The rise of crypto ETF: Fidelity joined and batch ETF applications flooded into sec

After a large number of Bitcoin ETF applications have been handed over to the SEC, the attitude of the SEC may soon be unable to carry on.

Fidelity, an asset management giant, recently filed an application for registration of Bitcoin exchange traded funds (ETFs) with the sec.

Fidelity's ETF application is just the latest of many.In the past two months, after a large number of Bitcoin ETF applications have been handed over to the SEC, the attitude of the SEC may soon be unable to carry on.

In the past February, the first ETF in North America supported by BTC rather than derivatives was launched. This ETF, called pure Bitcoin ETF, became the first Bitcoin fund for ordinary investors in the world.On its first day of listing, the Bitcoin ETF reached a new high of nearly US $165 million.It held more than 10000 BTCs in just a week.Since then, although trading slowed down, the ETF has exceeded C $1 billion (about $800 million) in a month.

Judging from the public feedback from the market, it seems that many people did not expect the popularity of the Bitcoin ETF.At present, pure Bitcoin ETF has become the preferred investment tool of an institution.

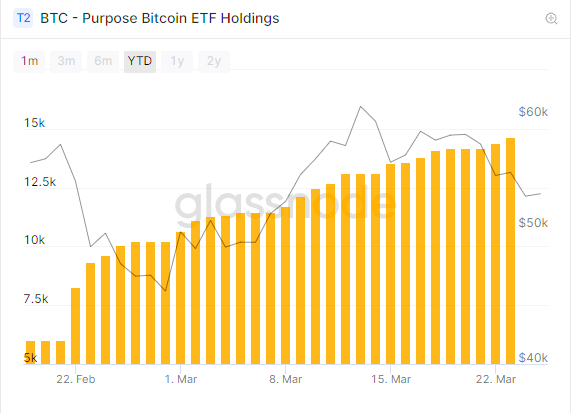

According to glassnode, a blockchain data platform, as of March 22, the number of Bitcoin ETFs held had reached 14659.99.

Hester Peirce, a member of the securities and Exchange Commission of the United States, also made such a comment: if Bitcoin ETF is not approved, the United States may lose its first mover advantage.

Around Bitcoin ETF, many institutions from Wall Street have been active.

- Batch ETF applications coming

In July 2013, Winklevoss twin brothers, a well-known American investor, first applied to SEC for Bitcoin ETF, creating a precedent for ETF application.The full name of ETF is exchange traded fund, which belongs to open-ended fund. It can be traded in the stock exchange. Fund management companies can sell new fund units to investors at any time, and also need to buy back the fund shares held by them at any time at the request of investors.Through Bitcoin ETF, many enterprises and institutions in the United States that want to buy Bitcoin have further solved the problem of compliance and reduced the risk and threshold of Bitcoin investment.

For retail investors in the United States, ETF is considered to be a product that is very beneficial to ordinary investors in the U.S. stock market. It allows investors to trade a basket of assets on the stock market. The stock of Bitcoin ETF can track the price of bitcoin, so that investors can effectively trade Bitcoin in the stock market.For a long time, Bitcoin ETF has been highly anticipated.

In the long years after 2013, a number of institutions made similar attempts, but they were all rejected by the sec.According to public information, according to incomplete statistics of foreign media, eight companies have successively applied to the SEC for Bitcoin ETF, but they have not been successful.

The reasons for the SEC's refusal were "the issuer could not guarantee the potential market manipulation of bitcoin", "the price volatility of Bitcoin was huge", and the "Bitcoin custody mechanism was not mature" at that stage.The SEC takes a very cautious attitude towards bitcoin, an alternative asset.

At the end of 2020, with the continuous breakthrough of Bitcoin price, the popularity of crypto market is increasing, and it coincides with the change of SEC, and Jay Clayton, the former chairman, leaves office.After the new sec chairman takes office, the possibility of Bitcoin ETF application being approved has been raised again, leaving the SEC with little time to think.

In contrast, Canada, which has long been in the North American market with the United States for a long time, took the lead in passing the Bitcoin ETF application.In the beginning of 2021, pure investments and evolve funds, a Canadian asset management company, have been approved by the Ontario Securities Commission (OSC) of Canada and issued Bitcoin ETFs. The first pure Bitcoin ETF is welcomed by the market.

In Canada, a total of three Bitcoin ETFs were approved and listed in February, namely: pure Bitcoin ETF (transaction code: BTCC), evolve Bitcoin ETF (EBIT), CI Galaxy Bitcoin Fund (btcx).

Interestingly, behind the first two ETFs launched, Gemini trust company seems to be standing behind the two, providing secondary custody for them.The Winklevoss brothers, founder of Gemini and well-known investor of crypto community, seem to have succeeded in their strategy of moving to Canada after repeatedly rejecting their applications for Bitcoin ETF.

Other proposed Bitcoin ETFs are also in the process of waiting for approval, according to the documents from SEDAR, the relevant Canadian agency. Preliminary decision documents have been issued on the Bitcoin ETF specification submitted by horizons ETF Management (Canada), arxnovum investments and accelerate financial.

Although Canada has successfully issued two Bitcoin ETFs, there is still a gap in the number of market participants and market activity in the two listing paths of the United States and Canada.At present, the price of Bitcoin has already reached a new high of more than 60000 US dollars, and the current total market value has exceeded 1 trillion US dollars.

The firecoin Research Institute pointed out in a report that at present, the market size of the United States is about 27 times that of the Canadian market. If the United States can approve Bitcoin ETF to enter the market, its Bitcoin ETF trading volume is likely to cause explosive growth under the enthusiasm of investors.Inspired by the advantages of the cryptocurrency ETF product, the Canadian regulatory authorities first launched the product, but the huge and complex U.S. market determines that it may have more concerns and is difficult to go out of the same innovation path as Canada.

At a time of strong institutional demand, batch of Bitcoin ETF applications have again flocked to the sec.

On January 22, during the "transitional period" of SEC's term change, U.S. investment management company van Eck re applied for Bitcoin ETF again, and planned to launch the Vaneck vectors digital assets ETF, which will track the price and yield performance of MVIs (a digital asset index provider) global digital asset stock index.At the same time, the Chicago Board of options (CBOE) has submitted a document requiring the listing of Vaneck's proposed Bitcoin ETF.Recently, the SEC announced the relevant situation, and the application of Vaneck Bitcoin ETF has opened a 45 day review period.If approved, the ETF could become the first open Bitcoin exchange traded product in the United States.

On March 20, skybridge capital filed a Bitcoin ETF application with the securities and Exchange Commission.As early as January this year, skybridge capital launched the Bitcoin fund.

Also in March, WisdomTree investments, a New York City based asset management firm, filed an application with the SEC to launch the Bitcoin Exchange Traded Fund (ETF), which is to be traded on the Chicago options exchange.In the Bitcoin ETF application submitted by New York digital investment group (nydig), it intends to list its nydig Bitcoin ETF on the New York Stock Exchange (NYSE).

In the "US stock + Bitcoin ETF" (NASDAQ: SPBC) application submitted by simplify asset management company, there is also a non-traditional combination of stock and cryptocurrency for investors to choose from.For this type of portfolio fund, 15% of the fund's total assets will be invested in the gray Bitcoin trust (GBTC) and indirectly in bitcoin.

- Compliance investment tools of mainstream funds

In the face of a new wave, gray scale is also preparing.Gray has published a number of ETF related recruitment information in the official information, causing market speculation.

For a long time, it has been the main channel for traditional institutional investors to buy Bitcoin through gray Bitcoin trust.While ETF allows market makers to create and redeem stocks at will, if liquidity is sufficient, the phenomenon of premium or discount will be rare.In the traditional market, its risk is also considered to be much smaller than that of closed-end trust funds such as GBTC, ETF tools are more easily accepted by public funds and pension funds, and Canadian ETF may be more popular.

In an interview on March 24, gray CEO Michael sonnenshein publicly said that grayscale is taking a wait-and-see attitude towards applying for Bitcoin ETF, and grayscale is preparing for this possibility.But the SEC may not be ready to approve Bitcoin ETFs.

While the market is still arguing about the SEC's attitude, "ETF effect" has begun to spread.

First, South America made some moves. On March 3 and 19, Brazil also approved the first Bitcoin ETF in South America, which was issued by QR asset management, an asset management company. It will be put on the shelves in B3 of the Brazilian stock exchange under the code name qbtc11. It is expected that it will enter the B3 open trading in June this year.

On the other hand, this effect also spread to eth.After the issuance of Bitcoin ETF, evolve again submitted its preliminary prospectus for Ethereum ETF (ethr) to the Canadian Securities Regulatory Authority (CSA) in early March.According to the official introduction, ethx will directly invest in Ethereum, and its assets will be priced by the pembo Galaxy Ethereum index (which is also the settlement index of Ethereum futures contracts on CME).

Whether a variety of encrypted ETF applications can be approved will become the next focus of the market.

Yu Jianing, President of firecoin University, publicly analyzed that "the successful approval of Bitcoin ETF means that as long as there is a compliant stock account, Bitcoin can be purchased indirectly. For the Bitcoin market, users will upgrade by an unimaginable order of magnitude. Retail investors and institutions of traditional finance can buy a large number of bitcoin, and the market will usher in another dimension of upgrading.".

At the present stage, the market is still eager for new capital.If ETF based on Bitcoin can be issued and circulated, the metropolitan market has new expectations for the entry of a large number of users' funds.

Some industry observers have also seen the huge demand in institutions. In early March, Mathew McDermott, head of digital assets at Goldman Sachs, released a survey, which said: more than a third of the institutional clients surveyed by Goldman Sachs said they currently hold digital assets,And more than half of institutional clients plan to expand their digital portfolio in the coming months.They are witnessing huge demand from institutions over the Bitcoin and crypto markets, and in terms of institutional demand, there is no sign of any weakening.

The institutional needs discussed here cover the entire industry, referring to hedge funds, asset management companies, macro funds, banks, corporate treasurers, insurance and pension funds. Most institutional clients are actually talking about bitcoin.Loose monetary policy has boosted institutional demand for digital assets.We may be optimistic about the SEC's approval of Bitcoin ETF.

Airdrop March 31st - How to Earn up to $1500 USD in Crypto Absoluty Free.