MAP Rewarder: MAPR Payouts to Delegators and Price Increase for Token-Holders for 26 October 2020 (17.5% APR)

Earn significant passive income with STEEM without locking SP by investing in MAPR tokens.

This week's distributed profits are 0.336%, equivalent to 17.5% APR and 19.2% APY.

This is higher than most individuals can earn from vesting their own STEEM.

There is a lot of information to get through today, so please read the News below very carefully.

Some sections may appear repetitive, but some important news does not always change on a weekly basis. I also doubt that every member reads every weekly post, so worth repeating some things.

General Info

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the same amount in STEEM as you would have done under the old system of just paying out STEEM transfers.

Token-holders receive no token distribution, unless they are also delegators. Their profit comes in the token price increase.

The added bonus is that if you don't sell this week's tokens, then next week their value will rise to at least the new BUY Price. This is how the token allows compounding of profits, for both delegators and token-holders.

Using the language of investment trusts, delegators hold "income" stakes where the "interest" is paid out in tokens, whereas token-holders have "capital" stakes where the profit is added to the token price.

A reminder that new delegations start to earn 2 days after the day of delegation. This means that the first week's payout will be lower than for a 7-day week. Also, as payouts are done on Mondays, delegating on a Saturday or Sunday will yield no distribution till the following week. This has always been in place and is to avoid people trying to game the distribution. The positive part is that there is no unstaking period for the tokens, merely the standard waiting time for undelegating.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 32.6% [1a], 18.6% [1b], 17.9% [1c]

Value of Steem author rewards payouts = APR 15.9% [2a], 9.1% [2b], 8.7% [2c]

Distributed MAPR payouts = 0.336% (APR 17.5%) [3]

Projected Compounded APY 19.2% [4]

Average APR 18.9% (26-weeks)

MAPR BUY Price: 1.1980 STEEM [5]

MAPR Price increase = +4.2% APR

MAPR SELL Price: 1.2250 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3]. We now have enough data to give a better historical picture of progress and have including a 26-week average to give a measure of medium-term returns.

[5] Our BUY price is the price you may sell your MAPR tokens such that their value in STEEM is the same as if this week's distribution was done by direct STEEM transfer.

[6] Our SELL price is about 1% above the BUY price.

Our MAPR distribution [3] is much higher than the average blockchain author rewards for most users [2b & 2c].

Profits will be paid today in the new MAPR tokens. The token buy-backs on Steem-Engine may need to wait a few hours for our power-down to take place.

MAPR News

This week we have managed to slightly increase our income, and the Steem blockchain yield has finally stopped falling! Indeed, the average yield seems to be on the rise again - we shall see.

The Steem blockchain seems to have bounced off the 30% mark, but we shall wait and see if this heralds a short-term floor or a dead cat bounce. As always, worth comparing yields within the same system, and we are still above the expected author returns for a whale vote. Most users are now earning somewhere around the 9% mark using their own SP.

As mentioned in recent weeks, as the vast majority of token-holders are also delegators, I'm letting the token price slip so that we can return to a par on assets. Just to reiterate, we have very few meaningful third-party tokens left as so many have migrated. This has happened since the creation of our M token, which has not had to deal with similar devaluations. One positive thing is that we are slowly converting some BLURT into STEEM. This will help the MAPR fund in the medium term. This is not a reflection of the Blurt chain itself, but I really do not see the case to create another MAPR clone for now. I am using the new platform and will reflect on whether some kind of fund can be created on there.

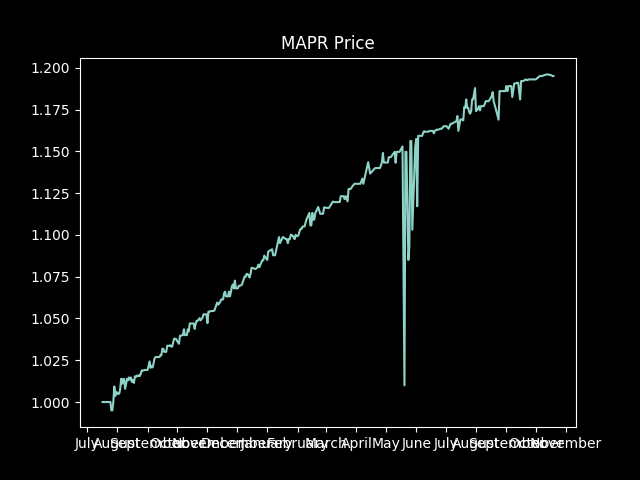

Anyway, I feel the weekly income remains healthy and if the token price needs to drift upwards more slowly then users are still getting a great return. Let us also not forget that the buy price started at just 1.0 STEEM, so we have seen a 20% rise in about a year, which is pretty much on target. Those tokens earnt a year ago are now worth 20% more too.

We shall continue to generate yields that are as high as we can given the economic model and in the hope that activity - voting rshares activity - will pick up further.

And finally, although our weekly returns are variable, here is a graph of how the token price has been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

MAP Rewarder, without the token, has been in operation for some 30 months, so you can extrapolate back from that graph to get an idea of our returns to members. We celebrated 2 years of operations at the start of February.

Anyway, don't panic! We may need to flatten the curve slightly but, to be honest, this is the least of our worries.

See you next week!

Next rewards distribution will be on Monday 26 October.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

ONECENT: The First Strategic Token Investment Game (STIG)