Analysing Ethereum Beacon Chain’s level of decentralisation in its current form

Ethereum is scheduled to transition to Proof of Stake Network in a few days, details of this I provided in my earlier blog here -

Many retail Ethereum holders have managed to stake on Beacon Chain availing services of Staking Pools.

![]()

Source

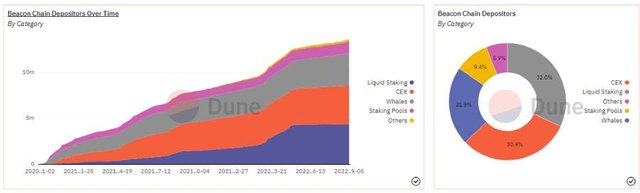

*Ethereum's Beacon Chain has been open accepting ETH stake deposits since December 2020. *

Let’s take a sneak peak on Ethereum deposit and staking picture in Ethereum’s Beacon Chain with data provided by Blockchain data analytics firm Dune here -

https://dune.com/hildobby/ETH2-Deposits

An overview of staking numbers in Ethereum’s Beacon Chain Network

Data from Dune Analytics

So, currently over 11% of ETH Supply is locked in Beacon chain with 13,620,226 ETH deposited in the Beacon Chain contract since it launched in Dec 2020 almost 2 years ago.

Beacon Chain has 425,632 validators in its network.

Evaluating the current Beacon Chain Network’s level of decentralization

Let’s analyze how decentralized the Beacon Chain is, looking at the network stake held by staking entities.

Let’s check the ETH stake controlled by Ethereum staking pools now.

![]()

Data from Dune Analytics

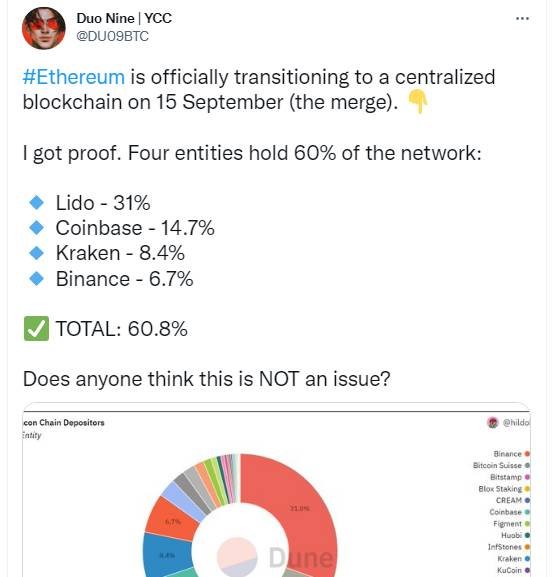

Lido Finance holds 30.37% market share of staked Ethereum in Ethereum’s Beacon Chain, while Coinbase holds 14.53%, Kraken 8.34% and Binance 6.6%. These entities together hold more than 2/3rds of Ethereum that’s staked in Ethereum’s Beacon Chain. In total these top 4 Staking Pool entities hold 60% of Ethereum that’s staked in Beacon Chain!!

![]()

Data from Dune Analytics

Yes, when seen this way, Ethereum’s Beacon Chain looks Centralized, as the top 4 Pools hold significant percentage of staked Ethereum. In a decentralized network, stakes are distributed to multiple validators, so that control of the network is decentralized.

This is why a section of the crypto community has concerns about Ethereum Beacon Chain’s centralisation and they have concerns especially over Lido holding more than 30% market share of staked Ethereum in Beacon Chain. This is obviously huge.

Ethereum Beacon Chain Network can still become decentralized in future

However, this is not the complete picture as now only over 11% of ETH supply is deposited in Beacon Chain, it’s possible that more Ethereum staking pools will arise in the near future, absorbing more of Ethereum stake deposits.

Also, when more Ethereum depositors stake in Beacon Chain, the dynamics may change if they stake on other available staking pools instead of the staking pools that already hold majority of staked Ethereum in the Beacon Chain.

Most Ethereum staked on Beacon Chain is on staking pools that offer liquid staking

Most of the staking in Beacon Chain is done availing liquid staking services, where Ethereum users are able to stake Ethereum while getting a liquid staked Ethereum asset which they can utilize in DEFI. All the while the user’s staked Ethereum remains locked in the Beacon Chain till deposit withdrawals are activated in the Beacon Chain.

32% Ethereum that’s staked in Beacon Chain is on staking pools that offer these Liquid staking services. Lido Finance’s stETH is the market leader as a liquid staked Ethereum asset with Lido Finance’s stETH widely used in DEFI protocols like AAVE and Compound.

stETH asset has been so prominent that the asset’s depeg to Ethereum this year caused turmoil for CEFI lending platform Celsius.

You can read about this interesting stETH story in my article -:

Celebrating the Ethereum Merge with a stETH story as this asset made headlines this year !!

Significant proportion of Ethereum staking done using services of CEXs

Data from Dune Analytics

CEXs hold over 30% market share of staked Ethereum with many users staking their ETH in Beacon Chain using staking services of CEXs like Binance, Coinbase and Kraken.

Liquid staked Ethereum is also offered by Binance staking pool, with users who staked their ETH there receiving bETH which is Binance Beacon ETH, This bETH can be used in DEFI in Binance’s Smart Chain.

Coinbase Staking Pool also provides its version of liquid staked Ethereum asset to those who staked in its staking pool, with them receiving cbETH, which is Coinbase Wrapped Staked ETH. cbETH can be used the same way in DEFI as stETH.

Let’s collectively stake our Ethereum responsibility to keep the Network decentralised

Well, if I was to stake my Ethereum using a staking pool, I will choose a staking pool like Ankr since it’s market share is less than 1% of staked Ethereum deposits in Beacon chain, as I care about decentralization and this is something I can do to support a decentralized Ethereum Network.

Of course, I hope Ankr too provides liquid staked Ethereum that I can use in DEFI.

This is my 3rd article related to the Ethereum Beacon Chain celebrating the month of the ‘Merge’ happening this month of September in just a few days.

You can read my other two articles related to Ethereum Beacon Chain -:

Celebrating the Ethereum Merge with a stETH story as this asset made headlines this year !!

Thankyou for reading.

Hi @mintymile

This is what stands out the most in this new Ethereum process, the centralization of the network in a few players, worse I think the trend in finance is that power is wielded by those who have the most, and even to a large extent in the crypto economy you can see that.

I also believe that after the new validation model is deployed in ethereum more investors could enter and change that centralized distribution, just have to see what happens in the coming days.