Knowing your customer

Greetings everyone hope you are all doing good it's a good day and I'm happy to participate in this contest that @khursheedanwar organized thanks a lot.

What is knowing your customer?

Knowing your customer simply means understanding of customers needs and wants, their buying habits and their age or sex thus enabling the creation and marketing of appropriate products and services. So, effectively collecting and analyzing data gives a better picture of clients, develops loyalty schemes and offers improved customer satisfaction.

It can also help in formulating clear and purposeful marketing communications and improvement of services provided to customers. This define a business ‘position on where it should be today, where it is likely to be in the future, possible ways of benefiting from better positioning and escaping competition from rival firms. Finally, the creation of strong customer relations by learning your customer is the solution for more sales, greater retention rates, and a longer lasting business especially in this current contemporary business environment.

In which recent crypto project or anything related to Crypto compelled you to verify yourself through KYC? Explain?

One recent instance of a cryptocurrency project that compelled myself and other participants to clear the KYC is the development of a brand-new decentralized financial platform named "SecureFi." Users in the cryptocurrency community became interested in SecureFi because of the novel concepts around the introduction of secure DeFi services based on the crypto platform.

|  |

|---|

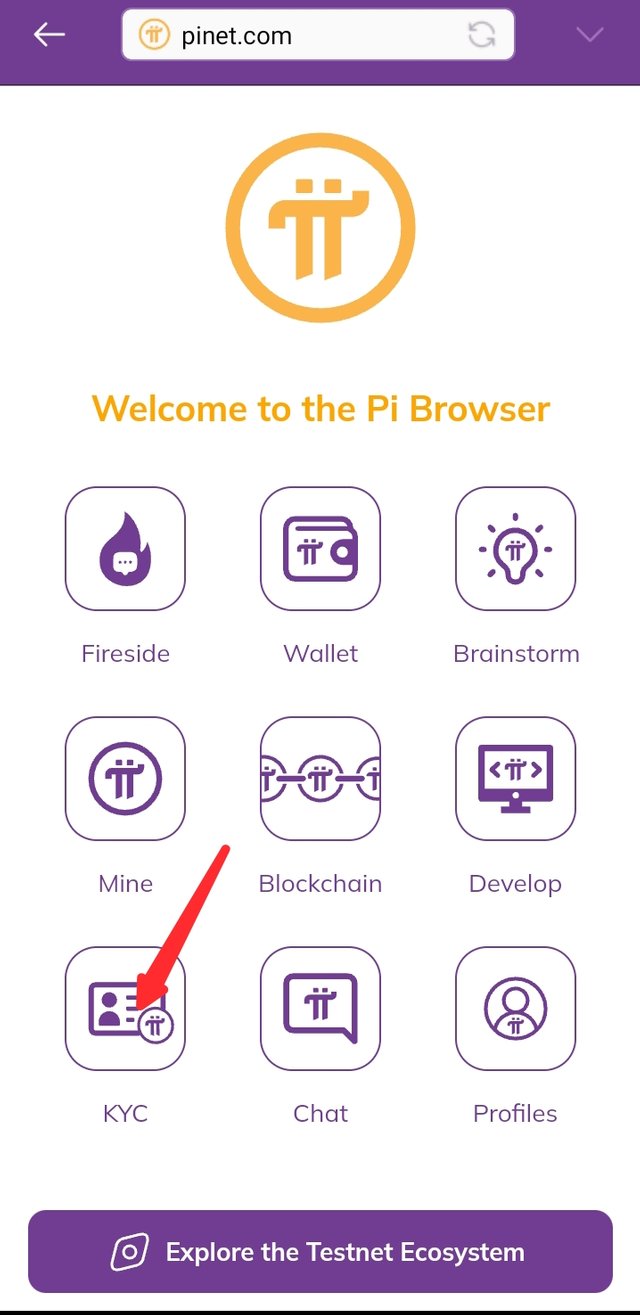

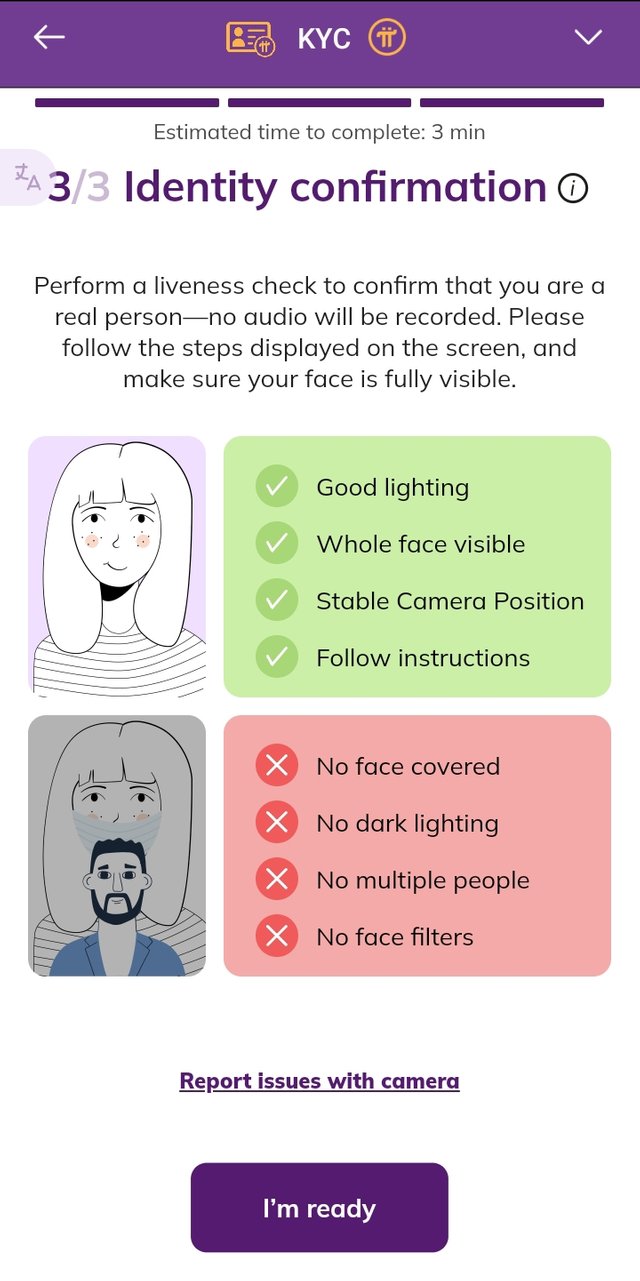

This is a screenshot from my Pi browser.

Apart from this, due to compliance with the regulatory requirements and improvement of the security measures, KYC verification was introduced for the users who intended to use the services of SecureFi. The following were the reasons that led to the decision of insisting on KYC verification. First of all, it intended to create credibility and responsibility among the consumers by authenticating them and filtering the scams on the platform.

Secondly, KYC policies availed SecureFi a way to avoid any links with money laundering, financing of terrorist activities, and all sorts of unlawful operations that could have negative consequences for the organization and lead to its shutdown in the crypto field. In sum, through the application of KYC verification, SecureFi positively showed that it is willing to create an environment that would ensure users of decentralized services are safe from regulatory actions to prevent their dealings in the decentralized finance space.

Thanks for reading my post I'm inviting @rad-austine, @eluustanley and @ability20 to participate in this contest.

https://x.com/entity673865/status/1808499548802674964