Grassroot Crypto Education | Series 2 Volume 10 - The Concept of Market Makers and Takers | (#burnsteem25)

Introduction

Hello, everyone. It's a great pleasure to be back in your midst again for the week as I welcome you to the 10th volume of series 2 of the crypto education in the community. I hope you are doing great and today, we would be talking about an important concept in the crypto ecosystem as pertains to trading. Be my guest on this!

Designed with Adobe Photoshop

The Concept of Market Makers and Takers

Order book is an important component of trading in the crypto ecosystem and pertained to the centralized exchanges where the order book is visible to everyone to choose what price they are buying or selling their assets. Unlike decentralized exchanges where orders are matched through smart contracts with no visible order book.

On centralized exchanges, the orders placed by traders provide liquidity for the assets, that is the ease of exchanging assets. Well, centralized exchanges are more preferred for that high liquidity feature. That being said, the order book is often associated with two market operators, the makers, and takers and this is what we would be looking into in this piece. To understand the order book better, take a look at one of our previous lessons here.

Market Makers

Makers in its literal meaning is to create/develop something and in this context, Market makers simply refers to the unique creators of different types of orders in the crypto market which is visible on the order book. The activities of the Market makers can either be in the form of buy/sell orders which allow other market participants to take part.

Market makers places order or ad in some cases at a predetermined price, either buying price (bid price) or selling price (ask price) which make them the actual order makers that are utilized by other traders willing to buy or sell in a market of a crypto asset. In other words, we can call the market makers the creator of orders which are filled by other market participants.

In addition, the name market maker may sound a bit cumbersome to a newbie of your level, technically it's not hard, anyone can act as a market maker be it big financial institutions or tiny traders, as long as they have the minimum amount required for trading in a crypto market. In essence, as a market maker, your orders are not filled immediately rather it's there for a while for the right consumers to fulfill their market intentions.

Illustration of a Market Maker

The concept of acting as a Maker maker should not be confused with limit orders, if you don't have an idea what a limit order means, you should check the link attached earlier as we have discussed different order types in the crypto trading.

A limit order means you are buying/selling at a predetermined price which makes you feel you are a market maker but NO, you are not. Limit orders would match your order with another order placed on the order book and have it filled at that price, as such you are not a market maker.

To effectively act as a market maker in a market, you should consider the order type known as Limit Order (Post only), this is a type of order that is created specifically to act as the market maker, your order is not matched with another existing order rather it stands independently and in that case, you are a Market maker waiting for other market participants to buy/sell from your unique order, as such the fee charged on your trade when filled is as a Market maker, not a taker. See an example below.

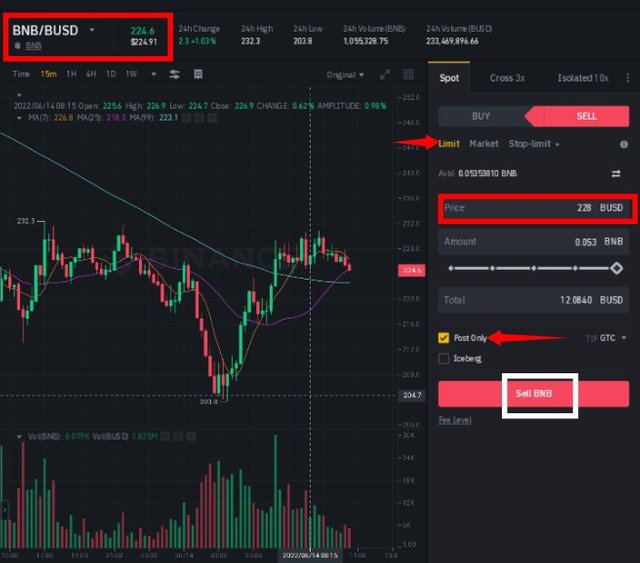

- To perform a market maker trade, I will utilize the spot trading platform on https://www.binance.com/en.

- Now I chose to sell BNB as a market maker, at my specific price. Utilizing the BNB/BUSD pair, the asset was trading at 224.6 BUSD, I placed a limit price at 228 BUSD, 100% of the asset, check the Post only box and clicked sell. See the screenshot below.

BNB/BUSD Spot Trading Platform | Binance

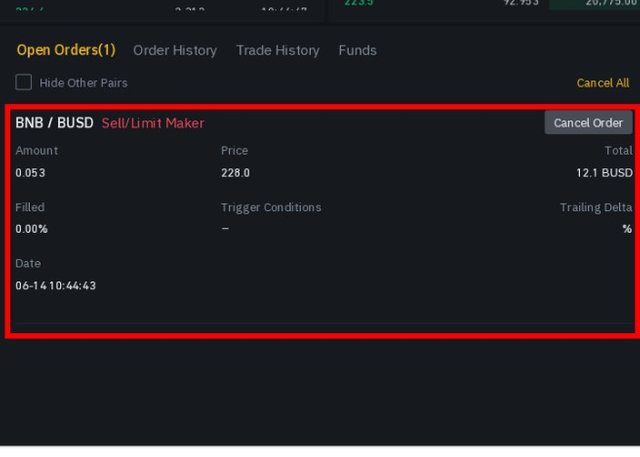

BNB/BUSD Spot Trading Platform: Open Order | Binance

Market Takers

Market takers are what I referred to as market consumers, they utilizes orders placed by the makers to fulfill their trading desires as such they create orders/ads for their trades to be filled from already created orders by the market makers. This is the most common method utilized by traders who are interested in a quick exchange of their assets without wasting much time waiting for their orders to be matched with a desired buyer or seller.

Market takers can utilize market order or even limit order for their trades. Using market order simply means the taker is buying/selling at the current market price as such the order is filled immediately, also he/she can utilize the limit order such that a predetermined price is set for the order to get filled, to fulfill that, it would be matched with existing orders in the market of such asset.

In addition, market takers' limit order doesn't include post only as seen in the case of market makers and that is a distinctive difference between both, take note of that.

Illustration of a Market Taker

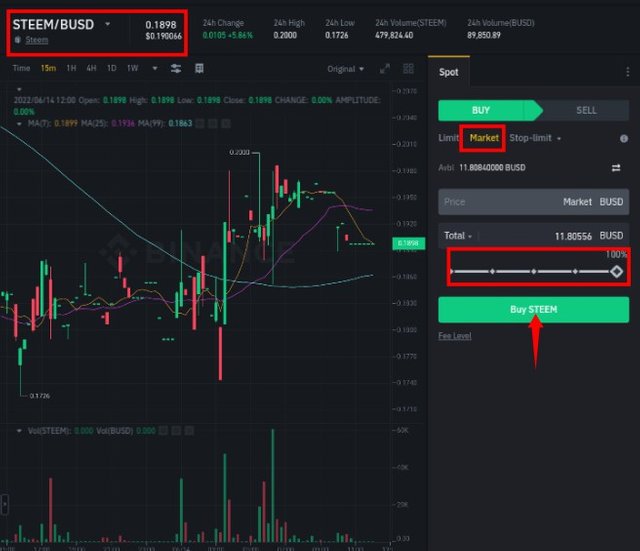

To perform a transaction as a market taker in this section, I will utilize the market order type to participate in the market of an asset. Let's see a brief illustration below.

- The spot trading platform of https://www.binance.com/en would be utilized.

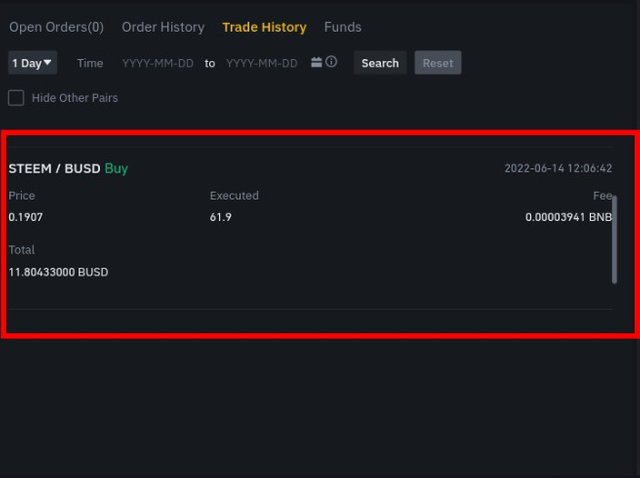

- The market of STEEM/BUSD would be our market this time, precisely buying STEEM. On the spot platform, I switched to the STEEM/BUSD pair and STEEM was trading at 0.1898 BUSD. Market order was clicked on (buying at the market price), selecting 100% of the asset (buying with 11.8 BUSD) and hitting the buy button. See the screenshot below.

STEEM/BUSD Spot Trading Platform | Binance

STEEM/BUSD Spot Trading Platform: Filled Order | Binance

The activities of market makers and takers have a great impact on the liquidity of a market. Each time a market maker creates an order, it adds to the liquidity of the market as it opens room for takers to walk around the order book and choose a suitable price for buying/selling while the activities of takers as they get their orders filled reduces the liquidity of the market.

These two have a solid impact on the active trading of an asset, as such if makers have not created more orders, the market would be less liquid, and takers enable the orders placed by makers to be fulfilled. Both are dependent on each other for the continuous flow of trades.

Conclusion

In conclusion, we have been able to talk about market makers and takers in this piece, the role of each in the market, and the different methods utilized by them to place their orders in the quest to get their trading desires fulfilled. It is worth knowing that a mere limit order doesn't make one a market maker, it can only be distinctively a maker order if the user chooses limit order (post only). I hope you have been able to learn more today and I look forward to your participation. Thank you.

Homework Task

- Briefly Explain an Order book in the Crypto Ecosystem. What is your understanding of Market Makers and Market Takers? State their Differences.

- What are the types of orders that can be utilized by Market Makers and Market Takers? Show an illustration from an exchange with screenshots (It's not necessary to make real trades, please take note).

Guidelines

- Write an article of at least 300 words. Keep your explanation as simple as possible.

- Include the tag #grassroot-educations2v10, #fintech, #steemexclusive, and your club status among the first 4 tags. Also, tag me @fredquantum in your homework entry.

- The participation in this lecture/homework task is open to everybody (anyone can write, I will leave my comments on your entries) but only entries made by verified kids (not participating in the Academy yet) would be accessed with grades.

- I will check your articles and drop comments on the entries submitted now till 11:59 pm UTC, 19/06/2022.

Cc:-

@steemkidss

Thank you for another great lesson to the kids. With this lesson I have come to understand that makert makers are unique creators of different types of orders in the crypto market which is visible on the order book and as well as market takers being referred to as consumers. I was wondering which group I belong. hahahahaha

I really appreciate the effort you put in developing this article.

Thanks for the verification, @udyliciouz. I'm glad you have learned from this piece and I guess you are a market taker, lol. At least you have utilized the internal market for the conversion of SBD to STEEM before. Do enjoy the rest of the day.

This post has been upvoted through @steemcurator07

Curated by- @ngoenyi

Curation Team: Steem Growth

Thanks for the support, @ngoenyi.

I will surely do this assignment tomorrow. I really want to understand crypto terminologies. Thanks for sharing

I look forward to your participation, @dorismos. Best wishes.

Its an amazing lecture and also very interesting home work task i will make sure to submit my entry soon @fredquantum

Thank you @fredquantum for the lesson.

My entry

https://steemit.com/hive-139765/@ghani12/grassroot-educations2v10-the-concept-of-market-makers-and-takers-or-10-beiificary-to-steemkidss-or-25-beneficiary-to-null-or-by

https://steemit.com/hive-139765/@dorismos/grassroot-crypto-education-assignment-or-the-concept-of-market-makers-and-takers-by-dorismos

My entry

https://steemit.com/hive-139765/@habdallah/grassroots-crypto-education-s2volume10-or-or-the-concept-of-market-makers-and-takers-or-or-by-habdallah

i will make sure to submit my entry soon @fredquantum

Here is my entry sir:

https://steemit.com/hive-139765/@david-o/grassroot-crypto-education-or-series-2-volume-10-the-concept-of-market-makers-and-takers-by-david-o