Matching Engine In Crypto [Buy and Sell Matching Orders]

A matching engine in crypto is said to be the critical component of a trading platform, usually called the brain within financial markets. It is a software system that's responsible for matching trading orders which includes the buy and sell orders on certain algorithms. This matching orders ensures fast and fair transactions or trades.

It's more like a matchmaker that makes sure everyone gets the best trading deal ever. Trades are executed effectively and efficiently with this matching machine and it has some major functions as the order book management which maintains an order book that lists all these orders while the order matching processes these orders according to time priority and price as the case may be.

When orders are matched, there's an execution of trades. This matching engine play an important role in crypto exchanges with regards to the market's liquidity and functionality. This ensures trades are processed swiftly. Some important roles it plays include;

Ensuring trades are executed fairly according to the rules and that market runs smoothly by making buyers and sellers always available to orders which places an ease to how people transact without having to search for buyers and sellers outside the chain.

The integrity of the market is upheld and liquidity in the market is maintained which makes it easier for traders to buy and sell assets without significant changes in price.

The trades performance are optimised in the best way possible to handle large volumes of transactions per second which is beneficial for large exchanges like Bybit and Binance.

Components of market orders |

|---|

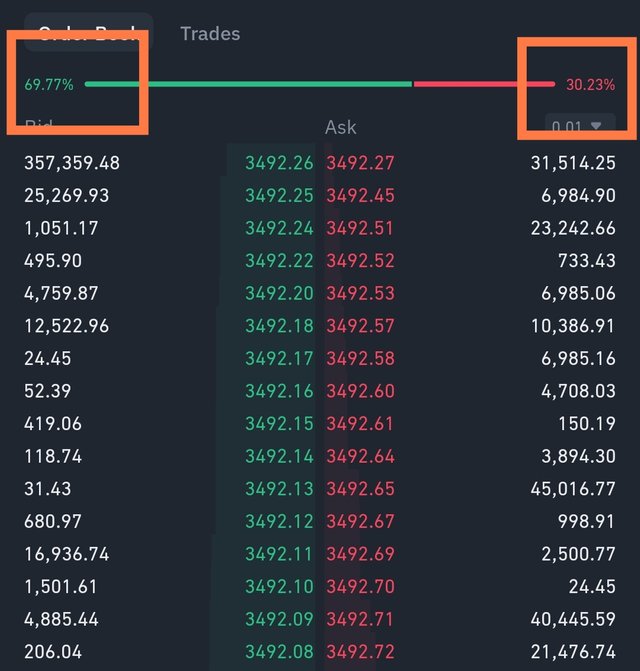

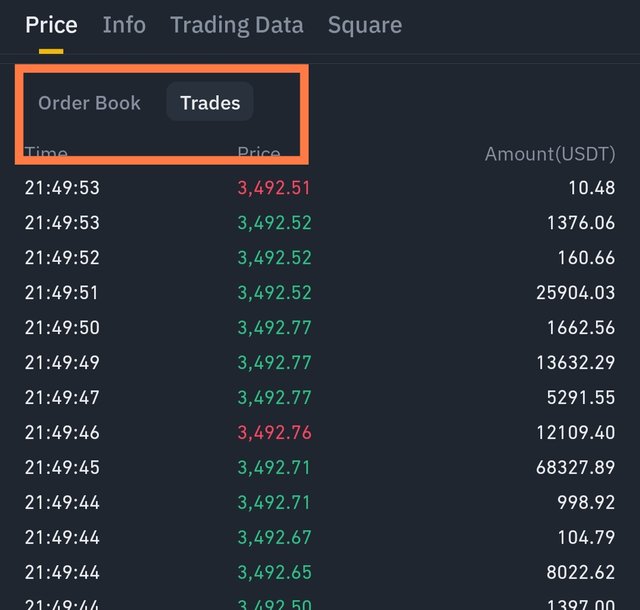

There are various components of a matching engine which includes the order book which is more like a ledger that keeps track of all buy and sell orders in the open market. This order book is being updated with new orders of buy and sell prices. This is shown in the screenshot below where there's a constant changing of prices in the orders.

- The buy orders are called bids which is the list of prices which the buyer is willing to pay for a certain amount of asset. The seller order are called Asks which when joined together we have bid-Ask spread. This is the seller's list of prices they are willing to sell a particular crypto asset.

Matching algorithms

This matching engine uses algorithms in making decisions of how to pair and buy and sell order from the order book to ensure fair trading. These algorithms work based on different strategies of which one is;

matching based on price before the time these orders are placed and this price is based on the best and the time is also based on the order placed earliest which is matched first.

Another way of checking this is by dividing the incoming order among all the matching orders in the order book and another is the method of first in, first out. These components work hand-in-hand in ensuring that the market operates smoothly.

In my everyday trading pattern, I usually use these orders to keep myself posted on when to enter or place a buy order trade. The prices keep moving and if you're scalping, you'll need speed and accuracy with good precision to enter a trade at a good price zone using the order book as surface.

Using this matching engines needs management of risks before execution to avoid untold losses. Checking the order limits, funds and margin requirements are good risks management strategies that can help. In conclusion, this matching engine is a programmed software in exchanges that gives a buyer and seller a matched order that is fair and effective.

All screenshots are from my binance

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

Hello @bossj23,

Your twitter promotion link is missing again, what challenge are you having with this?

Ohkay. My challenge is that my twitter do log me out for 24 hours before I'll be able to post again. I have some hours left before it's unlocked. Please bear with me. I'll put the link in no time

Ok please, you can create multiple accounts so you don't have issues promoting steemit on twitter

Seems this is what I'll do

https://twitter.com/bossj23Mod/status/1805538898799464715?s=19