Learn with Steem : TUTORIAL CLASS NO:6 TYPES OF AUDIT AND AUDIT REPORT||Welcome to the classes of Cost and Accounting by @Monz122 || club75

Last class we learnt about objectives of Audit and its features . In today's tutorial class we will cover the topics of types of Audit and Audit report. Hope you will get to know more about the concept of audit in today's tutorial.

Types of Audit |

|---|

There are total of 5 types of Audit among which 8 type of audits are most important and can be classified as:

1) Statutory Audit 2) Government Audit 3) Internal Audit 4) Forensic Audit 5) Final Audit

• Statutory Audit : checking of the accounts required by law annually of the financial records of a company is known as Statutory Audit .

Statutory audit is conducted in a specified manner by a qualified Auditor. It is applicable to all private companies proprietorship and partnership firms .

• Government Audit : a systematic, professional and independent examination of financial administrative and the other operations of a public entity for the purpose of verification of the accounts and presenting a report is known as Government Audit . The objective of this Audit is to present the fair value of the accounts.

• Internal Audit : to improve the operations of an organisation internal audit is performed which is an independent activity design to add improvement and value to the operations of an organisation. Internal audit also helps in effectiveness of risk management control and governance processes.

• Forensic Audit :this type of audit involves the regalaties by the examination and blending techniques of Proprietory Audit . Forensic Audit is done generally to detect the fraud and manipulations in the accounts of the company.

• Final Audit : Final Audit is conducted at the end of the accounting years when the books accounts have been closed . Final audit helps in detecting the errors are fraud or any misstatement presented by the company and the books of accounts.

Audit Report |

|---|

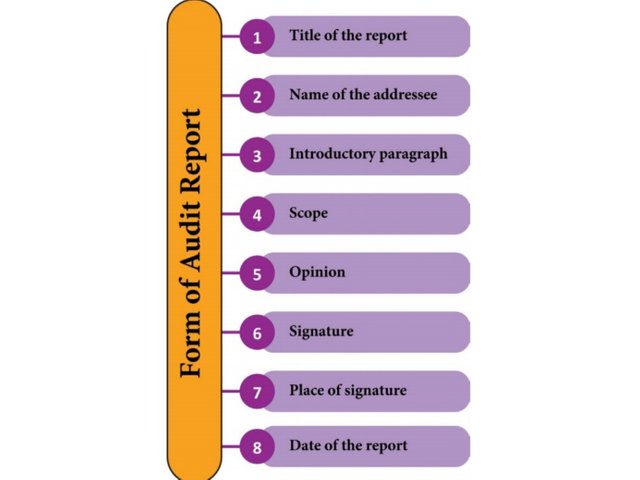

Audit Report is also known as the end product of an auditing it also helps in giving the auditors opinion on the records and accounts of the company and reflects the work done by him.

src

src

It indicates the true correct and real financial status of the company which can be considered as a reliable document.

While conducting every audit the auditor has to go through three phases before preparing the Audit report which are preliminary work of audit , conduction of actual audit and submission of audit.

So in today's tutorial we learnt about types of audit and its significance and preparation of Audit Report. In next class we will learn about qualification disqualification and powers of the Auditor. If you have any questions relating to this tutorial then do ask me in the comment section.

That's all for today's class thank you and have a great day ahead

Regards

@monz122

Thank you for contributing to #LearnWithSteem theme. This post has been upvoted by @cryptogecko using @steemcurator09 account. We encourage you to keep publishing quality and original content in the Steemit ecosystem to earn support for your content.

Regards,

Team #Sevengers

Thank you for sharing with us sister 😊

Welcome to #steemindiaa community

Thank you for contributing to our community. We greatly value the work you have put into this post.

We have carefully reviewed your post and come up with the following conclusion:

Feedback and Conclusions

Regards,

@deepak94 (Moderator)

Steem India Community

I am an accounting student and this was very helpful to me. I have managed to understand some things here that I did not previously understand. Thanks for sharing