STEEM/NAIRA ANALYSIS]:- My Naira /Steem VS My Steem /Naira|| (MNMS Week #03): Are The Bears Over?

Hello steemians! Welcome to another weekend to look at the major activities that happened in the market within the week. A lot has really happened in the market during the week and My Naira/ My Steem is here to serve you with the best of market events.

Activities covering the larger market perspective looking at the influence of BTC Price fluctuations on other coins or tokens, would be looked at. Also the Steem/Naira performances within the week would be reviewed.

Market Overview

STEEM/USDT Price actions

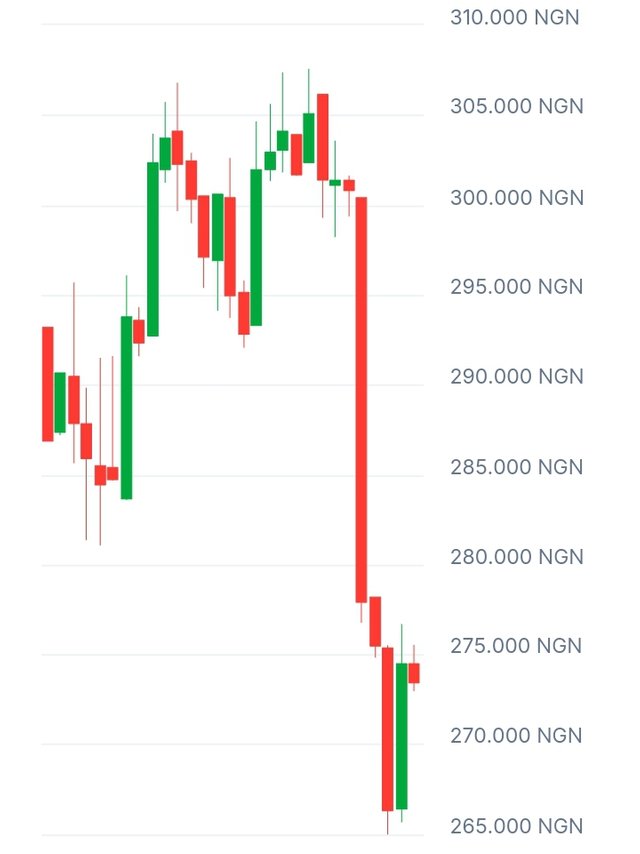

Steem/Naira price actions

Steem/Naira Statistics

The Market Outlook

[source] screenshot from Bybit Exchange

[source] screenshot from Bybit Exchange

A noticeable event took place in the cryptocurrency market where more than 20,200 BTC worth over $1.23 billion was shifted into the accumulation addresses on June 27. An analyst say the accumulation addresses are akin to investors holding their assets for long term appreciation rather than often trading their assets. Analysts are of the opinion that the timing of the transfer is necessary as it happened when the market is down and would signal a bullish run.

The week saw the parent crypto BTC closing more lower than the previous closing price. On Saturday 22nd June 2024, BTC opened the day at $64, 142.67 to close at $64,259.11 making an increase of 0.18% by adding $116. 44 difference to the price. The price could not be sustained and later continued the downward drop to $60, 433.19 reflecting –2.05% and less of –$1,262.68 on Friday 28 June,2024. On Saturday 29 June, BTC starts showing a sign of recovery as it got strengthened by closing at $60,979.90 with 0.90% increase in value reflecting a change of $546.71

Though the Stoch and RSI are heading towards the 50 line mark, the SAR still is above the price charts, there is no confirmation might be recovering but is maintaining its stability within the threshold of $61,804.29 and $60,979.90 in the last 5 days.

[source] Screenshot from Bybit Exchange

The downturn in the larger cryptocurrency market also impacted our own crypto here, the steem. It closed lower from 0.1972 on Saturday 22nd June, to a lower low of 0.1942 on Saturday 29 June, shedding –0.0036 and reflecting –1.82%. Although buyers stepped in during the week, they could not push the price any higher as sellers dominated by selling more of their steem holdings. Currently, the Oscillator is stable above the 80 line band at the price 0.1942, while the RSI is pointing to cross the 50 line green band.

The SAR trades below the price charts, indicating hopes that the steem might bounce back as buyers are gradually coming in to buy at the low prices.

On Saturday 29 June 2024, the steem closed at Steem/N 275.450 lower than it closed at the price of Steem/N 293.280 On Saturday 22nd June 2024. This also show that the steem is getting its own share of the persistent bearish impact from the larger market. But despite the current market condition, steem remain fundamentally strong and could pick up at the larger market recovery.

Current Trading price: N275.450 as at 29|06|24

Market Capitalization

128,750,268,167.559 NGN

Last Day Trading Volume

1,260,549,294.792 NGN

Qty in Supply

465,384,263

Source

There is a general negative sentiment in the crypto market as the fear and greed index remains at the Fear condition.

The transfer of the over $1.23 billion into the accumulation addresses, is expected to begin a slow market recovery. This when combined with the indication of the RSIs which show that the market is in its Oversold region, signals a potential opportunity to buying positions.

This also the same for the STEEM as its Oversold Conditions is could likely trigger taking buying positions.

I wish you all a fruitful days in the week!

https://x.com/GoodluckUba2/status/1807510272158159273