At the beginning of 2021, Ethereum has risen more than Bitcoin. Will it continue to be bullish in the future?

At the beginning of the new year, the price of Ethereum, the second largest cryptocurrency by market value, soared. Since January 1, it has outperformed Bitcoin with an increase of approximately 81%. Last Sunday, the price of Ethereum soared to $1,454.32, another record high. Despite a temporary correction, it is still one of the strongest performing assets among the top ten assets.

Ethereum price analysis

Ethereum has climbed to the upper resistance level of $1,300, and the bulls are trying to resume the upward trend. A rising moving average and relative strength index above 61 indicate that the bulls are in control.

ETH/USDT daily chart

If the price falls from the upper resistance level, the currency pair may fall to the 20-day moving average ($1,166). A rebound from this support level will increase the possibility of resuming the upward trend.

However, if the next downtrend breaks below the uptrend line, it indicates that the trend may change. The next support level on the downside is the 50-day moving average ($882).

ETH/USDT chart

The bears are currently trying to hold the overhead resistance of $1,350. If the price turns down from the current level, it may find support at the moving average entry point. A rebound from this level will indicate that the bulls are buying at every small decline, which will increase the possibility of a breakthrough of $1,350.

Contrary to this assumption, if the bears break the price below the moving average, the currency pair may fall to the upward trend line. A break below the support level will indicate a change in market sentiment and may lead to a deeper correction.

Ethereum gains more than Bitcoin

So far, Bitcoin has increased by more than 15% in 2021, but Ethereum has performed much better, rising by more than 70% in the same period.

The fast-growing total locked-in value (TVL) of the DeFi market has driven the growth of DeFi tokens, and the total locked-in value is the most popular indicator for tracking DeFi and its corresponding growth.

According to OKLink data, the total lock-up volume (TVL) of the Ethereum DeFi protocol has exceeded 36 billion U.S. dollars, indicating a large demand. This is crucial to the momentum of Ethereum, as more and more applications and tokens rely on its network.

In August 2020, Arcax and Algorand announced plans to develop tools for introducing DeFi into organizations. In the fall of 2020, xSigma, a subsidiary of ZK International traded on Nasdaq, is committed to developing DeFi services and is preparing to launch a decentralized exchange to trade stable coins.

Other first-layer blockchain protocols are also growing and are expected to compete with Ethereum, such as Polkadot and Cosmos. However, in the foreseeable future, the network effects of Ethereum and the comprehensive value of the DeFi protocol on Ethereum make it unlikely that Ethereum's dominant position in the DeFi field will be challenged in the short term.

The Ethereum community has a strong bullish atmosphere

Since Ethereum broke the record price set in January 2018, the sentiment surrounding the Ethereum community has become very positive.

Anthony Sassano, a long-term investor in Ethereum, the marketing director of Set Protocol, said that this rise represents the fundamental work done by developers in the Ethereum ecosystem over the past three years.

The new momentum generated by the increased demand for decentralized finance has enabled Ethereum to outperform Bitcoin in the recent bull market cycle. Sassano said:

"Many dedicated Ethereum community members spent 3 years building the Ethereum ecosystem during the bear market. Now, their efforts have paid off."

The data on the chain also shows an upward trend, and there are many other indicators that indicate that the ETH price increase may have just begun.

Ethereum price trend in one week

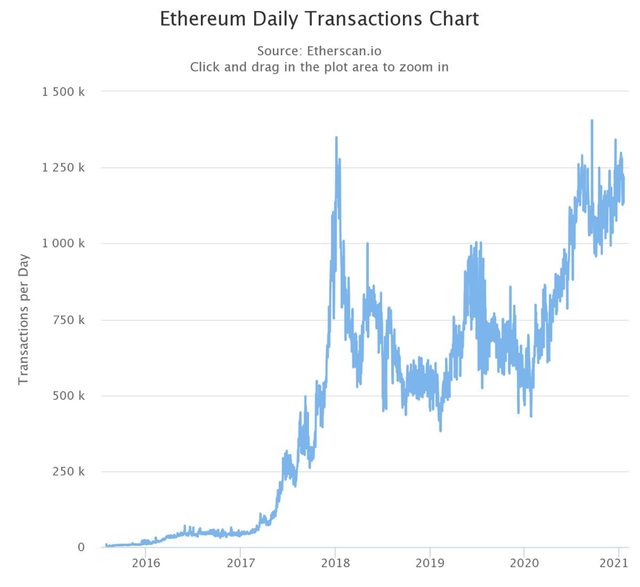

Ethereum transaction volume growth

In 2020, the value of transactions recorded on the Ethereum blockchain will exceed $1 trillion. These figures exceed the transaction volume of payment giants such as PayPal, which has more than 350 million users, and the average quarterly transaction volume generally does not exceed 200 billion US dollars.

Every transaction will incur a network fee paid in ETH. And since the growth rate of the network is still high, we can confidently expect that the "bullish" trend of Ethereum will continue.

People’s interest in cryptocurrencies is increasing, as are the number of active wallets, the number of transactions on the network, and the average transaction size.

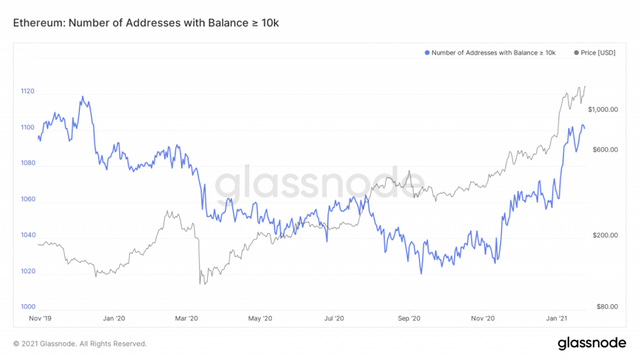

According to on-chain data from the blockchain analysis company Glassnode, last Saturday, the number of whale addresses (with at least 10,000 ETH) jumped to 1,103, a 13-month high. In this month alone, 35 has been added, and 75 have been added since mid-November. The increasing funds accumulated by investors may push the price of Ethereum to rise further.

Number of addresses with more than 10,000 ETH

On January 19, Spencer Noon of Variant, a cryptocurrency venture capital fund, pointed out that in the past eight months, more than 1 million unique addresses have interacted with DeFi.

Noon added that the monthly DEX transaction volume is currently at the highest level in history, exceeding $30 billion, and more than $20 billion has been deposited into the DeFi loan agreement.

In addition to DeFi, Noon also emphasized that on a daily basis, Ethereum is the largest blockchain network-more than 50% higher than Bitcoin; in the past 12 months, the number of daily active Ethereum addresses has doubled , Reaching 550,000, a record high; in the past year, a stable currency worth nearly 20 billion US dollars has been minted on Ethereum.

Although the fundamentals of Ethereum are soaring, Noon noted that the number of ETH transactions worth more than $100,000 is seven times less than the January 2018 high, indicating that "institutions have not yet entered the game."

Ethereum daily transaction volume

In 2021, Ethereum achieves a "good start", so what factors will push its price to rise further in the future?

Ethereum futures are coming soon

The Chicago Mercantile Exchange (CME), the world's largest derivatives platform, publicly announced on December 16 that it plans to launch Ethereum futures before February 8.

The arrival of Ethereum futures will eventually bring more maturity to the crypto market. Although the futures are not actually delivered, they are more liquid. This is beneficial because it will give institutional investors the opportunity to hedge their spot positions, thereby reducing overall risk and making Ethereum a more attractive investment.

The first phase of Ethereum 2.0 is expected to be launched this year

Ethereum is transitioning from a proof-of-work blockchain to a blockchain that uses a proof-of-stake consensus mechanism. The goal is to become a faster, more efficient and more scalable platform. The Ethereum 2.0 upgrade is divided into four different phases: phase 0, phase 1, phase 1.5 and phase 2. Each stage lays the technical foundation for the next stage until the final stage is completed.

Phase 0 went live on December 1, 2020, and implemented the beacon chain (a new blockchain layer that will coordinate activities between individual Ethereum shard chains).

The first stage is the next stage of Ethereum development and will start 64 shard chains. All transaction activities on the entire network will eventually be distributed and processed between these separate blockchains. The advantage of this new system is that the transaction does not need to be verified by the entire network, but only requires one branch. This will greatly reduce the time required to confirm transactions, and the entire network will be able to handle larger transaction volumes without suffering from current network congestion.

Although there is no exact date to start the first phase, it is expected to be launched this year.

in conclusion

At the beginning of 2021, Ethereum has achieved a "good start", with an increase exceeding Bitcoin. During the period when Bitcoin was consolidating with low volatility, Ethereum did not “depress” with it, but achieved a “counterattack”, and transaction volume increased substantially. How will its trend develop in the future, let us wait and see!

Image source: Tradingview, Pixabay, Glassnode, Etherscan,io

This post was resteemed by @steemvote and received a 13.24% Upvote. Send 0.5 SBD or STEEM to @steemvote