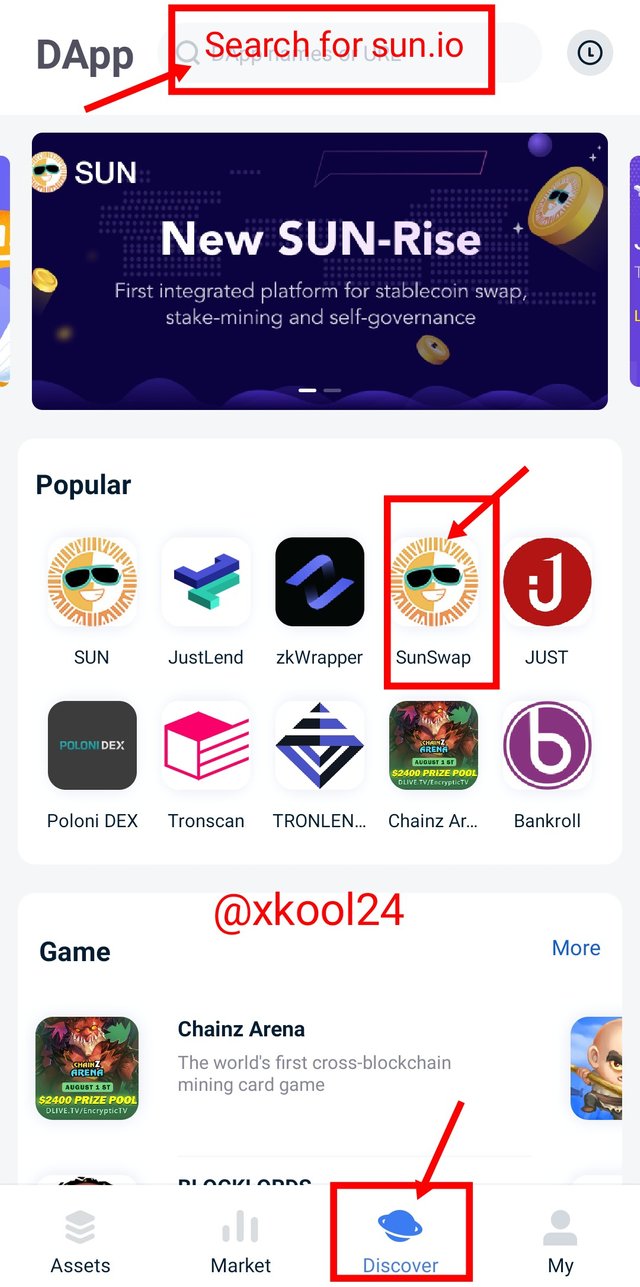

Connecting to this protocol is always easier using my Tronlink wallet App. Launch your wallet account and click on the Discover icon below the screen. This would launch into an interface showing the different dApps on the Tron Ecosystem at a glance. We can see the Sunswap icon there already or you can enter the Sun.io in the search box to launch dApp.

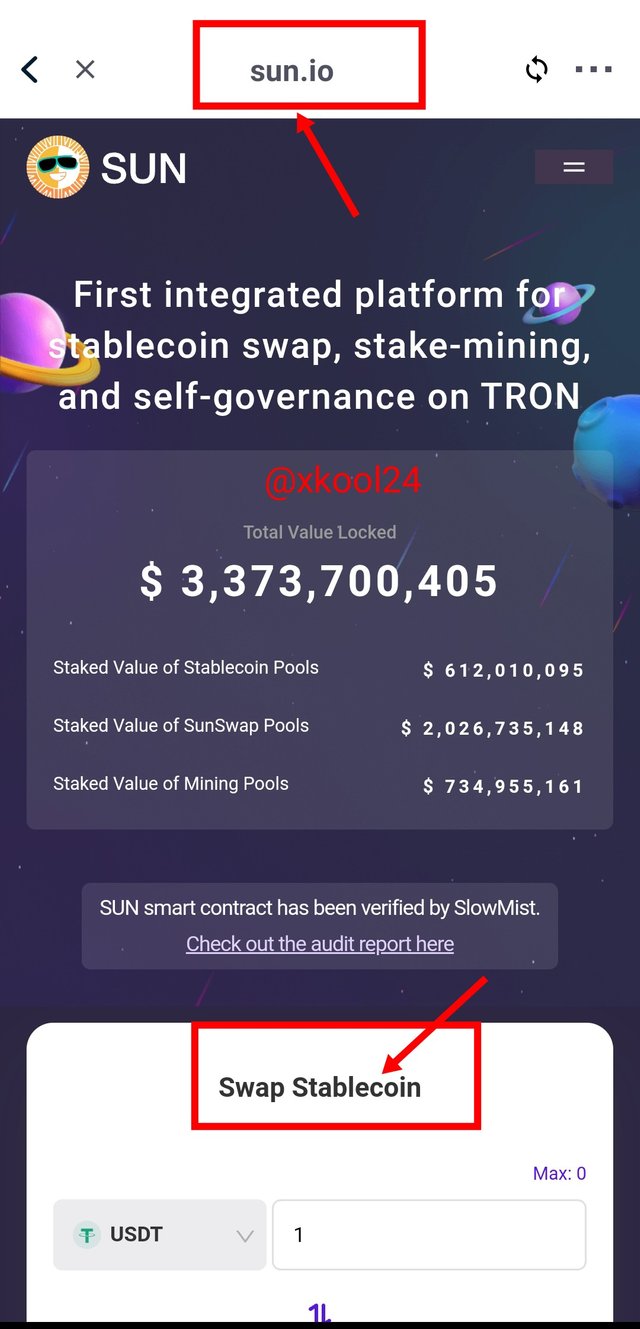

From the landing interface, we can see the different core features of the Sun.io dApp. We have the Sunswap, Stablecoins Swap/Sun Pool, LP Pool, and Stakes.

The Sunswap

These little changes observed in the Sunswap emergence from Justswap is in its fractional part of transaction fees allotted to burning. Ordinarily, we know that 0.3% transaction fee is charged when engaging the Sunswap protocol with 100% all distributed to Liquidity Providers but with the new Sun.io governance, 1/6th of this 0.3% transaction fees are withheld and used for SUN burning which in turn help to stabilize the tokens fortune in the long run.

This model would help stabilize the Demand and Supply pressured in the market vis-a-vis the overall performance of this Sun Token. What the Sunswap is to primarily provide Liquidity for coins through the token pairs and allow participants to engage the pool and earn rewards based on their contributory capacity relative to the total pool value.

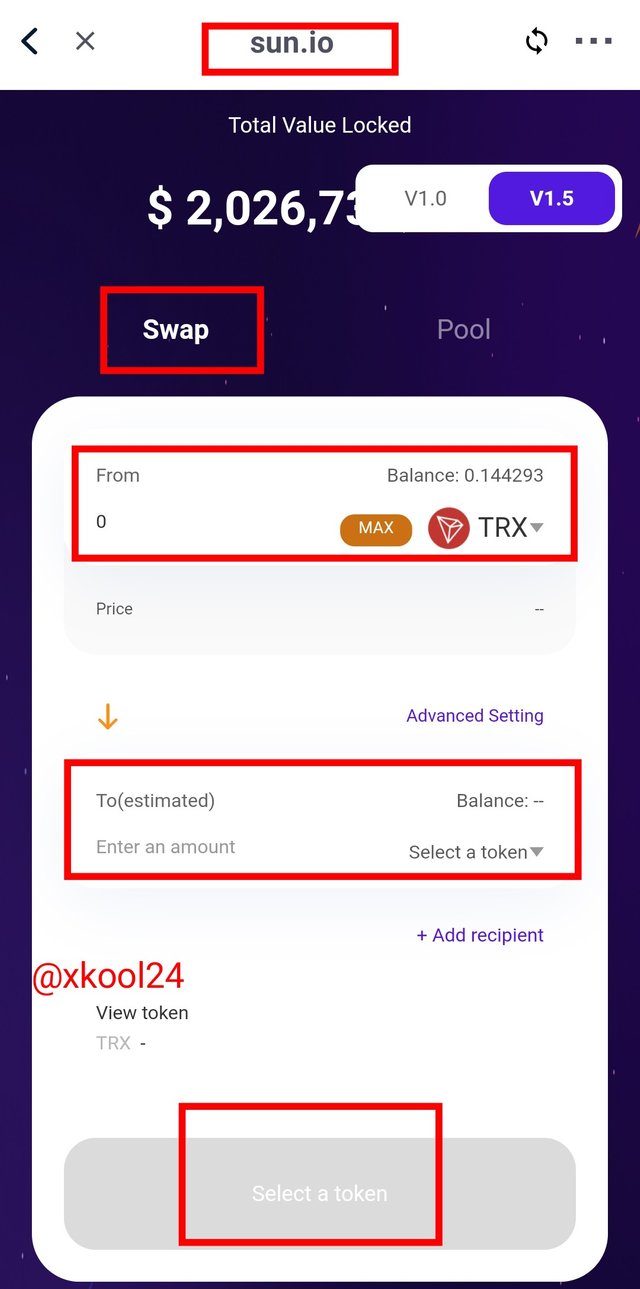

From its usage, participants are required to enter the amount of interest from their token as well as choose the other token of interest to swap to.

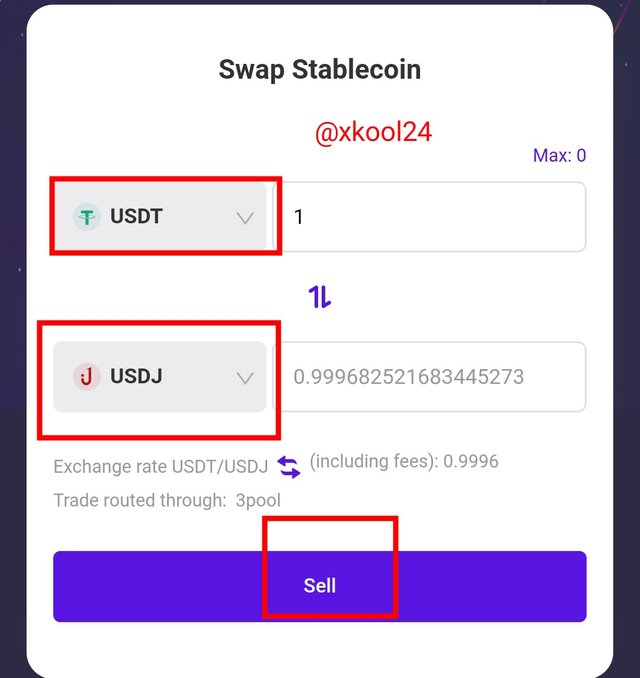

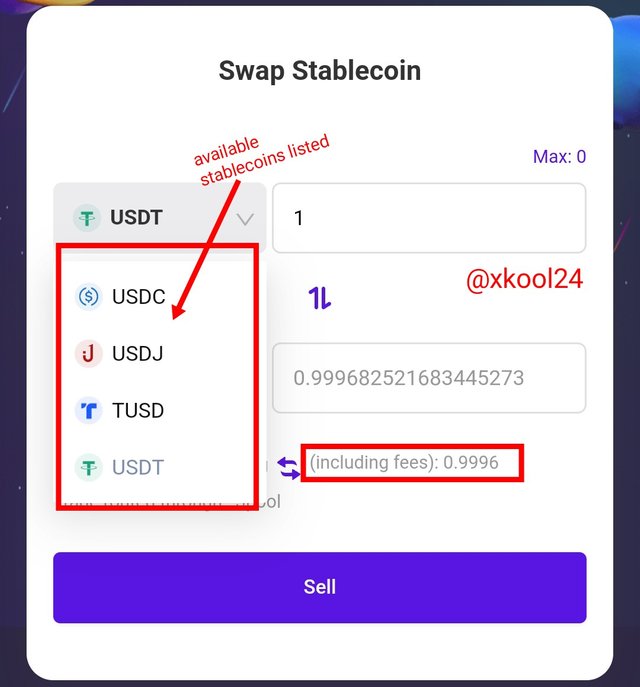

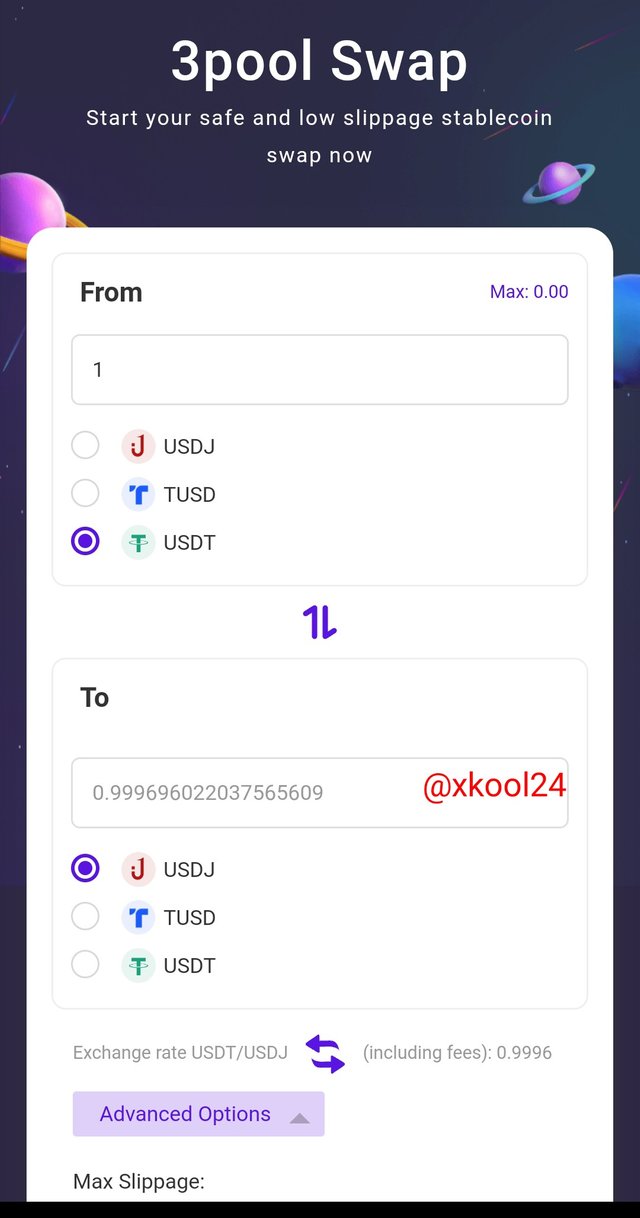

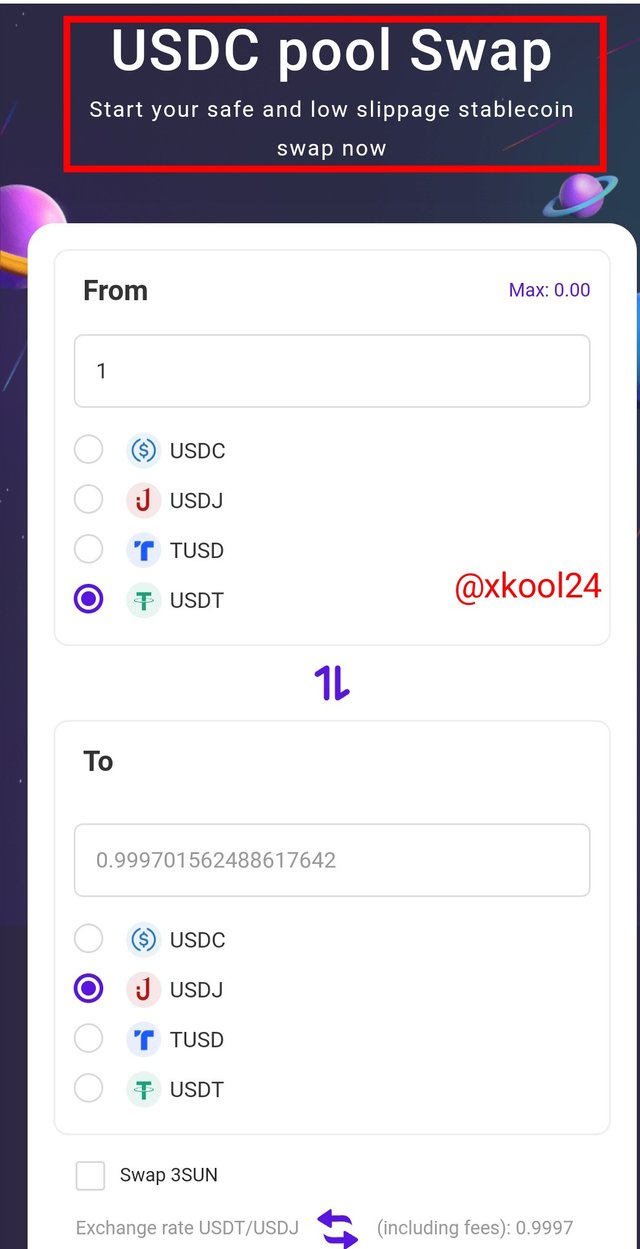

The Stablecoin Swap

In the Defi world, it is expected that we fund the Liquidity with more of the Stablecoin pairs to maintain the value or worth of these coins while still in the pool. This is to avoid the depreciation of assets before the maturity stage. Hence the Sun.io in its Stablecoin Swap protocol has the ***USDT, USDC, TUSD, and USDJ which gives users varieties and access to these major coins.

All we need to do is to select the Stablecoin which we already have some values in the "From" option as well select the preferred Stablecoin to be swapped in the "To" option and now click on the Sell button to sign the transaction. We can see the exchange rate for selected tokens including fees displayed.

The Sun Pools

The Sun pool comprises the different Pools associated with the Sun.io which is a makeup of the 3Pool and the USDC. The 3Pool is a combination of the USDT, USDJ & TUSD and as at the time of this post has a Base APY of 0.31% and rewards APY of 4.94%. On the other hand, the USDC pool comprises the USDC and the 3SUN with a Base APY of 0.21% and a Rewards APY of 8.20%. Total Pool Deposits stands at 612,010,864.79 and Daily Volume of $15,362,886.74.

LP Pool

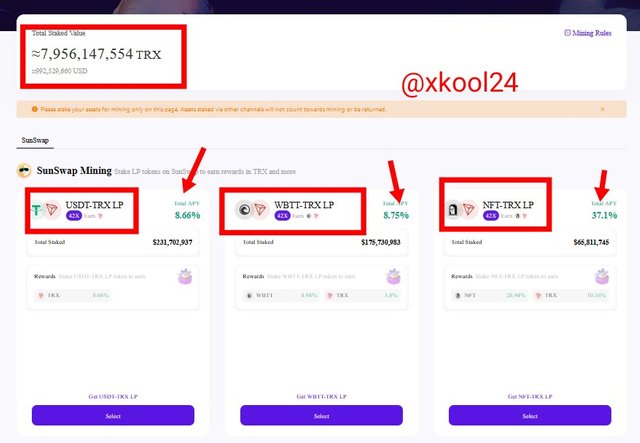

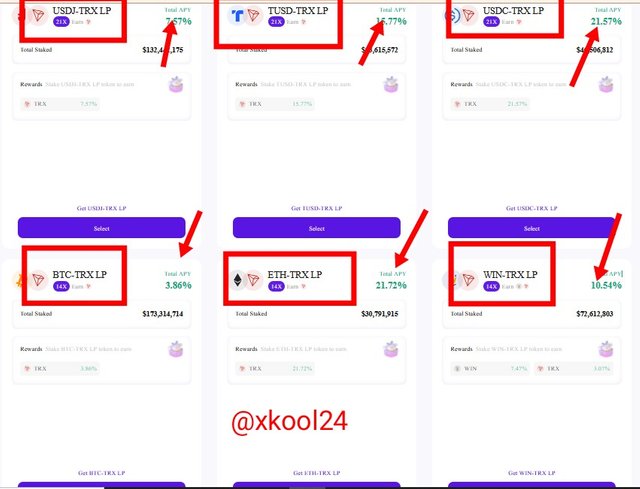

Once we click on the LP Pool feature by the side of the menu button, it navigates us to a landing page with the Mining details in Sun.io. There are different options available to Provide Liquidity in the protocol which we can observe with their different percentage APY offerings, Total staked for each of these pairs.

Amongst the pairs, we have the NFT-TRX LP offering a higher Total APY of 37.1%. Other pairs also observed here include the USDT-TRX, WBTT-TRX, USDJ-TRX, TUSD-TRX, USDC-TRX, BTC-TRX, ETH-TRX, and WIN-TRX.

Therefore for these pairs, when Liquidity is provided through them, the Liquidity Provider gets 5/6th of 0.3% given to the new Sun.io governance.

(2) Visit Sunswap and scan the different LP pools? How many different LP tokens are available in Sunswap? Based on the available data in Sun scan, how much fee did it generate in the last 24 hrs? What percentage of that fee is being utilized to buy back and burn SUN?

Just as I have explained having access to Sunswap.io, I will be launching that via my Tronlink wallet App. Click on the Discover icon down the screen, and then click on the Sunswap icon from the landing interface.

Click on the three parallel lines on your top right / or the menu button. This brings a dropdown with the Scan feature visible for click.

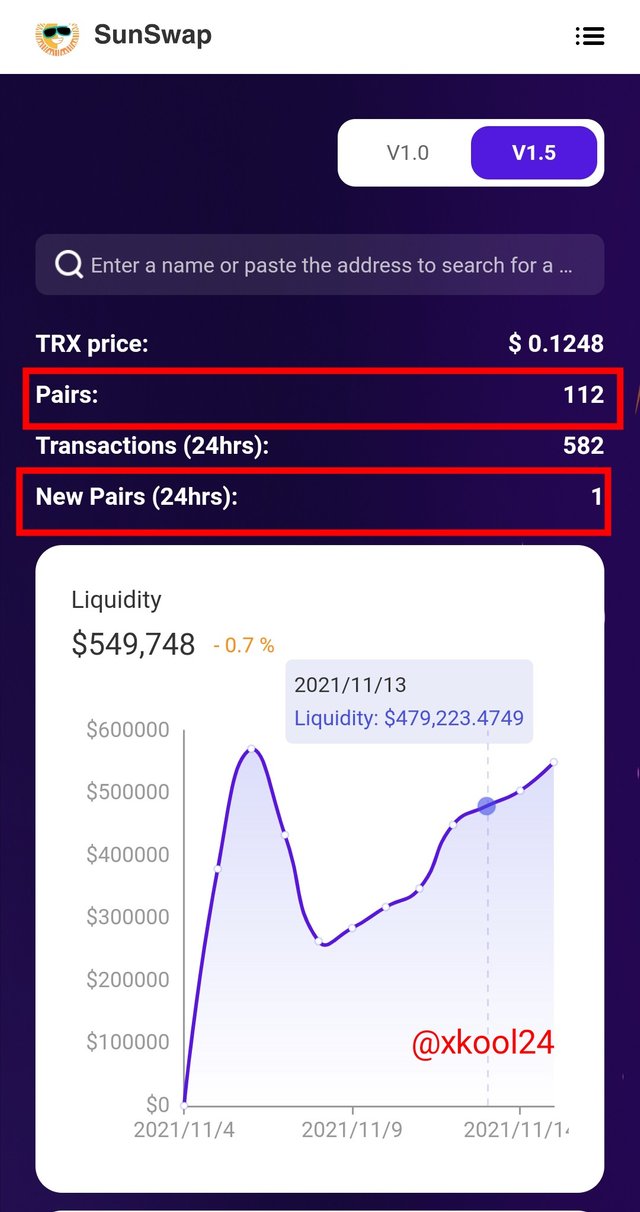

How many different LP tokens are available in Sunswap

As of the time of the report, we have about 112 LP token pairs* available in the Sunswap which include PIDC, SAFE MONEY, SOAR, SUN, TSTD, USDT JURA all pairing with the TRX token. In the last 24hrs, there were one (1) new pair introduced into the Sunswap.io protocol.

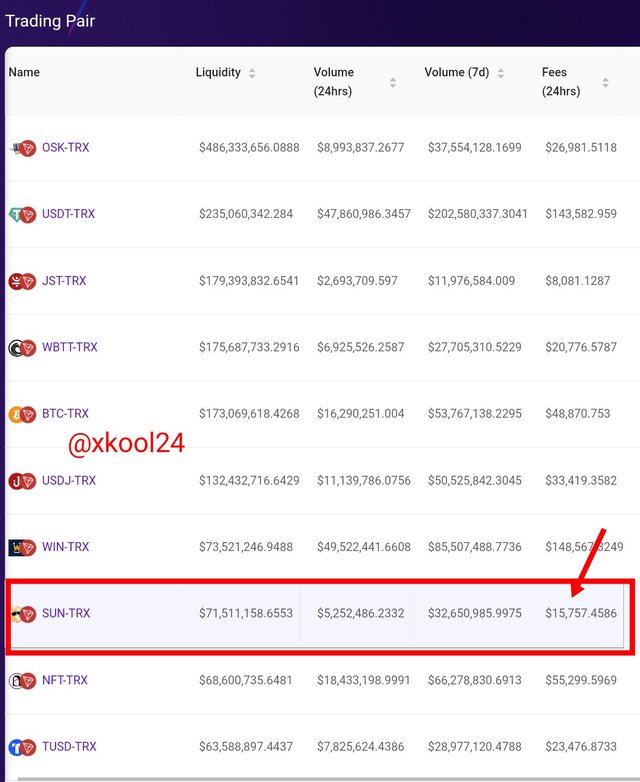

How much fee did the Sun scan generate in the last 24 hrs

Goto the Sun-TRX pair and open for the required details. We have $15,757.4586 fees generated in the; last 24 hrs.

What percentage of that fee is being utilized to buy back and burn SUN

Since we have $15,757.4586 fees generated in the last 24 Hrs for SUN-TRX Pair, therefore we should expect that 5/6th of this fee is distributed to all participated Liquidity Providers and the remaining 1/6th would be used to buy back and burn SUN.

Fee Distributed to Liquidity Providers: 5/6 ($15,757.4586) = $13,131.2155

The fee to be Used to Buy Back & Burn SUN: 1/6($15,757.4586) = $2,626.2431

(3) Deposit either 3 Pool LP or USDC LP or SUN-TRX LP in Sun.io. Stake them to maximize the mining rewards? Demonstrate the entire process with a real transaction? (Screenshot required)? Include the resource consumption statement, take the help of Block Explorer?

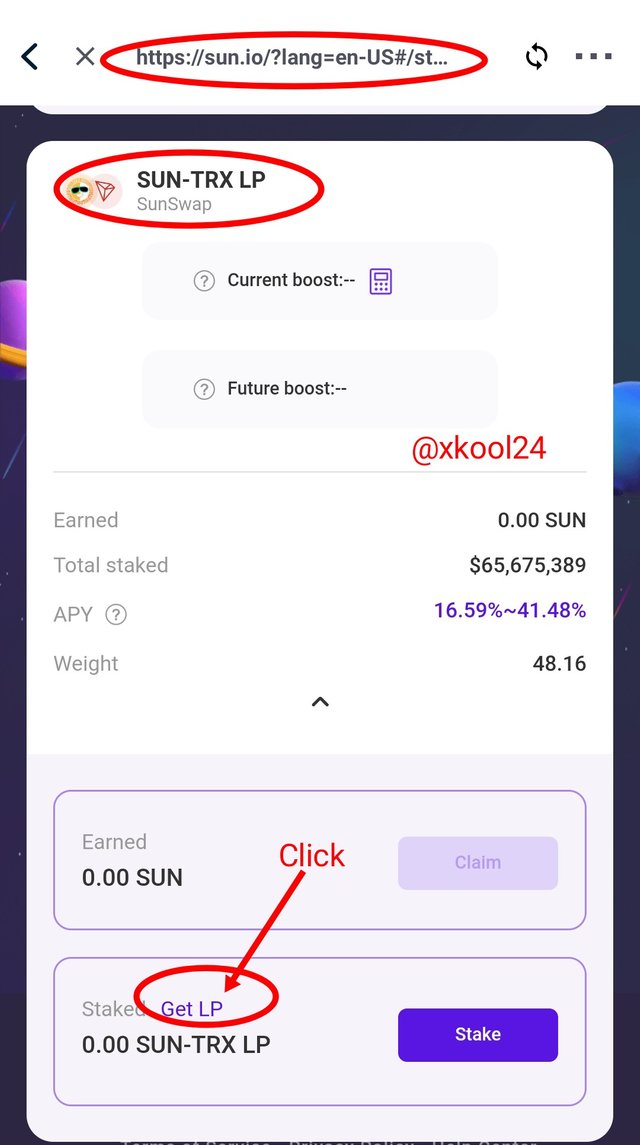

How to deposit SUN-TRX LP in Sun.io

- Launch your Tronlink Wallet App and click on the Discover icon down the screen

- Enter this link in the search box https://sun.io/?lang=en-US#/stake

- This is to enable me to perform real transactions when connected to my wallet.

- Then scroll down the screen to get to the SUN-TRX LP option to deposit

- Click on GET LP

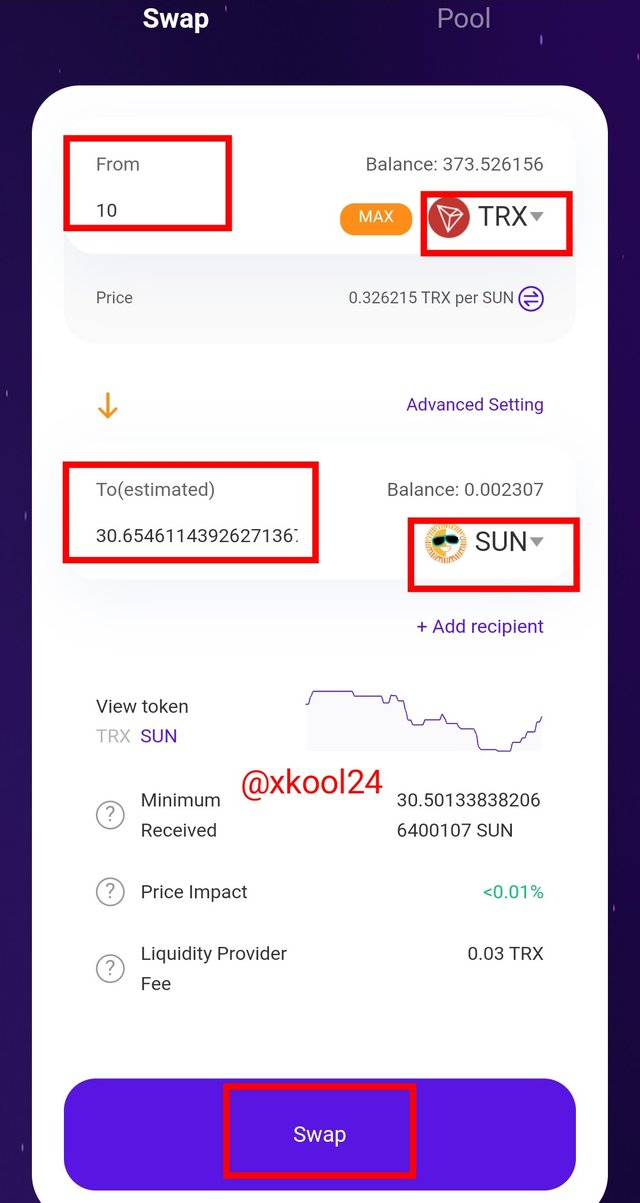

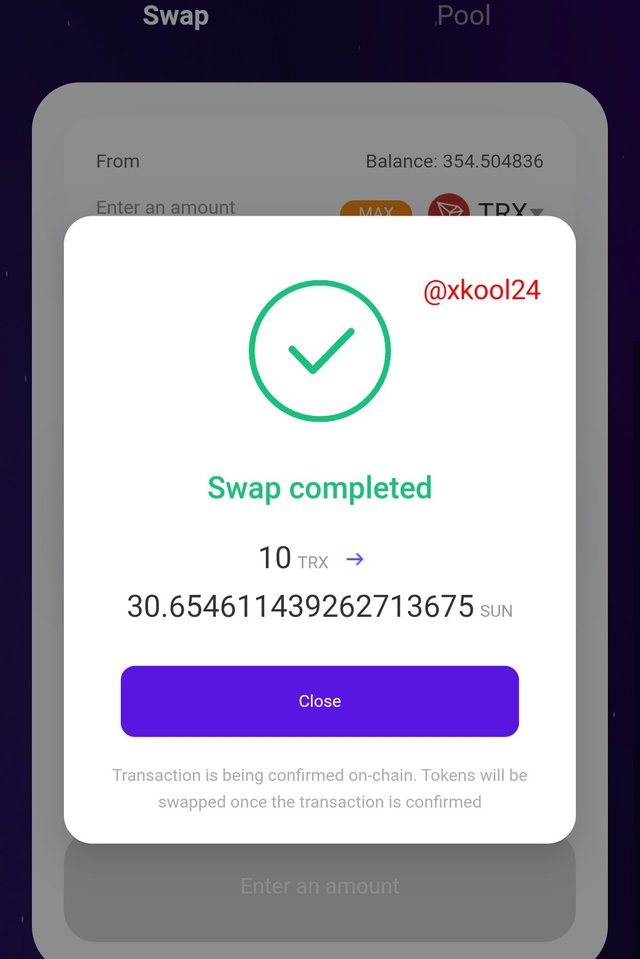

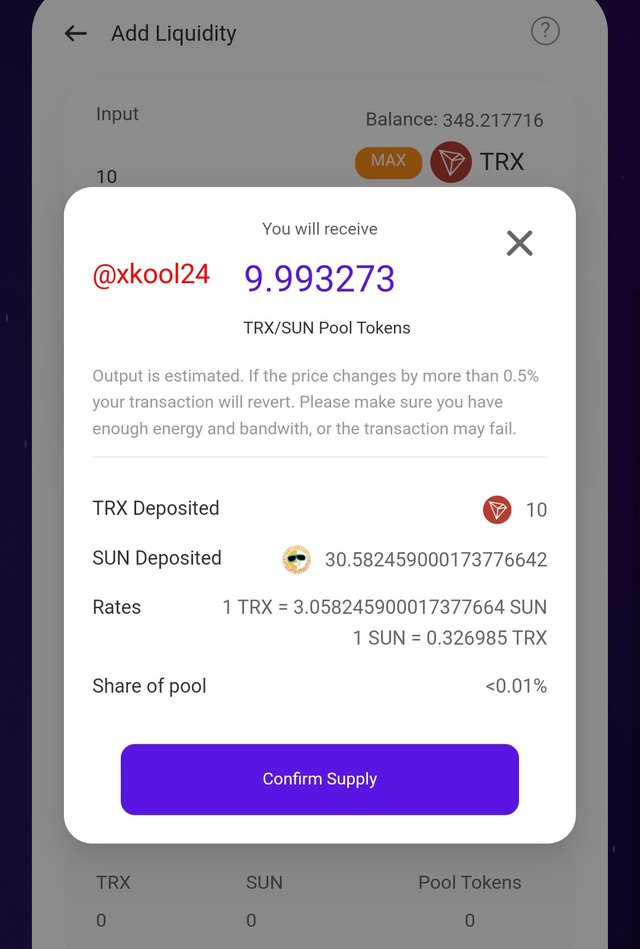

- It takes me to another interface to enter the amount of USDC to be deposited ( Before now I have to swap some of my TRX to SUN which makes it easier for me to continue. 10 TRX for 30.65 SUN).

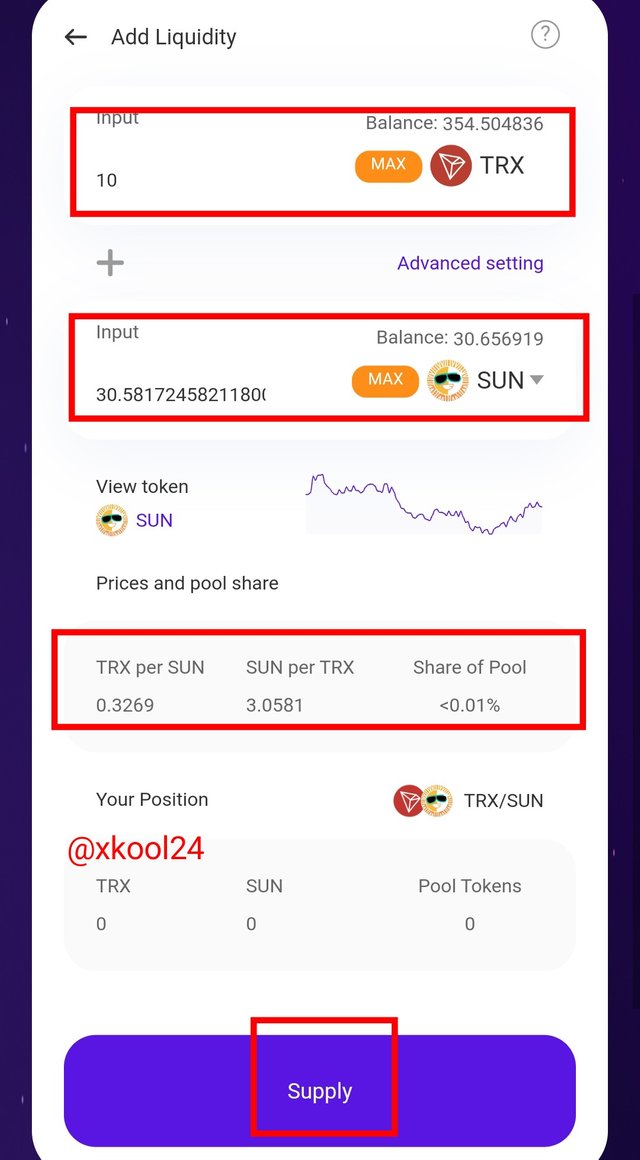

- I have to enter the required values which include:

First token: TRX - 10TRX

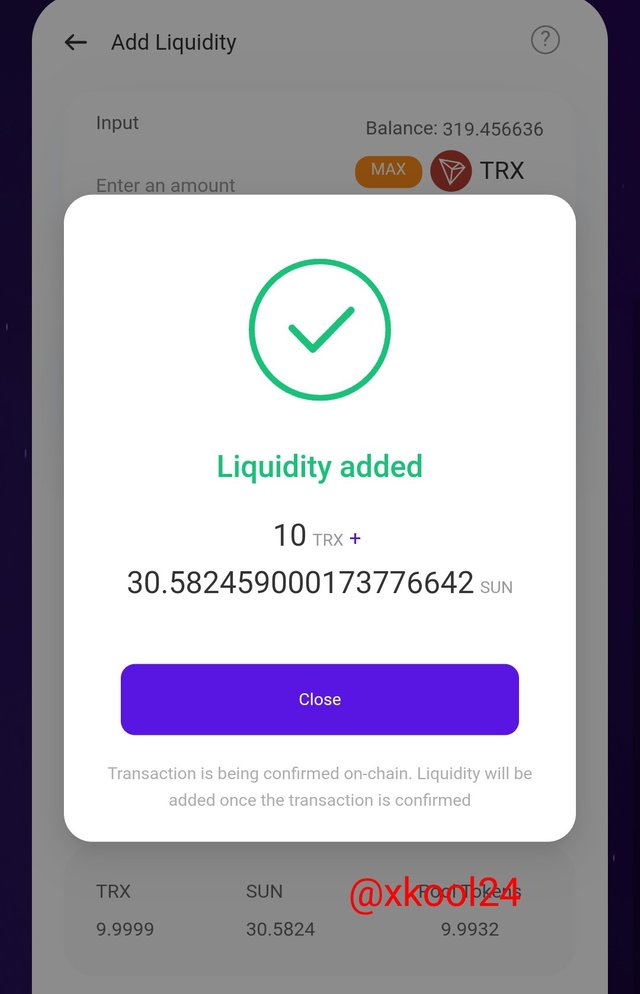

Second Token: SUN - 30.58SUN - Then click on the Supply button & Sign your transaction

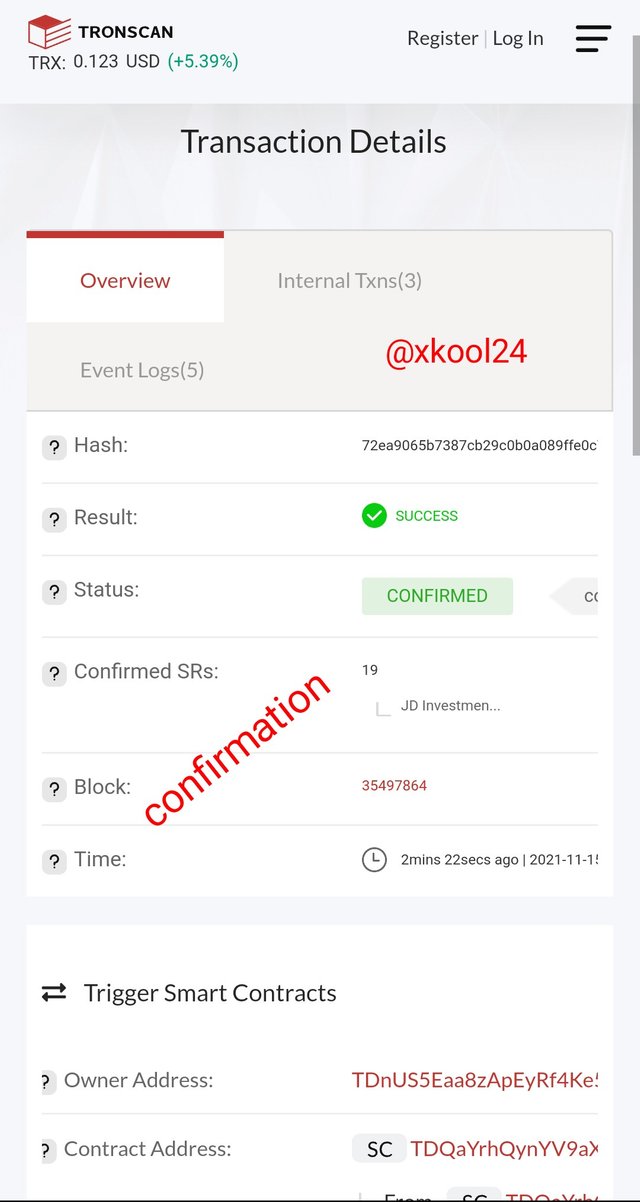

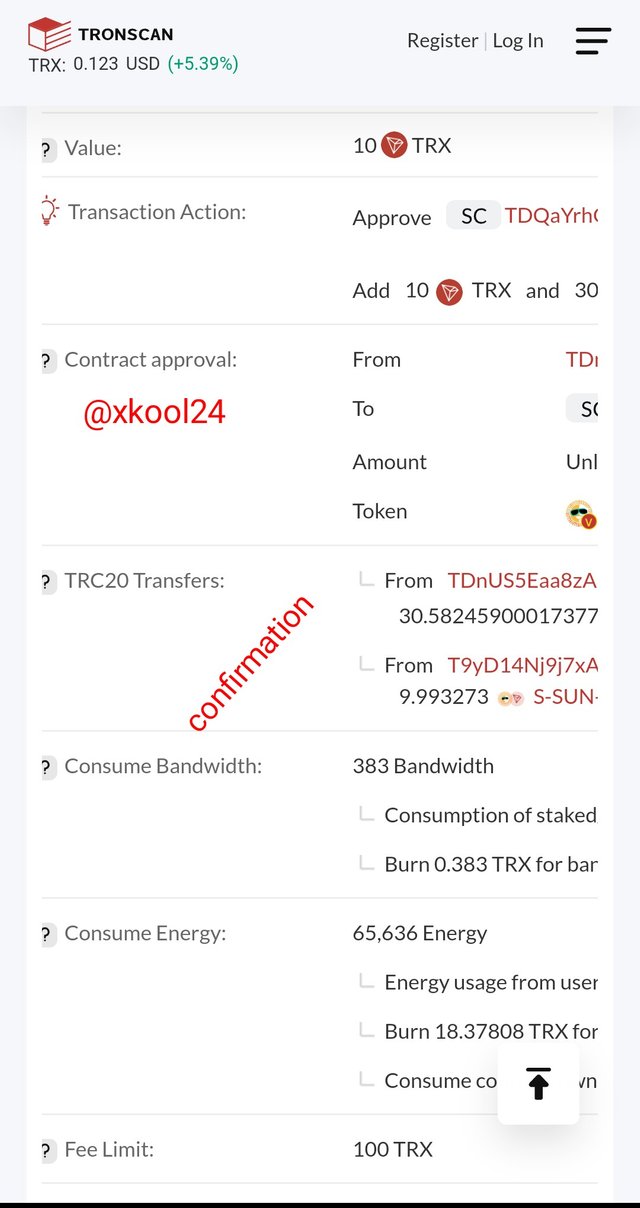

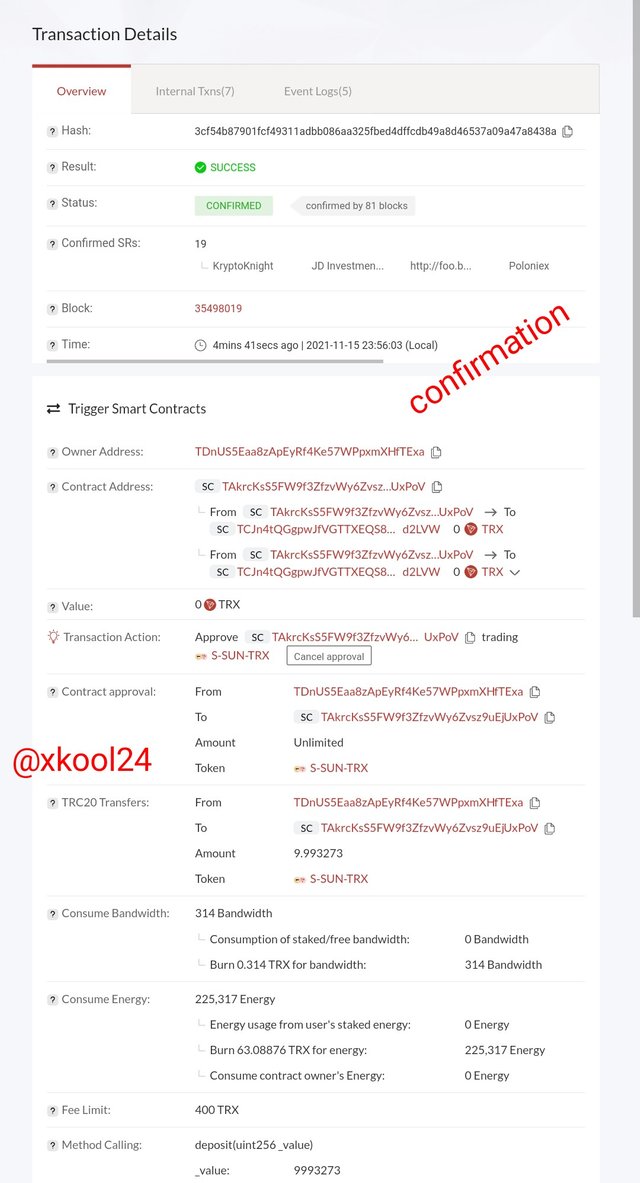

- Confirmation from TRON SCAN _Block explorer

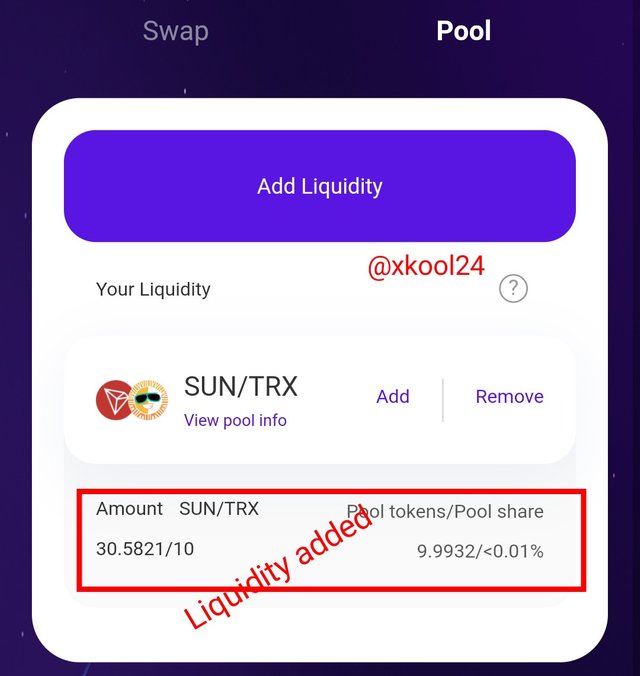

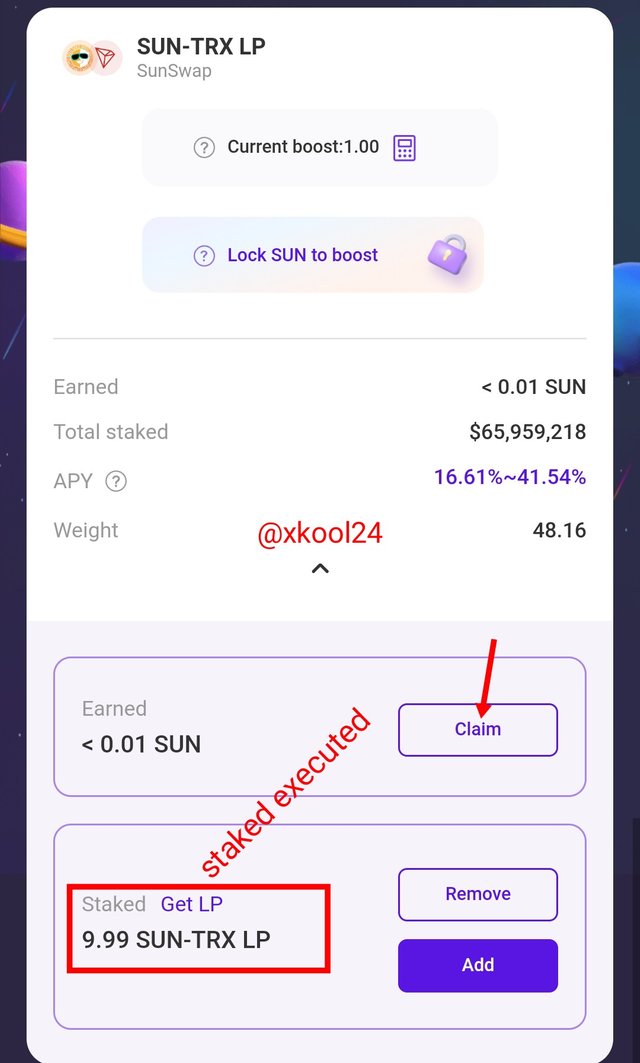

Staking the Already deposited Liquidity on the SUN-TRX Pair

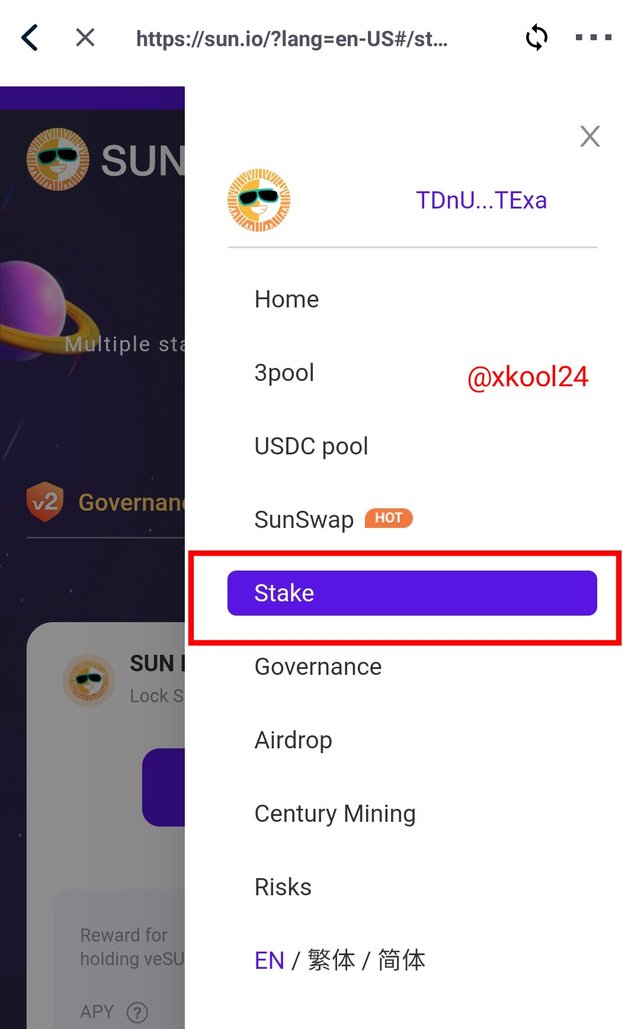

- Go back to the Menu button and click on the Stake option

- From the landing page, scroll down to the SUN-TRX LP option.

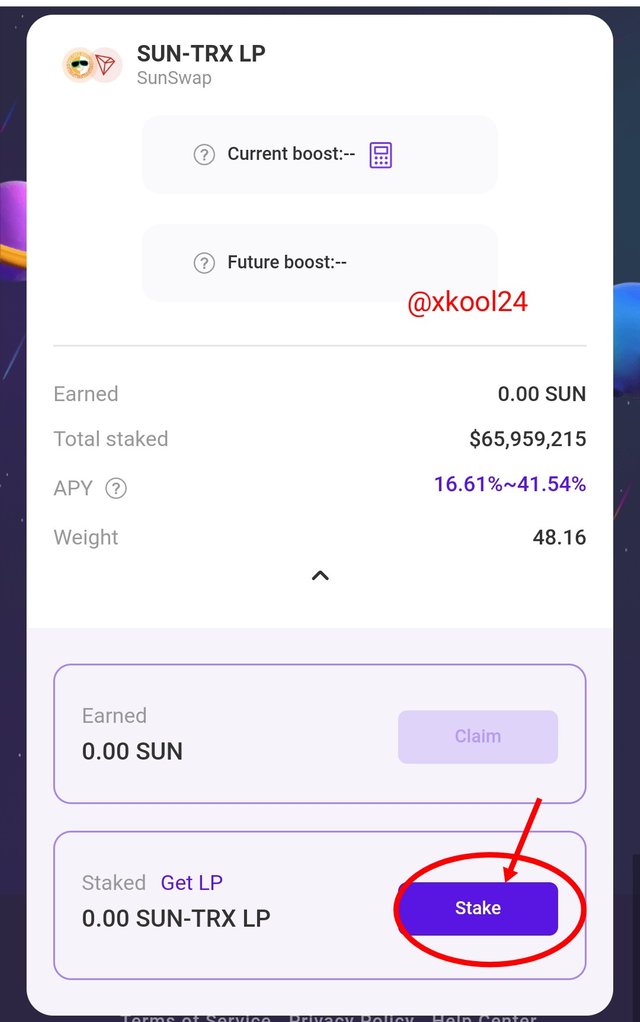

- Click on the Stake button

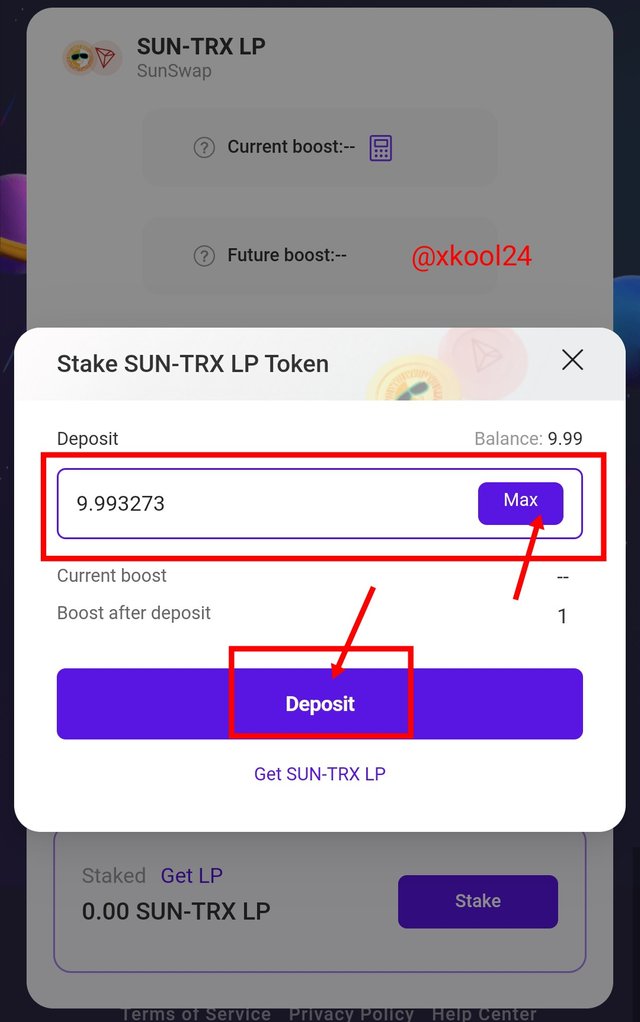

- Enter the required amount you desire. I will click on the MAX button

- Then click on the Deposit Button and sign the transaction

- we can already see that I have earned 0.01SUN to be claimed. 9.99 SUN-TRX LP was staked.

- Confirmation from TRONSCAN block explorer

(4) What is veSUN? What is the 3-in-1 benefit of holding veSUN tokens?

The Vote Escrowed SUN (veSUN)

The veSUN is a governance-related project in the TRON ecosystem as seen in phase 2 of the Sun.io protocol. The veSUN token allows users to acquire more voting rights during governance throughout the participant's need. Before a user can use this token adequately, the user has to stake this token for a minimum period of six (6) months or a maximum period of four (4) years.

Therefore a user would enjoy the full or partial benefits of the veSUN token depending on the periods in which it was locked up. Minimum benefits would accrue 12.5% of the veSUN token for 6 months period and Maximum benefits of 100% for 4 years which means that the user would get an equivalent amount of token staked.

Mining speed can be boosted with the use of the veSUN token which means that users now have an opportunity to increase their mining capacity by 2.5x max with extra rewards anticipated therein.

Holders of the veSUN are also placed on an advantage as 50% of stablecoins swap fees are distributed to all veSUN holders. And lastly, the great determinants of the Liquidity pool in the Sun.io have decided through the veSUN community voting which any holder of this token is a member. When this decision-making is made, the weight of Liquidity pools is adjusted therein which is also observed to happen every Thursday at 8:00 SGT.

What is the 3-in-1 benefit of holding veSUN tokens?

The veSUN token is observed with some benefits in which holders of these tokens enjoy at a given period. Just as earlier discussed above, the veSUN gives the user an edge in governance activities as far as Sun.io is concerned. These are 3-in-1 benefits observed in the veSUN:

- It helps to boost the Mining speed of the user to a high of 2.5 max. This entails that users can now have more accrued rewards just by this push.

- It offers 50% rewards generated from Stablecoin swap fees to all veSUN holders.

- the weight of Liquidity pools which is decided during community Voting is primarily done by the veSUN holders. Adjustment either upwards or Downwards is decided in this voting period.

(5) What is the stablecoin swap facility in Sun.io? How many different stablecoins are supported in the SUN platform? What is its use in the context of staking & mining?

The stablecoin Swap facility in Sun.io & Supported Stablecoins

The Stablecoin Swap facility in Sun.io is an interface that handles swap activities amongst the listed Stablecoins in the protocol. There are other Interfaces just like the Swap feature which can swap both the ordinary tokens and Stablecoins, hence the Stablecoin are restrictive to only Stablecoin tokens.

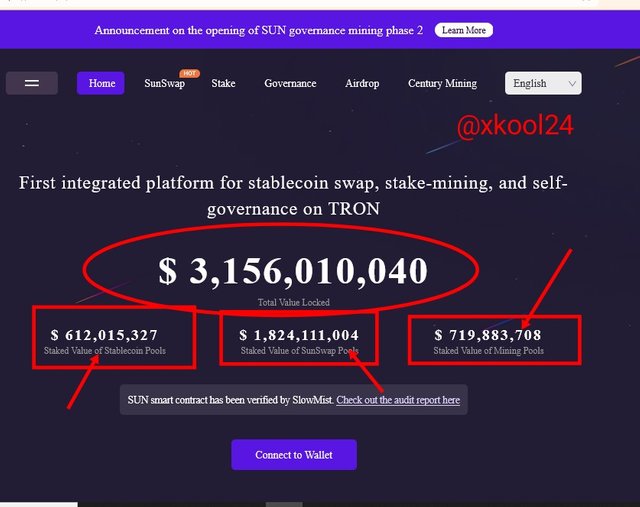

This interface can be accessed if we log in with the https://Sun.io, the landing page gives us a clearer view of how to use the interface. As of the time of this post, this platform holds the Stablecoin swap, Stake-mining, and self Self-governance of Tron valued at $3,156,010,040. The Stablecoin stake is valued at $612,015,327 with Sunswap Pools with $1,824,111,004 and $719,883,708 for Mining pools.

There are four (4) supported Stablecoins listed in the Sun.io which include;

- USDT

- USDC

- USD

- TUSD

Users can now easily swap to any of these stablecoins at will and in a more efficient way. In the facility, we have the 3pool which is a combination of three(3) Stablecoins namely USDT, USDJ & TUSD as well the USDC pool which comprises the USDC and 3SUN.

Total Deposits for Stablecoin are observed with a 7.75% APY while Stake has a whopping 41.55% APY.

The use of Stablecoins in Mining and Staking most especially is a concept that ameliorates liquidation of assets while in the pool. Just as the name is Stablecoin, they can retain their worth at any given period irrespective of the market forces and price volatility.

Conclusion

The acquisition of Justswap by Sun.io to Sunswap has brought about some improvements in its governance which users can now share 5/6th of transaction fees in the protocol with the remaining 1/6th value set aside for token burn. Users can as well receive 50% Stablecoin rewards on Swap fees but for participants with the veSUN token.

Thank you Professor @sapwood for your lessons

Written by: @xkool24

All screenshots are done through my Tronlink wallet.