SLC-S21W5: How to Handle Amazon Taxes

|

|---|

Research and Explain

- Tax rates for self-employed or self-employed individuals in Bangladesh depend on annual income. As per the Income Tax Ordinance, the tax rates for individual taxpayers for the tax year 2023-24 are as follows:

- First Rs. 3,50,000: Tax-free (Applicable to men).

A limit of Rs.4,00,000 escapes taxes for Women and Senior Citizens (65+).

For Persons with disabilities: Tax-free limit of Rs. 4,75,000.

The third-gender population: Tax-free limit of Rs. 4,50,000.

- Upto Rs. 3,50,001 to Rs. 7,00,000 has a 10% tax.

- Upto Rs. 7,00,001 to 1200000 a tax of fifteen percent 15%.

- Upto Rs.12,00,001 to 30,00,000 , 20%.

- Over Rs.30,00, 001, a tax of 25%.

Illustration:

For instance, if your self-employment income is Rs.8,00,000 in a year:

As claimed earlier, first Rs. 3,50,000 is tax free.

The next succeeding Rs. 3,50,000 will be taxed at: 10% of = 35,000 Rs.

The remaining one hundred thousand rupees will be taxed at: fifteen percent of = 15,000 Rs.

Final Tax amount: Rs.50,000.

eTIN is a requirement for self-employment. And one is to declare income taxes on an annual basis. Special Note: I don't have any taxable income so I submit a zero return

- Income from Amazon’s affiliate program is typically classified as either freelance or digital services income with foreign origins. Such income is also remitted in Bangladesh if brought into the country through formal banking channels. However, this income is often ignored by the government. Many times few of our youngsters have to be the victims of the harassments. Because cryptocurrency is not legal in Bangladesh at the moment.

A. Allowance of Taxes on Freelancers or Remittance Income:

As per Bangladesh government policy, there are some circumstances whereby freelance income received during the tax year 2023-24 may be tax exempt:

If funding is received through a bank or mobile money service.

Nonetheless, this provision is not applicable to persons who have an annual income level that is higher than the tax exempt limit of tk. 3.5 lakh or other applicable limits.

b. Business profit of sorts

Certain other business segments or practices may also recognize Amazon Affiliate Income as business income tax applicable in this case, but investments in certain sectors or under special tax exemption may get some relief.

-- –

c. Duty to file tax returns

All persons with eTIN are required to have an Amazon affiliate or online related exploitation.

For a freelancer or in case of earning by affiliate marketing, these earnings should be declared in income tax returns on a normal basis, even

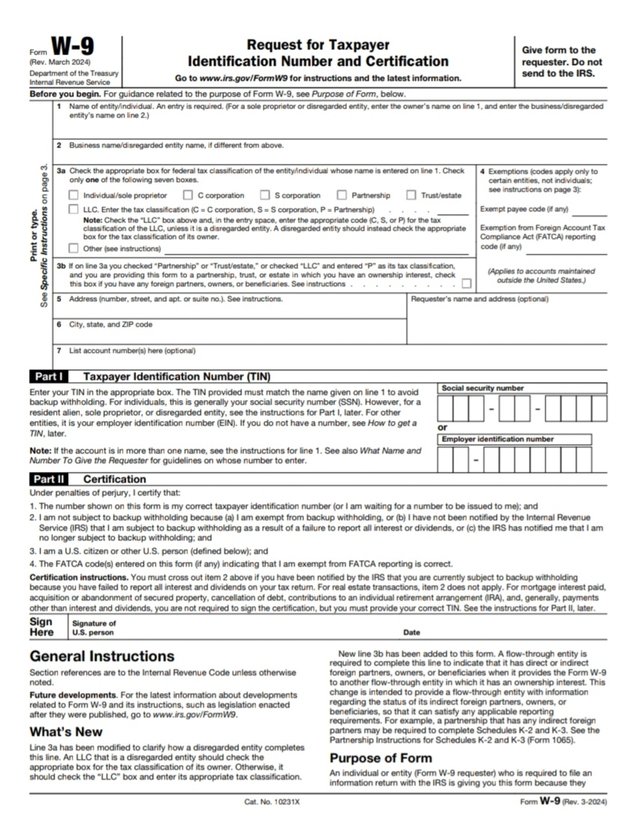

Amazon Tax Form Submission:

- W-9 Form Submission Process (US Citizen or Resident). It is not required for Bangladesh.Form W-9 is a "Request for Taxpayer Identification Number and Certification". This is usually required when you need to report a tax on any income in the US. Fill in the required information:Your name and business name (if any). Social Security Number (SSN) or Employer Identification Number (EIN).Give your correct signature below the form.

|

|---|

from website

The W-9 form is sent directly to the organization (individual or organization) that requests it.

However, not everyone needs to submit this form to the IRS. Procedure for submitting Form W-8BEN (Non-US Citizens):W-8BEN is "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting". This is usually used by US companies to reduce the tax rate on income from foreign nationals or companies. As I am from Bangladesh, I don't need this form. I will submit as return of Bangladesh.

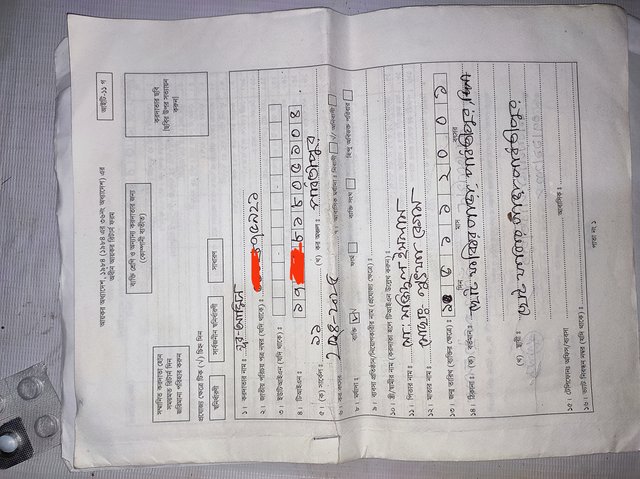

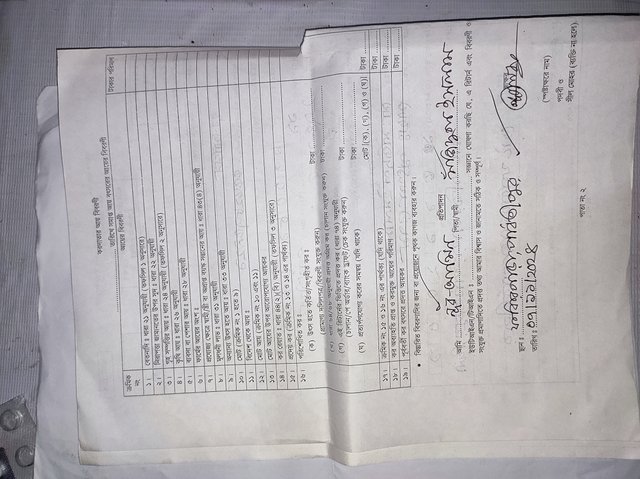

Tax Filing Process in Your Country:

|

|---|

- It is fairly correct to say that online tax filing process in Bangladesh has evolved to be simple and efficient. Correct procedure is for the taxpayer to go to the National Board of Revenue (NBR) Website and login using ETIN (Electronic Tax Identification Number). If one does not have an ETIN, he will have to do a fresh registration on NBR’s website. Once there is a successful login, login information phone number is given and client should upon update, fill in the required information in the taxpayer’s profile such as his/her ethnicity, place of residence type, source of income, and the kind of tax to apply.Following that, the taxpayer must pick the required tax form from the E-Filing option and complete it appropriately. In the form, taxpayers are supposed to state their annual income and taxable income, as well as the sources of their income that are subject to tax provision. When the form is completed, it may be submitted and the tax can be paid with the help of online payment facilities that are provided by banks or mobile financial services such as Bikash or Cash etc. If a successful payment has been processed, it is possible to receive a digital acknowledgment receipt by email or by downloading it from the internet, which is then retained for future use. As a result, this system provides convenience to the taxpayer by saving time and effort when making a tax payment and, as a result, has enhanced the accountability of the tax payment process in the entire country.

- The first step is to collect the TEX number from the tax office or online.

How to Apply:

Apply online by visiting the National Board of Revenue (NBR) website. I did it online.

To apply you will need:

National Identity Card (NID)

Trade license in case of business

Address proof (sometimes copy of electricity bill is required.) I didn't need them.

Once the application process is completed you will be issued an e-TIN card. After all the process you will be given a 10 digit TIN card.

Tax return filing process

Tax returns can be filed in two ways:

Online via:

Using NBR's e-filing system.

Register on the portal and fill the form

Manually: Fill the prescribed form (Income Tax Form 1) and submit it to the concerned tax office. I submitted this tax online yesterday. My taxes were zero.

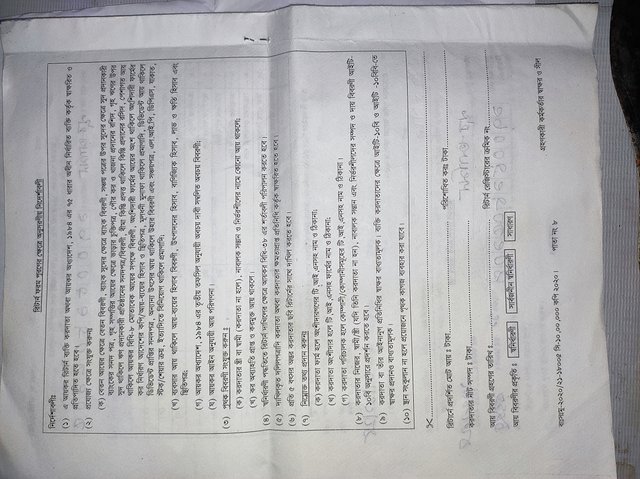

Reflection

|

|---|

- Tax matters in the case of online earnings are very crucial as it brings about some level of accountability to the individual or the organization and validates the earned income in law. In the other hand, nonpayment of online earning income taxes or poor management of it can result in legal issues, and as well can affect the individual in future financial endeavors. Even, the benefits of proper tax payment can include other state benefits such as easy acquisition of loans or obtaining renewals for business licenses. It is also a way through which social responsibility is practiced, which has a favorable effect on the country’s economic growth. Proper planning and strategy in management of taxes instills confidence in online earnings and aids in the preservation of income in the long run. And when the tax is not paid, then there is a fine of 50 taka or 2 steem equivalent per year and complexity with the filing procedures.

|

|---|

- By understanding that the tax I should pay is crucial, I learned that I have to take full responsibility, and this message has been learned by everyone. It is when he/she has to be precise and pays taxes because it is a civic obligation to act like it as a responsible citizen. Thus, such an individual will assist the development activities of the state since the tax income is empowered to develop the following services: education, health, and infrastructures. The following activities were also understood and acknowledged the necessity of preparing a financial plan and a knowledge of the law and also of being disciplined when handling the tax filing activities. It then adds that one can become involved in matters of taxation and possess knowledge of the subject.

Cc: @hamzayousafzai

Thank you very much for sharing your assignment task with us! We truly appreciate the time, effort, and creativity you have put into completing this assignment. Your dedication to following the guidelines and your commitment to learning are evident, and it’s a pleasure to see your progress.

Below are the evaluation results, highlighting the strengths of your post and any areas of focus for improvement:

Teacher Recommendation and Feedback!

Total | 7.5/10

Upvoted! Thank you for supporting witness @jswit.

Congratulations, your post has been upvoted by @scilwa, which is a curating account for @R2cornell's Discord Community. We can also be found on our hive community & peakd as well as on my Discord Server

Felicitaciones, su publication ha sido votado por @scilwa. También puedo ser encontrado en nuestra comunidad de colmena y Peakd así como en mi servidor de discordia