The 50/30/20 Rule: Building Financial Freedom Through Balanced Budgeting

Money management can be daunting, especially with rising expenses and unpredictable markets. For those seeking control over their finances without sacrificing all comforts, the 50/30/20 rule offers a simple yet powerful strategy. This approach ensures you cover essentials, secure future savings, and enjoy your earnings. Let’s explore this rule, breaking down each part and demonstrating how to apply it for lasting financial stability.

Why the 50/30/20 Rule?

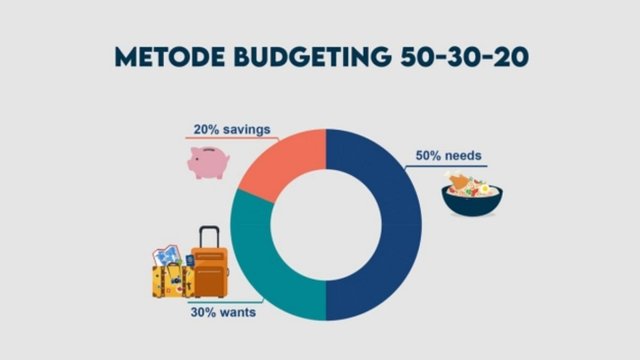

Originally popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan, the 50/30/20 rule divides your monthly income into three essential categories:

| Percentage | Category | Description |

|---|---|---|

| 50% | Essentials | Core expenses you can’t avoid (e.g., housing, utilities). |

| 30% | Wants | Discretionary spending to enrich your life. |

| 20% | Savings & Debt Reduction | Investments in future security, including savings, debt repayments, and investments. |

This structure balances financial responsibility with the enjoyment of your income, encouraging a sustainable budgeting approach that doesn’t just limit spending but enhances your quality of life.

Diving into Each Category

1. 50% for Essentials: The Foundation of Financial Stability

Essentials cover non-negotiable costs, such as housing, groceries, utilities, healthcare, transportation, and minimum debt payments. Here’s a breakdown:

- Housing: Rent or mortgage should ideally take up no more than 30% of income.

- Food and Groceries: Stick to staple items and avoid impulse buys.

- Transportation: Consider fuel, public transit, and car maintenance, aiming to reduce unnecessary trips.

2. 30% for Wants: Enriching Life Without Overspending

Allocating 30% for wants allows room for leisure and lifestyle expenses, like dining out, entertainment, or hobbies.

- Experiences vs. Possessions: Studies suggest experiences often bring more happiness than material goods.

- Intentional Choices: Focus on quality over quantity to make spending align with long-term goals.

3. 20% for Savings & Debt Reduction: Investing in Your Future

The remaining 20% should go toward building your financial future:

- Emergency Fund: Aim to save 3-6 months of expenses as a safety net.

- Investments: Contribute to retirement or high-yield investments to grow wealth over time.

- Debt Repayment: Prioritize paying off high-interest debt to increase financial resilience.

Implementing the 50/30/20 Rule

Step 1: Calculate Monthly Income

Use post-tax income as your baseline for budgeting.Step 2: Track Spending

Track current expenses for at least a month to understand your spending patterns.Step 3: Adjust & Allocate

If one category exceeds its limit, look for ways to reallocate or cut back.

Forecasting with the 50/30/20 Rule

Following this rule builds monthly stability and provides a long-term roadmap. With regular savings and strategic investing, the 50/30/20 structure helps you progress towards financial milestones like a home, retirement, or debt freedom.

Real-Life Example

| Category | Monthly Budget (Example with $3,000 Income) |

|---|---|

| Essentials | $1,500 |

| Wants | $900 |

| Savings/Debt | $600 |

Advantages & Challenges

Advantages:

- Flexibility: Suitable for various income levels without extreme measures.

- Balance: Allows enjoyment and responsibility.

- Simplicity: Easy to track without advanced tools.

Challenges:

- Regional Cost Variations: Higher living costs may strain the 50% essentials cap.

- Discipline Needed: Requires commitment to avoid overspending on wants.

Conclusion: Make Budgeting Work for You

The 50/30/20 rule transforms budgeting into a journey toward financial empowerment, balancing current enjoyment with future security. Start with small adjustments, refine your plan monthly, and watch as you gain confidence over your financial journey.

This approach is simple yet powerful, providing a structured path toward financial freedom and balance. Begin today and see how budgeting can transform your life.