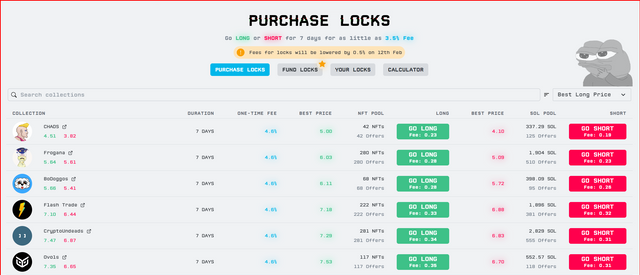

Options of Tensor's Price Lock

The "Price Lock" feature on the Tensor NFT market appears to offer a range of options for users who want to trade or invest in NFTs with a different approach compared to traditional buying and selling.

Go Long: This option would typically allow a user to bet on the increase in price of a particular NFT. By going long, the user is essentially purchasing a price lock for an NFT at the current market price with the expectation that the price will go up. If the NFT's value increases within the locked period, the user can profit from this rise.

Go Short: Conversely, going short allows a user to speculate on the decline in price of an NFT. This means that the user is betting the price of the NFT will drop, and they aim to profit from this decrease. A short position would usually involve a contractual agreement to sell the NFT at its current price and repurchase it later at a lower price.

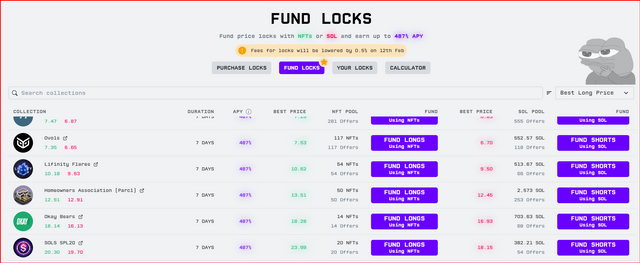

Fund Longs: This option is for users who wish to provide liquidity or capital to those wanting to go long. In this role, you're essentially the counterparty to the long position. By funding longs, you might receive a yield or fee from the traders who take the long positions, assuming the NFT's price doesn't increase past a certain point.

Fund Shorts: Similarly, funding shorts means providing liquidity or capital to those wanting to take short positions on NFTs. The funder would potentially earn a yield or fee from the traders who are shorting the NFTs, as long as the price of the NFT doesn't fall below a certain threshold.

These types of options introduce a form of derivative trading to the NFT marketplace, where instead of directly buying or selling the NFTs, users can engage in contracts that speculate on future price movements or provide capital to those speculations, earning a yield in return.

It's a more advanced trading strategy that resembles financial market activities and is likely aimed at more experienced traders or those familiar with such financial instruments.

Harry Potter Library (HPL) Community

Please join the HPL community. You will get upvotes for your posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: [해리포터의 도서관 (Harry Potter Library, HPL)](https://steemit.com/hive-140602/@harryji/ab7uv-harry-potter-library-hpl