Robinia Swap | Understanding Freezing or Staking, Adding Liquidity (Yield Farming)

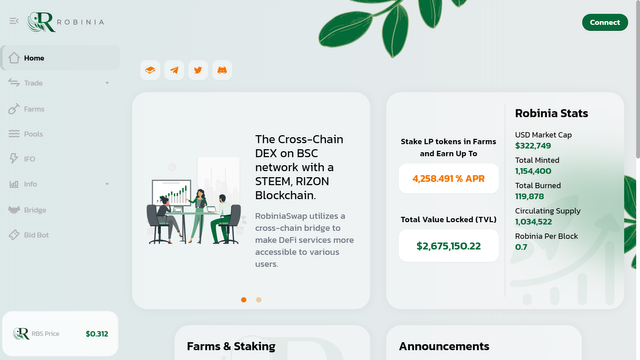

Yet another most powerful DeFi project is on the track and that is Robinia Swap Exchange that runs by Automated Market Makers through decentralized transactions on Binance Smart Chain (BSC).

Users on Robinia can earn healthy returns in APR% through yield farming and liquidity pools.

The best part that I loved most is that this project is operated and managed by Blokfield.INC who is the Witness on Steemit blockchain with the name @roadofrich and also a validator of HDAC (RIZON Platform) Blockchain.

So, Robinia has the best & strong team and experienced persons behind making this powerful platform also they have run a strong blockchain community for many years. That's why the team is strong and committed enough to run secured DeFi services. We can verify the team through Steemit, HDAC(ATOLO), and WICC.

Our mission is to continuously expand the core user base of the Robinia project and bring value to the existing user base.

The best marketing in the crypto space is collaboration and interoperability. Our aim is to build new applications to service a wider audience within the crypto

One of our latest projects, Steem Field, is getting ready to introduce STEEM holders into the world of DeFi. Source

Some people feel Defi is complicated and face difficulties in understanding it but according to my knowledge and understanding, it's quite simple as we deposit our money in the bank and earn some percentage of interest on it. When we start banking we face some trouble in the same way if we do have not a proper understanding of its a procedure it feels like some tough.

In traditional banking and financing, there are mediators like Central Banks, but in DeFi, there are no intermediaries and centralized controlling authorities to check and verify each transaction. This work is done by a Smart Contract in Decentralized Financing called DeFi. This Smart Contract is a computer-coded program that is signed by both parties = lenders, and borrowers and they both have to comply with the contract rules and obligations.

The best part in DeFi is that we can withdraw our money anytime we want rather than the traditional banking method of fixed time duration and this service runs 24x7 and 365 days. In addition, the interest rates will also be higher than we are getting with traditional banking So we can increase our money with compound growth with much higher interest rates.

There are two types of earning in DeFi (1) For Freezing or Staking and (2) Adding Liquidity in Farming.

1. For Freezing or Staking

The first one is the simple and easiest process for Freezing or Staking funds in Pool. To understand it by example, I can say it's like powering up our SP from Steem Balance. Powering up increases our influence on Steemit and thus our voting power increases and it gives other voting rewards.

So in DeFi if we stake Robinia it generates Robinia for us and this procedure applies to all the available currencies.

2. Adding Liquidity in Farming

For adding liquidity in farming, basically, we need to have a pair of tokens. We have to convert this pair into LP tokens before staking and farming.

I will try to explain it with an example, if I am going to Farm with the CAKE-BNB LP pair, I must have both CAKE and BNB in equal dollar amounts. In this case, if I have 1000 dollars that I want to invest, I must simply buy 500 dollars in CAKE and 500 dollars in BNB.

After I have LP Tokens and have them in exchange, Simply I will go to add liquidity and in one simple step I will convert it with CAKE-BNB LP token. After that, I will go to Farm and Stake this pair and wait for the profits that's all. It's so simple and easy once you do it practically nothing more than nothing less.

What is DeFi Native Currency

When we freeze money (our funds) in PANQUECASWAP, what we will earn as interest for keeping our funds there will be in that platform's native currency, in this case, Cake. In the same way, for ROBINIASWAP, what we will earn will be the native token of this platform, which will be ROBINIA TOKEN (RBS).

Robinia tokens that we have won will have an additional utility which will serve us for a purpose in STEEMIT and they can be exchanged for votes in favor of the platform and in my opinion that is the best part of Robinia Swap. It will also help us in rewarding on Steemit or I can say we can get upvote support from the earnings.

PS:

This is not financial advice and investors should use their own thinking and research before making an investment. The main purpose of this post is to aware all of you of DeFi and to explain how this system works on the blockchain.

Robinia is already launched on October 1st and soon I will post another article on Swapping, Farming, and the use of Liquidity Pools on Robinia SWAP.

| RobiniaSwap | Useful Links |

|---|---|

| Website: | https://robiniaswap.com/ |

| RobiniaSwap Official Documentation: | https://robiniaswap.gitbook.io/robiniaswap/ |

| Discord Channel: | https://discord.gg/wGv4UjER2f |

CC to: @robiniaswap @nia @robinia @robinia.witness @project.hope @crypto.piotr @juanmolina @lanzjoseg @fucho80 @jadams2k18 @pedrobrito2004 @content-creators

hi @printskill

I've small question related to liquidity pools and impermanent loss.

I'm trying to wrap my head around it and based on my understanding:

in that case I would need 5000 RBS tokens and 1000 usd worth od BUSD. Is that correct?

Now, what would happen if price of RBS would:

a) scenario one: RBS would drop down to 0.1$ (50% drop)

b) scenario two: RBS would go up to 0.4% (100% increase)

I presume that the moment I exit liquidity pool, then I would end up still with 1000usd worth of BUSD, but amount of RBS tokens would be different.

Now, my question is: how many RBS tokens would I have at the end of the day (depending on the scenario).

Enjoy your weekend buddy,

Yours, Piotr

Thank you @crypto.piotr for your engaging comment. Practically I have not faced any situations before like this.

Let me first go through the practical experience with @robinia and then let me see what happens in this scenario.

So, at the moment I apologize for not being able to give an answer to your question. But definitely, I will go deep into your point.

I also welcome your feedback and best answer if you have it because I am earning so many new things from your experience.

Regards.

@printskill

thanks for being so responsive @printskill