Trading Crypto currencies - Crypto Academy / S4W6- Homework Post for @reminiscence01

Greetings to everyone out there, I would love to join Prof. @reminiscence01 to welcome each and everyone to the sixth week of this season. The topic for this week is Trading Cryptocurrencies and I'll try my best to give detailed answers to the test questions listed. If you reach the requirements, you could join me to do same my reading up the lesson on this link

1.)

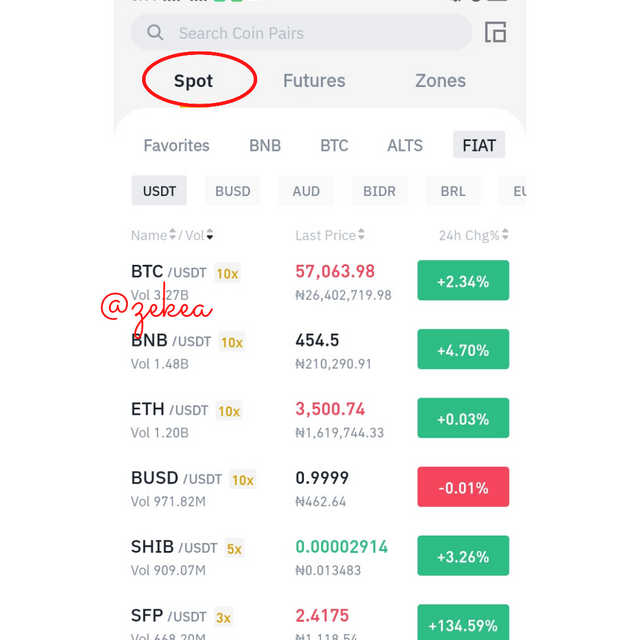

Explanation Of Spot Trading

The Spot Trading platform is simply a service where you can trade cryptocurrencies. That is, it is a large market on the exchange, where a user can "buy" or "sell" coins to various users on the exchange. As the name implies, your transaction is being settled on the spot. Meaning, depending on the kind of order made by the user, trades are paid off once the order is filled. On the Spot Market, one thing to note is that, the moment coins are purchased, the buyer is in total possession of the coin (he owns them).

Mechanism of the Spot Market

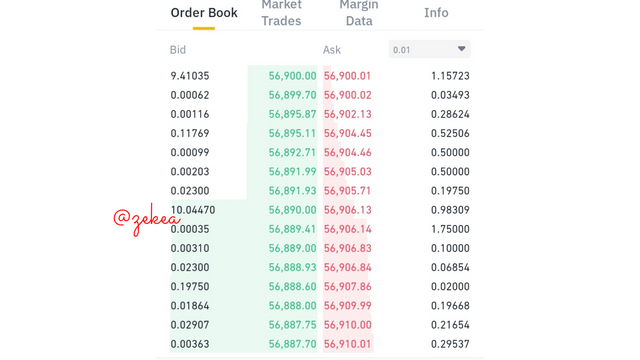

Bids or asks in the spot market are filled or matched on the order book. The order book is a catalogue or record of all open orders (unfilled or unmatched orders) of a buyer or a seller for a particular cryptocurrency pair. The order book is mainly used or filled by limit orders.

A limit order is one where traders specify a certain price. So, sellers make trades with a specific ask price( this is the lowest price they can sell their assets) and the buyers make trades with a specific bid price (the highest amount they can buy an asset).

These type of orders are made by marker makers. They liquidate the spot market with their pending tokens waiting for a match. Once their prices are matched, the assets are exchanged. The traders who use the market order (this is the current price of an asset in the market), are matched immediately with the highest bid or lowest ask price on the order book. They receive their tokens swiftly, hereby enjoying and consuming Liquidity in the spot market.

Advantages of Spot Trading

High Liquidity Production: Spot trading is a superb feature on exchanges. It aids users to perform quick trades with their coins. The spot trading platform tries to improve the liquidity of market pairs with an advance creation of the order book where pending orders are recorded and assets placed for this pending orders are with held by the market to grease or aid in rapid transactions. Once a price is matched, it completes the transaction swiftly and assets are exchanged.

Profit making: It creates an avenue to make profits, with features like the limit orders, where traders can set a buy order at a very low rate because they have predicted that the value of this assets would be reduced and the prices would go into a downtrend. It may take a bit of time but once their orders are matched, the asset would be rewarded to them at such a low rate and they can immediately place a sell order after his analysis to sell off the tokens when the prices are high.

Although, he would need to master his use of indicators and method of analysis. This feature helps an experienced trader make a whole lot of profit.

Total Ownership: Spot trading helps a trader to exchange his coins for a preferred or desired cryptocurrency. At the end of this transaction, the trader attains full possession or ownership of the tokens. He then has the right to make whatever decision with it. Whether to hoard the coin for months or years till it pays off or to sell it off.

Disadvantages of Spot Trading

Demerit to Market Makers: These ones are the ones that fill up the order book with their limit orders. Unfortunately for some or them, they may place outrageous bid or ask prices due to poor or wrong analysis. Their orders then become impossible to match up and they end up wasting their time or losing out on some good deals.

Probability of Losses: Cryptocurrencies can be very volatile and due to fact that their prices are highly affected by the emotions of traders, an inexperienced trader who plans to hold a coin can buy a it for a high price, unfortunately for him, in the long run the price can even slash by 50% and in fear of the price reducing further, the trader then rushes to sell off the assets. He then loses a whole lot so easily.

Explanation Of Futures Trading

Now, the futures market, a very risky platform. This is because of its feature of giving you a tempting opportunity (leverages) to invest a lot more than you have in your portfolio to get good rewards or let's say make really high profits. It seems fun until the story is on the negative side :(.

Definition

From the English dictionary, "Future is something that would exist or is going to happen soon or much later" and trading is the process of exchanging an item or a physical quantity for an equivalent. Adding up this definitions, Futures Trading on an exchange is simply an agreement or a contract between a trader and the exchange for a transaction that would take place at a later time.

Let's use a physical and relative illustration, Mr. Dangote wants to start a company that produces cement and for him to be able to do that, he needs to reach out to another company that mines limestones (This company represents the exchange). He reaches out to the company and proposes

a deal to receive a ton of limestones for $10. The company agrees and they lay out a contract(the futures contract) that the deal will take place a month from that present date. Meaning, if the day was October 14th, the deal would take place on November 14th. Also, a trader on the exhange market can be seen playing the part of the seller.

The catch is that, Mr Dangote must have done his analysis and predicted that the current price ($8 for a ton) may double in a months time due to some sort of scarcity. If that happens, on the 14th of November, while other cement companies will be buying a ton of limestone at $14, Mr. Dangote will be enjoying the contract and the limestone company will be at a loss with no option than to sell at that price. On the other hand, if the price even reduced in advent of new limestone companies and the price dropped to $6 a ton, Mr. Dangote will be at a huge loss.

In this same way, the cryptocurrency markets are so volatile (prices of coins can increase by 100% and also reduce by 100% unpredictably) and profits can be made in the same way I illustrated above. The only difference is the addition of a feature to enable the trader to take leverages and make higher profits up to a 100 times or more on some platforms. On the futures market, a trader doesn't buy the coin, instead he purchases a futures contract. He doesn't necessarily need to stake the exact worth of this contract, the higher the leverage, the lower the stake and vice versa.

Like I said, the futures market is very risky and there are higher losses to traders than to the exchanges everyday.

Advantages of Futures Trading

Leverage: The futures market provides traders with leverage which aids this trader to make high profits than he invested. A coin like SOL (solana) is at $160, unlike the spot trading market, on futures market a trader is given an opportunity or leverage to purchase contracts for this coin with just a fraction like $16 and still make the profit you would make with the full coin.

Bull and Bear market Profit: In the spot market, if a trader buys a coin at $5,000 to hold and price begins to fall he immediately starts making a loss. This simply means that in spot trading, traders only make a profit from their coins when the price rises. In the futures market, it is possible to make profits off bear markets by selling futures contract to go short.

Hedging: This is a risk management strategy. Aids traders to buy futures contract in protection of risks in situations where price changes to become higher in future.

.

Disadvantages of Futures Trading

Huge Loss Risk: This type of trading can be very risky and of cause dangerous, the same way high profits can be made on the futures market, traders can stand the chance of losing all their capital due to high leverages set.

Uneasy and unfavourable for Beginners: The futures market is never a good start up for novices in cryptocurrency trading. It's not a playground and slight mistakes in predictions causes huge losses. There is need for support and guidance from experienced financial advisers to learn and start receiving profits.

Volatility of Cryptocurrencies: Crypto currencies are largely affected by emotions of trading and this causes it to be volatile and unpredictable. Since futures trading is highly based on predictions, it is difficult to be sure of making profits.

Explanation Of Margin Trading

Margin trading is somewhat different from that of the futures trading. In this type of trading, traders are given the opportunity to borrow bulk coins from third parties like investors (other traders) or even an exchange to partake in trades in other to make huge amount of profits.

Take for instance, a 20% profit for a $500 worth of bitcoins is just an extra $100 but with the ability to borrow up to $1000 worth of bitcoins, that same 20% profit is equivalently $200. Traders benefit the abilty to expand their outputs with this feature and also, just like the futures trading, they are also given leverages to increase their borrowed funds and make more profits.

Traders have good opportunities to use coins borrowed to them to make out some profit for themselves and also the third parties. In event of losses where the trader can not meet up with the minimum margin trading requirements, a margin call is made to the trader to invest more funds from his portfolio. If he is unable to do so, the third parties can issue a "forced sale" to liquidate all possessions of the trader.

Advantages of Margin Trading

Leverages: The margin trading market gives a trader the opportunity to take leverages to maximize earnings for the trader and the third party lenders. If the trader has $60,000 available, using leverages like let's say a 10x, he can increase his stake to $600,000 and more money increases profits for sure.

Increased purchasing Power: In the margin trading platform, a trader has an increased amount of cash than what is actually in his account to purchase assets. The purchasing power in margin trading is simply the total amount of cash in the traders account plus the margin available. Some exchanges provide traders with about 50% margin and this is calculated by dividing the value of the traders account by 50%. Meaning $100 actually yields a purchasing power of $(100/(50/100) which equals $200.

Disadvantages of Margin Trading

High Risk of Losses: On the margin trading platform the same way a trader can earn a huge load of profits from making trades with leverages and borrowed cash, so can he also makes extreme losses and lose his entire equity. The crypto markets are extremely volatile and aren't easily predicted.

The trader bears all the risk: In margin trading, the brokers do not bear any risk, all risks are pressed down on the trader. So, in cases of high losses up to 40% of $100,000 worth of assets used ($50,000 from the trader and $50,000 from the broker), meaning the left over cash is just $60,000. Once the trade is close, the brokers are given back their $50,000 plus interest and comission and the trader is left with just a percentage of the remaining $10,000.

2.)

An order is an authoritative instruction from the trader on how to carry out a particulation transaction. There are different types of orders on the crypto currency market exchanges:

Market Order

A market order is the execution of a trade at the current price in the market. It is the default buy or sell option when trading in exchanges. The market order is the fastest kind of order because prices for the assets are taken at the highest available bid from the buyers and the lowest available ask from the sellers. This type of order is issued by the market taker. He takes liquidity from the market as his transactions are filled and matched immediately. An advantage of this order over the he limit order is that there is always a guarantee that the order will be completed in due time.

Pending Order

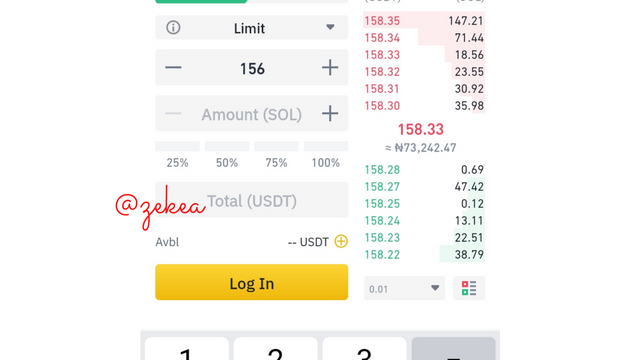

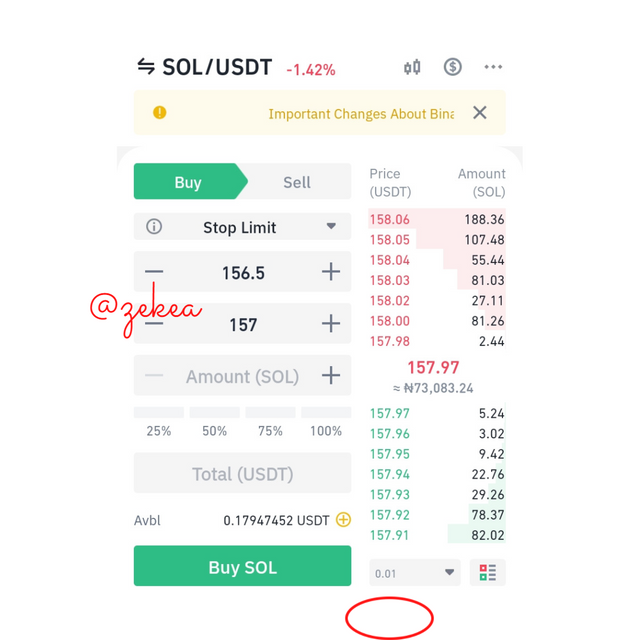

A pending order is an authoritative instruction from a trader to the exchange, to buy or sell assets at a particular stated price. That is, prices for assets to be purchased or sold are specified by the trader. Unlike the market order, if price of a coin like SOL is currently $160, a trader is given the right to place a buy order to purchase the coin at $157. Trader then has to wait for the market price to align with his order. After a while, the order is matched and he makes a profit of $3. This is also dependent on how good the traders analysis where because there is no guarantee that his order will be matched.There are order types of the pending order:

- Limit Order: This is a kind of pending order in which a trader states his position or price point in the market. This type of order is best used in scenarios where a trader wants to trade a coin but he believes there would be a turn in the current price of the market. He then places a limitation on the maximum price he wants to buy a coin or the minimum price he can sell that coin. If he is patient enough and his predictions were correct, his order gets filled and he makes a gain.

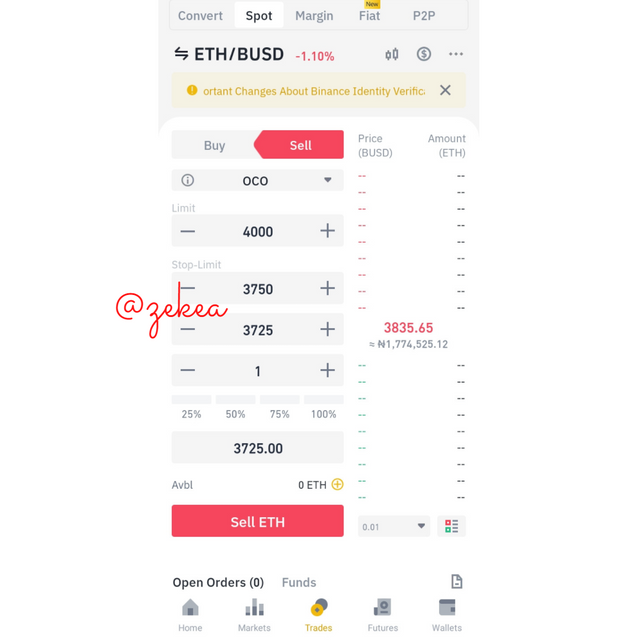

- OCO order: OCO also known as One Cancels the Other is another type of pending order. This is a type of order where the trader is given the ability to make two trades for a particular crypto currency pair. It uses the combination of the limit order and the stop limit order to be able to make it possible for traders to fill two orders with their specific prices at the same time. Which ever one of the orders is matched first, as the name implies "One Cancels the other", the second order is cancelled and the trade is only paid once.

For example, If you buy SOL at $155 and the current price in the market is at $158, since crypto currencies are volatile in nature you cannot really predict where the price is heading to. So, you want to set a limit order to sell your SOL asset when the price goes up to $162 or rather also set a atop-limit order, making the stop $156 and the limit $155.5 incase the coin's price begins to fall. You can't do this with the normal limit order but this is possible on the OCO order. This means that if the price gets to $162, it automatically sells at that price but if the price falls to $156, it sells the SOL at $155.5.

- Stop-Limit Order: A stop limit order is a type of pending order where a trader sets his trade to be triggered once the price action attains a certain price. The stop limit uses the combination of the stop loss and the limit order to place deals. For instance, a support level is at $152, a stop limit order can be made in such a way that once the price attains $155, a limit order is set for $152. This type of order once set operates automatically no matter the case, if the trader is available or not. For a buy order, the limit order is normally higher than the stop and vice versa for a sell order.

Exit Orders: Orders used to opt out on a trade at a certain price level. There are two examples

Stop Loss: This is different from all the other types of orders, it is one set to operate in worst case scenarios. It is an order set by the trader instructing the exchange to trade the coins immediately once the price goes up or goes down to a certain level against the traders prediction to avoid risk of extreme losses. It operates automatically and since this type of order requires immediacy to reduce losses, a market order is placed. It is most times mixed up with the take profit order. For a sell order, the stop loss is normally set above the current market price and the take profit set below the current market price.

Take Profit Order: This is a type of order set by a trader informing the exchange to opt out of a certain trade immediately once the price goes in favour of the trader's prediction. It also happens automatically and a market order is set. The trader buys a coin at $50,000 and sets his take profit at $55,000, once the coin rises to that level, it is sold off immediately. It is normally set at a level close to the resistance of a coin for a sell order and a level close to the support of a coin for a buy order.

How can a trader manage risk using an OCO order?

The OCO trading order is very useful to traders in scenarios where the trader is not really sure of the next direction the market price is going to attain. In a case where a lucky trader buys the Ethereum token at $3,700 and the current market price is now at $3,824, he then decides to sell the coin to make some profit after his analysis that the value of the coin may get to $4,000. With the OCO order he can now set two orders to avoid risks of losses.

He can set his limit sell price at $4,000 and then make a stop-limit order inputting $3750 as his stop and $3,725 as his limit. This means that, the trader has given an instruction to the exchange that if the market price attains $4,000, his assets should be sold off and if the price drops to $3,750, the assets should be sold at $3,725. Which ever order occurs first cancels the other one.

This aids the trader to avoid losses because due to the greed effect, everyone wants to make the highest scale of profit obtainable and he is given two options such that if the price goes against his predictions, he doesn't still make losses.

3.)

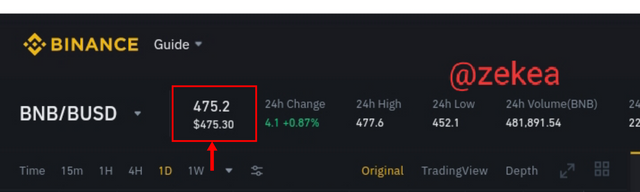

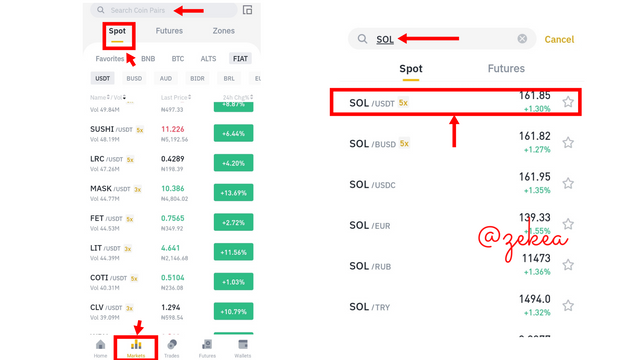

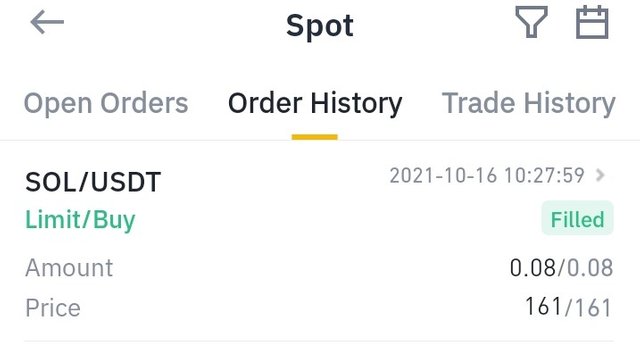

For this assignment, I used Binance to make the limit order in the spot market.

- Sign into your account on Binance

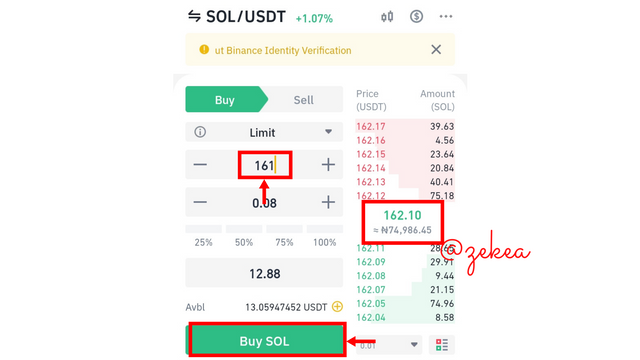

- Click on markets then move straight to the search bar and type in the asset you wish to trade with. Here, I'll be using the SOL/USDT crypto currency pair.

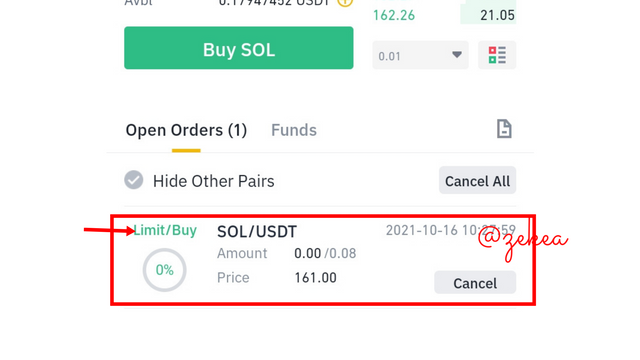

- If you close closely at the market price, you would notice it's currently at $162.1. So, understanding how this assets can be so volatile, I set my limit order at $161 and clicked on Buy.

- The limit order has been placed and all I'll do is wait till the value of the coin drops to $161. Note this, like I earlier stated, your analysis can be wrong so there is no guarantee that you would get the order at that price point.

.jpg)

- The transaction was successful

4.)

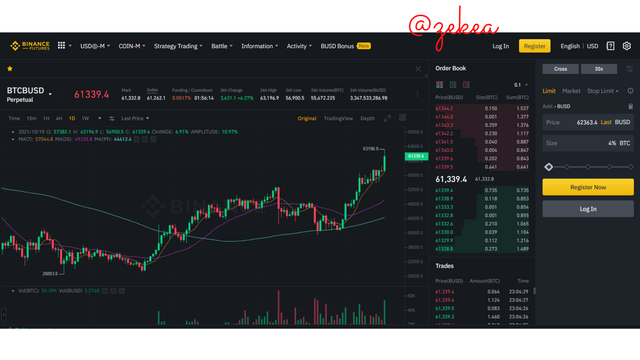

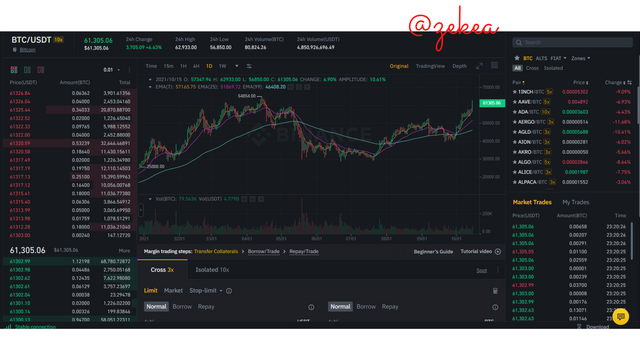

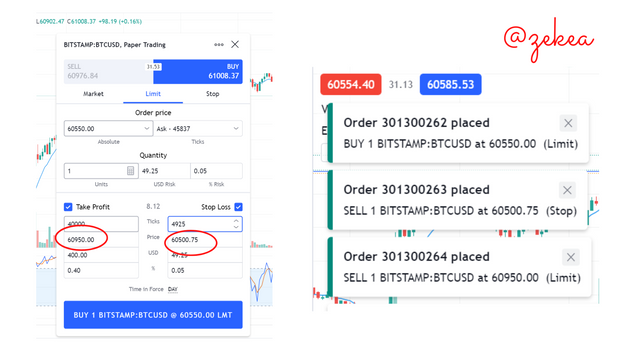

I would be making the trade using the paper trade on trading view with the BTC/USDT pairs.

Why you chose the crypto asset

I chose the BTC/USDT because of recent, BTC has been experiencing high spikes in its price and that means there will be a lot of price movements on the chart and this will create a lot of trading opportunies.Why you chose the indicator and how it suits your trading style.

I learnt how to use the stochastic and EMA indicators in week 4's lesson and they are really a good match to make trades. I use the stochastic to determine when the price is at the Overbought or oversold region then the EMA to confirm if the price is going into and uptrend or downtrend.

On the chart above I used the stochastic indicator and the EMA to do my analysis. The price was in a downtrend and recently entered the oversold region. This simply means that the price would definitely be forced into and uptrend. So, I made a buy order.

The current price in the market was $60,600, so I inputed a limit order of $60,550, since the uptrend had already started, I put my stop loss at $60,500.75 (this was risky, I should have given more space on my stop loss) and set my take profit to $60,950. After affirming my decision, I clicked on buy and just watched the charts.

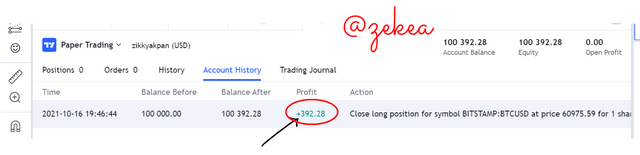

The price came down to $60,350, I was busy at the time and didn't see that. Luckily for me, I made a limit order and the buy trade went through. Kept waiting for my take profit to sell the coin. The price went up to 61,101 and the bitcoin sold before then.

Luckily for me I made a profit of $398.2 from this trade with the help of the stochastic and the EMA.

Here's the chart above in an uptrend

Trading on crypto currency platforms may feel so scary because of its high volatility and the fact of the possibility of making extreme losses. With the different kinds of orders on these exchanges, the ability of the trader to give instructions to the exchange to fill in orders immediately and automatically even in cases of his unavailabilty has gone a long way to help we the users to curb the level of our losses and maximize our profits.

Trading platforms like the spot trading help users purchase assets to hold. They have possession of these assets and control its movements (when to sell and when to buy). Other platforms like the margin and the futures trading gives experienced users the opportunity to make large profits with just little stake. They are given leverages which aid them to attain this.

With all that said, I must chip this in, the crypto currency markets are very volatile and the slightest things like lack of concentration when using indicators or lack of the necessary experience can cause a user to make bad trades and lose his entire portfolio. So, be careful out there.

This was a very nice lesson

Special thanks to @reminiscence01

Hello @zekea I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.