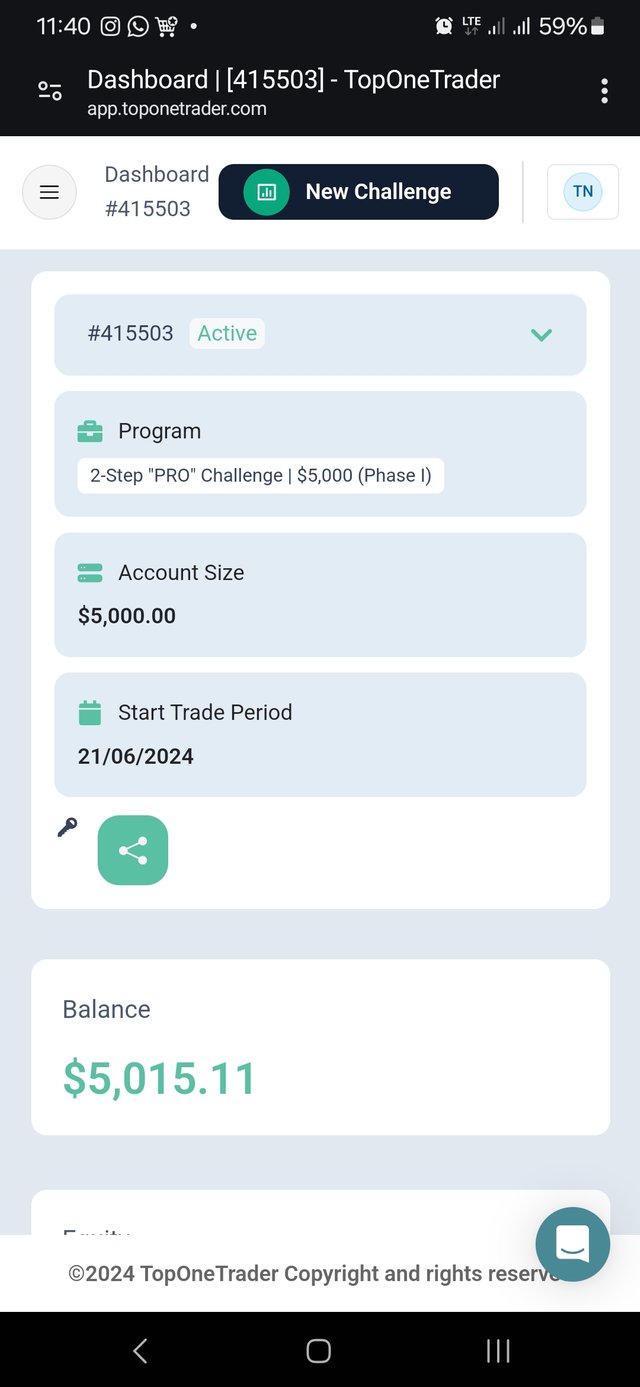

Trading Insights from My Journey: Lessons Learned on Day 71 of Trading My Top One Trader $5K Prop Account

It’s day 71 of trading my $5,000 prop account with Top One Trader, and I find myself back at break-even. This journey has been a mix of highs and lows, and through it all, I've gathered some valuable insights that I believe could help anyone striving to become a better trader. Trading is not just about the numbers; it’s about the lessons you learn along the way and how you adapt to them. Below are a few key takeaways that have significantly impacted my trading journey, and I hope they can do the same for you.

1. Make Backtesting a Daily Habit

One of the most crucial habits I’ve developed over the past few months is backtesting. Backtesting is not just a task to check off your list; it’s a critical component of refining your strategy and becoming a successful trader. Every day, as traders, we are exposed to new information and market conditions that might prompt us to tweak our strategies. However, these tweaks, although well-intentioned, can sometimes be detrimental if they aren’t thoroughly tested.

Backtesting allows you to see how your strategy would have performed in the past under similar conditions. It helps you identify patterns, potential pitfalls, and areas for improvement without risking your capital. The importance of backtesting cannot be overstated; it gives you the confidence to execute trades knowing that your strategy has been tested against historical data. This confidence is crucial when facing the market because doubt can be your worst enemy.

Moreover, backtesting helps you avoid the trap of making impulsive changes based on a small sample size. Sometimes, you might notice something that seems to work over a few trades, but without proper testing, it could lead to poor results in the long run. By making backtesting a daily habit, you ensure that every change to your strategy is well-founded, leading to more consistent results over time.

2. Higher Timeframes: A Shield Against Market Manipulation

Another lesson that has greatly influenced my trading approach is the importance of higher timeframes. One of the challenges every trader faces is dealing with market manipulation, which can often lead to impulsive decisions and unnecessary losses. Market manipulation refers to the artificial inflation or deflation of asset prices, often by large players, to create volatility and take advantage of smaller traders.

Trading on higher timeframes can help you mitigate the effects of this manipulation. When you focus on higher timeframes, such as the daily or weekly charts, the market noise that often causes short-term fluctuations becomes less significant. This broader perspective allows you to identify the primary trend more accurately and make more informed trading decisions.

It’s true that trading on higher timeframes typically requires a larger stop loss, which can reduce your risk-to-reward ratio. However, for many traders, especially those who are still working on mastering their psychology, a higher win rate is often more important than a high risk-to-reward ratio. A higher win rate means more consistent wins, which can help maintain a positive mindset and reduce the stress that comes with trading.

Additionally, higher timeframes tend to present more reliable setups. Because the price movements on higher timeframes are less erratic, they provide clearer signals and trends, making it easier to spot profitable opportunities. This doesn’t mean that trading on lower timeframes is inherently bad, but for those struggling with impulsive decisions or frequent losses, shifting focus to higher timeframes might offer a more stable approach.

3. Expect the Worst, Hope for the Best: A Mindset for Resilience

Trading is as much a psychological battle as it is a strategic one. One of the most valuable mental shifts I’ve made is learning to expect the worst while hoping for the best. This mindset has helped me stay grounded and resilient, especially during losing streaks.

Expecting the worst doesn’t mean being pessimistic; rather, it’s about being prepared for all possible outcomes. In trading, losses are inevitable, and how you handle them can make or break your success. High expectations can be dangerous because they amplify the emotional impact of losses. When you expect to win and the market doesn’t go your way, the disappointment can be overwhelming, leading to frustration and potentially reckless behavior.

By expecting the worst, you prepare yourself mentally for the possibility of loss, which can help reduce the emotional toll when it happens. This approach allows you to stay focused on your strategy and stick to your rules, even during tough times. At the same time, hoping for the best keeps you optimistic and motivated, which is essential for maintaining a healthy trading mindset.

One of the most significant dangers in trading is becoming emotionally attached to your wins and losses. When you place too much importance on each trade, you risk making decisions based on emotion rather than logic. This emotional attachment can lead to overtrading, revenge trading, or deviating from your strategy in an attempt to recover losses or secure more wins.

By expecting the worst, you can detach yourself from the outcome of each trade and focus on the bigger picture. Over time, this mindset will help you develop the emotional resilience needed to navigate the ups and downs of trading successfully.

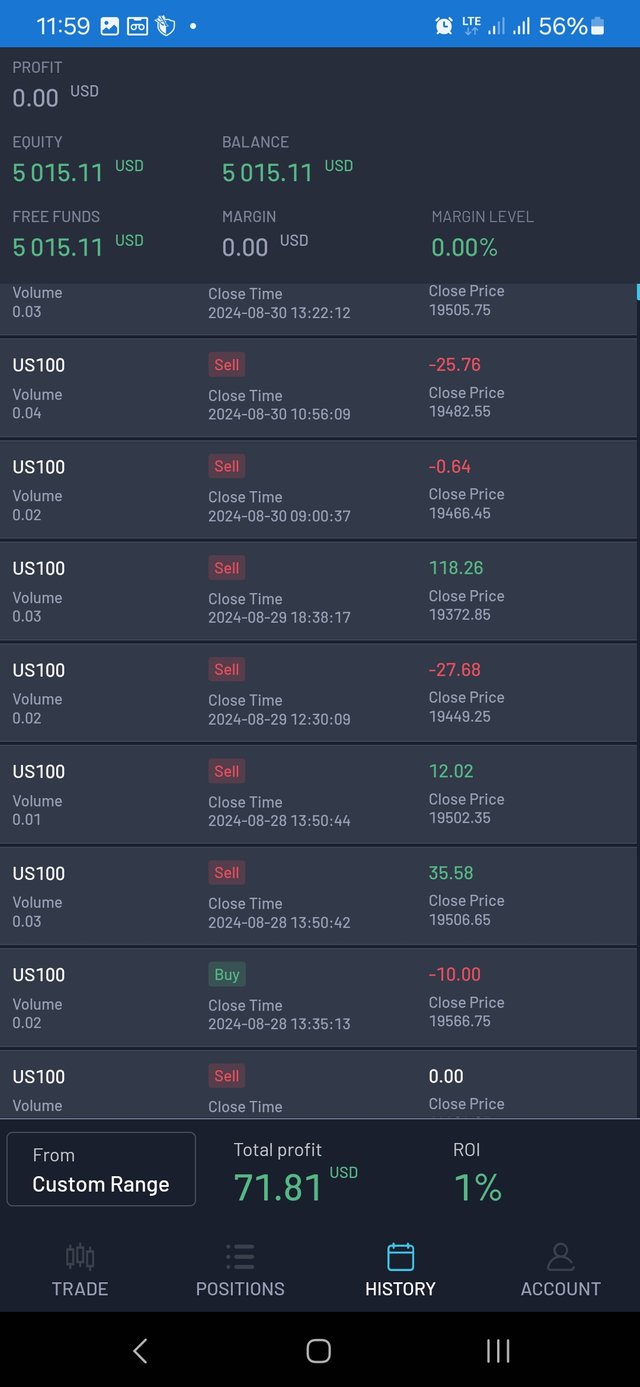

Here's a screenshot of one or the good moment

Trading history