An Innovative DeFi Project: Alpaca Finance

Because of my banking background, I have a special interest in DeFi projects. Out of curiosity and anticipation of some high returns, I have studied the DeFi world in detail in recent months. I have made trial investments in various financial applications operating on the Ethereum, Binance, and Polygon networks. So I had the opportunity to experience many positive and negative events that a DeFi user can encounter. As a result of all these activities, I created a shortlist of Defi applications including Sushiswap, Apeswap, 1inch, and Alpaca Finance.

The first question I ask myself when evaluating DeFi applications is, "Would I use this application?". I experience the app, and if my experience is positive, I begin to explore the project in depth. I've been using Alpaca Finance app for a while, and I've invested in Alpaca cryptocurrency. I wanted to introduce this project to you in an article.

Alpaca Finance General Information

Alpaca Finance is a DeFi application that operates on the Binance Smart Chain. The app gets its name from the cute animal of the sheep camel mix that you see in the picture above. The core value proposition of the application is to ensure leveraged investment in liquidity pools. So, for example, you can invest $ 1000 in a liquidity pool in Pancakeswap as if you had $ 3000. The application provides this by using the money you have invested as collateral and borrowing from the market. The Alpaca app allows you to use leverage between 1x and 3.5x, although it varies according to the cryptocurrency pair. I usually prefer to use 2x leverage to avoid high risk. The use of leverage increases the risk of impermanent loss and brings the risk of liquidation. In this aspect, Alpaca Finance is not suitable for investors whose financial literacy is not sufficient.

Alpaca Finance coin, released on March 3, 2021, is currently ranked 244th among all cryptocurrencies.

According to https://defillama.com/home data, Alpaca is currently 22nd among all DeFi projects with a locked total value of $ 1.67 billion. Alpaca ranks third among Binance Smart Chain applications by locked total value.

Customer Experience

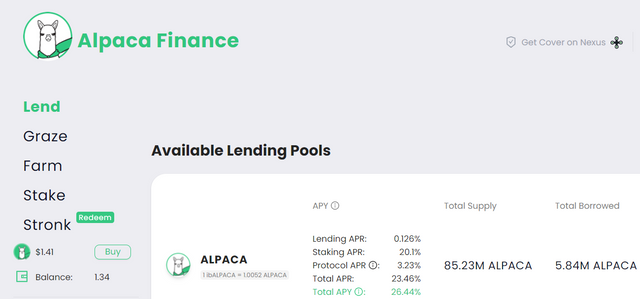

I like the Alpaca application both in terms of visuals and ease of use. There are detailed descriptions and representations of monetary calculations on the application.

To invest in a liquidity pool:

- We buy an equal monetary amount from a cryptocurrency pair

- Add the cryptocurrency pair to the liquidity pool

- Activate the relevant farm for investment

- Deposit the amount added to the liquidity pool to the relevant farm

However, on the Alpaca app, it is enough to prepare one of the two cryptocurrencies to be invested in the wallet. Alpaca Finance automatically performs all remaining transactions, including the leverage with one click.

Security

In the Defi world, serious security risks are arising from contracts. After a few minor accidents in other applications, I started to pay more attention to safety. Alpaca contracts are overseen by Certik, Peckshield, Slow Mist, and Inspex. Certik Safety Score of the application is 91. Although all this does not mean that one hundred percent security is provided, it shows that app developers take security seriously.

Tokenomics

Alpaca tokens are limited to a total of 188,000,000 units. Currently, 75% of this amount is in circulation. Only 13% of the tokens are owned by developers and early investors. So someone doesn't have a bunch of tokens to suppress a possible price rise.

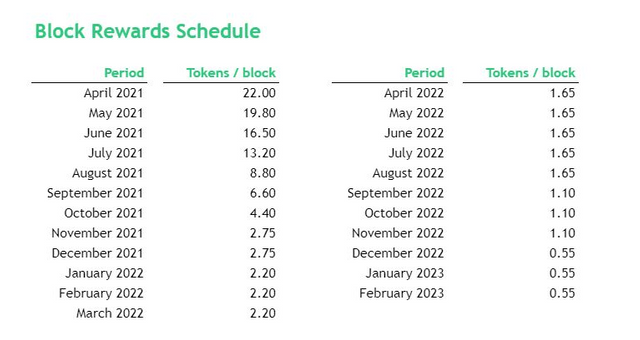

Alpaca token inflation is also organized to decrease over time. Details are included in the table below.

In addition, a considerable amount of platform revenue is used to burn Alpaca tokens.

Exchanges and Price Trend

Alpaca began trading in Binance on August 11, which led to price increases. Alpaca can also be bought and sold via Pancakeswap. The Alpaca token price, which is currently at $ 1.44, has been on a horizontal or upward course with a high trading volume since the beginning of July.

Roadmap

Alpaca developers plan to support multiple chains in the third quarter. They are also working to develop an automatic stop-loss function for leveraged transactions. SDK development to ensure easy integration with other apps is also important.

For the fourth quarter, it has goals such as the ability to work on adding new networks, add new pools, and develop a governance model.

Conclusion

From my narration, you may have noticed that my view of the project is quite positive. I would like to point out that I am not an investment expert and that you should make your financial decisions in line with your own research.

The fact that the project's documentation is well organized, its code is supervised by four separate security firms, and the carefully created screen designs show that we are facing a team that is meticulously doing their job. In addition, the app's value proposition is original and useful. I believe the Alpaca project has a bright future.

Thank you for reading.

Useful links:

https://alpacafinance.org/

https://app.alpacafinance.org/

https://www.coingecko.com/en/coins/alpaca-finance

https://medium.com/alpaca-finance

Note: I took the images from the app's websites.

Hello @muratkbesiroglu

I see that you have a good knowledge of the DeFi environment, you have explained it in a very simple way. From what I can read, it is a good project, when you take care of improving security it speaks well of the work you want to do and that you want it to last in time.

Which speaks well. However I must say that I did not know about it.

Thanks for the information.

Hi @muratkbesiroglu It is really important to try to understand where the return on any DeFi project comes from. In the case of Alpaca Finance, the source of its performance will depend on the way it is participated, so your post is very interesting and informative thanks for posting