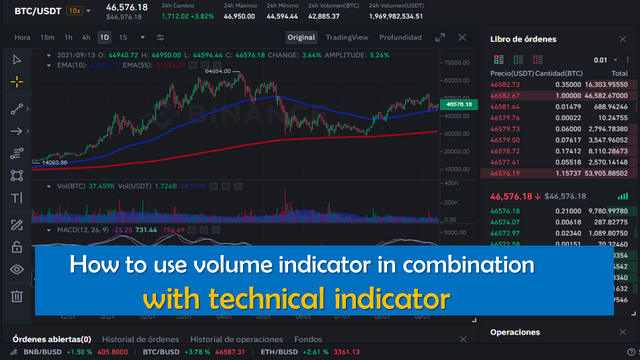

How to use volume indicator in combination with technical indicator

Introduction

In the world of trading, the ideal is to use more than one technical indicator in our trading operations, first because, it is not advisable to use only one indicator in the moments where we are executing any movement in the market, the right thing is to have a broader picture of the price action and to achieve a better view of the price action.

Several indicators should be combined to give us a more complete chart reading, namely moving averages, exponential moving averages, moving average convergence/divergence (MACD), relative strength index (RSI), Bollinger bands, parabolic sar, among others of equal or greater importance.

It is important to bear in mind that volume alone lacks statistical elements and, therefore, it is a serious mistake to use volume as the only indicator, because we fall into a technical bias by not considering other important variables within the analysis.

For example, knowing the fluctuations between two moving averages in a given period provides us with relevant statistical data that, when combined with volume, allows us to project with more confidence what the price is likely to do in the long and short term.

In other words, using volume in parallel with another indicator reduces the risks in our trading strategy, in my case besides volume I use the following technical indicators in my trading operations, 10-period EMA, 55-period EMA, RSI and MACD.

It should be noted that I have been incorporating these indicators with the objective of knowing the relationship between price, volume and trend, additionally, by combining volume with these indicators I can visualize different angles on the chart and thus get a more accurate perspective.

SOURCES CONSULTED

➊ Steven N Using Trading Volume to Understand Investment Activity. Link

OBSERVATION:

The cover image was designed by the author: @lupafilotaxia, incorporating image: Source: Binance

A very educational article, dear lupa, of great help to perform market analysis.