SLC-S21W5: How to Handle Amazon Taxes

Hey Steemian friends!

As we continue our Amazon affiliate marketing journey, understanding how taxes work with our online earnings is something to consider. Because It’s not just about following the rules and law which, of course matters!, but also about making smart decisions to avoid unnecessary financial issues. In today's post, I want to explore about taxes for Amazon Affiliate income in Sri Lanka, how to submit the tax forms to Amazon, and the steps for filing taxes here in Sri Lanka and obtaining a TIN number.

| 📱 Tax Rates for Self-Employment Income in Sri Lanka |

|---|

In Sri Lanka, any money we make from self employment including commissions from affiliate programs or other online income gets taxed. It all falls under the same category, so if I earn through online, I must pay tax. But there’s a good news which is the first part of my income is tax free!

For Sri Lankans, that tax free allowance is LKR 1,200,000 a year! This amount is quite unreasonable because before 2020 we had this rate at LKR 3,000,000 a year. However with the economic crash government made the changes to make everyone pay taxes.

The taxing get even more serious as we earn more the higher the tax rate we have to pay. This is how the calculation goes as per Inland Revenue Department of Sri Lanka.

| Amount | Tax percentage |

|---|---|

| First LKR 1,200,000 | Relief |

| Next LKR 500,000 | 6% |

| Next LKR 500,000 | 12% |

| Next LKR 500,000 | 18% |

| Next LKR 500,000 | 24% |

| Next LKR 500,000 | 30% |

| Balance Income over LKR 3,000,000 | 36% |

Example Calculation:

- Let's assume my monthly income is LKR 180,000 (US$600).

- Total annual Income: 180,000 x 12 = LKR 2,160,000

- Tax Free Allowance: LKR 1,200,000

| Monthly Salary (Annual Salary/12) | Rate (%) | Tax |

|---|---|---|

| Up to 1,200,000/12 | Relief | - |

| First 500,000/12 | 6% | LKR 2,500.00 |

| Next 460,000/12 | 12% | LKR 4,600.00 |

| Total (LKR 2,160,000) | - | LKR 7,100.00 |

- Taxable Income per year: 2,160,000 - 1,200,000 = LKR 960,000

- Total tax amount I should pay for a year: 7,100 x 12 = 85,200/-

| 📱 Does Amazon Affiliate Income Qualify for Any Deductions? |

|---|

I couldn't find any document to support this deduction specifically for Amazon Affiliate income. However, for self employed individual can claim deductions on certain expenses related to generating your Amazon Affiliate income. These deductions reduce taxable income, which make our tax liability lower.

Common Deductible Expenses:

- Internet and Phone Bills: Affiliate marketing is an online activity hence we always have these bills.

- Equipment Costs: We create content so any expenses for computers, cameras, or other equipment can fall to this cost.

- Website Hosting and Domain Fees: Maintaining cost of blog or website.

- Marketing and Advertising Expenses: Promotional cost of affiliate links.

- Office Supplies: Stationery, software subscriptions, and other supplies used for your business.

| 📱 Amazon Tax Form Submission |

|---|

- Submitting a W-8BEN Form to Amazon

This form basically tells Amazon and the U.S. government that I'm not a U.S. taxpayer. By submitting this form I will be able to cut down or even completely avoid the withholding tax on my earnings. This is the Steps to Submit the form.

- Step 01:

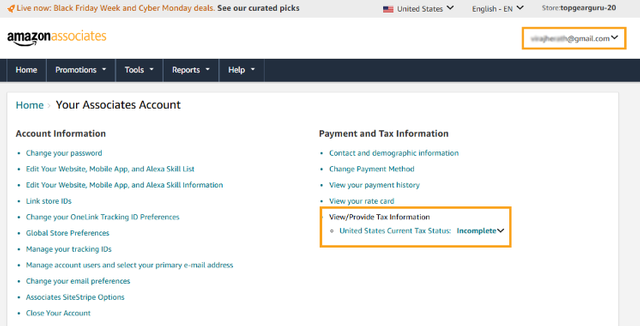

Access Tax Information: First we have to go to Amazon Associates Central and sign in. Then hover over your email on the right top where the dropdown with "Account Settings" and click on "United States Current Tax Status".

- Step 02:

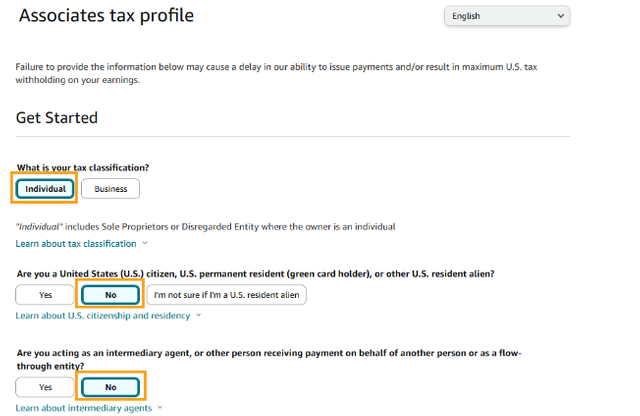

Filling out Associates tax profile: In this window we have to clarify that we are not U.S. taxpayers and do not act as a middle agent for a U.S. taxpayer.

- Step 03:

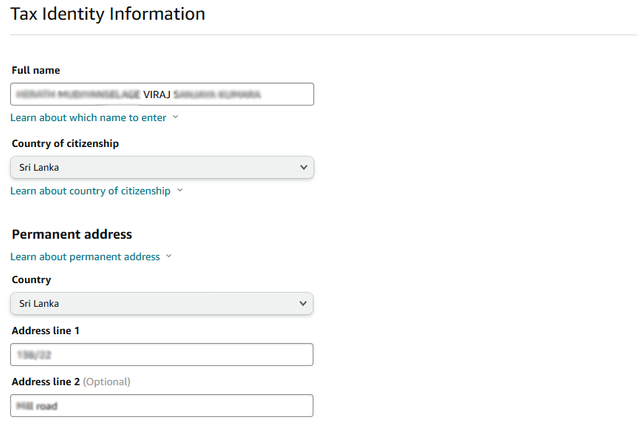

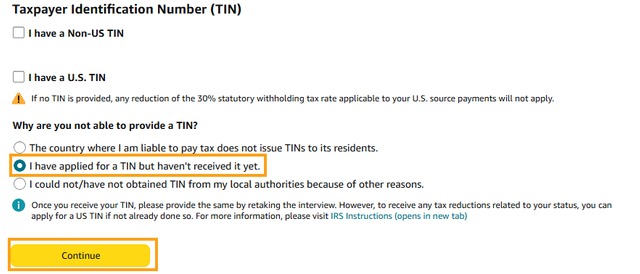

Provide Personal Information: Here we have to enter our full legal name and mailing address. For the checkmarks for TIN I left out both as I didn't receive my TIN in Sri Lanka and also we can leave U.S. TIN section as we do not have a US TIN.

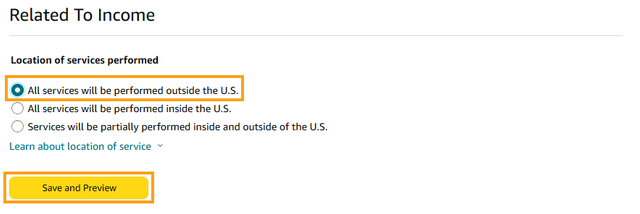

- Step 04:

Location of the services performed: I made sure to specify that all the services I offer are done outside the US by choosing the appropriate option.

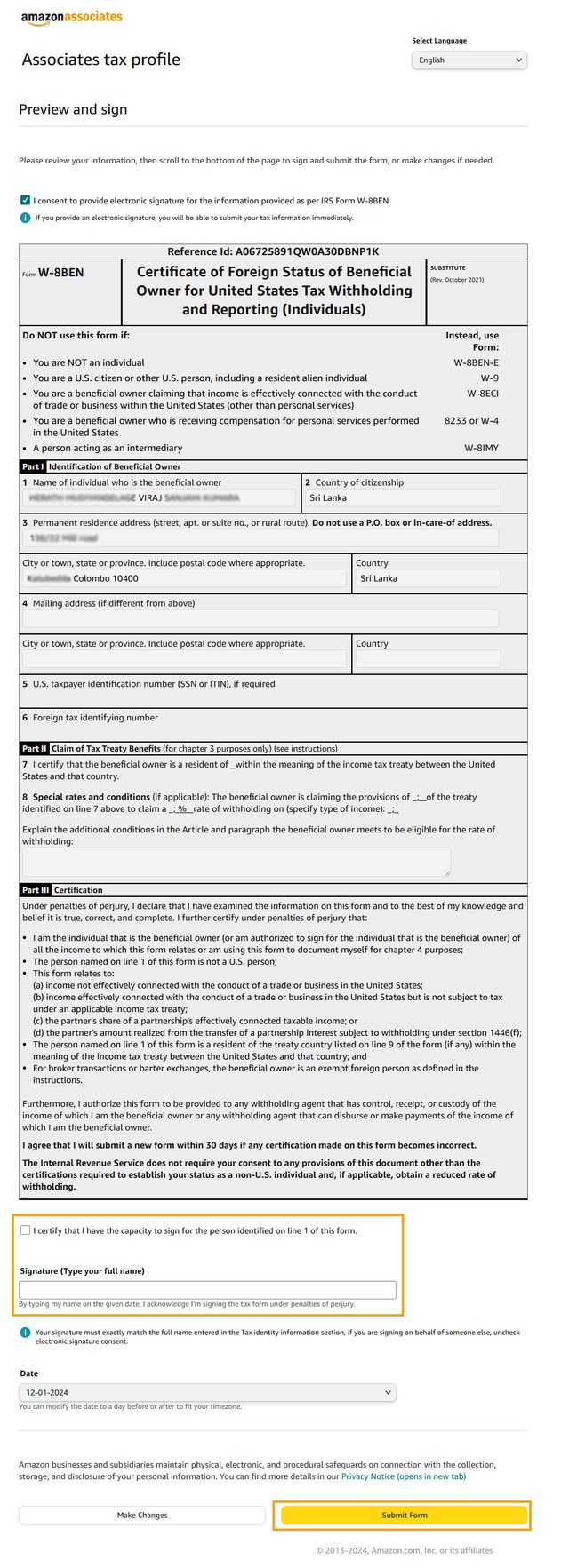

- Step 05:

Certification: Based on the information I provided the W-8BEN form has been automatically filled and all I had to do was to read the statement carefully and sign the form electronically.

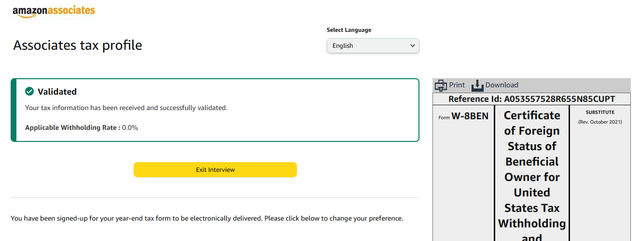

- Step 06:

Confirmation: After submission, I received a confirmation message indicating that my tax information has been received and validated. Also it clearly indicate that the "Applicable Withholding Rate : 0.0%"

| 📱 Tax Filing Process in Sri Lanka |

|---|

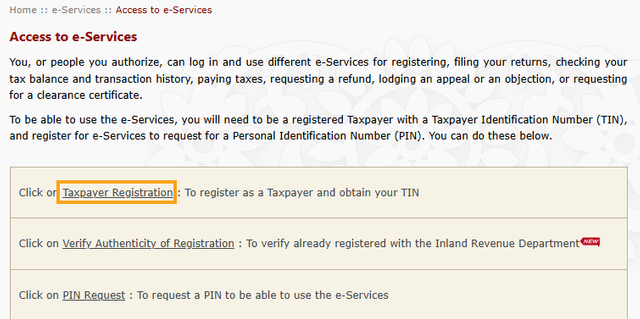

Sri Lanka's Inland Revenue Department(IRD) offers a system called "e-Services" to facilitate tax filings. These are the steps to do that.

- Step 01:

Visit the IRDwebsite: In the right corner we have a tab for all the e-Services from IRD. Click "Access to e-Services"

- Step 02:

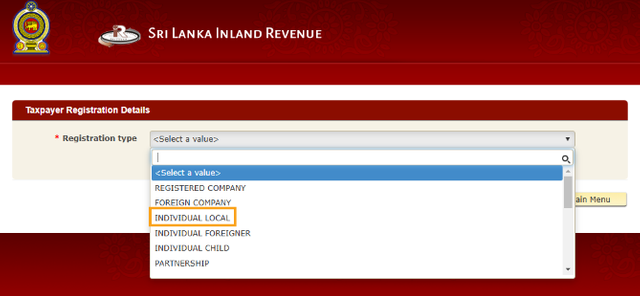

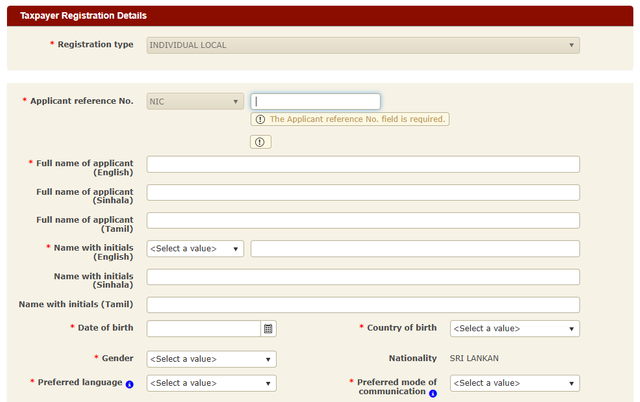

Taxpayer Registration: I have not submitted these forms yet so I clicked on "Taxpayer Registration" to proceed. Once I clicked it I had to make sure the registration type, as I'm a Sri Lankan Individual I selected "Individual Local" option from that.

- Step 03:

Fill out the Taxpayer Registration Details (TPR): Next step was to fill out almost all the details about myself and submit required documents like copy of National ID, proof of address. Once the registration done they will send us our TIN number within 05 business days to our email.

| 📱 Reflection |

|---|

- Why Is It Important to Manage Taxes Properly for Online Earnings?

When I first thought earning money from affiliate marketing, taxes were the last thing on my mind. I didn't think about the bigger picture and just excited about seeing those commissions roll in. But after this tutorial I realized that managing taxes is actually really important.

First off, whatever law in a country is a big deal. I learned that if I don't report my earnings properly, I could end up facing fines or other legal issues from Sri Lankan government and officials.

Further, Now that I know the tax rates in Sri Lanka, I have a clear idea of how much I need to allocate for my taxes, this makes budgeting and planning finances so much easier. I can avoids any last minute surprises when it’s time to pay my taxes. Plus, by keeping track of all my business expenses, like internet bills or equipment I’ve bought, I can claim deductions and save even more.

Another thing I noticed is that handling my taxes properly makes me look more professional. It shows that I'm serious about what I do, and that can build trust for my future work.

- What did I learn from this process?

Honestly, going through this whole tax process taught me a lot. For starters, I got a much better understanding of how the tax system works here in Sri Lanka, especially for someone who's self employed like me. I realized I need to create a TIN number and do my taxes properly going forward. The forms and process looked complicated at first, but breaking it down into steps made it manageable.

I also learned about dealing with international tax forms, like the W-8BEN for Amazon. Staying updated on tax laws turned out to be more important than I thought. Tax rates and rules can change, and knowing about these changes helps me avoid mistakes and plan better.

But honestly, the best part about learning taxes is the peace of mind it brings. I don’t have to stress about surprise legal problems or penalties popping up out of nowhere now. Instead, I can put all my energy into growing my affiliate business and being responsible for my country.

Thank you for choosing such knowledgeable course @hamzayousafzai. Looking forward to taking on the next week’s lesson. I would like to invite @walictd, @kathy-cute & @casv to participate in this contest.

Thank you.

Peace to all 🙏

Cover image has been developed by Midjourney / Dall E and photoshoped by me. The remaining images are screenshots from my accounts, and I’ve ensured proper sourcing for all other pictures used.

Thank you very much for sharing your assignment task with us! We truly appreciate the time, effort, and creativity you have put into completing this assignment. Your dedication to following the guidelines and your commitment to learning are evident, and it’s a pleasure to see your progress.

Below are the evaluation results, highlighting the strengths of your post and any areas of focus for improvement:

Teacher Recommendation and Feedback!

This is a strong effort and by enhancing your formatting skills and incorporating creative elements your assignments can become even more impactful.

Total | 9.5/10