The Double-Edged Sword of Centralized Exchanges in Crypto

Will CEXs be helpful in developing blockchain or crypto technologies and assets?

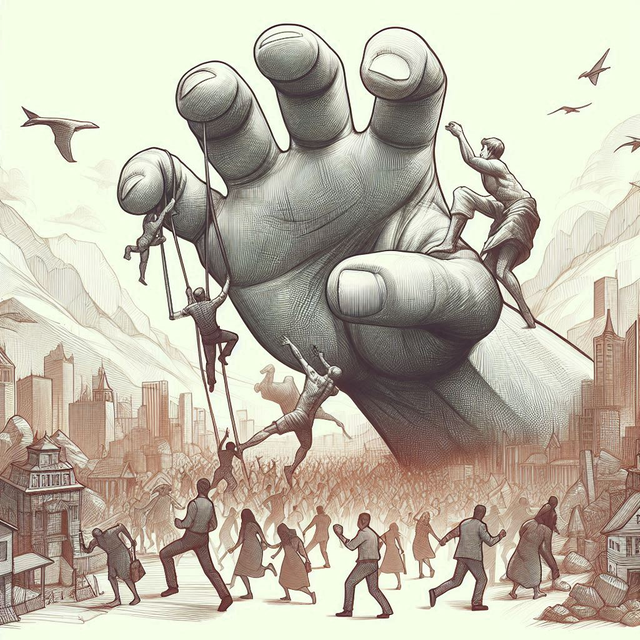

In the ever-evolving landscape of cryptocurrency, centralized exchanges (CEXs) have emerged as powerful gatekeepers, wielding significant influence over the industry's direction. While these platforms have played a crucial role in bringing crypto to the masses, recent events have highlighted the potential dangers of concentrating too much power in the hands of a few centralized entities.

The Rise and Fall of Crypto Giants

The crypto world has witnessed the meteoric rise and spectacular fall of major exchanges like FTX and Binance. These cases serve as stark reminders of the risks associated with centralized control in an industry built on the promise of decentralization.

FTX's collapse in 2022 sent shockwaves through the crypto ecosystem, revealing a web of mismanagement and alleged fraud. The fallout affected countless investors and eroded trust in centralized exchanges. Similarly, Binance's recent legal troubles with U.S. regulators have underscored the challenges CEXs face in navigating complex regulatory landscapes.

Coinbase: A Beacon of Hope or Another Centralized Behemoth?

As a publicly traded company, Coinbase has cultivated an image of transparency and compliance. However, its growing influence raises questions about the concentration of power within the crypto space.

Recent trends suggest that Coinbase may be leveraging its position to shape the direction of blockchain development and investment. There are concerns that the exchange might be favoring Ethereum Virtual Machine (EVM) compatible chains and its own Base chain, potentially at the expense of innovative platforms like Solana.

This bias could stem from the fact that many large traders and institutional investors have significant holdings in EVM-centric assets. Such a trend risks stifling innovation and diversity in the blockchain ecosystem.

The Perils of Centralization

The dominance of CEXs poses several risks to the crypto industry:

- Single Points of Failure: Centralized exchanges represent potential targets for hackers and malicious actors.

- Market Manipulation: Large exchanges can potentially influence asset prices and trading volumes.

- Censorship: CEXs have the power to delist assets or freeze accounts, sometimes without clear justification.

- Conflict of Interest: Exchanges may prioritize their own interests over those of their users or the broader crypto community.

Charting a Path Forward

To address these challenges and foster a healthier crypto ecosystem, several strategies can be considered:

Embrace Decentralized Alternatives: Support the development and adoption of decentralized exchanges (DEXs) to reduce reliance on centralized platforms.

Enhance Regulatory Frameworks: Work towards clear, balanced regulations that protect investors without stifling innovation.

Promote Blockchain Interoperability: Encourage the development of cross-chain solutions to reduce the dominance of any single ecosystem.

Educate Users: Increase awareness about the risks associated with centralized exchanges and the benefits of decentralized alternatives.

Support Open-Source Development: Foster collaborative, community-driven projects to distribute power more evenly across the ecosystem.

The Future of Crypto Trading

As the industry matures, we may see a gradual shift towards more decentralized models of exchange. Improvements in DEX technology, liquidity provision, and user experience could eventually challenge the dominance of CEXs.

However, it's likely that centralized and decentralized exchanges will coexist for the foreseeable future, each serving different needs within the crypto ecosystem. The key lies in striking a balance that preserves the benefits of centralization while mitigating its risks.

For investors, diversifying across different types of exchanges and being aware of the potential risks associated with CEXs will be crucial. As always in the crypto world, due diligence and a clear understanding of the underlying technologies and market dynamics remain essential.

The crypto industry stands at a crossroads. By addressing the challenges posed by centralized exchanges and embracing the principles of decentralization, we can work towards a more resilient, transparent, and truly revolutionary financial ecosystem.

Harry Potter Library (HPL) Community

Please join the HPL community. You will get upvotes for your posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: [해리포터의 도서관 (Harry Potter Library, HPL)](https://steemit.com/hive-140602/@harryji/ab7uv-harry-potter-library-hpl