Zethyr Finance - Crypto Academy / S4W8 - Homework Post for @fredquantum

Hello friends, it's a new week with new lessons shared in the SteemitCryptoAcacademy. I will be attending lessons presented by prof @fredquantum on Zephyr Finance.

- What is Zethyr Finance?

The Zethyr is a dApp built on the Tron Blockchain with a unique feature of distributing revenue to active users of its protocol. It has received a wide adoption percentage since its emergence that as well saw it ranked amongst the top 3000 DApps in use and top 130 in Exchange platforms.

It is primarily a Decentralized Finance (Defi) that allows participants holding tokens in the ecosystem to lend and borrow the TRX. Those who deposit their tokens in the system are also observed to be rewarded in the Zethyr Finance. These deposits made can in extension guarantee the need for a loan request as well in the system. This loan request at this time is backed up by the collateral deposits already made.

The Zethyr Finance ecosystem allows its users to collateralize their Tron assets to borrow TRX or any of the available assets. Lending also in the ecosystem can be assumed as a collateralized asset for borrowing.

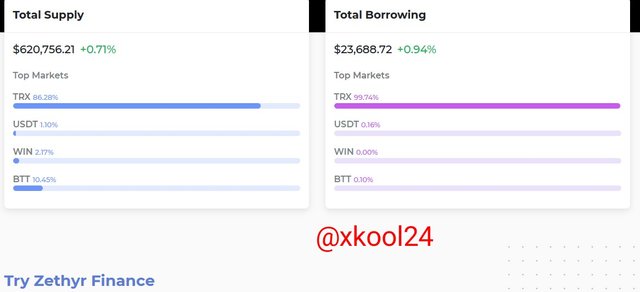

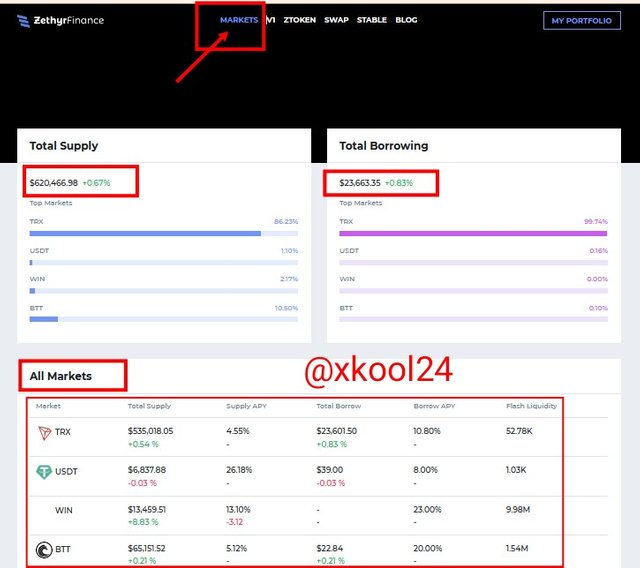

At the time of this report, the Total Supply and Borrowing in the Zethyr Finance stands at $620,751.22 and $23,688.72 respectively with TRX, USDT, WIN, and BTT representing 86.28%, 1.10%, 2.17%, and 10.45% respectively.

This also sees borrowing of TRX, USDT, WIN, and BTT assets with 99.74%, 0.16%, 0%, and 0.10% respectively. We can also see the integral representation of these assets relative to their APY and Flash Liquidity.

2- What are the features of Zethyr Finance? Discuss them. What's your understanding of DEX Aggregator?

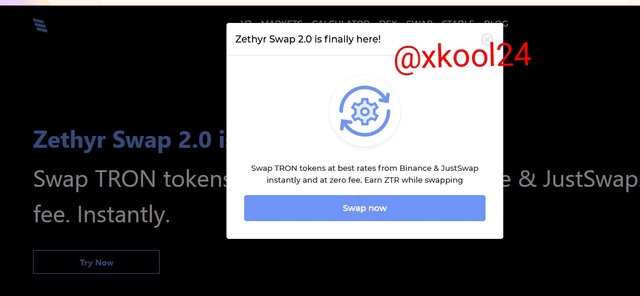

The Swap / VI feature

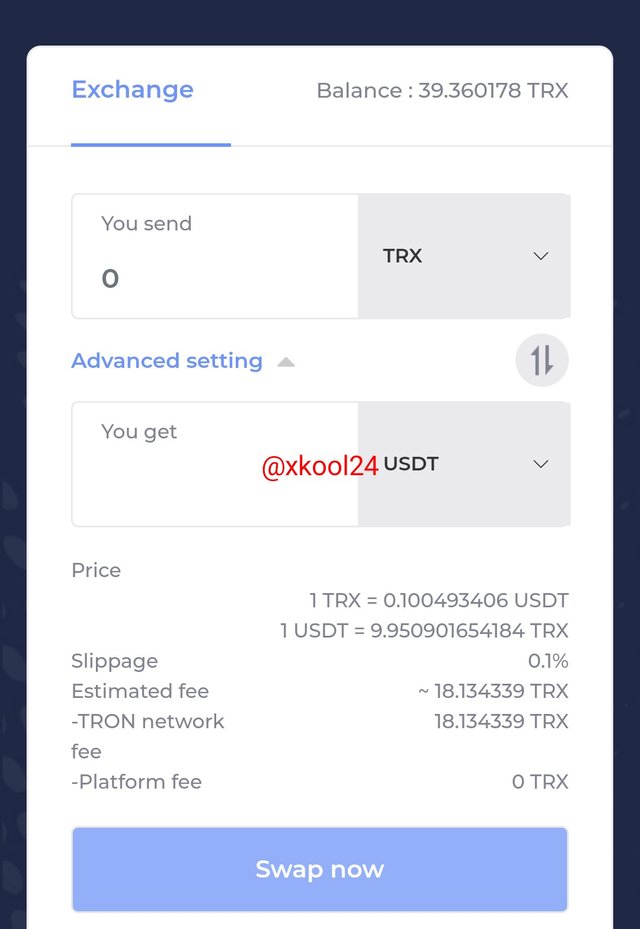

This is the Zethyr Swap feature that uses the Zethyr version 2.0 to swap tokens in its a system. This gives instant and zero fees of Tron assets at best rates when swapped using the Binance and Justswap platforms.

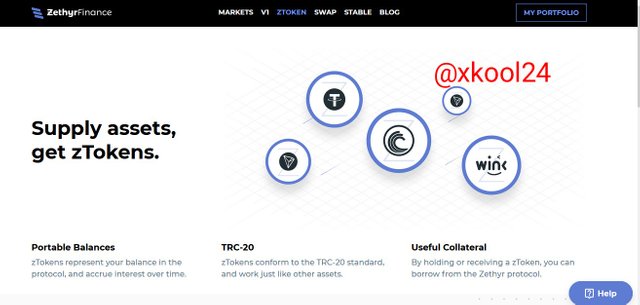

The tokens

When we engage in lending most especially, rewards are paid via the transaction fees to the Liquidity Providers and this is done with the tokens. Interest accrued throughout interacting with the Zethyr protocol is done via the tokens. They conform with the TRC-20 standard token and represent the regular native token on the ecosystem. This can also guarantee collaterals should In case we want to borrow from the Zethyr Finance.

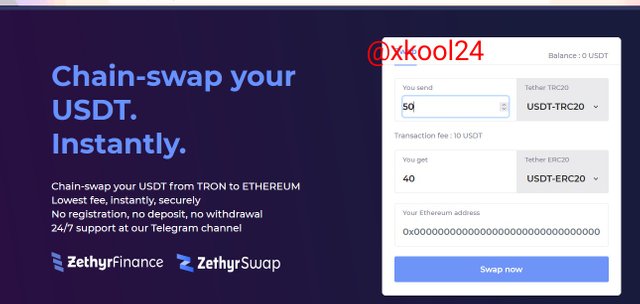

The Stable Feature

The Zethyr Finance and Zethyr Swap were able to come up with the protocol that allows the swapping of stable coins from the TRC-20 to ERC-20 in its Blockchain. This is a welcomed development as it allows for wide use cases and the adoption of the protocol.

From the swap exchange interface, it shows that for every amount to be exchanged, there is a 20% fee charge. For Example, when I entered 50USDT of TRC-20, I am expected to receive 40USDT of ERC-20. This is means, we have to be intentional when using this feature given its relatively high fees. But in All, it guarantees relative scalability and security of assets.

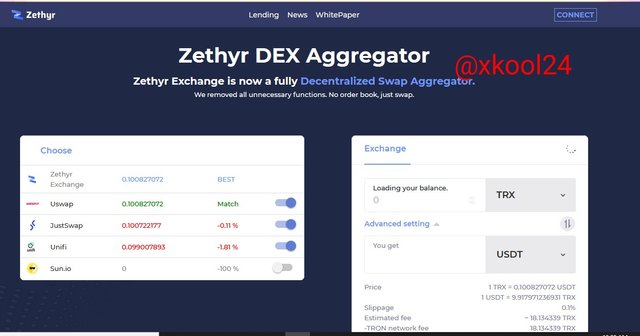

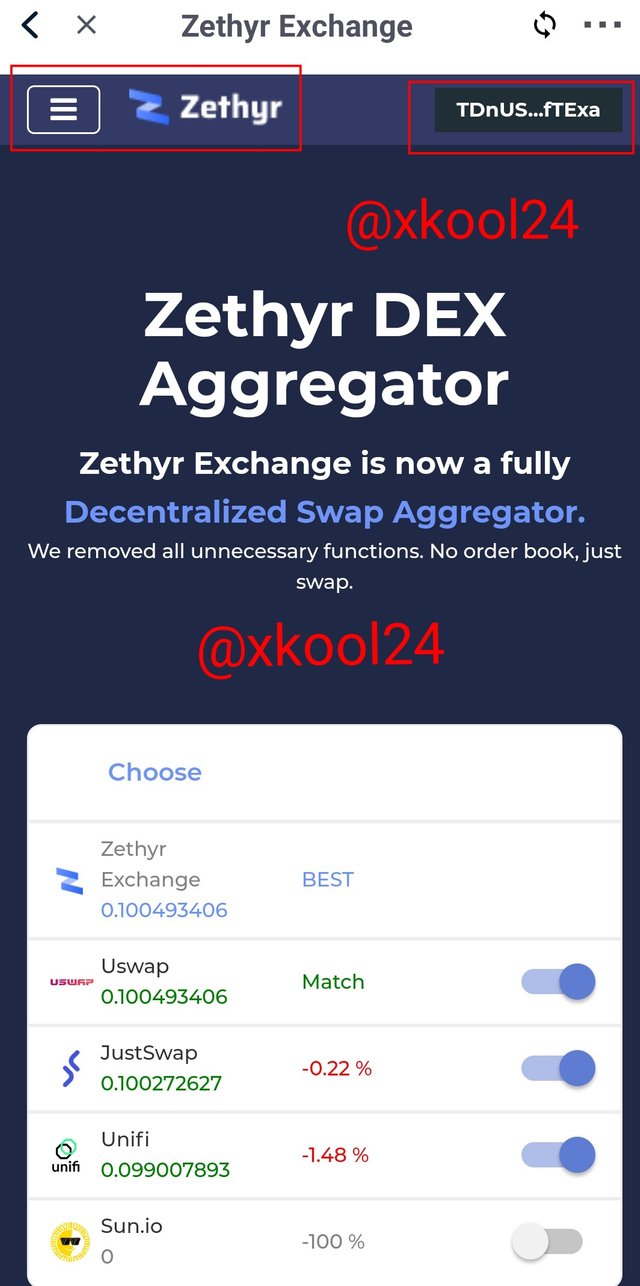

The Zethyr DEX Aggregator

Before the introduction of the Zethyr version 2.2.8, participants has been interacting with the Zethyr protocol based on data recoded which deals with the use of theOrder book Model. But this was changed after the new version launch which saw the Zethyr Exchange merged with the Zethyr Swap protocol.

This merger gave rise to the DEX Aggregator we have in Zethyr Finance today. This means that the protocol does no longer use the Order book Model for its operation rather all swap and exchange activities can now be done on the Zethyr DEX Aggregator and with the best exchange rates.

The Zethyr DEX Aggregator compiles all the different exchanges and swaps and comes up best rates suitable for users' adoption. As of the time of posting, we have the Justswap and Uswap on the Zethyr DEX Aggregator with Sun.io still in view.

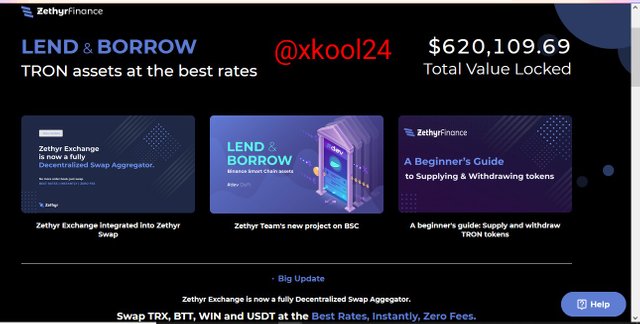

The Lend & Borrow Feature

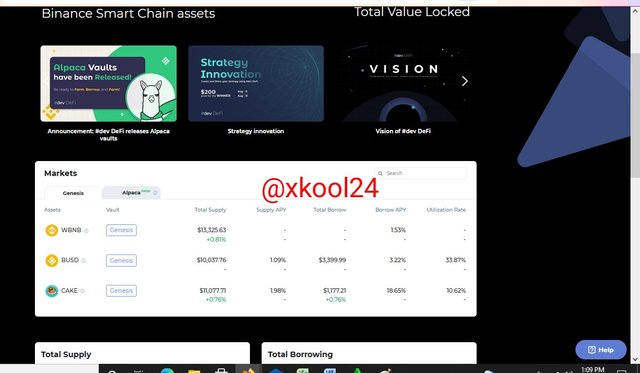

This happens to be one of the primary mainstays of Zethyr Finance where users can provide Liquidity to the ecosystem as well as earn a reward (interest) on token locked. As of the time of post, the total locked value is $620,209.69.

We have in extension the Binance Smart Chain assets like WBNB, BUSD, CAKE, etc all in the pool.

3- Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

Exploring the Zethyr Finance Market

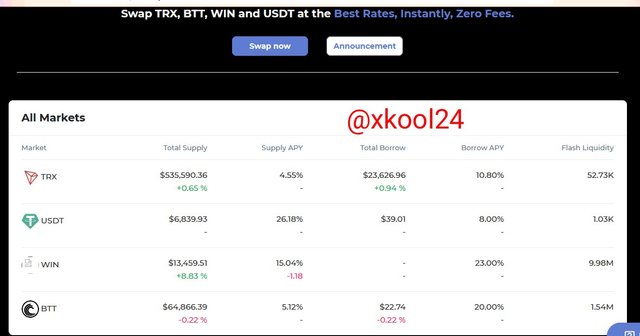

In exploring the Zethyr Finance Markets, we need to launch the interface protocol using the https://zethyr.finance/#/.

From the landing interface, click on the market feature on the screen top. This will land is into the interface having the Zethyr Finance market details.

From the interface, we can observe that Total Supply stands at $620,457.97 with Total Borrowing at $23,633.35. This also went further to give is the intrinsic value of those assets that make up the Zethyr Finance ecosystem which is built on the Tron Network.

We have the TRX, USDT, WIN, and BTT with supply values and Borrowing values as listed below:

| Token (Asset) | Supply Value & %Value | Borrowing Value & % value |

|---|---|---|

| TRX | $535,081.05 (86.23%) | $23,601.50 (99.74%) |

| USDT | $6,837.88 (26.18%) | $39.00 (0.16%) |

| WIN | $13,459.51 (2.17%) | $0.00 (0.00%) |

| BTT | $65,142.52 (10.50%) | $22.84 (0.10%) |

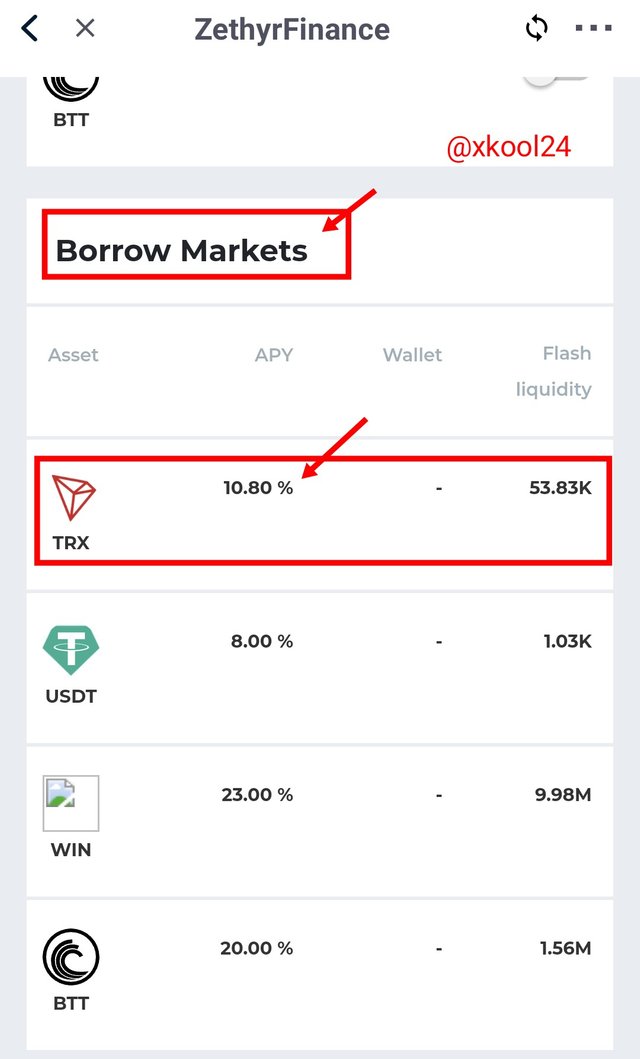

We can observe that there's mass adoption of the TRX asset both in the supply and in the borrowing wing. Maybe this has a relatively low borrowing %APY of 10.80%.

We can also observe the Supply %APY following a pattern. The lower the supply percentage %APY, the higher the total supply captured. This also follows suit for the borrowing %APY. The lower the percentage APY, the higher the adoption.

| Token | Supply APY | Borrowing APY |

|---|---|---|

| TRX | 4.55% | 10.80% |

| USDT | 26.18% | 8.00% |

| WIN | 13.10% | 23.00% |

| BTT | 5.12% | 20.00% |

The %APY for the given asset is observed to directly correlate with the rate of token adoption, be it in the Total Supply or total Borrowing. In addition, we can see that thee USDT has the best Supply as well the best Borrowing %APY with 26.18% and 8.00% respectively.

4- Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

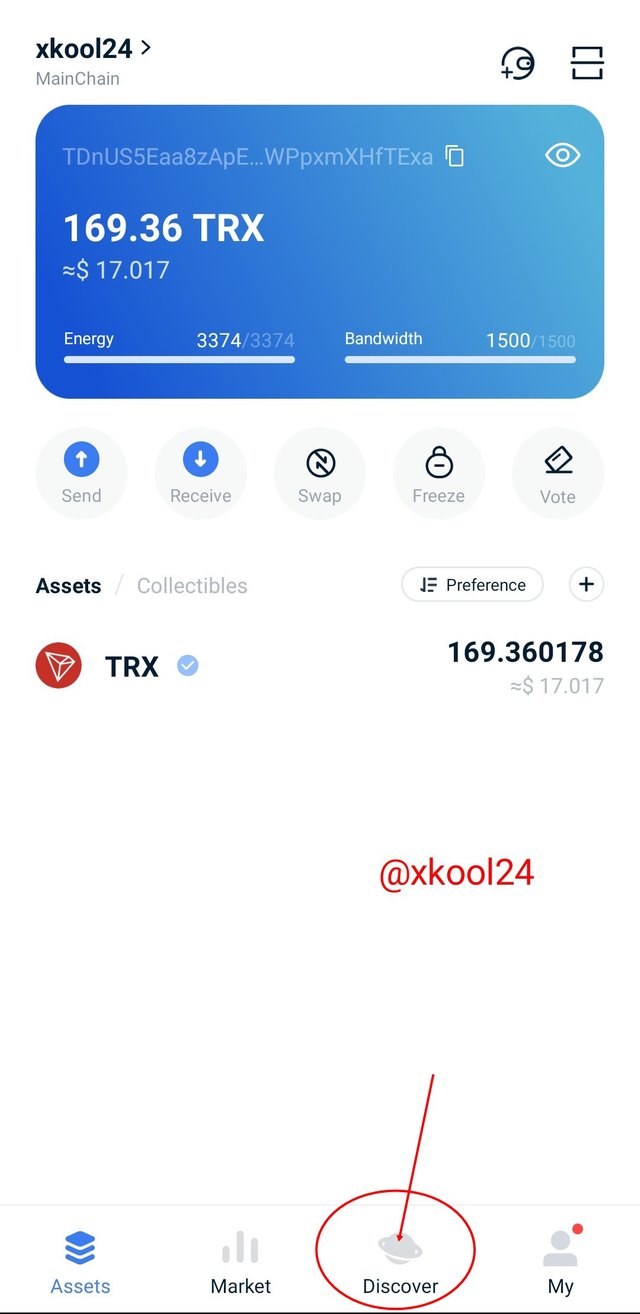

I will be demonstrating this using the Tronlink wallet App on my device.

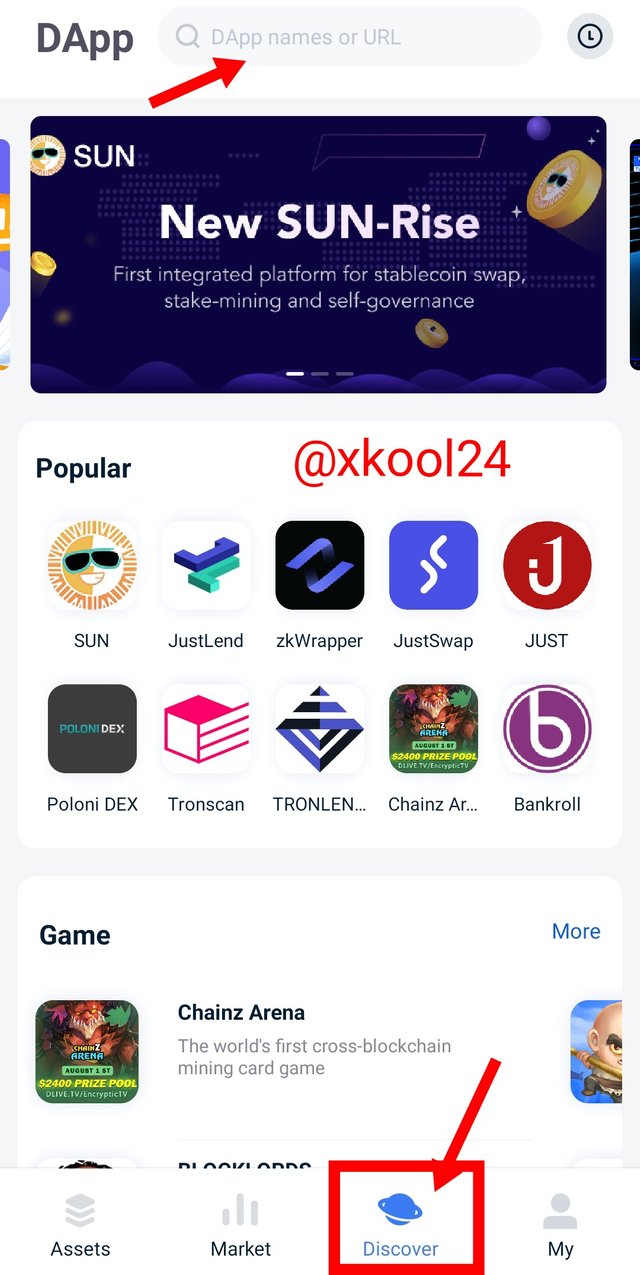

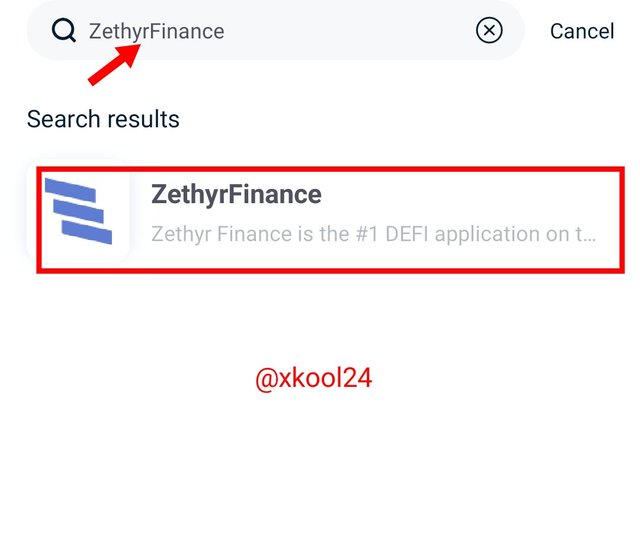

- launch the Tronlink wallet App

- Click on the Discover icon below your screen

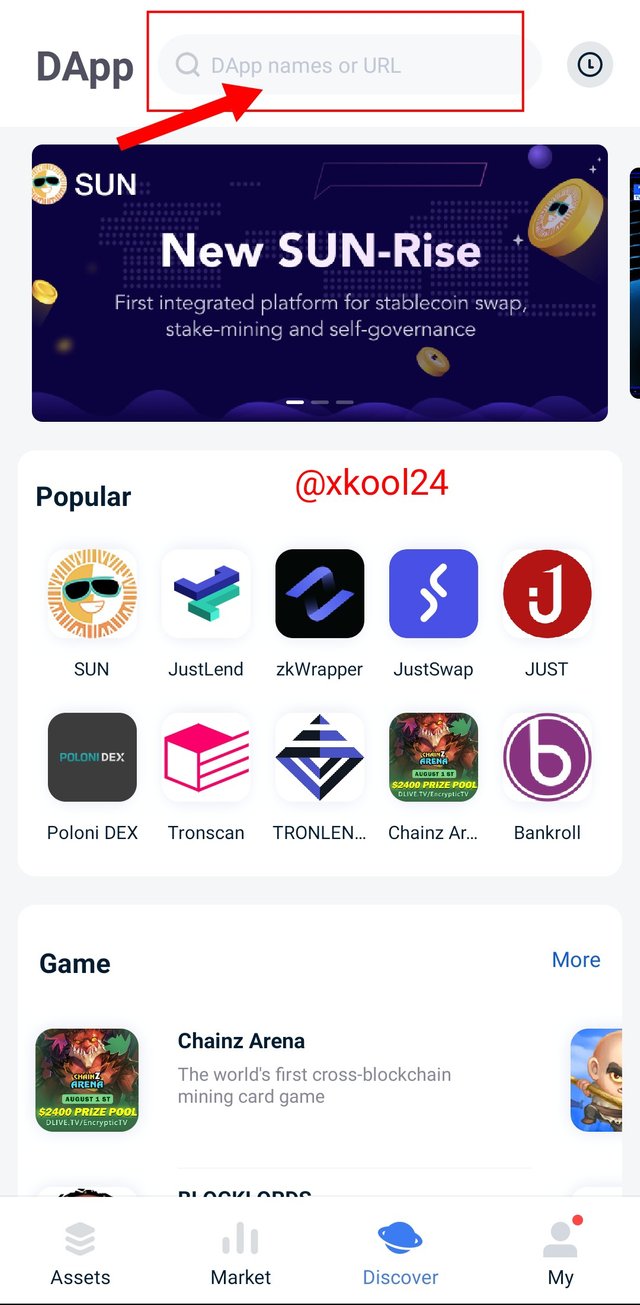

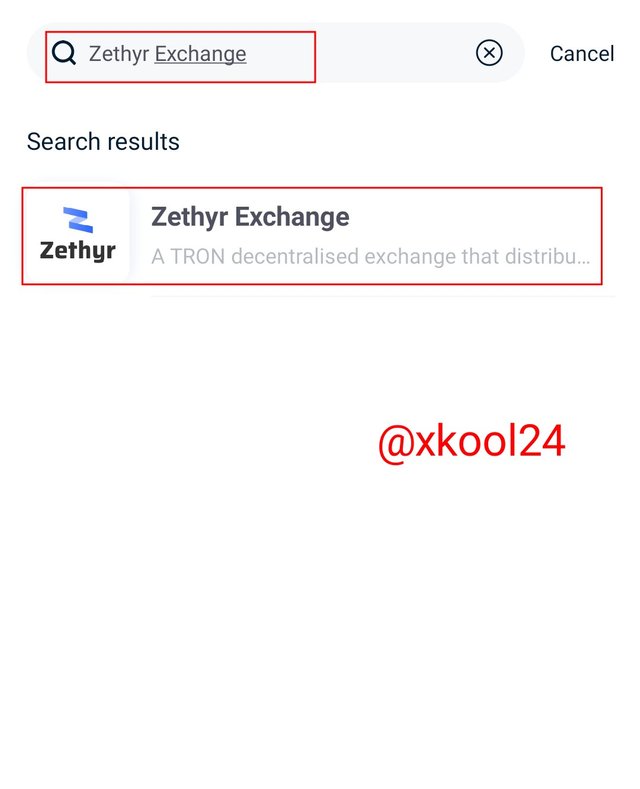

- Go to the search box on the top screen and enter Zethyr Exchange. Click on it to launch the dApp

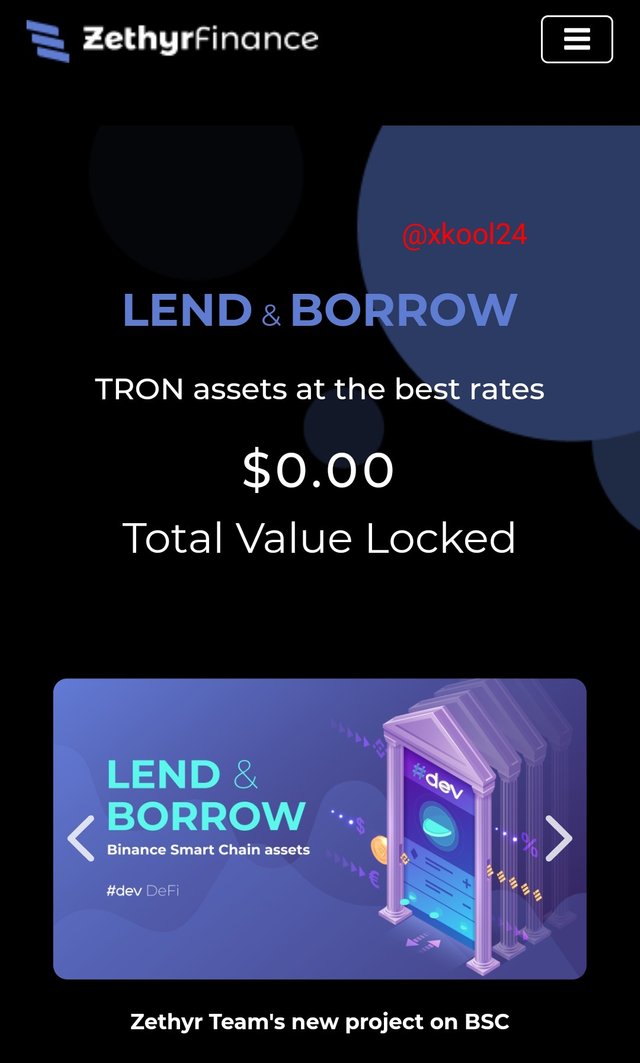

- from the landing page now, we can observe that the dApp is connected with my Tronlink wallet account.

- And when we scroll down we can see more of the screen interface with the exchange phase.

With this connection, one can now interact between the Zethyr Exchange and the Tron Network using the Tronlink wallet App.

5- Give a detailed understanding of token and research a token of another project that serves the same purpose as it.

The tokens in Zethyr Ecosystem

The Zethyr (ZTR) is a TRC-20 standard token given to its operation and governance built on the Tron Ecosystem. With this, holders of this token can vote, and propose changes in the protocol. This makes way for the tokens in the system which applies to all the acceptable collateral assets in the Zethyr ecosystem.

Deposits of these acceptable collateral assets like the TRX, USDT, WIN, and BTT tokens are all represented in the token nomenclature once they are interacted with in the Supply pool or Borrowing pool. A corresponding value of tokens is released or minted in the same vain which may either be zTRX, zUSDT, zWIN, and BTT tokens.

The tokens when minted or released when are pegged in a ratio of 1:1 relative to the underlying assets deposited in the Zethyr platform. Just the way they are minted upon a given deposit, they are as well burned when they are redeemed.

But just for us to note that the tokens are freely stored, traded, and also transferred since they derive their value and functionality from the underlying asset. More importantly, when a user provides Liquidity (Supply) to the system, the accrued interest generated is also paid in equivalent tokens amounts. This would be minted and sent directly to users' wallets.

Lastly, the tokens present in the Zethyr ecosystem are observed to enjoy all corresponding benefits derived from the underlying asset which it represents.

Another Similar Token (jTokens)

The jTokens is also another utility token found in the Tron Ecosystem relative to its use case in the JustLend protocol. The JustLend protocol is a central money market built on the Tron Network specifically to create a pool of funds where borrowing and lending of Liquidity would take place.

The JustLend enables a protocol that allows the borrowers and depositors( Liquidity Providers) to interact in such a manner that floating interest is paid or earned respectively. This earned interest comes in the form of tokens which is equivalent to the underlying asset in which was initially deposited.

Tokens supplied to the market are observed to be jTokens which is a TRC-20 standard token

Holders can acquire this corresponding joke which also draws its benefits the same as the underlying asset.

6- Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

I will give us an explicit step-by-step process while illustrating this process.

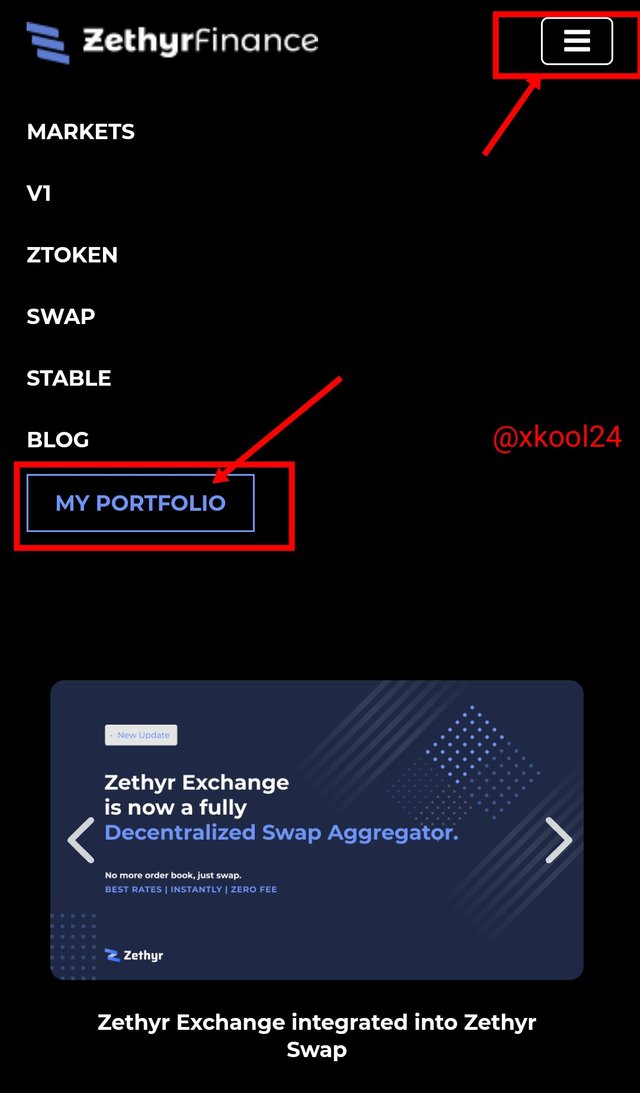

Connecting & Enabling the Supply Asset Pool

- launch your Tronlink App

- quickly Click on the Discover icon below the screen

- Enter the Zethyr Finance in the search box

- we can see that we are already connected with the dApp & Tronlink wallet.

- Click on the three parallel lines on your top left to confirm the account has been connected.

- then click on portfolio and click on the supply option

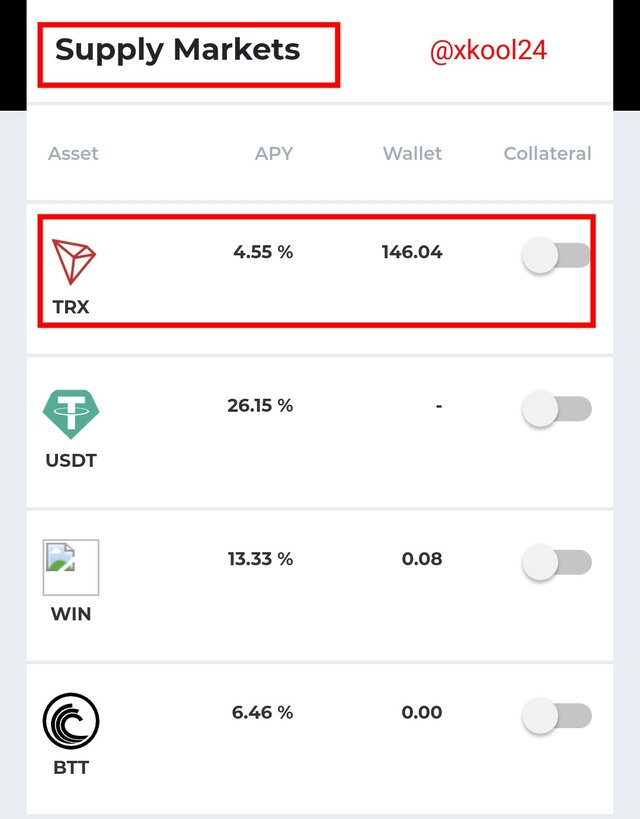

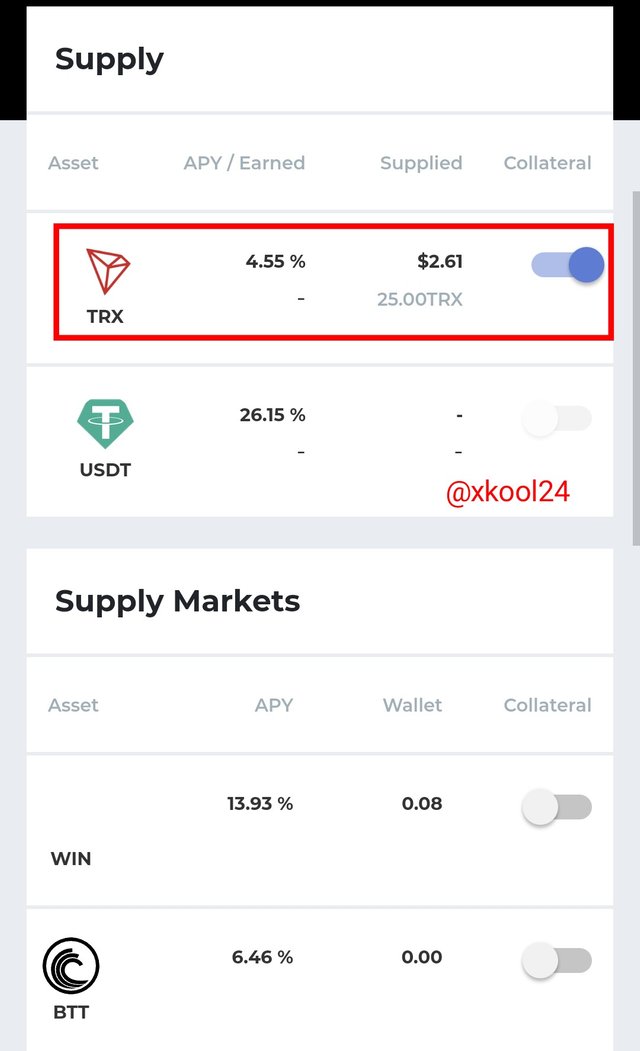

- I will be using the TRX token since I already have the assets in my wallet. Therefore click on the asset.

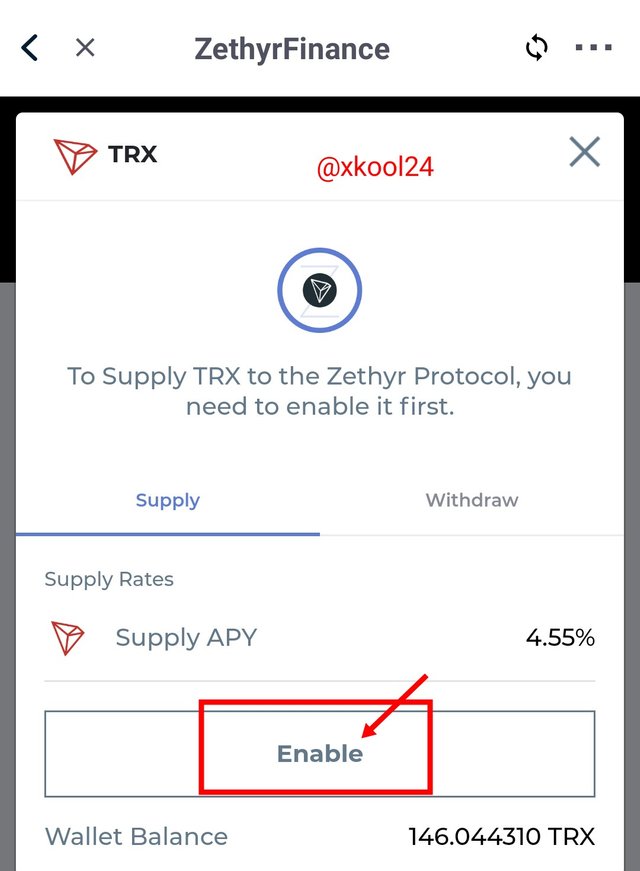

- Click on the supply option and then click on the enable button

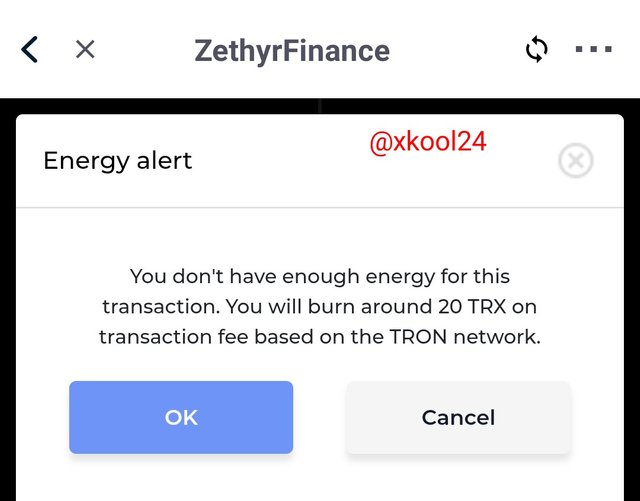

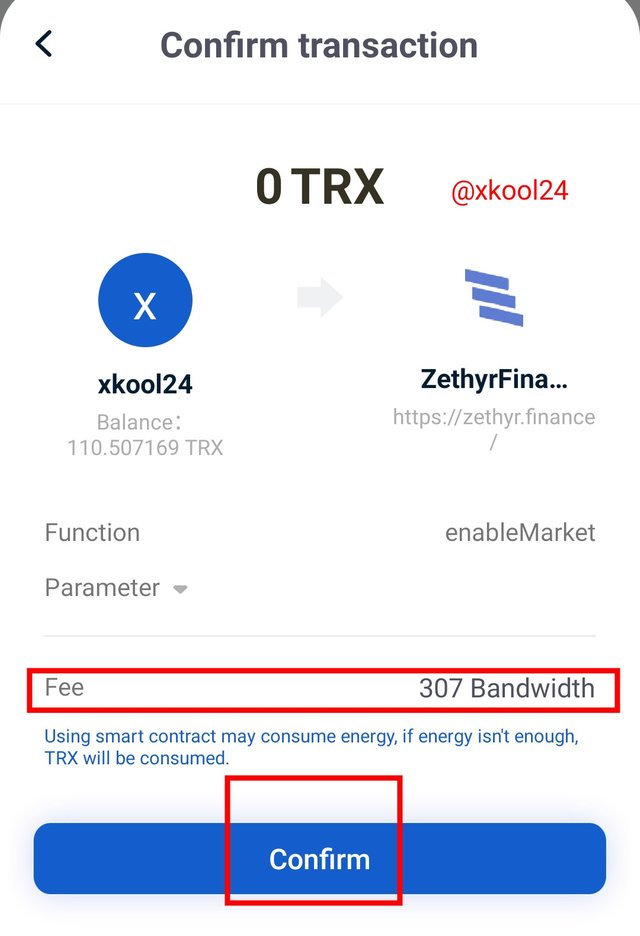

- I will be Burning 20 TRX as a transaction fee

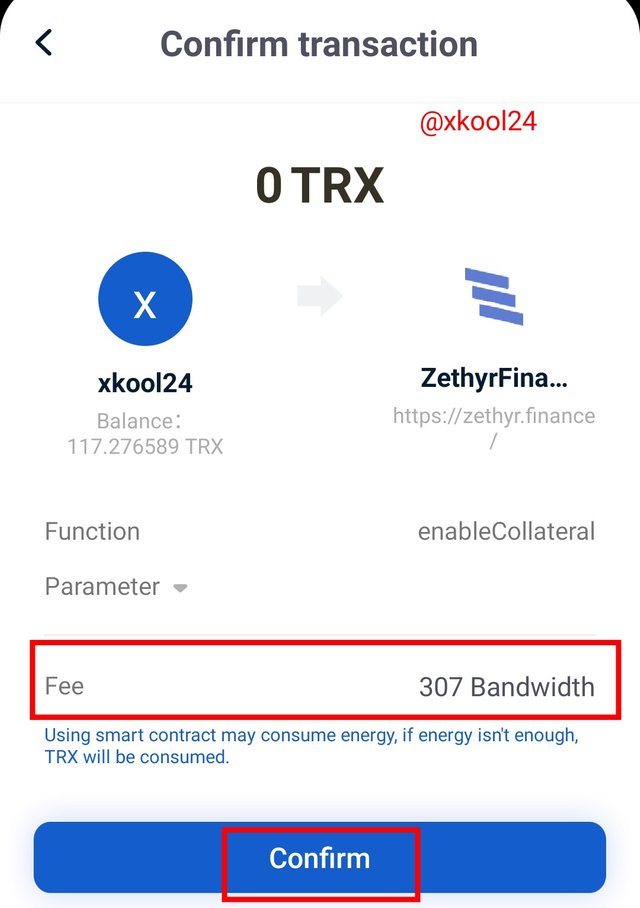

- Also is a 307 Bandwidth fee required

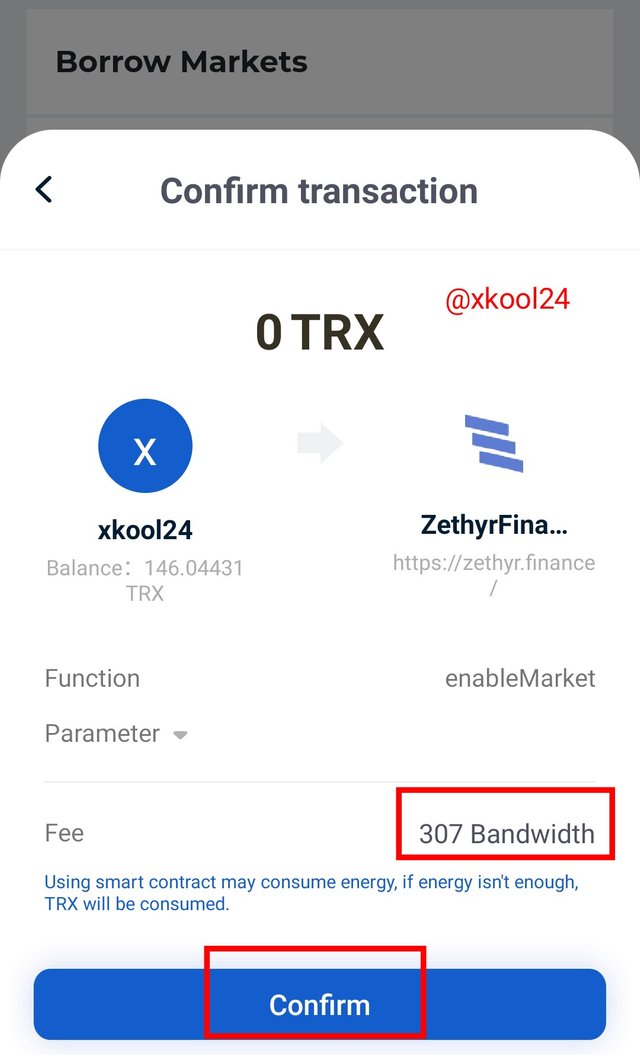

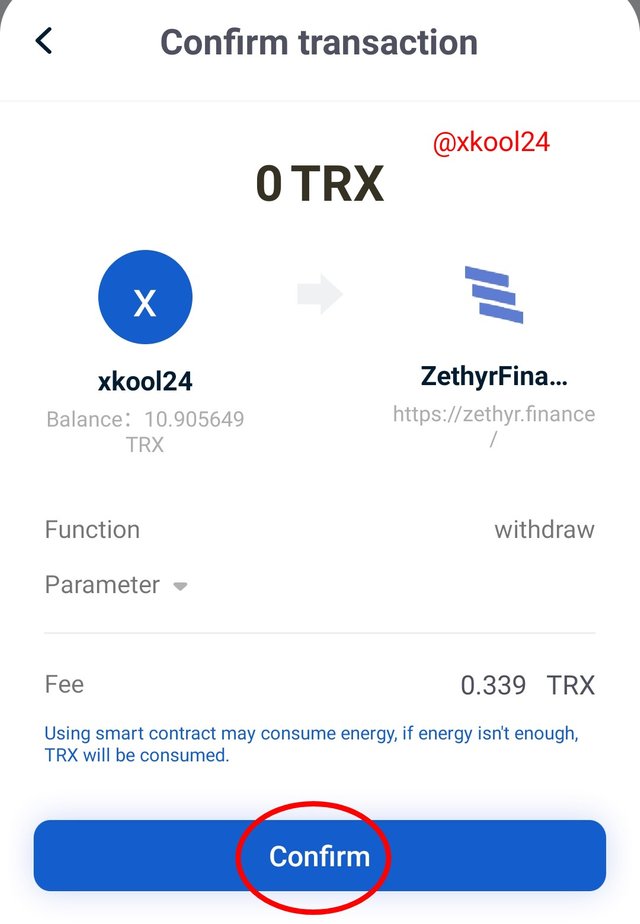

- then Click on Confirm

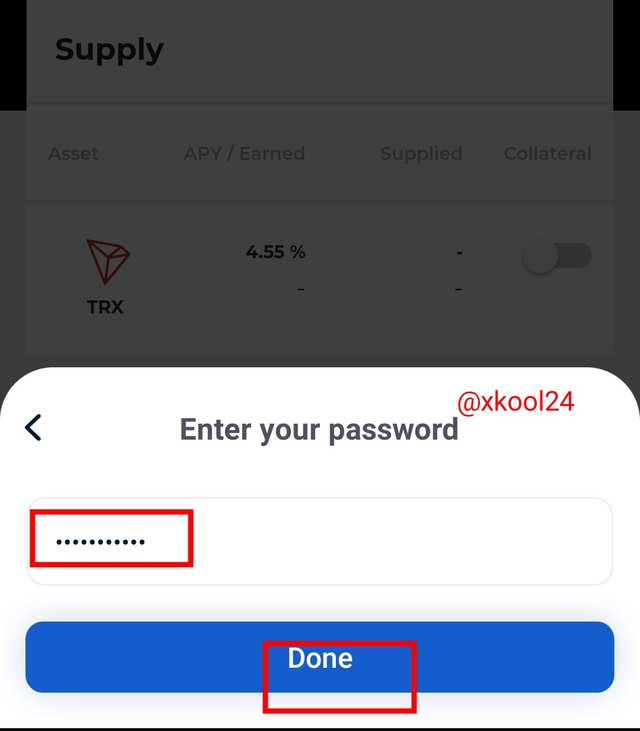

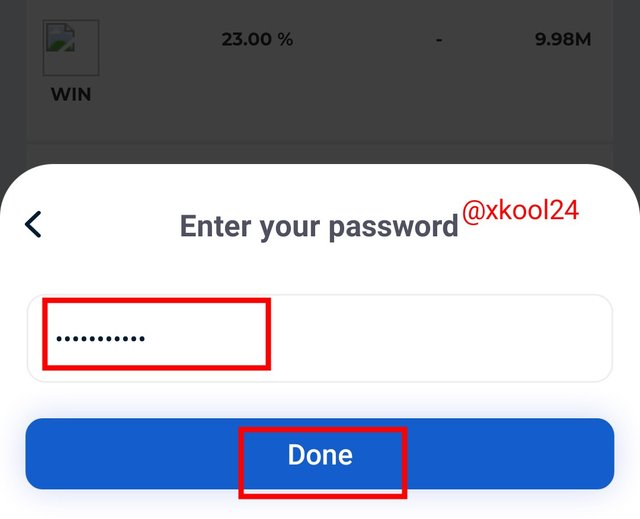

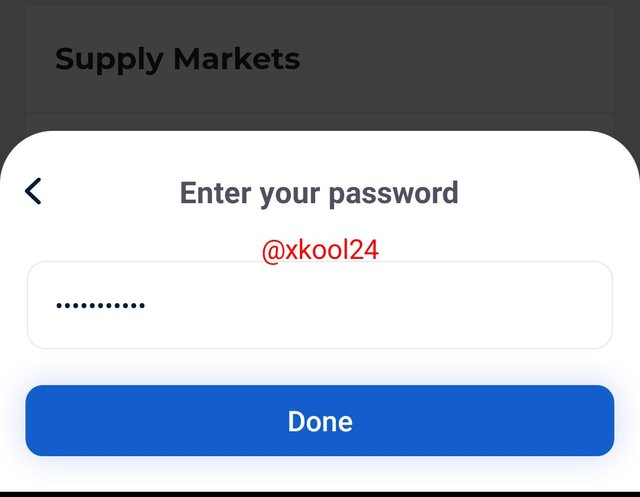

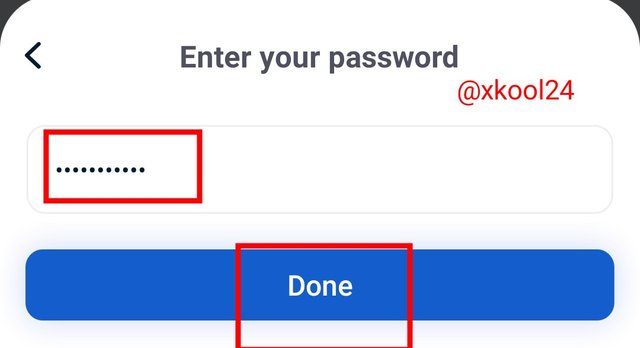

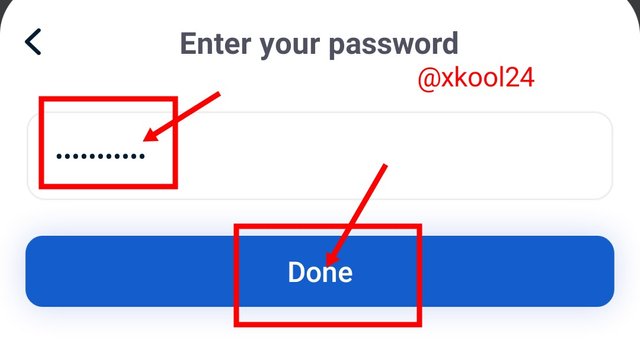

- Enter Password to sign the transaction.

In continuation of this process after enabling the supply asset pool, we have to also repeat the process for the Borrow Asset option.

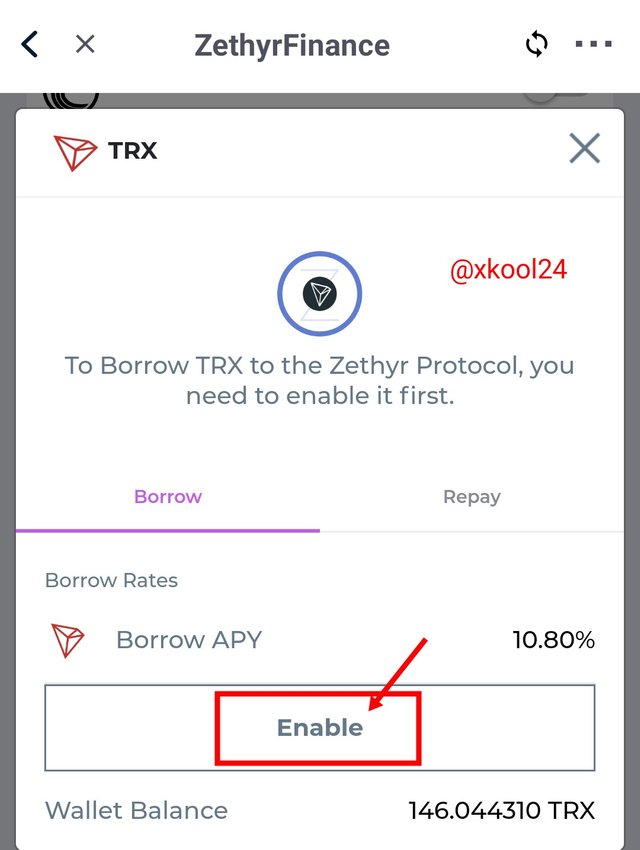

Enabling the Borrow Asset Pool

- Click on the TRX assets

- Click on the enable button

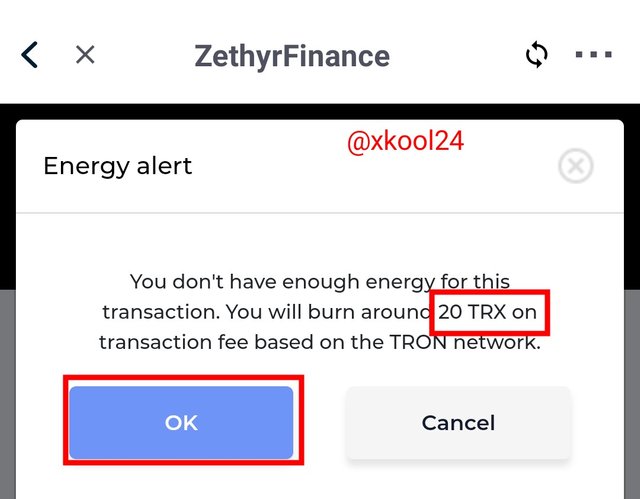

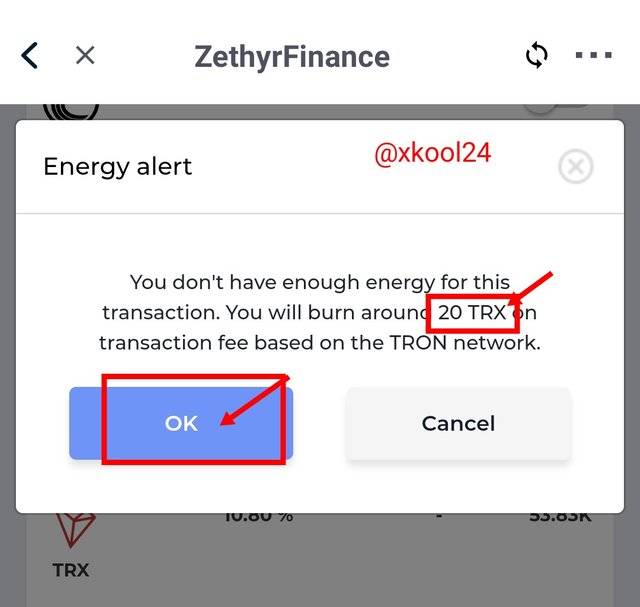

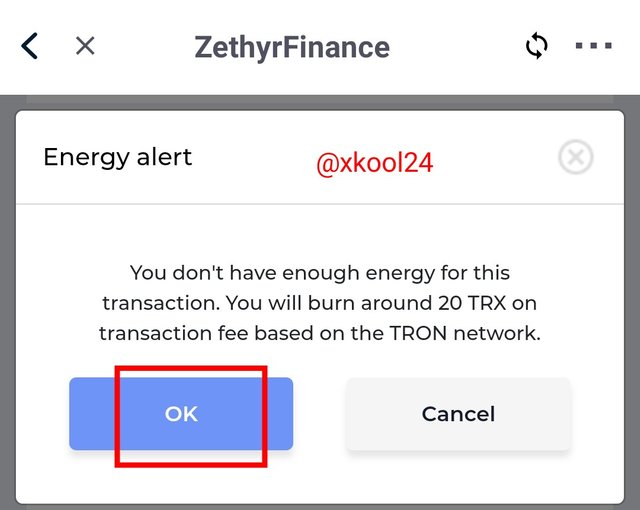

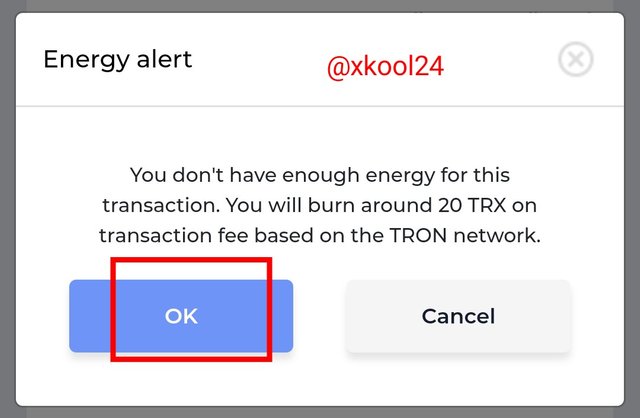

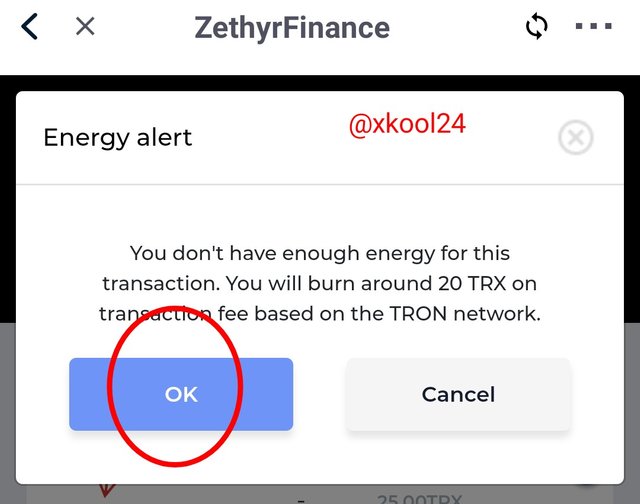

- Click on OK (20 TRX fee required)

- Click on Confirm

- Enter your password to sign the transaction

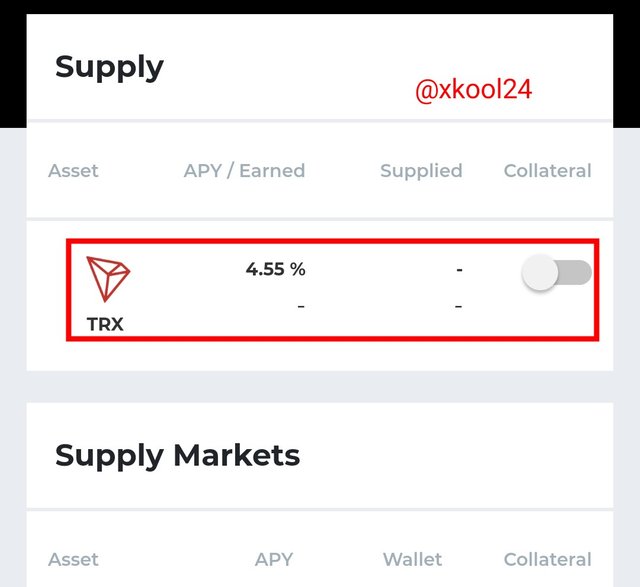

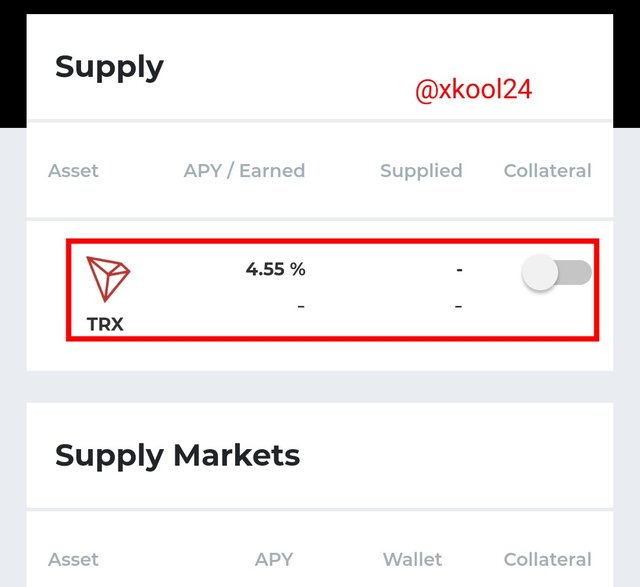

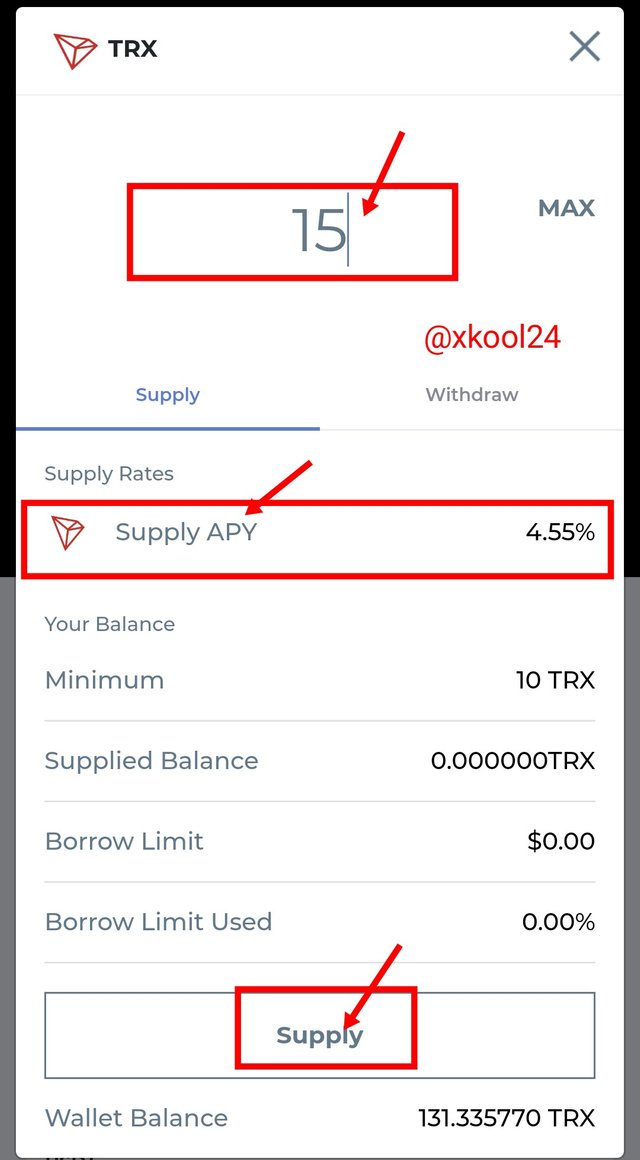

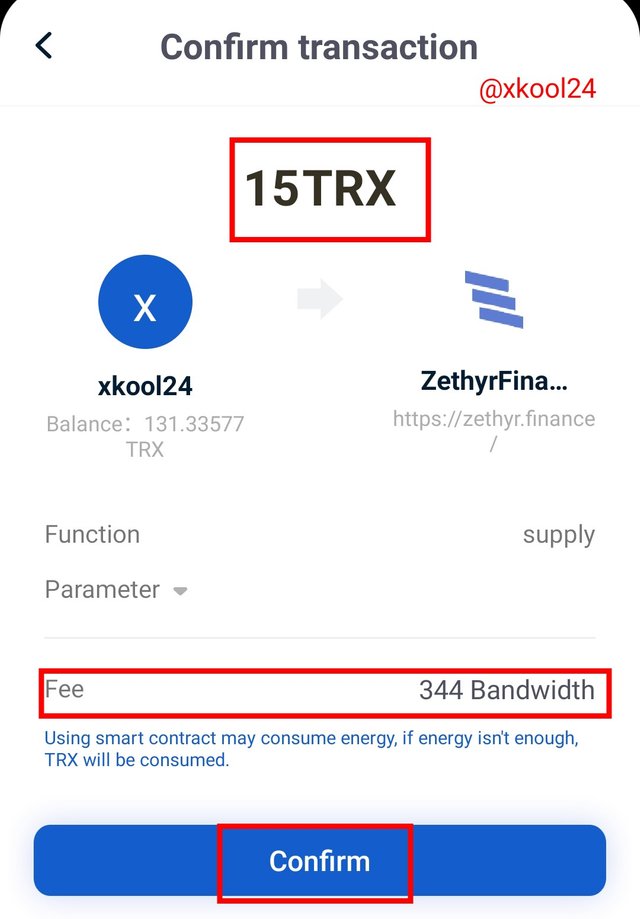

Supplying TRX asset in the Zethyr Finance

- Click on the Asset

- Enter the TRX value to be supplied

- we have a supply APY of 4.55%

- then Click on the supply button

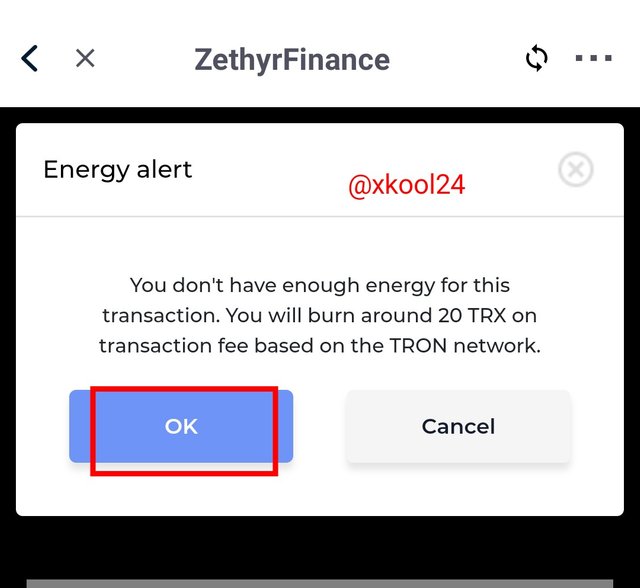

- Energy required to burn transaction 20TRX

- Click on Confirm

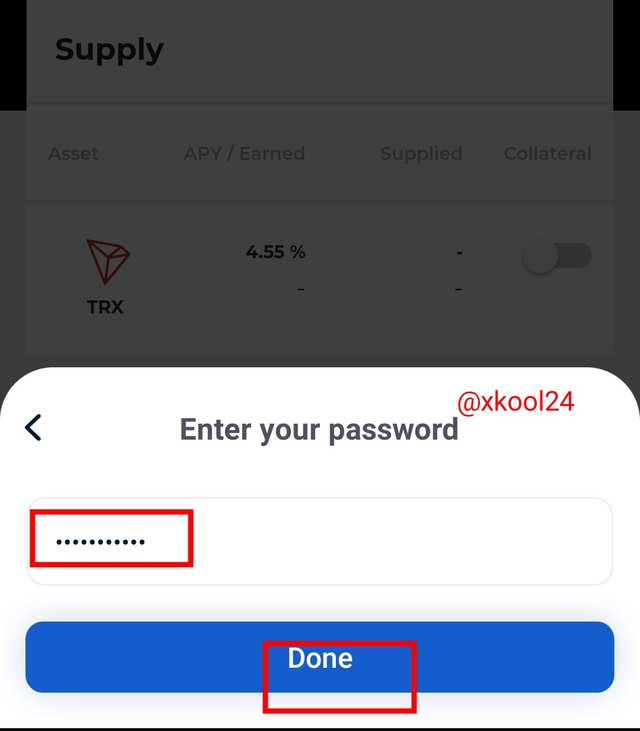

- Enter your password to sign the transaction

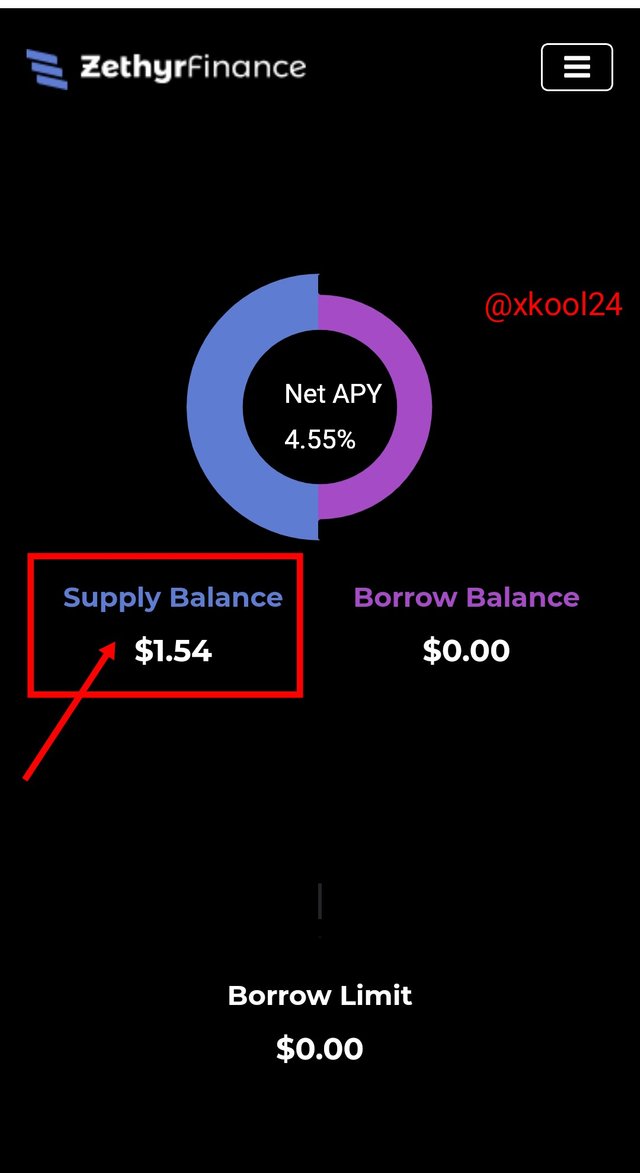

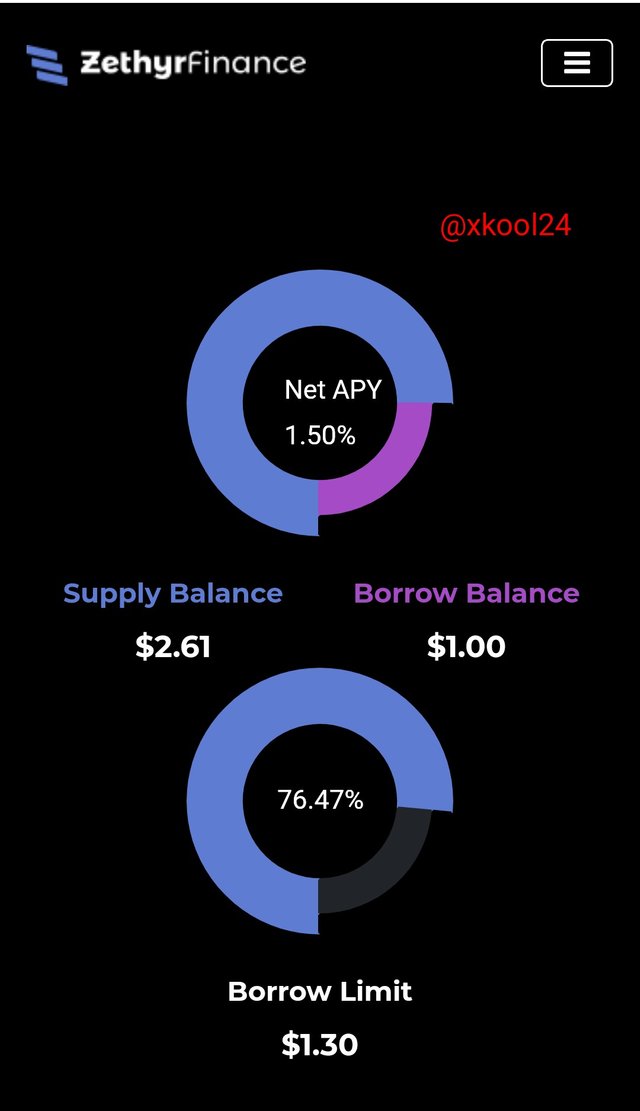

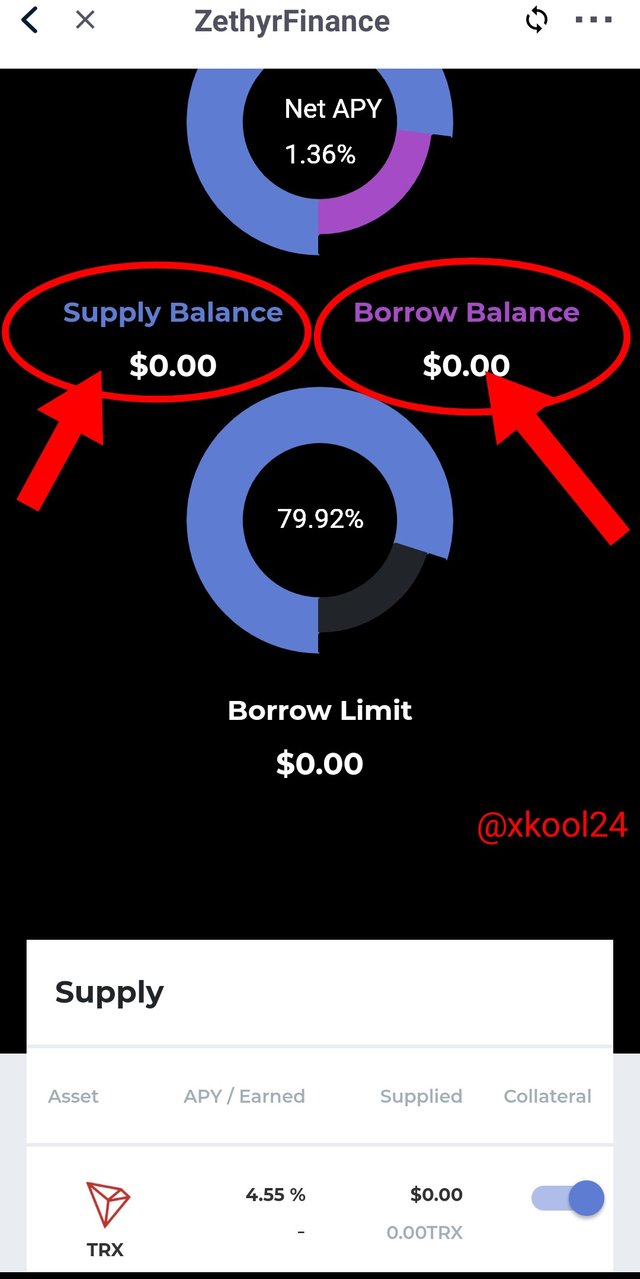

- We can observe that this has been successfully supplied. With a supply balance of $1.54

- See a confirm link below.

Link to this transaction done

https://tronscan.io/#/transaction/2da520288d5914c19ef032d0c983860acd4cc9c59949191c9990ae814e6a6df4?lang=en

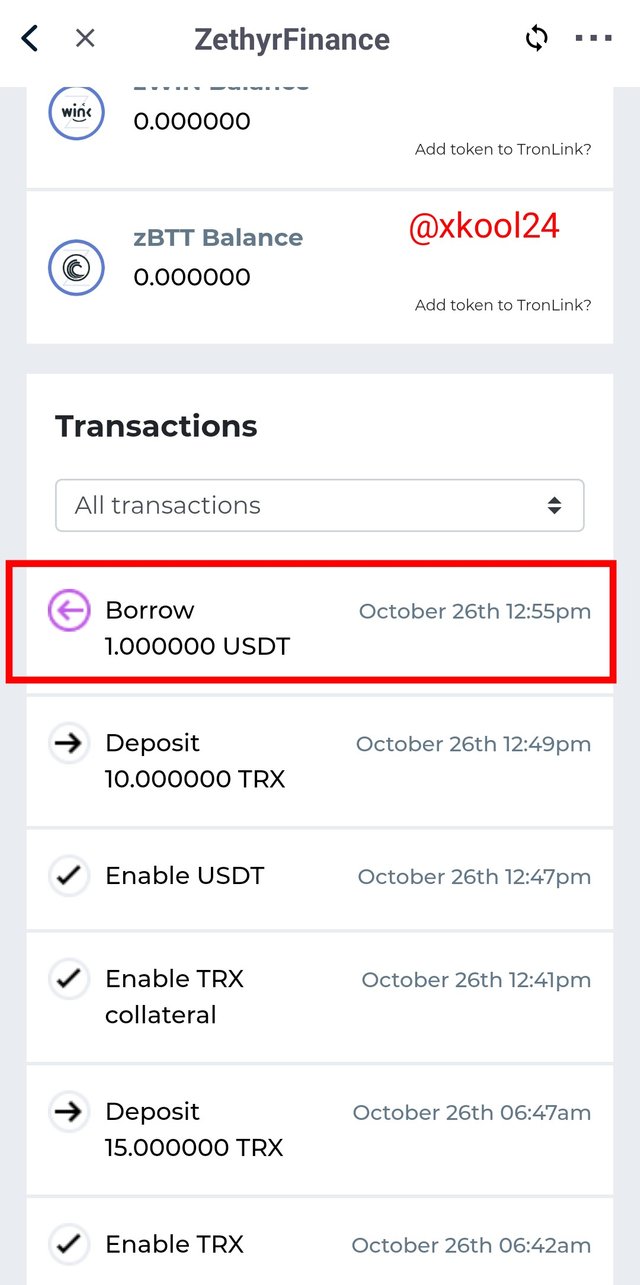

7- Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

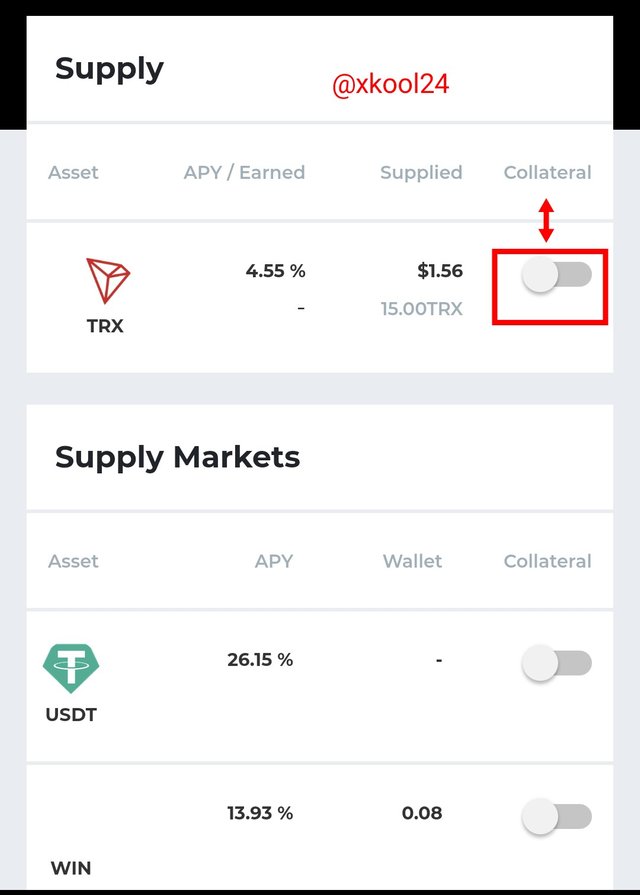

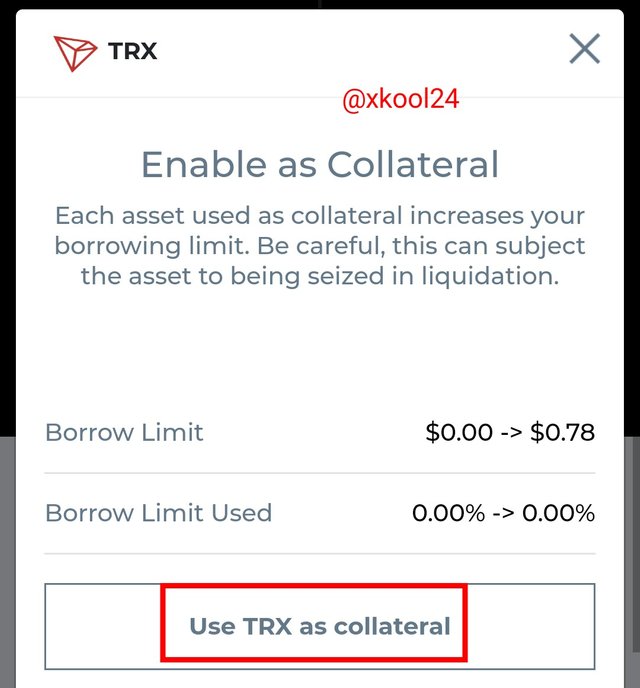

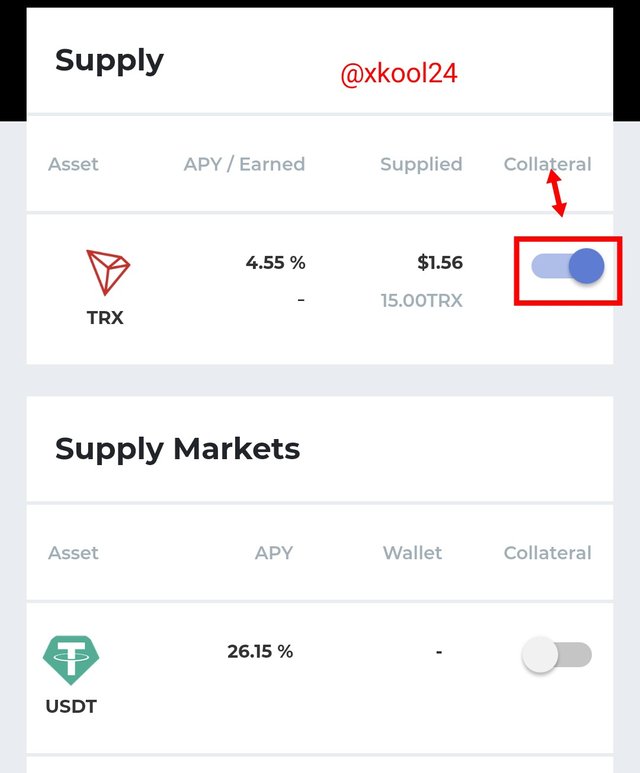

Collateralizing on my Asset

- From the supply option click on the asset already supplied by sliding the arrow key from left to right.

- from the pop-up message click on "USE TRX AS COLLATERAL"

- Click on ok from the 20 TRX energy requirement for the transaction

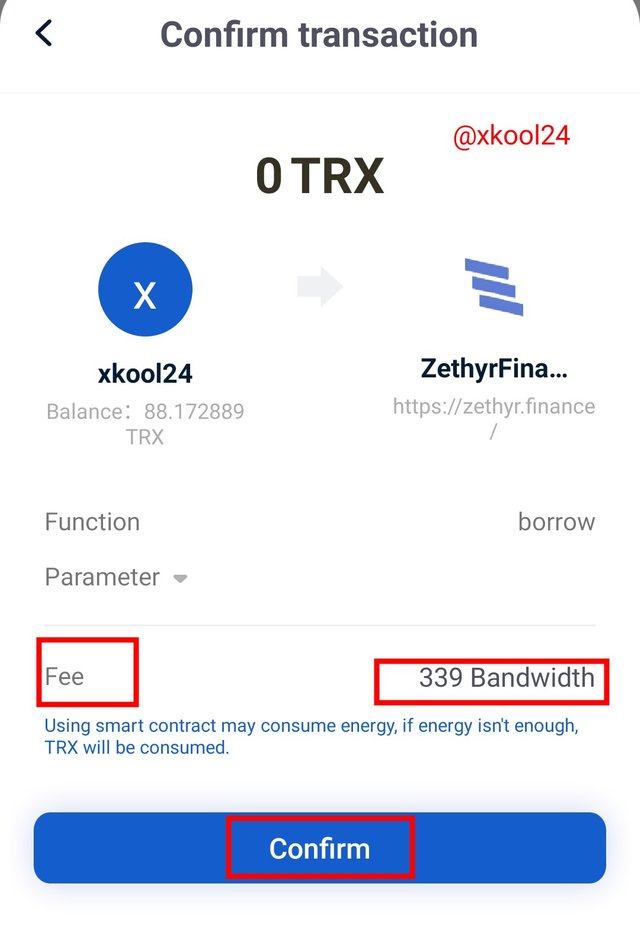

- Click on confirm button (with 307 bandwidth fee requirement)

- Enter the password to sign the transaction.

This gets the button-activated immediately

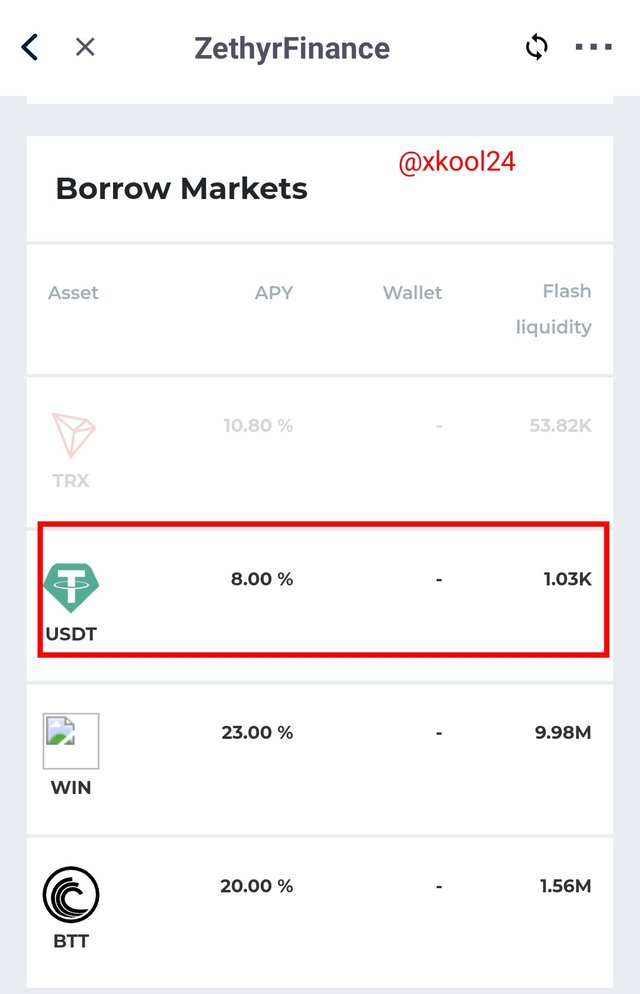

To Borrow from the Zethyr Finance

- Scroll down to the borrow asset option.

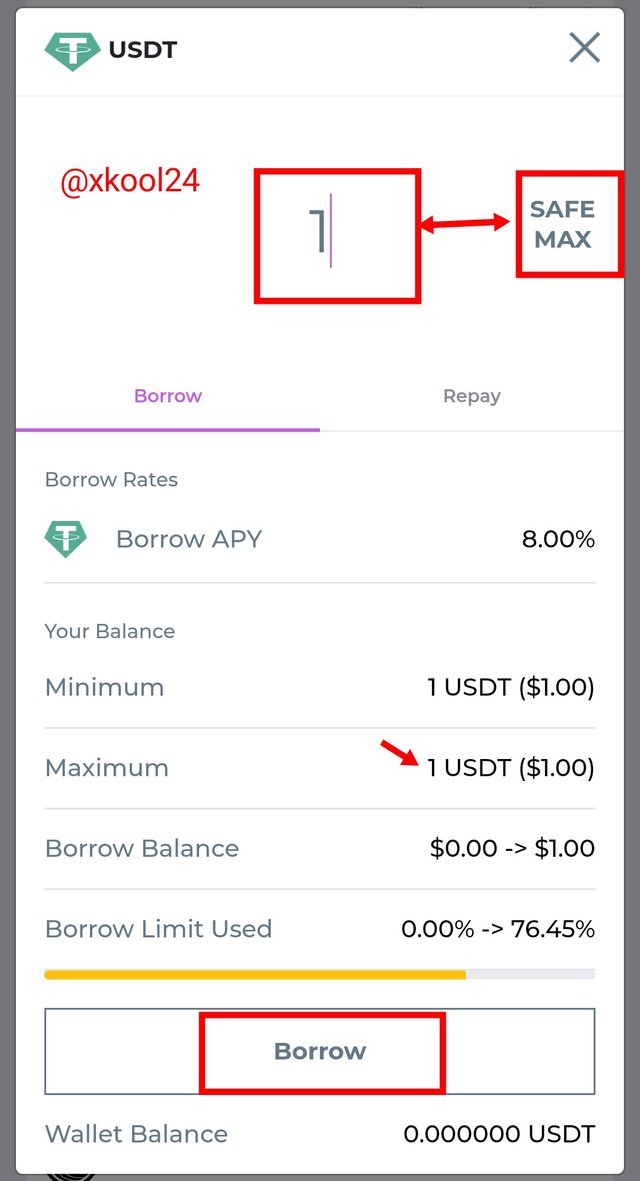

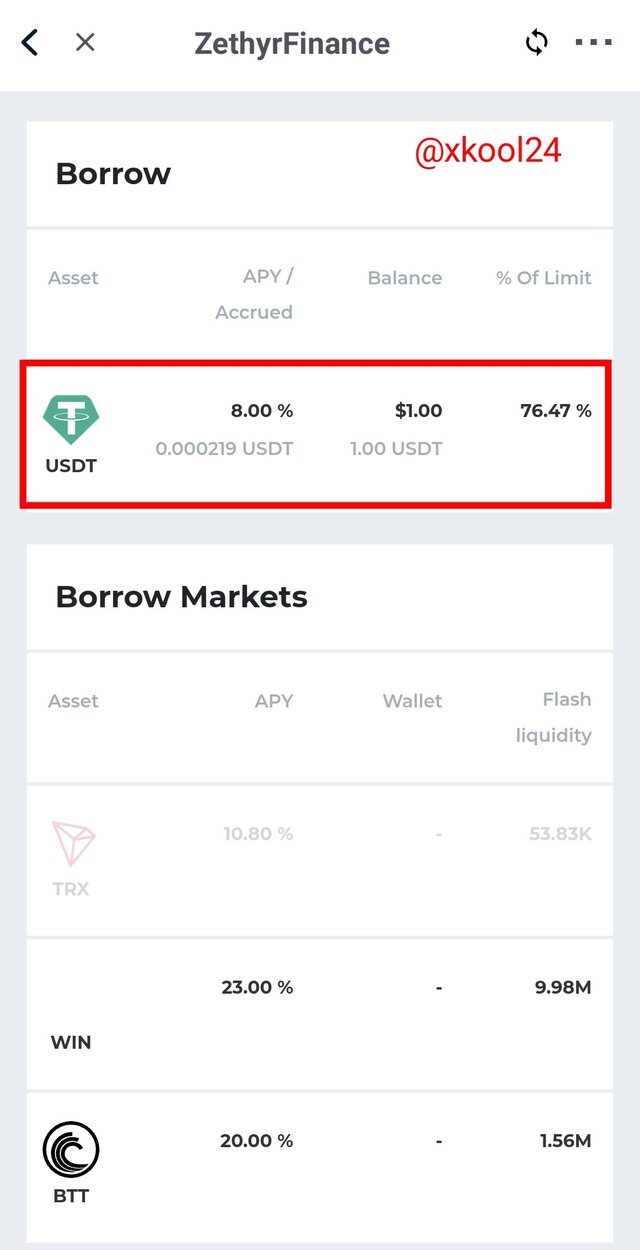

- I will be borrowing the USDT asset and the system protocol guarantees only 50% of supplied assets for safety. I have a $0.78 borrow limit already captured.

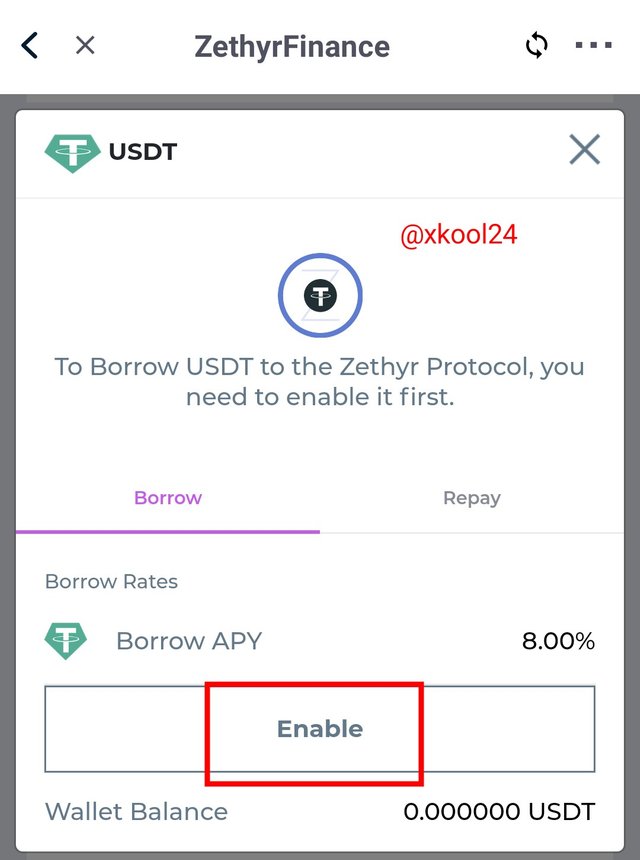

- then click on the USDT asset to be borrowed

- Click on enable button

- click on Ok (Requiring 20 TRX )

- Confirm transaction

- Enter the password to sign the transaction

- then click on the USDT asset to be borrowed

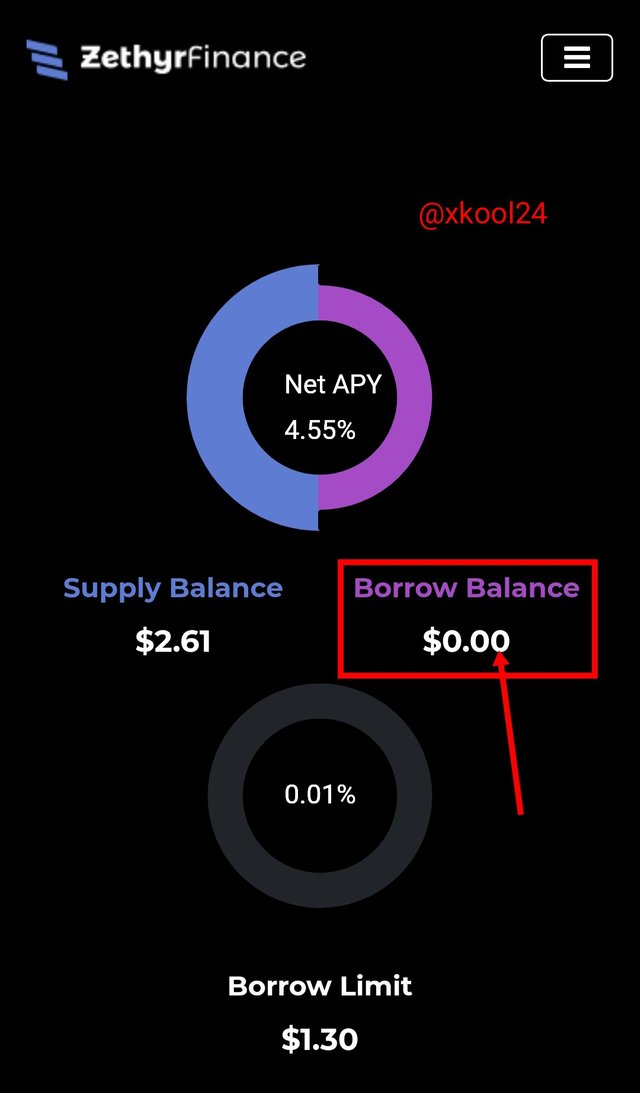

- Due to the minimum requirement value, I will be re-supplying more TRX assets. I now have a borrowing limit of $1.30. this can now go through.

- Enter the amount to be borrowed or click on the MAX SAFE button

- Click on the Borrow button

The energy required is 20TRX - Confirm and Sign the transaction

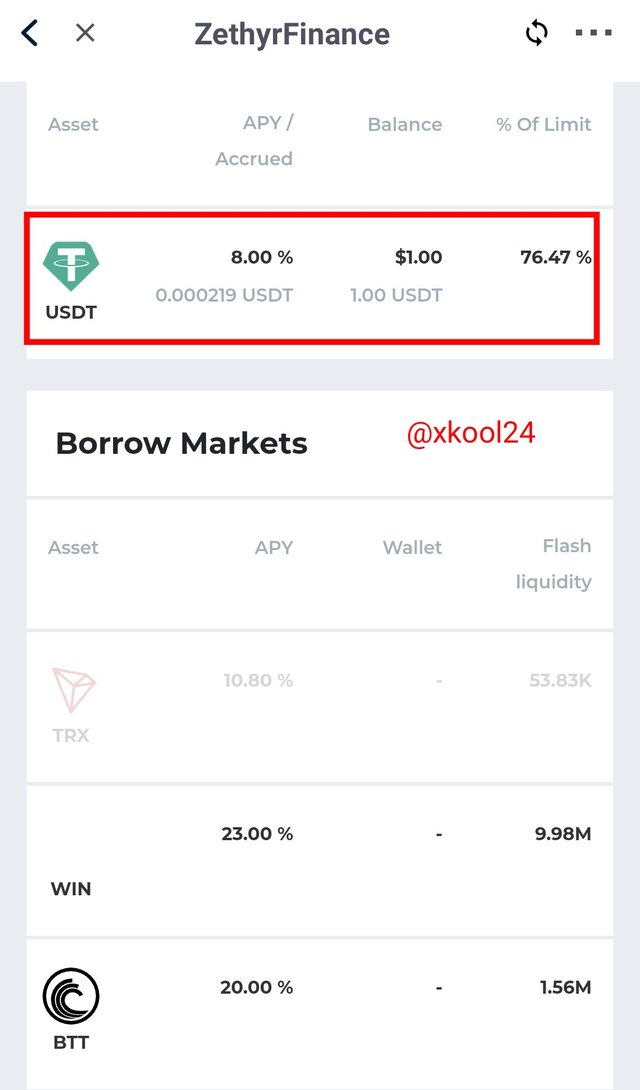

- Used 76.47% of my borrow limit

- And %APY of 10.80%

The link to this transaction

https://tronscan.io/#/transaction/352c7bfe8e05051d198a5b396dc54168d6aa22d55275b7b9a68563b8b6bd522e?lang=en

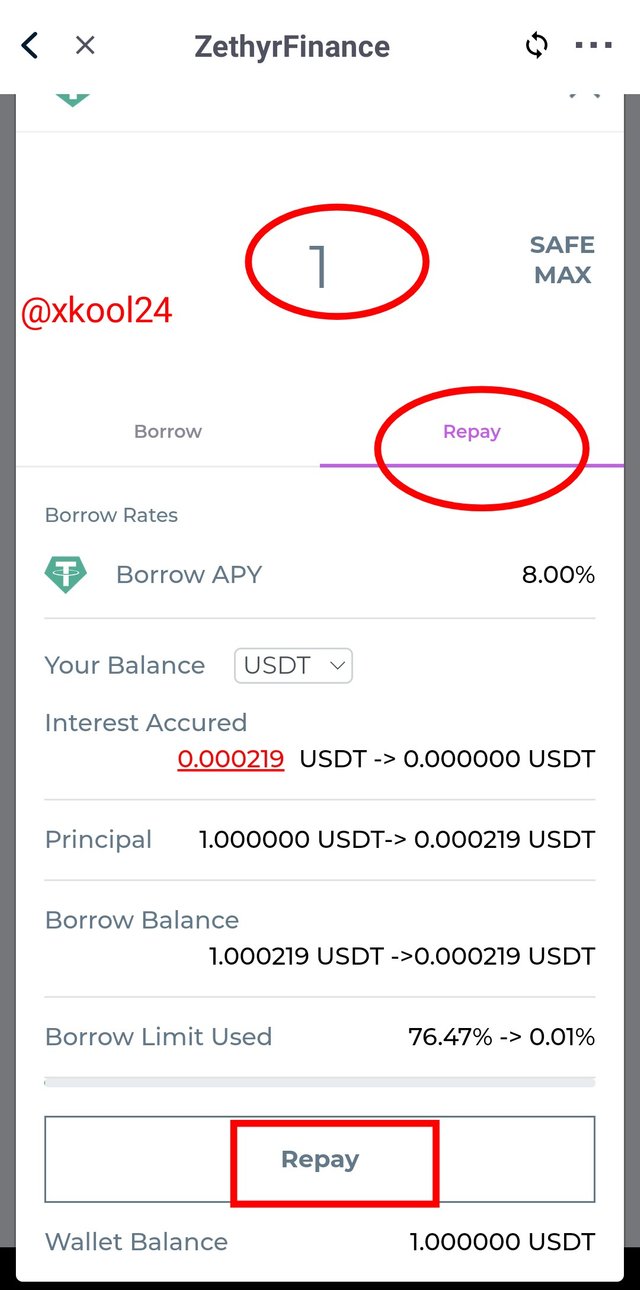

How to Repay for Borrowed Asset

- Click on the borrowed asset

- Now switch to the REPAY option

- Enter the value to be repaired for $1

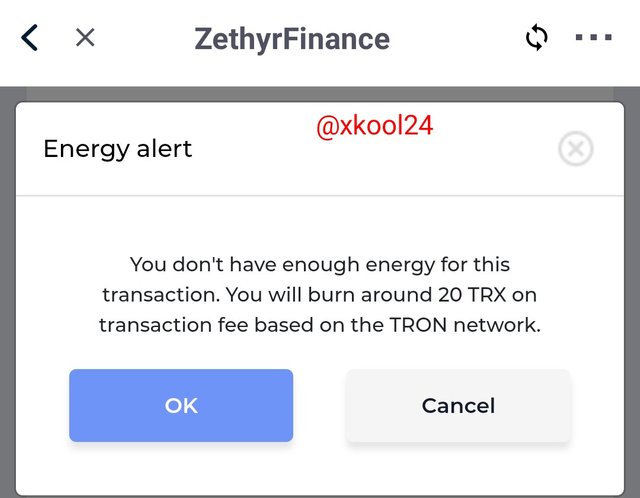

- Then click on the REPAY button

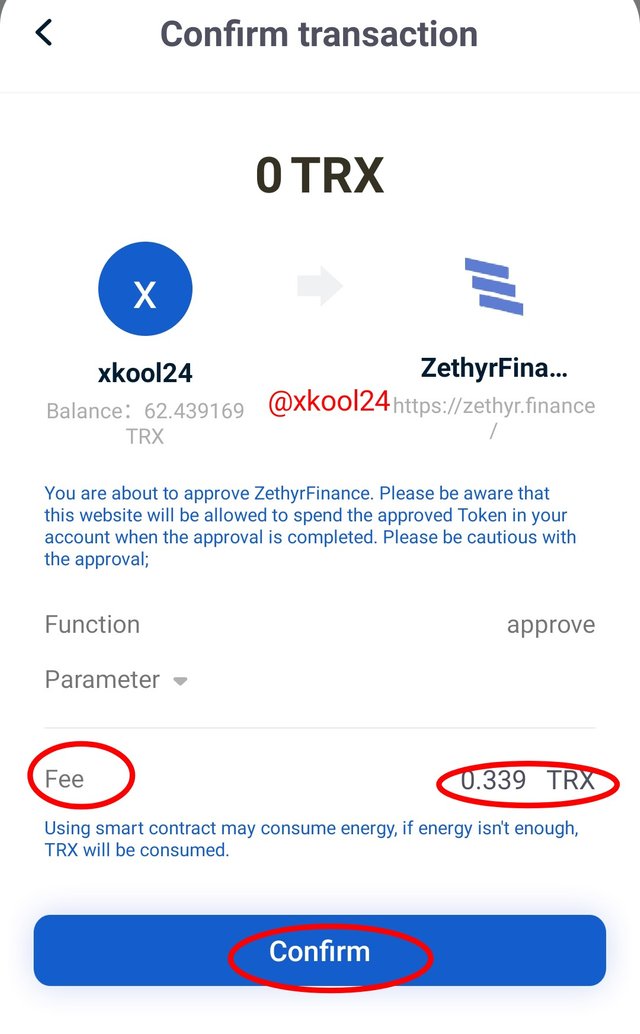

- Click on confirm, enter the password to sign your transaction

Link of transaction details

https://tronscan.io/#/transaction/7707ed493ee45ed984f45f18a0c109e3adb8ed97cabf38bc7abbaa9dbe1822dc?lang=en

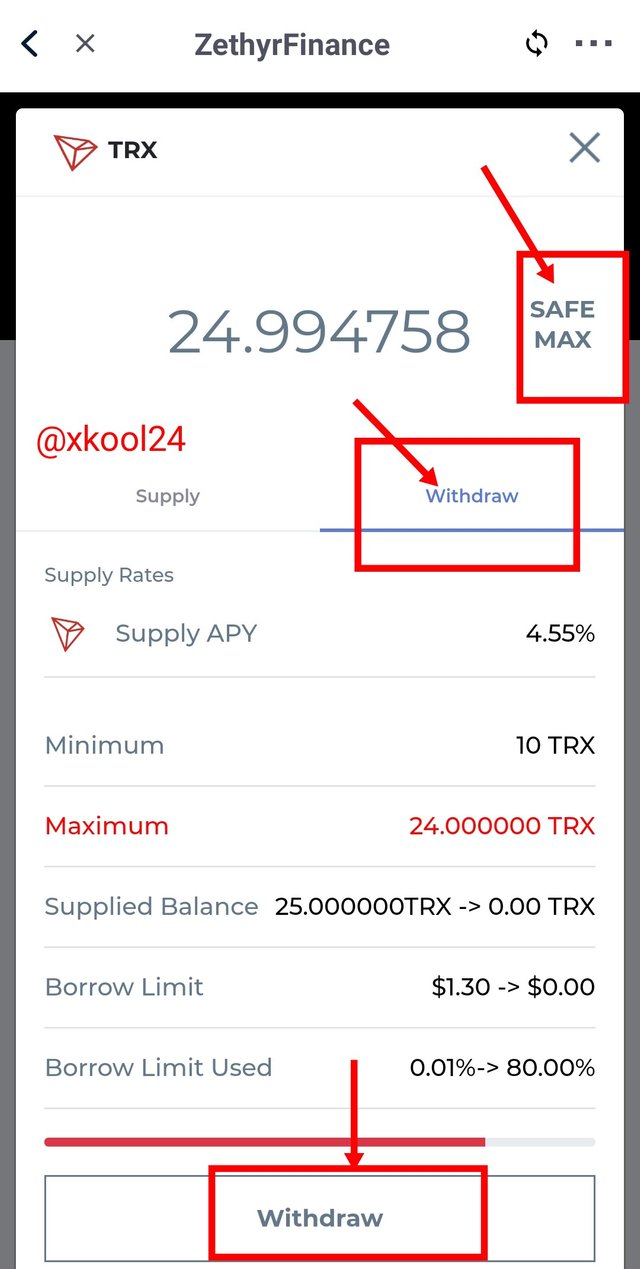

Withdrawing My Asset from the Supply Pool

- go-to the supply asset option

- Click on the asset already supplied

- switch to withdraw option

- click on SAFE MAX and then withdraw

- then click on confirm and sign the transaction

Link to transaction details

https://tronscan.io/#/transaction/0ad55fc502981b4c34dd170c5f15d43c027ca3bfff28c4164f0456a52975fcbe?lang=en

8- What do you think of Zethyr Finance? Is it great or not? State your reasons.

The Zethyr Finance is indeed a great protocol that allows participants to earn from supplying or providing Liquidity to the system. It is a DEX that provides Liquidity to its teaming users with its lending feature and unique use of its DEX Aggregator.

It adopts the Rebalancing feature which is done once every day. This ensures the Liquidity of flash loans in the ecosystem as well withdrawals. It also guarantees better yields for its participants and Diversification of risk. Another great feature is the presence of SAFE MAX which ensures that there's constant Liquidity in the trade as well protects the protocol of unforeseen liquidation.

The Lending/Borrowing Feature

The already explained points device its basics from the lending and borrowing feature of the Zethyr Finance which helps as another means of passive income to the trader. Traders can now lend idle funds/assets to the network and earn rewards in ZTokens given the expected %APY. On the other hand, the SAFE MAX button helps in providing the required and appropriate value for borrow limit so as to ameliorate issues of liquidation.

Stable SWAP

This is another great feature from Zethyr finance that helps participants to exchange their assets to their preferred choice at a given time. Just like we have in here, the TRC-20 USDT can be exchanged for the ERC-20 USDT coin. These are exclusively for users demand who find the different network coins appropriate for transactions.

Conclusion

The Zethyr Finance and Exchange emergence is a Decentralized Exchange whose emergence has helped users in trading and swapping tokens with ease. It was another great partnership between the Tron blockchain and the Zethyr team which has a far-reaching adoption advantage of native tokens for both protocols. With the already launched DEX aggregator, participants do not have to engage with the Order books anymore instead this smart contract provides the best APY yields and values to interact with.

With Zethyr Finance, Tron coins can now be swapped to any coin of our choice as listed in the protocol. The TRC-20 standard token for USDT can now be exchanged for the ERC-20 standard token for the same USDT.

Thank you Prof for your lessons.

#club5050 😀

Thank you 😊