Steemit Crypto Academy | Season 3 Week 8 - Risk Management in Trading

Trading is a highly risky venture but also highly rewarding when trades play out well in your favour. You may be asking yourself, is trading gambling? Yes, it is gambling when you trade without proper risk management. When you apply risk management on every trade, it ceases to be gambling, it’s then rather called speculation. The latter is trading professionally for consistently profitable trading.

What is Risk Management?

Risk management in trading refers to the processes employed in controlling losses at the same time maintaining a set risk to reward ratio.

In other words, there is a certain amount of money you are willing to lose to gain more money.

Risk management is another core aspect in trading that every beginner and Expert trader must have in addition to their trading strategy and market psychology. Therefore, without proper risk management, it does not matter how an expert trader you are using a great Trading strategy, you are liable to registering huge losses or even blowing up your account in the long run. Before you think of making any money, you have to first put in place measures to protect the initial capital on your account.

In trading not every trade will be profitable. The fact is that you win some and lose some. As a trader, you have to safeguard yourself from the negative human emotions that may throw you into panic and frustrations when it comes to losses. The idea behind risk management is staying in the business for a long time through managing the losses as you continue aiming to win more trades with your well-trusted Trading strategy.

Planning your Trades

Ensuring proper Planning of your trading is one of the processes that are pivotal in Risk management. As a common saying “you fail to plan, you plan to fail.” Without a systematic plan on when to enter and exit a trade will get you doomed to failure in your trading.

As a trader, you have to have a personal trading strategy that you have backtested, practised with on a demo account before applying it in your trading on a real account.

Applying both technical and fundamental analysis in your trading is also a good way to plan for your trading. This involves the use of several trading indicators on the trading charts that aid you in making a sound judgment on every trade. It also includes keeping updated about the different news surrounding that Crypto asset.

The 1% rule

Since not every trade will be profitable in trading. It’s therefore important to have a set amount of money you are willing to lose on every trade. Most traders are willing to lose 1% and others that are a bit risk-averse will opt for 2%. For example, according to the 1% rule, if you have $10,000 as your initial capital it implies that you are only willing to lose up to $100 on every trade and those that opt for 2%, are willing to lose $200 on every trade.

This is a rule in risk management which traders must strictly observe if they are to minimize the losses made on a few bad trades of the day. Otherwise, any compromise of this rule implies heavy losses on a few losing trades. Therefore to safeguard your account from registering heavy losses on a few bad trades, you have to carefully observe the 1% rule in your trading.

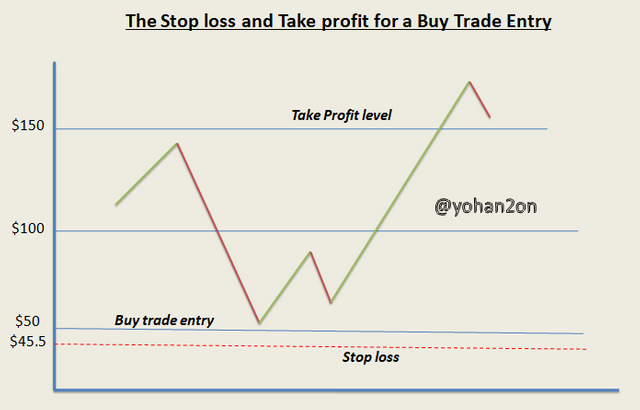

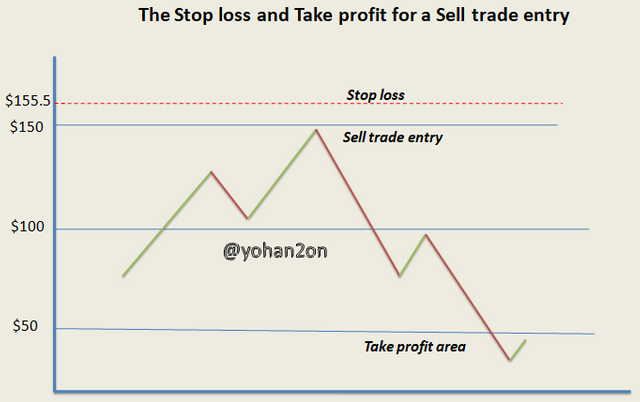

The Stop Loss and Take Profit

Setting up the Stop Loss and Take profit for every trade is another vital aspect involved in Risk management. Without a stop loss, you can lose a lot of money on a few bad trades and without a take profit, trades in profits can reverse back into losses in the absence of a profit target. As a trader, when you spot a trade entry/opportunity, the first thing you have to do is to set up the stop loss and take profit for your trade.

The Risk: Reward ratio is used in setting up the Stop loss and Take profit.

A good risk to reward ratio should be a 1:2 or 1:3. The 1:2 risk-reward ratio implies that you want doubled rewards and the 1:3 implies that you are looking for a Tripled reward for the money you have risked on a particular trade.

The Stop loss and take profit can be set using trading indicators like moving averages, Fibonacci retracement and so on.

How to effectively set the Stop loss

Many Traders make mistakes when it comes to setting the stop loss and in the due process, the markets take them out early then reverse in the speculated direction. Ideally, a stop loss ought to be set 5-10 pips above the recent swing high for a sell entry trade. For a buy entry trade, the stop loss should ideally be set 5 – 10pips below the recent swing low. The main idea behind that is to give enough room for the trade to play out. It is also some sort of breathing space that you provide to the trade and thereby, avoiding being taken out of that trade very early.

Avoid Break-even stops

Many times amateur traders prefer removing the risk from the trade as soon as it gets into profits. They do this by shifting the stop loss to a break-even point of the trade “at a 0 loss” just in case the trade eventually goes against their trade decision. This is not a good habit as it can end up yielding lots of unprofitable trades for the trader since price oftentimes makes retests of the already established support and resistance levels.

Use Moving averages, Fibonacci retracement levels or support and Resistance in spotting good areas to place your stop loss.

In Conclusion, though often underlooked, Risk management is a very important aspect in Trading that every trader must incorporate in their trading for professional and consistently profitable trading.

Homework task

1- Define the following Trading terminologies;

- Buy stop

- Sell stop

- Buy limit

- Sell limit

- Trailing stop loss

- Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

2 - Practically demonstrate your understanding of Risk management in Trading.

*Briefly talk about Risk management

*Be creative (I will expect some illustrations)

*Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

Rules and guidelines

- Post your homework article in the steemit Crypto Academy

- Only steemexclusive articles will be curated

- Do not reproduce the information I have provided in my course article. Expand your knowledge "Be original and Creative"

- Your article should range between 600– 1000words. (Be straight to the point)

- Use an exclusive tag #yohan2on-s3week8 and also tag me @yohan2on so that I can easily find your article.

- Clearly reference your work in case you have directly borrowed any content from other sources. Otherwise, be original and as creative as possible.

- Plagiarism and spinning off other users’ articles will not be tolerated in the homework task. Otherwise repeat offenders will be blacklisted and banned from the Crypto Academy.

- Use only copy-right free images and showcase their source.

- To participate in this task, you should have a minimum of 250SP and your reputation score should not be less than 55.

- This homework task runs till 21st/08/2021, Time: 11:59 pm UTC.

Will definitely try to submit this homework soon sir!

Okay, I will be waiting for your work.

Sir plz check and give me marks

https://steemit.com/hive-108451/@ansardillewali/steemit-crypto-academy-season-3-week-7-how-to-create-an-account-on-trading-view-using-indicators-tools-trading-view-features

Sorry, you were late. The submission deadline for your work was Saturday at 11:59 pm UTC time.

Very sad to hear

Thanks so much Professor @yohan2on. That is great homework we will love to share.

Thanks for your effort!

Thanks for the appreciation. I am looking forward to your work.

Good job professor , I am glad to see this topic . This lesson is really very wonderful because I wanted to teach about it before this .

Well explained Prof. Risk management is indeed the first thing a trader must understand, and put into consideration when trading. God bless you Prof.

Thanks for the appreciation. I am looking forward to your work.

Hello professor @yohan2on here is my assignment post

https://steemit.com/hive-108451/@vhenom/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Dear Professor, this is a course that will be very useful for us. Would it be a disadvantage for us to pass 1000 words while preparing homework?

I think it’s preferable to follow the rules as given

You may exceed 1000 words by just 100 to 200words. The idea is to keep your content focused on what is required of you.

The last two weeks assignment wasn't voted Sir

https://steemit.com/hive-108451/@opeyemioguns/steemit-cryptoacademy-or-season-3-week-6-or-cryptoscam-and-how-to-avoid-them-by-yohan2on

Forwarded to the curators.

Thank you Sir

Please prof @yousafharoonkhan and @yohan2on my work hasn't been reviewed

https://steemit.com/hive-108451/@sadiqxylo/crypto-academy-season-3-week-7-homework-post-for-professor-yousafharoonkhan

Reviewed

Thanks prof

Please @yohan2on, my post is 5 days and you have not reviewed.

https://steemit.com/hive-108451/@princesstj/risk-management-in-trading

Hello professor @yohan2on, this is the link to my assignment