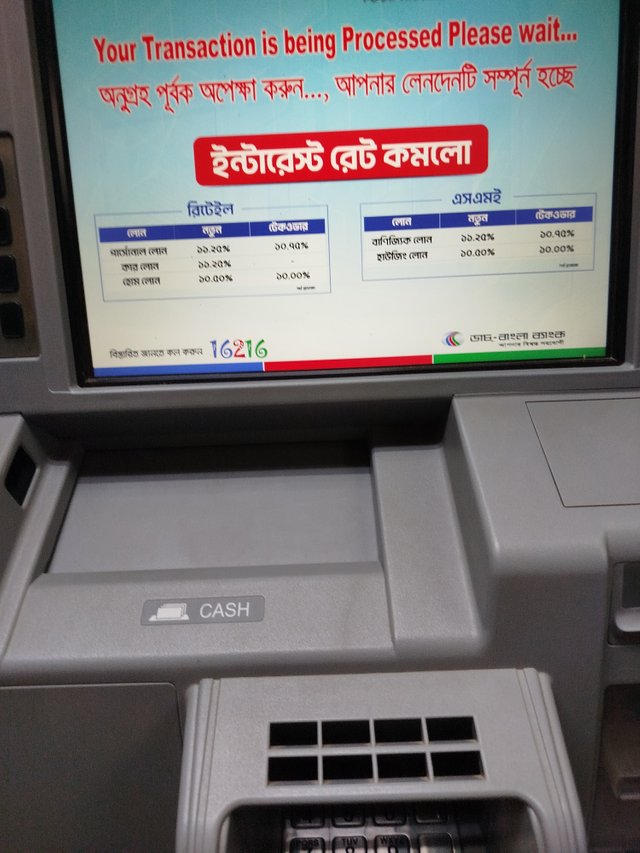

Withdraw money from ATM booth. (24 November 2024)

Assalamu alaikum

How are you all friends I hope you are all well I am also Alhamdulillah.

Today I came to you with a new blog

ATM withdrawal.

I will share with you how I did it.

I run a small business so I want to withdraw money every day at the ATM booth.

ATM booth facility

An ATM (Automated Teller Machine) booth is a facility that provides bank customers with 24/7 access to services like cash withdrawal, deposit, balance inquiry, and other transactions. It is an electronic device that allows users to perform banking tasks without visiting a bank branch.

Key Features of an ATM Booth:

- Cash Withdrawal: Withdraw money easily using a card and PIN.

2.Balance Inquiry: Check the current balance in your account.

3.Cash Deposit: Some ATMs allow cash deposits.

4.Mini Statement: View recent transaction details.

5.PIN Change: Update your password directly from the ATM.

Steps to Use:

1.Insert your ATM card.

2. Enter your PIN.

3. Select the desired transaction (e.g., cash withdrawal).

4. Provide the necessary details and complete the process.

Safety Tips:

Keep your PIN confidential.

Do not accept help from strangers.

Collect your receipt and card after completing the transaction.

ATM booths are usually located in bank branches, shopping malls, hospitals, and other public places. They make everyday financial activities faster and more convenient.

Advantages and Disadvantages of ATM Booths.

Here is the detailed discussion on the advantages and disadvantages of ATM (Automated Teller Machine) booths:

Advantages of ATM Booths

1. Cash Withdrawal Facility

You can withdraw money anytime without depending on bank operating hours.

2. 24/7 Service

ATM booths are open round the clock, even on holidays.

3. Global Accessibility

Allows international withdrawals while traveling abroad.

4. Time-Saving

Eliminates the need to wait in long lines at the bank.

5. Cash Deposit Options

Some ATMs allow cash deposits directly into your account.

6. Balance Inquiry and Mini Statement

Users can check account balances and transaction history easily.

7. Bill Payment Facilities

Certain ATMs allow payment of utility bills like electricity, water, etc.

8. Safe Transactions

Reduces the risk of carrying large amounts of cash.

9. Multiple Services

ATMs often support cards from various banks (if part of the network).

Disadvantages of ATM Booths

1. Technical Issues

Transactions become impossible during machine breakdowns or server downtimes.

2. Fraud Risks

Skimming devices or PIN theft can lead to fraudulent activities.

3. Withdrawal Limits

Daily withdrawal limits restrict the amount of cash you can access.

4. Card Retention

Cards may get stuck due to repeated incorrect PIN attempts or technical glitches.

5. Insufficient Cash in ATM

ATMs sometimes run out of cash, causing inconvenience.

6. Bank Fees

Using an ATM of another bank may incur additional fees.

7. Security and Fraudulent Risks

Personal data theft or account hacking poses a serious threat.

8. Risky in Remote Areas

Using ATMs in unsafe locations increases the risk of theft or robbery.

9. High Charges Abroad

International transactions may incur hefty fees or unfavorable exchange rates.

10. Card Loss

Losing or having your ATM card stolen can jeopardize account security.

Conclusion

ATM booths make cash transactions convenient and quick. However, addressing security and technical issues can enhance their usability. Customers are advised to use ATMs cautiously and securely.

Dutch-Bangla Bank's ATM booths are among the most popular and technologically advanced in Bangladesh. Customers generally enjoy the following services:

1. Cash Withdrawal: Quick and easy withdrawal of cash.

2. Balance Inquiry: Check account balance conveniently.

3. Mini Statement Print: Print a brief transaction history.

4. Deposit Facility (at select booths): Some booths allow cash or cheque deposits.

5. 24/7 Availability: Accessible at any time.

6. Bill Payment and Mobile Recharge: Certain booths offer these additional services.

Quality of ATM Booths:

Security: Most booths are equipped with CCTV cameras and security personnel.

Cleanliness: Booths are usually clean and customer-friendly.

Card Compatibility: In addition to Dutch-Bangla Bank cards, most booths support other banks' cards through the "NPSB" system.

However, there may be occasional issues, such as unavailability of cash or technical malfunctions. It’s advisable to check with Dutch-Bangla Bank's mobile app or customer care for updates before visiting a booth.

For work I use:

mobile |

radmi note_13 |

photographer |

@romzan15 |

location |

Jhenaidah Bangladesh |

taking pictures |

At the ATM booth |

Friends, that's it for today.

Share your experience withdrawing money from RKK ATM booth.

Comment your comments

thank you.

Allah hafez