Fundamental cryptographic analysis? Market capitalization? What do they indicate?

Introduction

The crypto market represents an accumulation of users in constant interaction dedicated to trading cryptocurrency. Smart contracts allow transactions by the second (TPS) through a P2P system to reach consensus.

This characterizes spot trading where supply and demand cause the value of a given crypto to fluctuate trying to establish a reasonable price for buying and selling.

Is it possible to accurately determine the value of a crypto? How and when should I invest? What is the most recommended cryptocurrency to trade?

It should be noted, that crypto trading activity can be measured with a certain margin of accuracy, however, it is usually almost impossible to calculate the exact value that a crypto will reach due to the volatility of the market and its impulsive nature on the handling of assets by the user.

Those interested in investing in blockchain should know how to identify a reliable project; the importance of becoming familiar with reading and interpreting candlestick charts, as well as, mastering the trading tools and products offered by an Exchange is a necessary task to obtain good trading results.

But even so, the main question always remains:

Which currency should I select, and is there a method to help me decide?

I believe that by following some recommended steps to operate in crypto trading you can improve your experience and get favorable results, for this you can make a qualitative and quantitative analysis according to the reality of spot trading. For this I will take into account the following points:

Capitalization

This indicator is determined by the amount of tokens circulating in the market. If we look at the buy-sell orders issued by an Exchange we can calculate this factor, which happens to be the product of the supply by the value of the crypto in a given time interval, this value changes constantly according to the commercial movement.

Market capitalization lets us see the importance of a crypto based on the level of confidence in it, this induces a higher quotation and from there to the scale of importance, solidity and financial liquidity, which denotes the preference and general interests of the mass to conclude business.

How does capitalization help me in my decision making?

If we take a good look at this aspect, we will have an elementary notion about the crypto that we can choose for and make safe profits.

It is worth noting that investing in large-cap coins like BTC and ETH takes less risk as the price is unlikely to drop sharply due to many holders in the market, transactional volume and open orders.

On the other hand, when working with small-cap cryptos, a process inversely proportional to the previous one is fulfilled.

Liquidity

The factor measures the financial stability of a Cryptocurrency based on the transactional volume in the exchanges. Once the market buy-sell value is established, active trades begin to materialize, which equals real assets transferred to a given wallet address.

These addresses linked to smart contracts, already processed, represent the liquid state of the cryptocurrency beyond the initial buy-sell order which refers only to the client's "intention" to trade.

What does liquidity indicate?

Secure access and ease of purchase. Let's remember that there is the freedom to cancel any order according to one's own convenience and this cancellation impacts on capitalization, on the other hand, successful operations correspond to a transferred balance with a tangible value that translates into stock market liquidity and generates real income to the ecosystem.

Liquidity makes it easier to buy or sell as the token holding is concrete and by stabilizing the economics of a blockchain the risk will be lower facilitating trade while building trust and preference from demographics.

Investing Cryptocurrency

How much encryption do I need to enter the trade?

The above diagnostic, obtained from market capitalization and stock market liquidity, has allowed us to focus on a suitable cryptocurrency to make our investment.

This represents the product of a cryptographic analysis based on exchange platform, since the processed data are offered by the interface of the financial services provider company as a tool to facilitate the user experience and give access to trading.

Now, the user should know that the selected currency is autonomous and subject to unforeseen changes. Cryptographic analysis helps us to choose, but the decision of what amount of crypto you should buy will always be a subjective decision adjusted to the possibilities of each one.

But what average user could buy a Bitcoin?

You can have a small amount to invest, which is free of commitments and you can handle the possibility of losing, without affecting us mostly.

The most important cryptos accept amounts up to at least eight decimal places for trading.

Just to give a random example, you could buy: 0.00000001 BTC ($ 0.000586 USD) or 0.000001 BTC ($ 0.586 USD); Current value according to Coingecko. Please understand that this is in no way a recommendation on my part.

Fundamental cryptographic analysis

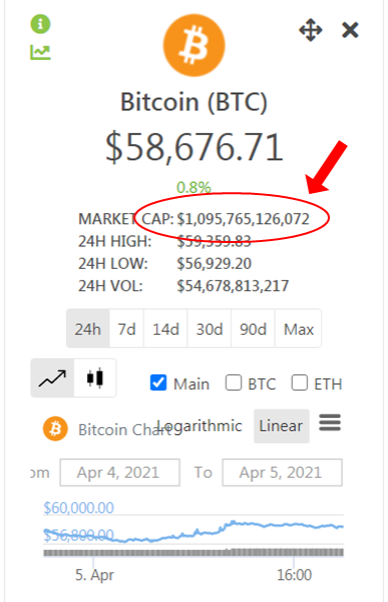

To do the conclusive analysis, we will resort to a financial platform to extract the real-time spot trading data, of the crypto which we choose to trade. In this case, we will consider BTC and the query will be made in reference to the data offered by Coingecko, for the time of writing this article.

In the label we can visualize in an updated form the Bitcoin Market Capitalization value. This figure fluctuates constantly, therefore, we will notice a slight variation in short time intervals. It is important to know that a supply of active tokens over 10 million corresponds to a large capitalization (which is the case of bitcoin), therefore this value will be our main guide in the analysis, it will serve us to know the reliability of a coin and its stock market strength.

But we wonder:

Where does this figure come from, how can I validate it, will it be possible to calculate it myself?

Of course it is, it is possible to calculate it ourselves and get involved in the interpretation of the diagram. Let's remember what each figure means:

- Circulating offer: We have 18.674.618 BTC that have been put into play based on a total of 21 million that the bitcoin blockchain has, this means the amount of people who have decided to invest at the current rate of 58.686,19.

By multiplying this value by the current price of BTC ($58,686.19 USD; according to Coingecko) we will get the market capitalization.

- Current bid * BTC value = Market capitalization;

18.674.618 * 58.686,19 = 1.095.942.180.125,42

Note: The variation of the resulting value (1,095,942,180,125.42) is due to the fluctuation of BTC seconds after the capitalization calculations were performed.

Final thoughts.

It is important to study the financial market through a cryptographic analysis, since cryptocurrency is a new economic system related to decentralization where users have the ownership to trade and apply unique strategies product of their experience and investment capabilities. It is not a trade regulated or directed by a central entity that takes care of everything according to its own interests, but, on the other hand, crypto trading is represented by real, autonomous, free-thinking people making decisions. This makes cryptotrading a volatile, complex and somewhat difficult to understand space. But with a little interest on our part we can reach the desired level of readiness to trade for ourselves safely.

Crypto analysis encompasses multiple factors beyond those mentioned in this post, however, Market Capitalization, Liquidity and Transactional Volume are some of the determining characteristics in order to choose a reliable crypto.

Original content

2021

It's nice to meet you, here is my new presentation on Steemit.com: IntroduceYourself

Hello dear friend, as always excellent information, your publications are quite complete, the world of cryptocurrencies is quite wide and there is a lot of information at our fingertips. Thank you for that, greetings!

@franyeligonzalez

Thanks to you for the visit and evaluation :)

Thank you for your kind comment @franyeligonzalez! it's a pleasure to share on @project.hope community

Unfortunately, when it comes to crypto, most alts are the same. There is an opinion shared by many traders that exact project doesn't matter. These traders just go with pure technical analysis and don't care about projects and its fundamentals and parameters. And they prove again and again that on a bullrun you can profit from any shitcoin if you do the right moves.

ok