Baby Boomer Assets - What the Fed Giveth the Fed Taketh Away

After the crash of 1929, it took 25 years for the stock market to get back to its previous highs.

In between that time, we had the Great Depression.

The Fed, Rotschilds, did this on purpose. There was so much money lending thanks to the Feds lenient lending policies that people were borrowing money to play the stock market.

Today we are running the same scenario.

The Fed is tightening money to the extreme, and soon the stock-bond-real estate market are about to implode.

And thus begins the Greater Depression. (Make America Greater Again? You know?)

Boomer "wealth" = Money Printing

In 1971 Nixon took us off the gold standard (temporarily) and thus began the era of pure money printing.

In money printing, those closest to the spigot get the biggest reward. And the boomers were the first generation under the free money. So, the assets they bought, went up and up and up.

Houses have sky-rocketed in price. From, something like $10,000 to $1,000,000

Stocks from 1,000 to 15,000

Also, during this time wages for the upper echelons in companies went up, A LOT.

All of this increase is mostly due to money printing.

None of these "assets" actually increased much in real value.

Some people bought houses in the right part of town, and so, are much more valuable. (but the opposite is also true) But, overall, there is no real increase in the value of the asset. It just costs more.

What the Fed Giveth, the Fed Taketh Away

The Fed has been the cause (or exacerbated the situations) of many booms and busts.

By loosening or tightening money, they set up a cascade that causes these.

Right now, all the money made on commercial real estate, is about to go away, and suck so much wealth into its death vortex, leaving a crater where the banks used to be.

All the loans for these commercial buildings are coming due, and they will need to be refinanced at MUCH higher rates, meaning a lot of money is going to disappear. Already, huge impressive buildings are being sold for 10¢ on the dollar.

If you have been watching the "mean house price" you probably think that housing is still going up. However, the medium priced houses are not selling. All that is left is the suckers. And they are dwindling fast. If a person asks me if they should sell their house, i would remark that they are probably too late. Housing prices need to drop in half to make up for the rise in interest rates, and no one is lowering their house prices that much. Not even close.

Many analysts are saying the stock market is due for a correction. However, i feel they aren't thinking about how Great this correction is going to be.

Basically, the Fed is playing their old tricks. Crash the market, and have all their friends buy it up with more printed money.

And this is going to hurt the average boomer so much.

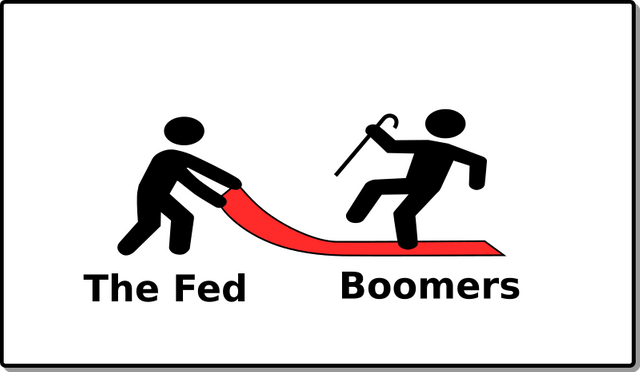

Just before they would cash in the retirement account, or sell their house and move into something smaller, or a retirement home, the rug is going to be pulled out from under them.

The MSM is still telling everyone its going to be ok. OK, well, it will be a soft landing…

Jim Cramer is still telling people to get into the stock market.

Even cash in the bank is not safe. All the banks, except the big 5 are going to close/crash

At this point there is so few ways to get out, that i don't even advice anyone.

You have bitcoin and silver. And, not the ETFs. Getting any sizeable amount into either of these is very difficult.

Most boomers will just watch as their retirement drops in half, and then half again as the govern-cement comes into rescue them by giving them "special" bonds. Boomers will watch as their house's value plummets. (weren't these kids just complaining about not having any houses to buy?)

All the boomers who thought they had their future set, are going to find they have nothing.

But, the future is actually very bright.

Yes, the Fed plans to crash everything, and then buy up all the "assets". But, they are not assets anymore. Their plans will completely fail. They will buy up garbage, that they find nobody wants. They will try to control markets and areas, where no one will wish to buy or live there.

It is like trying to completely control gun manufacturing, (buying up, or driving out of business everything) when everyone has switched to printing their own gun.

The Fed has put a hole in the bucket of the economy.

And are draining everything out.

Only to find their own bucket has a bigger hole in it, and there is nothing there.

The younger generations are just going to abandon the old world.

Banks? What are those?

Govern-cements? Yeah, really don't need those.

Manufacturing in China? Why would anyone do that? 3D printer go BRRRR

Electricity? Yeah, i got mine.

Suburban housing? Why would anyone live there?

So, we will make it through this. And humanity will be much better off.

However, it is going to look very scary.

Especially to Boomers who are stuck in their ways.