Crypto Expert (Beginner to Pro) #9 - P2P Marketplace in Cryptocurrency (Part I)

Introduction |

|---|

We have P2P (peer-to-peer) marketplaces across several financial sectors and it has remained a very important method users utilize to trade their assets amongst trading peers without involving a third party.

Free Image Edited with Canva

In cryptocurrency, traders in certain regions of the world depend on this method to buy crypto assets with fiat currency or sell their crypto assets for fiat currency. Let's dive into the first volume of the P2P marketplace.

P2P Marketplace |

|---|

When government regulations partially hinder the free transactions of cryptocurrencies in a region of the world, traders resolve to utilize the P2P method to buy and sell crypto assets.

Even though P2P in cryptocurrency can appear in different ways, one is having a group of friends that are interested in buying and selling and manually matching orders, a known merchant that buys and sells and so on. The two P2P mediums above remain tedious, and their error rate is very high (and even a possibility of falling victim to a scam).

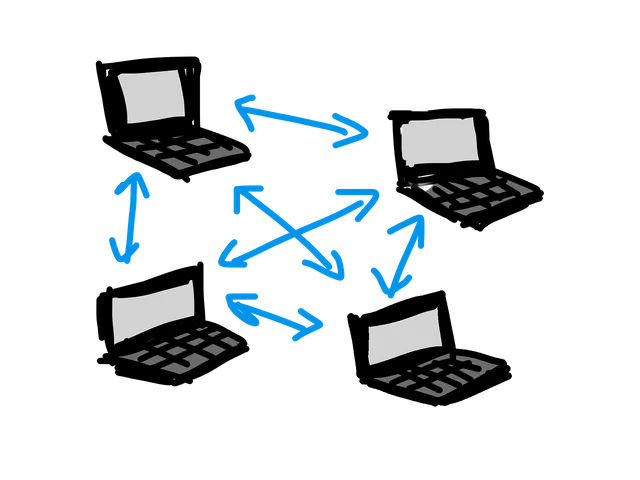

An illustration of interconnected networks can can independently communicate with each other | Source: Pixabay

Over the years, crypto exchanges have created P2P platforms that connect market makers and market takers to connect in real-time, without involving a third party. Unfortunately, some have no idea of how to go about using these platforms or a lot out there are still scared of trading with whom they don't know but then, it's completely safe using these platforms.

Key things to note on a P2P Marketplace |

|---|

The P2P marketplace is completely safe if the user has mastered the key aspects to avoid falling into a trap (which can only have maybe around 0.1% success rate) or reducing the waiting time in transactions.

Coin exchange | Source: Pexels

The P2P marketplace has the filter functionality that allows users to narrow down ads to suit a trade at any point in time. Let's take a look at some of the available options:

Mode of payment: A market maker or taker can choose a mode of payment to match their desired method of sending or receiving fiat in exchange for crypto assets (on the P2P platform).

Amount of assets: The amount of assets available for selling or buying helps to narrow down ads by potential buyers and sellers, thereby reducing the time of navigating through large ads that don't match one's preference.

Age- The age of a P2P market maker's account is a key metric that reveals how long a user has been using the platform and that helps to navigate through users that may likely not be time wasters.

Completed orders number- Completed orders number is an essential metric, especially for market takers to filter experienced market makers for swift transactions.

Completion rate- P2P market makers are rated in % over a period of time and this easily shows the credibility of a user over time. Giving market takers confidence to trade with a maker at any point in time.

Payment time limit- Each market maker has a custom payment time, which can be utilized by market takers to grab swift payment makers.

These are some of the key filter options on most of the P2P platforms, and more can be added subsequently when practically exploring some of the popular P2P platforms.

Benefits of the P2P Marketplace |

|---|

No Intermediary- There are no intermediaries in the presence of transactions, and that reduces the waiting time to a large extent. All transactions are controlled by smart contracts.

Lesser time of Confirmation- It takes less time to confirm trade authenticity by the buyer and seller. Unlike sending assets from one wallet to another and waiting for network confirmations, which may take several minutes or hours in some cases.

Safe- P2P platforms are safe to use because the exchange acts as an escrow in transactions and credits the rightful owner in the case of disputes.

Wide availability of assets: Users have access to trading different types of assets which other sole merchants might not be willing to buy or sell.

P2P marketplace by centralized exchanges often requires KYC (know your customer) verification before a user can utilize the platform as a market maker or taker. But then, P2P Marketplace is not limited to only centralized exchanges, there are decentralized P2P marketplaces that users can use without KYC verification.

Even though KYC is not required for a decentralized P2P marketplace, they are very safe because the platforms also act as escrow and only release assets to the rightful owner after all claims are verified.

In the subsequent series, we will be taking a look at how to become a market maker or taker on different exchanges, with real-life examples.

Good evening sir, I have really enjoyed this teaching on p2p marketplace. Some people still get to lose their tokens even when there's a clear warning not to release your coins without seeing payment.

During this period, some exchanges get involved in some of this frustrations people face. Scammers often label the transaction paid whereas they didn't pay and at last they make an appeal, some of this exchanges go on to freeze the account of the person. We just have to be really careful due to how things are.

I enjoyed the lesson.

You are right on point. The best thing to do in a situation like that is to make a quick appeal when it appears the maker is playing some kind of games and be available to submit the required documents.

That's why some key metrics like the age of a P2P account, completion rate, number of trades in a period and so on, matters a lot. We are going to talk extensively on that in the upcoming series.

Thanks for reading through this edition.

Yes, exactly.

Thank you