Should You Trust Trustless & Uncensored DAI?

There is no doubt that cryptocurrency is gaining mainstream adoption day by day but price volatility of cryptocurrency has been a great challenge. It is understood that the price discovery mechanism of cryptocurrency is still in nascent stage but the highly fluctuating price of all major cryptocurrencies has surely blocked the way of mass adoption. Yes, stablecoins started to exist due to this reason. Maximum popular stablecoins are centralized and backed by US dollar. For many investors, stablecoins are medium to enter into the market as they convert fiat to stablecoins. Stablecoins are used to hedge against the price volatility of crypto assets also. DAI is a decentralized stablecoin created by MakerDAO. It is stabilized against the value of the US dollar. Unlike other popular stablecoins, whose value is backed by USD or commodities, the value of DAI is backed by crypto collaterals.

Uncensored & Trustless

No centralized authority is there behind DAI. There is no bank where it is stored. DAI exists on Ethereum blockchain and anybody can generate DAI by depositing collateral asset. The smart contracts and publicly viewable assets make it truly trustless and uncensored. If you heard about the numerous controversies with stablecoins in the past regarding their asset backing, you should understand the reason of existence of DAI. The name DAI is derived from the Chinese character 貸 (means to lend).

SAI & DAI

Multi-Collateral DAI was launched on 18th Nov, 2019. Previously it was single collateral (only ETH collateral) backed. The name and ticker symbol of Single Collateral DAI changed to SAI. DAI now refers to DAI minted in the new multi-collateral DAI system only. If you’re still holding old DAI (SAI) in your personal wallet, you can migrate to the current version from here.

Maker & MakerDAO

DAI was created by the Maker Foundation, led by its CEO Rune Christensen. It is managed by MakerDAO, a decentralized organization of individuals holding the MKR token, who votes on governance of the DAI stablecoin system.

How does it maintain price stability?

Cryptocurrencies are extremely volatile. So, how does DAI maintain its price stability when it is backed by crypto collaterals? DAI is multi-collateral stablecoin. The collaterals are ETH, BAT mainly. The users deposit ETH or other collateral into a smart contract Vault to generate DAI. The deposit is a ‘collateralized debt position (CDP)’ and the debt is in the denomination of DAI. DAI generates its trading value from the collateral. DAI must be burned to retrieve the collateral.

Now, suppose the depositors want to retrieve their ETH. They need to return the DAI and a stability fee. Stability fee is basically an interest rate in layman’s language. If DAI value is below $1 USD, the stability fee is increased to make DAI loan expensive. When DAI loan becomes expensive, the demand of new loans get reduced and supply of DAI also gets reduced. Less supply of DAI triggers more demand of DAI. Price of DAI increases as per simple law of economics. Similarly, if DAI value is above $1 USD, the stability fee is decreased to make DAI loan cheaper. Cheap loan increases DAI supply. As DAI supply increases, demand gets reduced. Price of DAI gets reduced. The stability fee is decided by voting in the community by members, who hold MKR tokens. MKR tokens are created or destroyed as per price fluctuations of DAI to keep it near $1 USD.

There is something called DAI Savings Rate also. An owner of DAI can lock DAI to earn this. If the saving rate is reduced, DAI owners tend to sell DAI in the market and thus it drives the price down. Similarly, if the savings rate is increased, demand for hoarding DAI increases and it drives the price upward. The complete mechanism of price control takes places in a decentralized manner and without intervention of any central authority.

Image Source – DAI/USD price from Coingecko*

MakerDAO Blockchain Price Oracle

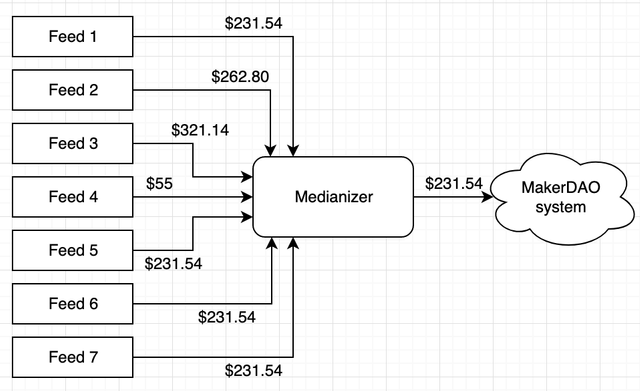

Blockchain Oracle is the buzzword nowadays. In cryptography, an oracle is a service to complete specified jobs. For example, when you transfer ether from your personal wallet to an exchange, the gas price feed is given by an Oracle. In the Maker Protocol, Oracles provide the price feed of various assets to determine when to liquidate a Vault or to calculate DAI generation amount from a Vault. MakerDAO Oracles receive data from different independent feeds. MakerDAO Oracles are multi tired and thus secured and robust. The Oracles are governed by MKR holders and in case of faults, these can be replaced also.

Image Source - MakerDAO Oracle functioning using Medianizer

If Liquidation happens

Liquidation is the process of selling the collateral to cover generated DAI from the collateral. A Vault is liquidated if the value of its collateral drops below the threshold level, calculated by the Liquidation Ratio. For example, if the Liquidation ration is 80%, the Vault will be liquidated when the asset value drops 20%. DAI needs to be around $1 USD. Liquidation ensures that DAI is always backed by sufficient collaterals by closing under-collateralized Vaults.

Why USDC as collateral?

On 12th March, 2020 market crashed and the price of ETH fell 30% within 24 hours and millions of dollar collaterals were auctioned off for $0. There was not enough DAI to maintain a stable peg to the US dollar. That is why MakerDAO community members and governors considered a proposal to add a third collateral type after ETH and BAT to maintain DAI liquidity. Ultimately in a controversial move, they added USDC (a centralized stablecoin maintained by Centre, a company run by Coinbase and Circle). To not flood the system with enormous USDC, the ‘stability fee’ for USDC was kept at much higher than ETH loans.

Where to buy DAI?

Oasis – This is the official platform of MakerDAO

DEX – Bancor, Loopring, RadarRelay etc

Centralized exchanges – Coinbase Pro, Kraken, OKEx, Bittrex, Kucoin, Bitfinex etc.

DAI can have different use cases down the line. It may be used in prediction markets and gambling in the near future. The DAPP eco-system of Ethereum is excellent and progress is taking place rapidly. Many more new collaterals can be introduced in the platform. The popularity of DAI will surely grow. DAI is not the perfect stablecoin. But it brought the transparency factor in the segment. DAI doesn’t discriminate and it is unbiased. A community driven stablecoin was a dream even a few years back but not now. We’ve already seen improvisation in the protocol (SAI to DAI journey). What next? May be, a better version of DAI! A more progressive DAI!

Note: All the images (if not cited), are generated by the author using free vectors.

Cheers @paragism.

Thank you for sharing your posts on Project Hope, including on both chains.

I thought I saw this post the first time on Publish. I had to go there to realize that you are the author of it.

I find this to be an excellent analysis of DAI.

Many thanks for appreciation. Hope I'll add value to the community with quality contents. Yes, I'm a regular writer in publish0x.:)

My pleasure. I'm following you there.

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

This is a detailed post about DAI, thanks for sharing on project hope buddy.

Many thanks. I am really glad to know that people liked this post. I spent good time to write this. :)

Resteemed already. Upvote on the way :)

DAI I don't know much about the token. I know just as a stable coin. How it works , it is difficult to me to understand. However, I hope there will be more projects that connect to real economy in the future not only for trading and bag holding.

Surely we'll see many unconventional stablecoins

There will be more stablecoin in the future. DAI is one of them. investors and merchants will be interested in stablecoins to be applied in their business.