The upper limit of DeFi and NFT depends on the degree of resolution of these three major challenges

"Bitcoin is attracting core banking customers," Fidelity digital asset executives said recently. The market value of Bitcoin has exceeded $1 trillion, which has already surpassed JP Morgan Chase and Industrial and Commercial Bank of China, the world's largest banks by market value.

At present, DeFi comes with many attributes of Bitcoin, which further promotes the transformation of the financial industry, and NFT brings a strong out-of-circle attribute similar to Bitcoin.

In the future, if DeFi and NFT are as successful as Bitcoin, their upper limit will be immeasurable, but the current state is that DeFi and NFT are also facing many challenges to be solved.

- First, safety is always the first priority

security issues should always be one of the biggest concerns of OTC funds.

Although DeFi has brought many benefits to the financial technology revolution. For example, improving capital utilization rate, high yield, flexibility and freedom, etc., but in fact, we still need to do a lot of work to really convince institutions or ordinary users to "eat crabs" with real money like bitcoin.

Because too many smart contract security and prediction machine security issues are constantly before our eyes. The reason why Bitcoin is becoming more and more popular is mainly because it is safe enough, and it can safely enter the market with tens of billions of funds, so that the market value of Bitcoin can reach the present level.

As the first priority for users to use with confidence, many DeFi projects that want to seek long-term development are bound to work hard on security.

The upcoming V3 version of DeFi metony my platform ForTube brings many security optimization schemes worthy of reference in the industry, and also refreshes the safe and reliable value support for $FOR Token:

1). Economic model optimization: reduce the system bad debt risk

In order to solve the problem of bad debt risk due to high asset fluctuation, ForTube started from version 2.0, taking into account the maximum loan-to-deposit ratio of users' borrowed assets, and introduced account "health index" to identify the health degree of accounts.

Liquidation may be triggered when the value of the user's deposit assets declines or the debt rises. ForTube V3 distinguishes the maximum loan-to-deposit ratio from the liquidation threshold, which further reduces the related system risks.

2). Asset rating and pool allocation

To meet the metonymic requirements of different users for different multi-assets, ForTube protocol is connected to other protocols and platforms through the composability of DeFi. Although it brings more choices, ForTube needs to rate these assets because of the different risks of introducing them.

Assets are not only evaluated from three dimensions: smart contract risk, market risk and counterparty risk, but also divided into five levels from low to high, so as to maintain a reasonable level of security for the system.

After that, ForTube is divided into a robust zone and an innovative zone according to the asset rating, which are independent of each other and do not interfere with each other, reducing systemic risks and providing users with products with different risk preferences.

3). Financial risk control and the safety of contracts and prediction machines

In fact, every stable financial system can not be separated from the risk control rules. In the face of various abnormal or potentially risky operations of users, the system can identify and send early warning notices to the operation managers, and instruct the contracts to deal with them accordingly.

The wind control of ForTube system has been iterated in three major versions. In V3, the wind control rule engine will be built step by step, and the wind control model will be upgraded, so that all business processes of ForTube are in a complete wind control closed loop.

In view of the fact that the risks of many projects lie in the insecurity of smart contracts, experienced contract developers and rigorous and professional well-known third-party audits are the most basic requirements. In addition, ForTube platform is equipped with a closely coordinated audit and monitoring system, which can further minimize asset losses.

Predictive machine system is also an important part of DeFi system. The multi-asset ForTube platform upgraded the prediction machine system in V3 version, and adopted the scheme of combining decentralized prediction machine with self-pricing, and cooperated with famous prediction machines such as ChainLink and Band to ensure accurate and timely pricing.

It is worth mentioning that the self pricing node will absorb the node cluster concept of the decentralized Oracle platform, effectively improve the decentralization and security of the node cluster, and realize the organic unity of scalability and security on the Oracle system.

- Second, the community and governance

In theory, DFI in the true sense ofcan not be dominated by only one project owner or developer. Decentralized community governance is the final destination, because it represents security in another dimension.

Without the restriction and approval of any person or institution, they can participate freely, and no one can deprive the assets belonging to individuals. At the same time, through the construction and governance of the community, more users can be attracted to join in and help to expand the community and platform spontaneously.

Most of the mainstream defi projects are advancing in this direction, but they are also faced with very difficult challenges in community construction and governance.The construction and governance of the community means that the leading of a project is left to the community to decide.

How to distribute the interests of community members?How to motivate participation and contribution?How to ensure the system into a virtuous circle?There are many problems to be solved.

After a long period of practice, the forTube community has also brought some highly referential governance paradigms.The core developer team is an equal member in the community, and also a role of employees. It is employed by the community to undertake the supervision of the construction of technical projects and ecological projects, and the maintenance of the technical architecture of the platform.

At the same time, some system gas fees, security audit and bug bounty programs are also allocated from the distribution of system revenue.

In V3, the forTube community will further introduce a new governance architecture to balance the issues of profit distribution, risk taking and governance decision-making.One of the most important roles is fdao.

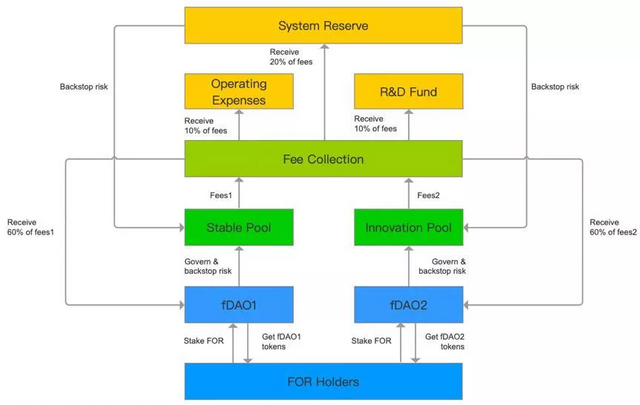

governance architecture

To put it simply, each fund pool partition (the stability zone and innovation zone mentioned above) is managed and operated by a corresponding fDAO, and FOR gets the holder of the corresponding fDAO Token from the corresponding FDAO as an incentive. To ensure rationality, $fDAO is issued in the form of joint curve.

The highlight of fDAO governance model is the risk. It is equivalent to an insurance for the partition on the platform.

Decentralized community governance with a mechanism of "mutual insurance" can disperse the impact of smart contracts and economic risks to a great extent. Through the rational design of the joint curve, the more the system reserves assets, the higher the number and proportion of the bottom assets, and the safer the metonymy pool will be.

ForTube protocol introduces a new governance framework based on the Bonding Curve to balance ForTube's revenue distribution, risk-taking and governance decision. Each metonymy pool of ForTube protocol will be operated and managed by the corresponding $fDAO.

Investors can obtain financial risk exposure of ForTube's future earnings by purchasing $fDAO Token. Mainly divided into three aspects:

Users can pledge assets to a certain fDAO pool according to their own risk preferences and obtain the corresponding $fDAO Token.

fDAO governs its metonymy pool and covers some risks.

The holders of $ fdaotoken share 60% of the revenue of the platform.

For ForTube, $fDAO Token can not only effectively motivate early investors and provide them with predictable returns, but also guarantee healthy liquidity. At the same time, the assets in the joint curve act as a safety pool, providing insurance for the money market to protect it from smart contracts and economic risks.

For investors, because the value of $fDAO Token will gradually increase along the joint curve, users who invest in $fDAO Token in the early stage will be able to make profits easily with the passage of time.

To sum up, ForTube maintains healthy operation and risk control through a simple and effective fund acquisition mechanism without affecting governance power. Investors can invest in ForTube with less friction and license, and keep their interests consistent with those of the platform.

- Third. Innovation and Sustainability

used to change rapidly in the field of crypto, and many projects came to a dead end because of lack of security foundation and failure of governance.

Some projects have a very short declaration cycle, so later everyone put forward an important condition for various projects that can participate: they must be sustainable projects.

If safety is the necessary foundation of DeFi and community and governance are the development direction, then sustainability must be the long-term goal of DeFi project.

Of course, for a sustainable development project, safety and governance are very important, and it is also necessary to innovate constantly on this basis. From the community news, ForTube also brought a lot of innovative designs:

1). New membership system

In the new membership system introduced by ForTube, a member is measured in the form of "star value" points, and the contribution of interest in deposit and loan activities to the system is evaluated.

That is to say, the greater the contribution, the more the "star value" and the higher the level, the greater the corresponding monthly airdrop income.

Step-by-step membership system has been proved to be a very successful incentive system in a large number of industries, which is also an additional innovative attempt besides fDAO community governance.

2). Plan to combine NFT gameplay to provide better creativity and experience

After DeFi, the value of NFT began to show constantly, and also brought many new experiences.

For example, we have seen a lot of GameFi, and the gamified DeFi has brought unprecedented new experiences to users, and also accelerated the growth of the project itself. There are also NFT insurance policies and Token insurance policies, which not only hold but also participate in mining to obtain additional income and have certain liquidity.

ForTube launched the first candy NFT and commemorative NFT at Christmas in 2020. It is reported that more NFT games will be launched in the follow-up ForTube program to provide users with better product creativity and experience.

In the future, ForTube will transfer the value of NFT assets to the corresponding NFT composite Token according to the characteristics of NFT assets and the design concept of DeFi products.

However, NFT's ability to get out of the circle is amazing, which can also bring extra flow and brand power to DeFi products, and they are also a complementary relationship.

- Summary

In the early development of crypto field, chaos emerged endlessly, and only the long-term sustainable development project "winner is king". Many DeFi applications, including ForTube, are still groping and innovating.

It is expected that they will bring safer, more stable and sustainable DeFi and NFT applications to users inside and outside the crypto field, and continuously increase the upper limit of the value of crypto applications.