The Evolution of Banking: How Blockchain is Transforming the Financial Landscape

Introduction:

In a world where technological innovation has become the cornerstone of progress, the integration of blockchain technology has emerged as a disruptor in the realm of traditional banking. With its decentralized, transparent, and secure nature, blockchain is poised to revolutionize the way financial institutions operate. In this article, we delve into the profound impact of blockchain on the banking system, exploring its implications, benefits, and challenges.

The Foundation of Trust: Decentralization and Transparency

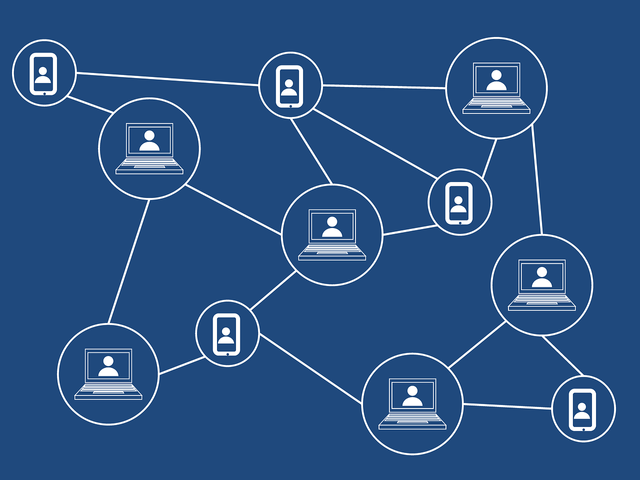

Blockchain's core strength lies in its decentralized nature, which eliminates the need for intermediaries and central authorities. This shift from a centralized model to a decentralized one allows banks to conduct transactions directly, enhancing transparency and trust. Every transaction is recorded on an immutable ledger, ensuring data integrity and reducing the risk of fraud.

Streamlining Cross-Border Payments and Remittances:

Blockchain has the potential to streamline cross-border payments, traditionally plagued by high fees, delays, and intermediaries. Through blockchain, transactions can be executed in real-time, with lower costs and enhanced security. This efficiency is particularly advantageous for remittances, enabling individuals to send funds across borders without the need for intermediaries.

Smart Contracts: Automating Financial Processes

Smart contracts are self-executing agreements with terms directly written into code. They can automate complex financial processes, such as loan approvals, trade settlements, and compliance checks. This automation not only accelerates processes but also reduces human error, ensuring accuracy and efficiency.

Enhanced Security and Fraud Prevention:

Blockchain's cryptographic techniques provide robust security measures, safeguarding sensitive financial data from cyber threats. With data stored across a distributed network, the risk of a single point of failure is minimized. Additionally, the transparent nature of blockchain makes it easier to trace and identify fraudulent activities, enhancing the overall security of the banking system.

Financial Inclusion: Reaching the Unbanked Population

A significant portion of the global population remains unbanked or underbanked due to limited access to traditional financial services. Blockchain's accessibility and borderless nature open the door to financial inclusion, allowing individuals without access to traditional banks to participate in the global economy.

Tokenization and Asset Management:

Blockchain enables the tokenization of assets, converting real-world assets into digital tokens. This innovation simplifies the process of managing and trading assets, such as stocks, real estate, and commodities. Investors can trade fractional ownership, reducing barriers to entry and democratizing investment opportunities.

Regulatory Challenges and Compliance:

While blockchain offers a plethora of advantages, its implementation in banking requires navigating regulatory complexities. Striking a balance between innovation and compliance is crucial. Governments and financial institutions need to work collaboratively to establish frameworks that harness blockchain's benefits while adhering to existing regulations.

Collaborative Ecosystem: Consortiums and Partnerships:

To maximize the potential of blockchain, banks are increasingly forming consortiums and partnerships. Collaborative efforts allow banks to jointly develop blockchain solutions, share insights, and pool resources. This approach accelerates the adoption of blockchain technology within the industry.

Data Privacy and Customer Empowerment:

Blockchain has the potential to empower customers with greater control over their financial data. With permissioned access to their transaction history, customers can securely share data with authorized parties, streamlining processes such as loan applications and credit assessments.

Evolution of Identity Verification:

Traditional identity verification processes can be time-consuming and vulnerable to data breaches. Blockchain offers a secure and decentralized solution for verifying identities, reducing the risk of identity theft and fraud.

Redefining Auditing and Compliance:

Blockchain's transparent and tamper-proof nature can transform auditing and compliance processes within the banking sector. Regulators can have real-time access to transaction data, simplifying audits and ensuring adherence to regulatory standards.

Embracing the Future of Banking

The banking system, with its centuries-old traditions, is on the cusp of transformation. Blockchain's impact on banking is far-reaching, touching upon processes, security, accessibility, and innovation. As financial institutions continue to explore and harness the potential of blockchain, they embark on a journey toward a more efficient, inclusive, and secure financial landscape. While challenges remain, the promise of blockchain's positive influence on the banking system is undeniable, paving the way for a new era of banking that is decentralized, transparent, and technologically advanced. With careful integration and collaboration, blockchain is set to reshape the banking industry and redefine the way we perceive and interact with financial services.

Collaborative Ecosystem: Consortiums and Partnerships:

To maximize the potential of blockchain, banks are increasingly forming consortiums and partnerships. Collaborative efforts allow banks to jointly develop blockchain solutions, share insights, and pool resources. This approach accelerates the adoption of blockchain technology within the industry.

Data Privacy and Customer Empowerment:

Blockchain has the potential to empower customers with greater control over their financial data. With permissioned access to their transaction history, customers can securely share data with authorized parties, streamlining processes such as loan applications and credit assessments.

Evolution of Identity Verification:

Traditional identity verification processes can be time-consuming and vulnerable to data breaches. Blockchain offers a secure and decentralized solution for verifying identities, reducing the risk of identity theft and fraud.

Redefining Auditing and Compliance:

Blockchain's transparent and tamper-proof nature can transform auditing and compliance processes within the banking sector. Regulators can have real-time access to transaction data, simplifying audits and ensuring adherence to regulatory standards.

Future Challenges and Considerations: Regulatory Frameworks and Scalability

While blockchain offers promising solutions, challenges remain. Developing standardized regulatory frameworks to govern blockchain-based financial activities is essential. Additionally, addressing scalability issues to accommodate a high volume of transactions without compromising speed and efficiency is crucial.

Real-World Implementations: Case Studies of Blockchain in Banking

Several financial institutions have embraced blockchain technology to enhance their operations. Case studies highlight how banks have utilized blockchain for trade finance, cross-border payments, and supply chain financing, showcasing real-world benefits and insights.

Beyond Banking: Expanding Blockchain's Horizon

Beyond its immediate impact on banking operations, blockchain holds potential for collaboration with other sectors, such as healthcare, supply chain management, and government services. Its versatile nature paves the way for cross-industry synergies and innovative solutions.

Educating the Workforce: Skill Development and Training

As blockchain adoption grows, there is a need to equip the banking workforce with the necessary skills to leverage this technology effectively. Training programs and educational initiatives can empower professionals to navigate the evolving landscape.

A Paradigm Shift in Banking

The transformative potential of blockchain technology within the banking system is undeniable. From enhancing transparency and security to revolutionizing cross-border payments and automating processes, blockchain is reshaping the future of finance. While challenges and regulatory considerations persist, the collaborative efforts of financial institutions and regulatory bodies can pave the way for a seamless integration of blockchain, ushering in a new era of banking that is efficient, inclusive, and technologically advanced. The journey has begun, and as blockchain's influence continues to expand, the banking industry stands at the threshold of a paradigm shift that will redefine banking as we know it.

Environmental Sustainability: Green Banking through Blockchain

Blockchain technology has the potential to contribute to environmental sustainability efforts within the banking sector. By enhancing supply chain transparency and tracking, blockchain can enable banks to support eco-friendly initiatives, such as responsible sourcing and reducing carbon footprints.

Regulatory Sandboxes: Fostering Innovation in a Controlled Environment

To encourage innovation while maintaining regulatory compliance, many countries have established regulatory sandboxes. These sandboxes allow banks and fintech companies to test blockchain solutions in a controlled environment, fostering collaboration and accelerating technological advancements.

Bridging the Gap: Blockchain and Traditional Banking Infrastructure

The integration of blockchain doesn't necessarily entail a complete overhaul of existing banking systems. Instead, hybrid solutions that combine blockchain's strengths with traditional infrastructure can provide a seamless transition, allowing banks to leverage the benefits of both worlds.

Cultural Shift: Embracing Change and Adaptation

Blockchain's impact extends beyond technology; it necessitates a cultural shift within banks. Embracing change, fostering a culture of innovation, and encouraging open collaboration can accelerate the adoption of blockchain technology and position banks as pioneers in the digital era.

21. Ethical Considerations: Balancing Innovation and Responsibility

As blockchain disrupts traditional banking, ethical considerations come to the forefront. Striking a balance between innovation and ethical responsibility requires careful consideration of data privacy, security, and the potential impact on vulnerable populations.

The Road Ahead: Continued Exploration and Integration

The journey of blockchain within the banking system is an ongoing one. The path forward involves continuous exploration, learning from successes and challenges, and refining blockchain solutions to meet the evolving needs of banks and their customers.

##A Global Movement: Collaborative Efforts for Industry Transformation

Blockchain's impact on the banking system is not limited by geographical boundaries. It's a global movement that requires collaborative efforts from banks, regulators, policymakers, and technology experts worldwide to unlock its full potential.

Embracing Possibilities: Transformative Power of Blockchain

In embracing blockchain technology, banks embark on a transformative journey that transcends traditional paradigms. The intersection of technology and finance is reshaping banking into a dynamic, responsive, and innovative ecosystem that has the power to redefine how we interact with money, conduct transactions, and envision the future of finance.

###Conclusion: Shaping a New Era of Banking.

The integration of blockchain technology into the banking system is more than just a technological upgrade; it's a catalyst for a new era of banking. As financial institutions harness the capabilities of blockchain, they unlock opportunities for greater efficiency, security, inclusivity, and collaboration. While challenges remain, the journey towards a blockchain-powered future is marked by innovation, adaptability, and a shared vision of a financial landscape that empowers individuals, businesses, and economies on a global scale.

...